Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

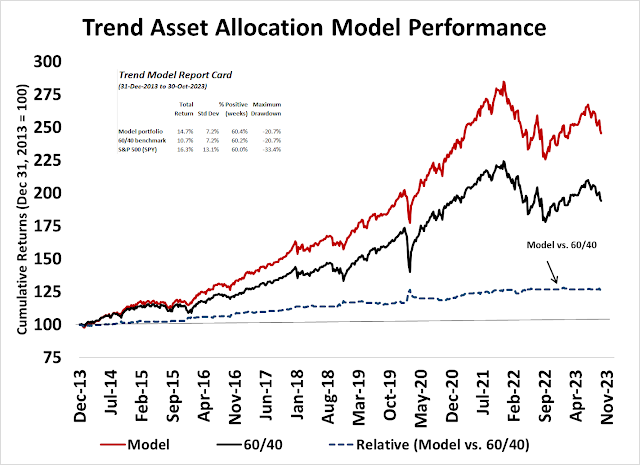

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Bullish (Last changed from “neutral” on 27-Oct-2023)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

This rally has legs

Last week, I outlined bullish and bearish scenarios and estimated their odds at 70% and 30%, respectively. The bulls won.

A relief rally was more or less inevitable. Once the S&P 500 violated a rising trend line that began at the COVID Crash bottom, it scared the daylights out of the bulls and caused a panic. The weekly slow stochastic touched 10, which has marked either important bottoms or tactical bottoms in the past.

I believe the combination of a severely oversold condition, washed out sentiment and the lifting of market concerns will spark a durable rally into year-end. I can think of nine reasons why this rally has legs. The reading of 10 on the weekly slow stochastics is just the first.

Supportive sentiment

Sentiment models are supportive of a durable rebound. The weekly AAII sentiment survey showed that the percentage of bears came in at 50% and bull-bear spread at -26%. Pay attention to the level of bearish sentiment. Similar readings have marked either short-term bottoms or prolonged bear markets in the past. AAII sentiment is a condition indicator and not an actionable trading signal. Nevertheless, it does inform investors that survey respondents are panicked.

The AAII Survey describes retail trader sentiment. Goldman Sachs prime brokerage, which offers a window into hedge fund sentiment, reported that the equity exposure long/short funds are the most defensively positioned in 11 years. Moreover, the CTA trend-following hedge funds are likely maximum short equity futures in light of recent market action, and further gains would trigger a buying stampede to reverse from short to long.

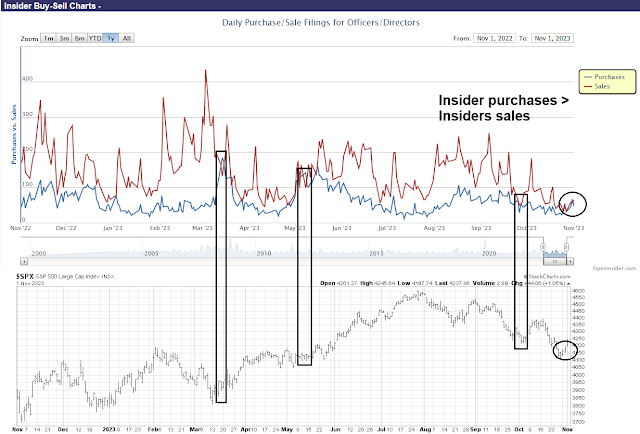

The other side of the sentiment coin is insider activity. While most extreme sentiment signals should be faded, extreme bullish insider sentiment is a buy signal. Not only have insiders bought the latest dip, they also continued to buy even after the market began to rally, which is another sign of a durable advance.

Falling macro uncertainty

Another factor supportive of a bullish scenario is the recent reduction in macro uncertainty. In the last few weeks, market psychology had become unsettled over the prospect of excessive Treasury supply putting upward pressure on yields. Indeed, the 10-year Treasury yield briefly traded above 5%, which rattled investors.

The U.S. Treasury’s Quarterly Refunding Announcement alleviated many of those concerns. Borrowing was lower than expected. In addition, Treasury announced that debt issuance would be tilted toward more short-term debt than expected, which alleviated many of the concerns over bond supply.

As a consequence, bond yields fell dramatically. The move was probably inevitable as yields have roughly tracked real-time indicators of economic strength, as measured by the Citigroup Economic Surprise Index. Yields had been rising in the past few months even as ESI flattened out. A convergence between the two was more or less inevitable once the fears of excess supply became alleviated.

Coming into last week, an air of uncertainty also hung over the FOMC decision. While a November pause was widely expected, it was less clear whether the hiking cycle was over. To no one’s surprise, the Fed left rates unchanged and kept the door open to another rate hike.

WSJ reporter Nick Timiraos reported that Fed Chair Powell telegraphed that the Fed was not eager to hike rates.

At Fed officials’ September meeting, most projected one more rate increase this year, but some have spoken in recent weeks as though they aren’t eager to hike again unless hotter-than-expected economic data force their hand.

Powell echoed that sentiment on Wednesday by repeatedly highlighting how much inflation has fallen, rather than emphasizing the economy’s recent strength.

Indeed, there are signs that both inflation and the jobs market are cooling. Q3 S&P 500 earnings calls show a decline in references to “labour shortage” and increases in “job cuts”.

Q3 real GDP growth came in at a very hot 4.9%, which raised worries about excessive growth leading to inflation. Those concerns may be misplaced. The latest Q3 productivity report showed a 5.9% jump in output and a 4.7% surge in productivity. These readings should alleviate many of the concerns over wage inflation and excessive growth.

The October Jobs Report came in slightly softer than expected. Headline employment rose 150,000 against an expected 180,000, though the more volatile household survey showed a loss of -348,000 jobs. The participation rate stayed steady and the unemployment rate edged up to 3.9% from 3.8%. More importantly, the rate of change in average hourly earnings is decelerating, indicating moderation in wage growth.

These are very market friendly reports. The combination of slightly soft employment, tame wage growth and strong productivity paints a picture disinflationary growth. If continued, it should allow the Fed to stay on hold and possibly cut rates next year.

A Zweig Breadth Thrust buy signal

Last but not least, the market flashed a rare Zweig Breadth Thrust buy signal Friday when price momentum surged, as measured by market breadth indicators rising from an oversold to overbought condition within 10 trading days. The latest signal only took five days to achieve the momentum surge, which is unusual even for a breadth thrust.

ZBT buy signals are extremely rare. Not counting the latest, there have only been seven out-of-sample buy signals since Marty Zweig outlined this system in 1986. The S&P 500 has been up after a year after every signal. There were, however, three instances of failed momentum when the market pulled back after the initial buy signal. Those “failures” occurred against a backdrop of rising rates, which may not be the case this time if consensus market expectations are correct.

The “ZBT failures” occurred against a backdrop of rising rates, which may not be the case this time if consensus market expectations are correct. Historically, peaks in the 2-year Treasury yield have coincided with peaks in the Fed Funds rate, but investors won’t know if the 2-year yield has actually peaked until after the fact.

In the short run, the stock advance may be due for a breather. It isn’t unusual for the market to pause and consolidate for a few days after a ZBT buy signal. The S&P 500 has risen very quickly and become overbought on the 5-day RSI and the NYSE McClellan Oscillator. It is now approaching overhead resistance at 4380-4400, which is also the site of an unfilled gap from September 20.

Finally, if the market were to pull back next week, the S&P 500 could be forming an inverse head and shoulders pattern. Keep in mind, however, that head and shoulders formations are incomplete until the neckline breaks, so this scenario is highly speculative.

Putting all together, I have enumerated reasons why the market is due for a relief rally, but what makes the rally sustainable? The stock market reached an extreme oversold condition and recycled to signal a relief rally is underway. Every oversold rally begins with short covering, but needs more buying fuel to keep going. Evidence of insider buying, even after the onset of the rally, provides bottom-up fundamental support to further gains. In addition, psychological relief from macro uncertainty also provides top-down bullish fuel for a sustainable advance, culminating in a breadth thrust, which is a technical condition indicating a FOMO buying stampede.

My inner trader was fortunate enough to have bought in just before the onset of the price surge. Under normal circumstances, he was ready to take profits last Friday as the market had become extremely overbought – until evidence of the ZBT came to light. He decided to look through likely short-term turbulence next week in anticipation of greater gains. Your decision process will vary depending on your risk appetite and pain threshold. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

Oversold stochs can of course become oversold. Look at 2008 in your chart.

This is the problem for most of us. When something truly nasty like 2008 comes along, things get oversold in the first leg down and then when the bounce happens we stay “frozen”, hoping to get back out at break even.

The ZBT has a track record of the market always being higher 1 year later, but look at the chart from 1980 to present. What would ZBTs from 1925 to 1975 have shown?

But we very well could have new highs.. We have a combination of seasonal, presidential election cycle, federal deficits to infinity,(which are stimulative) and this underlying belief that rates have to come down (look at Japan)

Still it’s scary times, but I’m always at least a bit scared.

There has been a plunge in CCC junk spreads last week as stocks surged. This is my favorite stock market economic indicator. It confirms this solid low that I have expecting in October for a a run to spring 2024 like Cam is saying.

The spread chart also gives us a recession failure indicator. If the junk spread goes above the recent high, the recession outlook is back on and we have to hunker down for a nasty bear market.

Great call! Our portfolio shows it!

One interesting thing- equal weighted slightly outperformed the S&P during this period. Does this indicate that market is broadening out?

Would Nasdaq 100 be more likely to rally?

Thanks

Back tests show SP equal-weight has better returns than cap-weight during NOV-APR period, 75% of time. A good odds.

QQQ already triggered a buy signal based on its volatility drop.

RE has been ridiculously decimated by algos. Many have yields much higher than all bond maturities. It looks like 2009 when it was once in a generation opp to buy. All you need is a perception that rates can only go down from here.

Thank you for your insights. Helps clarifying my thinking as well.

I dipped into RE a little too early. Will add over time.

Good luck!

RE?

The famous ZBT for me is a big bullshit, because how many of them were successful without QE, i think none is very near the good answer, and between 1928-2004 it’s less than 40%, that mean you chance are better if you flip a nickel