Tightening credit = Rising defaults

Most U.S. banks have reported Q2 earnings results. Virtually all are tightening lending criteria and raising loan loss provisions in anticipation of an economic slowdown. The Senior Loan Officer Survey due out on July 31 will undoubtedly confirm these conditions.

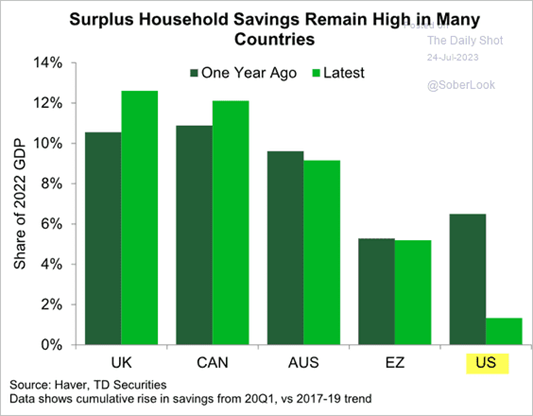

U.S. household finances are increasingly stressed. While surplus cash levels are elevated in many industrialized countries in the post-pandemic era, Americans have mostly depleted their savings.

On the corporate side, commercial and industrial loan growth has been abysmal in 2023. In addition, the FT reported that the $1.4-trillion risky corporate loan market has been hit by $136 billion in downgrades, which has only been exceeded by the pandemic shock of 2020.

Don’t worry, be happy

So far, the market is reacting to these potential sources of stress by whistling the song, “Don’t Worry, Be Happy”. Credit markets don’t look very worried. Yield spreads are narrowing and not showing signs of anxiety.

Over in the stock market, financial stocks are turning up against the S&P 500. Relative breadth indicators are also showing signs of improvement (bottom two panels).

From a global perspective, the only signs of financial stress are appearing in China. U.S. large-cap financials are bottoming relative to the S&P 500, and so are the troubled regional banks. European financials are even in better shape as they have been in a relative uptrend that began in March. The only blemish is China, which is dealing with its real estate problems. Since virtually all of the loans are made in RMB, problems in China are likely to stay in China and global contagion risk is relatively low.

Sound the All-Clear?

With the exception of a warning from the elevated level of the MOVE Index, market signals are unabashed bullish. Does that mean it’s time to sound the all-clear?

There can be little denying that, almost across the board, the readings on economic activity have been stronger than our expectations in September… All told, third-quarter growth in consumption looks stronger than we had expected, and spending appears to be headed into the fourth quarter with a bit more momentum.At present, it is difficult to find evidence in high-frequency indicators that the economy is in the process of turning down.

The only warning came from the Senior Loan Officers Opinion Survey as an indication of credit conditions:

In terms of credit provision, the Senior Loan Officer Opinion Survey revealed a sharp jump in the fraction of banks reporting tighter terms and standards on loans to businesses and households, a development consistent with the restraint on spending that we have built into our forecast. Consumer sentiment remains depressed relative to overall economic conditions, perhaps because of worries about financial developments.

How much weight should investors put on today’s shift in opinion by the Fed’s staff forecast from mild recession to soft landing and the downward revisions of Wall Street strategists of recession risk?

What about the message of the market? Technical analysts tell us that price reigns supreme and it’s the best forecast of the future. Let’s consider how the markets behaved in the Mother of Credit Events, the GFC.

Lehman Brothers went on to fail in September and the roof caved in on stock prices. The S&P 500 made an initial bottom in November, rallied and made a final bottom in March 2008.

Here is a more recent example of how technical analysis was unable to discount the risk of a well-known and well-telegraphed event, the start of the Russo-Ukraine War.

Everything changed on February 24, 2022, when Russia invaded Ukraine. The war sent the price of European gas soaring and the margins of BASF collapsed because of soaring natural gas prices.

Possible choppiness ahead

Where does that leave us? For the final word, I refer to the work of New Deal democrat, who uses a methodology of coincident, short-leading and long-leading indicators to forecast the economy. This discipline is especially attractive as it shows a picture that potential growth can evolve over different time frames. His latest update is calling for a mild recession:

- The U.S. economy is showing signs of a slowdown turning into a shallow recession, with weak consumer spending and negative long-leading indicators.

- But short-leading indicators have improved, driven by stock prices and a weak U.S. dollar, suggesting the slowdown may be temporary.

- One scenario suggested by the order of the indicators is an economy that wobbles back and forth between data that shows slow growth versus shallow contraction.

The last point about the wobble between the soft landing and recession narrative is important. If we are in such an environment, investors should be prepared for possible choppiness and the risk of a credit event that could derail the bullish narrative. In addition, investors should be aware of the possible risks from further ruptures in the Sino-American relationship as anti-Chinese rhetoric heats up ahead of the 2024 election (see How the G7 meeting exposes the risks for 2024).

A Lehman failure already happened with SVB but contagion did not happen because the Fed and Treasury immediately as in a couple of days, bailed the whole banking system.

The junk spreads are a key to any stealth problem in credit and they are cooling not heating up.

Keynes was right, government deficit spending gooses the economy. The $1.8 trillion deficit in 2023 and 2024 is overwhelming the Fed’s interest rate actions.

I read an article about higher interest rates and their impact on corporations in general. Turns out, interest costs are falling shockingly sharply NOT rising. As Cam said above, companies borrowed long when rates were stupidly low and now their cash balances are earning 5%. Another negative narrative bites the dust in this weird new world.

Last week in my comments I had mentioned that I had missed the rally from March 2023. I was extremely frustrated and had invited Cam and other readers to help me identify any technical indicators that could have identified the rally. Both Ken and Ingjiunn had responded. Ingjiunn had made any interesting observation which I researched further. There was a bottom in June 2022 and another one in October 2022 and another significant one in March 2023. With the S&P up over 20 % and the Nasdaq up in excess of 40% it might be a little late to get exceeding bullish. More so, now that the CNN Fear Index is showing excessive optimism – 78%. In the past that level has led to an Intermediate decline.

13/34 moving average moved higher in March. This was a technical signal to get long (Cam advised derisking at that time, based on macro considerations). Same metric as 50/200 dma MA cross over. We are still in the same situation.

Contagion can always happen. What if China sells a chunk of it’s bonds? Or whatever holdings they have that can affect US markets. Not saying this will happen, but it could.

That weak companies refinanced when rates were super low and thus have money for a couple more years fits with the low junk bond spreads because nobody is really worried about today.

That banks are tightening lending is important. How long a lag before this has an effect on the economy I have no idea, but there is a chicken and egg story there. When borrowing becomes harder, defaults go up because you can’t borrow. When defaults go up, lending standards tighten. Which comes first? I don’t know but they likely reinforce each other.

Markets are overpriced, this can go on for a long time, but not forever. At some point those companies that burn through their cash won’t be collecting a positive spread because they will have less cash but the same debt. When the next round of refinancing happens it could be ugly, and let’s not forget the consumer.

They say that when the rebound has traced this high a % of the fall that it is highly likely to make an all time high. I’m still nervous.

About a month ago Cam posted a chart of when the !ITBMRASPX recycled from overbought that there often was a correction. This was over a 4 year time frame. I noticed that there were no times where the signal failed 2 consecutive times, but it did, only this recent time it was really short lived and it should be watched.

That team soft landing declares victory I take as a contrarian signal.

Cam, one mistake:

Lehman Brothers went on to fail in September and the roof caved in on stock prices. The S&P 500 made an initial bottom in November, rallied and made a final bottom in March 2008.

FINAL BOTTOM WAS IN MARCH 2009 🙂 Thx.

A very small piece here about the world we live in today and how it even is like this. Finance affects everyone in human societies and it shapes the world due to the reflexivity.

In Jan 2006 I moved to Chicago and rented there. From Jan 1999 until then I had my first career job as an engineer in Silicon Valley, fresh from graduate school the previous Dec. Winter in Chicago is terrible and lengthy to say the least. But what I learned and witnessed during five years of stay there completely changed me. I was with one of the first few HFT outfits in Chicago (probably the whole world). We made nice money because the game was not well understood. In sometime mid 2007 I started to hear about the collusion plot to profit from the subprime fiasco. I befriended a few young secretaries and assistants of certain very connected people and got to know something was brewing. The necessary conditions were there already. We just needed to push into sufficient conditions to profit.

Within the HFT circle there were quite a few very brilliant graduates form the best colleges in US. It was very pleasant to work with them. We had run modeling and simulations of all the conceivable scenarios and knew all the financial details about every player in the game. So we knew who were the most likely vulnerable preys of the big connected banks. Now we just had to look at what’s happening to confirm our analysis. Once the evidence started to show up we knew the game was on. Our HFT activity became less important. We started to focus on piggy-backing on what the big shots were doing to MBS. We even had mafia members putting their money in. Guess it was better than selling drugs and terrorizing people.

It actually should have stopped at Bear Stearns and there would not be a GFC, although chaos and instability was ensured but certainly not to the same degree. But these greedy global banks felt they needed to make more money. That’s how Lehman Bros CDS blew up. It was even more ridiculous that Lehman Bros was allowed such high leverage ratio to begin with. Their investment were in a lot of non-liquid exotic products. AIG, the counter party of the LB CDS, was getting into bankruptcy and as expected bailed out by our gov. The total CDS payout was about 120B (180B?, don’t remember), to all the big banks in the world. Most of them are in the Anglo sphere. AIG never recovers but these big banks today are still playing the global financial games with aid of our politicians. The ramification of GFC is wide and far-reaching. What the world looks like today is shaped largely by the GFC.

The pittance of 120B payout worthy of the risk of total collapse of global financial system? The whole world is controlled by a transnational cabal. Everyday they are obligated to put on a show to obfuscate. Trust no one and believe nothing. That should be the motto for every average person.

For myself I changed from a concerned patriot to a disinterested spectator. Probably worse off personally. Yes we made nice money but what did it matter?

The more the world changes, more it stays the same. Wanna bet if more QE is on the cards? Lol.

Human nature does not change. There will always be fear and greed.

But I can’t see how HFT can significantly change markets. If the S&P goes to 6000, somebody has to buy, and nobody of size sell. Admittedly a collusion of traders passing shares back and forth can mimic volume and perhaps suckering in some buyers on the way up, but you still need buyers .

But they will play the psychology game, and they know where the stops are. They know that people are too impatient.

Fundamentals matter. If oil production declines because of insufficient CAPEX and demand exceeds supply, the price will go up eventually. I suppose they can keep prices down and just have empty pumps for most of us but I suspect that is political suicide.

If one followed Mike Wilson in 2022 and Tom Lee in 2023, one would have topped the charts. Reality is you follow the strategist who was most successful till he is not.

The most important lesson for me is to stay in a well diversified portfolio, rebalance and keep your strategic allocation. Sleep well, enjoy your life. Time gone by is time gone by forever.

No one gets it right all the time.

Could not agree with you more.