The market faces far more sources of volatility than just the Fed.

How the stock and bond market disagree

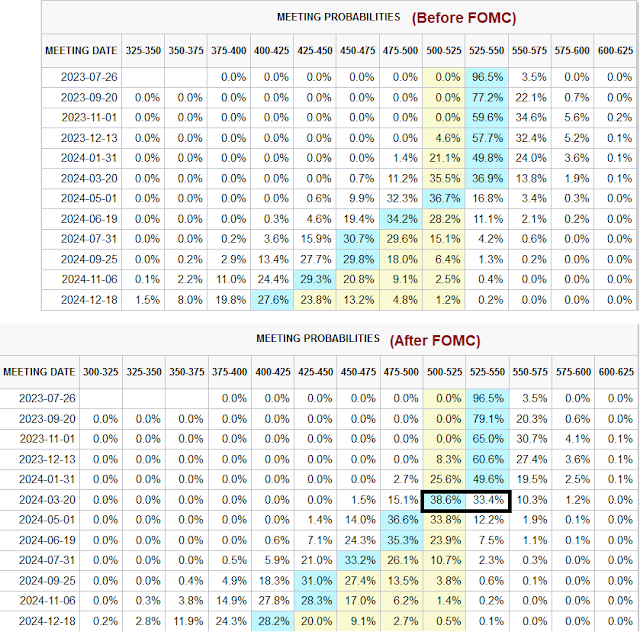

The stock and bond markets have been in disagreement. While the S&P 500 has moved steadily upward in the past few weeks, which indicates growing optimism about a soft landing, the bond market has been range-bound, indicating continuing concerns over inflation, the growth outlook, and Fed policy. Even as technicians analyze charts to discern the message of the market, the stock and bond market disagreement will be a source of risk and volatility. One source of near-term risk is the negative 5-day RSI divergence exhibited by the S&P 500 as it advanced.

Sources of volatility

We are proceeding through Q3 earnings season, with a number of prominent heavyweights reporting this week. Be prepared for choppiness as individual companies report results.

Looking ahead, we have interest rate decisions from the ECB and the BOJ this week. As well, investors will see an update to the inflation picture from PCE, which is the Fed’s preferred inflation metric, and the quarterly Employment Cost Index, which measures total compensation. While Fed Chair Powell declined to comment on any single union contract, the Fed is likely to see the recent UPS-Teamsters agreement as an indication of continuing strong wage pressures. In addition, gasoline prices have been rising, which will put upward pressure on headline inflation.

I’m in the inflation camp, even though I am a boomer and many of us have retired and old people are deflationary.

We have several major events that influence inflation. There was covid and the huge amount of helicopter money that was spent. There is the Ukraine war which spurred on deglobalisation which has been warming up with China US relation stresses, federal deficits forever it seems.

Oil is up over 10% this month and we have cut back on oil Capex because of ESG (or so they say).

Perhaps inflation was coming and what covid did was cause a spike which is unrelated to the underlying secular inflation, so we have this “honeymoon” disinflation going on as the spike fades, but the underlying inflation is just getting started.

TLT is in a bear market, only where will the money go?

David Hunter said months ago the S&P could go to 6000 or more before collapsing because that’s how bull markets end, maybe he is right, I can’t wrap my head around that but we shall see.

Shall I put it all into NVDA? Just joking.