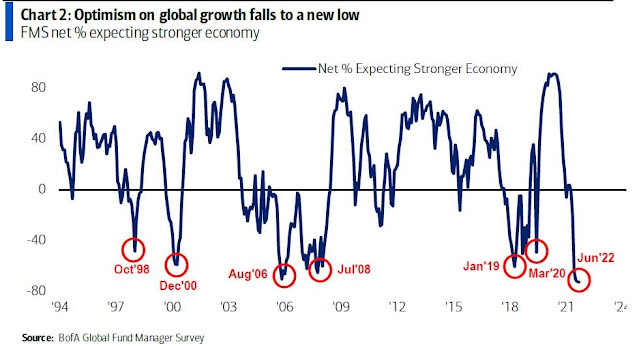

Even before the FOMC meeting and in a survey period that ended on June 10, 2022, which was the day of the hot May CPI print, the respondents to the BoA Global Fund Manager Survey showed a high degree of anxiety about a recession.

Here is the bad news. At the post-FOMC meeting press conference, Fed Chair Jerome Powell pointedly responded to a question with, “We are not trying to induce a recession”. Despite the “softish landing” rhetoric, it is becoming clear that the Fed is trying to induce a recession.

Volcker 2.0

Sometimes investors can find the most interesting clues on Fed policy intentions in speeches and statements, but the Fed hit the market with a sledgehammer with its communications policy at the June FOMC meeting. The new “dot plot” projects the Fed Funds peaking in 2023 and falling afterward. That pattern is consistent with a recession in 2023, followed by easing in 2024. By contrast, Fed Funds futures (grey line) expects a peak in 2022 and an easing in 2023, which pulls ahead of the implied probability of a recession into this year.

In addition, the most revealing sentence of the

FOMC statement was: “The Committee is strongly committed to returning inflation to its 2 percent objective”, indicating that the Fed is bent on taming inflation without regard to recession risk.

As well, Powell was asked during the post-FOMC press whether the Fed will focus on headline or core inflation in managing monetary policy. The surprising answer was “headline inflation”.

But all over the world, you are seeing these effects. And so — and we’re seeing them here, gas prices at, you know, all-time highs and things like that. That’s not — that’s not something we can do something about. So that is really — and by the way, headline inflation, headline inflation is important for expectations. People have — the public’s expectations; why would they be distinguishing between core inflation and headline inflation?

Core inflation is something we think about because it is a better predictor of future inflation. But headline inflation is what people experienced. They don’t know what core is; why would they? They have no reason to. So, that’s — expectations are very much at risk due to high headline inflation.

While core inflation is easier for central bankers to model, headline inflation fluctuates more with the volatile food and energy components, which are dependent on the resolution of the Russia-Ukraine war. Energy prices have spiked because of energy supply disruptions, and so have food prices. An influential

1997 paper by Bernanke Gertler, and Watson concluded that while recessions have followed surging oil prices, oil price increases alone weren’t the explanation. It was the Fed’s reaction to rising energy prices that caused recessions. If the Bernanke paper is correct and the Fed is focused on oil prices, which is a factor beyond its control, this is an instance of Volcker 2.0 that will induce a recession.

Here’s another ominous sign of Fed policy. Jerome Powell stated at the

WSJ Future of Everything Festival, “What we need to see is inflation coming down in a clear and convincing way, and we’re going to keep pushing until we see that.” He went on to use the “clear and convincing” language three times in the interview. It is well-known that monetary policy operates with a lag. If the Fed is waiting for “clear and convincing” evidence that inflation is falling, it will by definition overtighten.

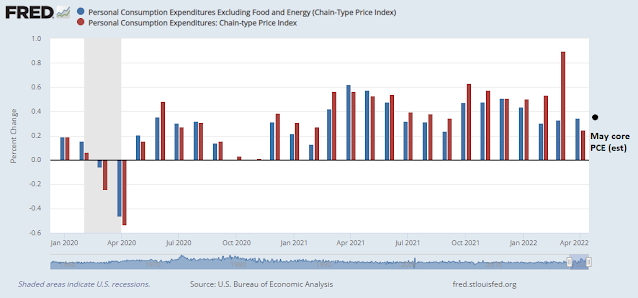

Here is how the monthly headline and core PCE, which are the Fed’s preferred inflation metrics, are shaping up. An estimate of May core PCE based the combination of the CPI and PPI reports is 0.39%. That’s not “clear and convincing” evidence of deceleration.

Even within the Fed, some unease is appearing. A

Fed research paper by David Ratner and Jae Sim offers the alternative hypothesis that the effects of the Volcker shock are exagerrated. Inflation of the 1970’s was addressed through the degradation of the union movement rather than monetary policy.

Is the Phillips curve dead? If so, who killed it? Conventional wisdom has it that the sound monetary policy since the 1980s not only conquered the Great Inflation, but also buried the Phillips curve itself. This paper provides an alternative explanation: labor market policies that have eroded worker bargaining power might have been the source of the demise of the Phillips curve. We develop what we call the “Kaleckian Phillips curve”, the slope of which is determined by the bargaining power of trade unions. We show that a nearly 90 percent reduction in inflation volatility is possible even without any changes in monetary policy when the economy transitions from equal shares of power between workers and firms to a new balance in which firms dominate. In addition, we show that the decline of trade union power reduces the share of monopoly rents appropriated by workers, and thus helps explain the secular decline of labor share, and the rise of profit share. We provide time series and cross sectional evidence.

I leave the discussion of policy choice up to you. The political ramifications of the conclusions is above my pay grade.

Good news

Here is the good news. Inflation is already decelerating. Callum Thomas of Topdown Charts pointed out that the leading indicators of growth, namely the backlog and order components of PMI, have been in a descending trend for several months. This should eventually lead to falling prices.

The CPI news this morning was so awful that it changed the bond market’s view of Fed trajectory, and the weakest sector broke. In bond jargon, MBS went “no-bid.” No buyers for MBS. Then a few posted prices beyond borrower demand, not wanting to buy except at penalty prices. Overnight the retail consequence has been a leap from roughly 5.50% to 6.00% for low-fee 30-fixed loans…

Another marker of MBS distress: the 10-year T-note had held 3.00% since April, the important top in 2012 and 2018. Trading 3.05% yesterday, now 3.20% — retail mortgages jumped triple that amount. The 10s/mortgages spread today is almost 300bps and double the 10s’ yield. Inconceivable. The Fed telltale 2-year T-note had held 2.70% since April, 2.85% yesterday, today 3.05% adding only one more .25% hike to the 2-cast, which is not enough to explain MBS overnight.

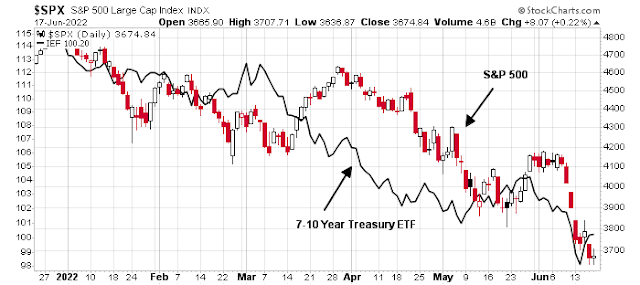

The earnings puzzle

Here is the market consensus. Both stock and bond prices are falling together. In other words, the market is expecting slower growth (stocks) but inflation will stay elevated (bonds). At a minimum, the bond market should begin to rally soon. Keep in mind that rates fell across the board in the wake of the FOMC meeting, which may be a sign that the Fed is ahead of the curve, not behind it.

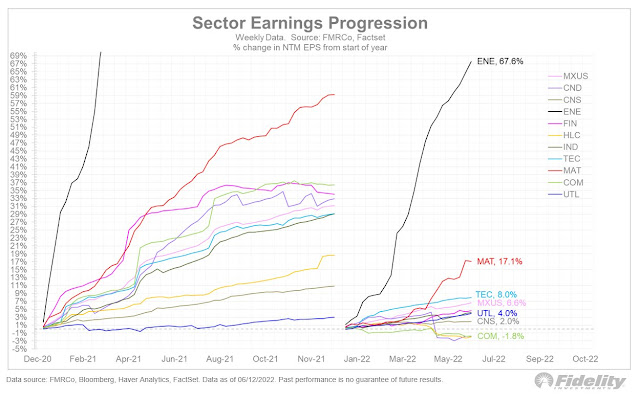

I have made the point before that the last time the 10-year Treasury yield was at similar levels, the S&P 500’s forward P/E ratio was trading in the 14-16 range. It is now 15.3, which represents fair value. The key question is how far earnings estimates fall should the economy experience a recession. Forward EPS estimates are still rising, so far.

Why aren’t earnings estimates falling? Doesn’t Wall Street realize there’s a slowdown on the horizon? A more detailed analysis of forward 12-month EPS estimates by sector shows that most of the gains are in the energy sector. However, most other sectors are still seeing positive estimate revisions.

Here is the process by which most Wall Street analysts estimate earnings for their companies. In additional to independent research, such as channel checks, company estimates depend on corporate guidance. If guidance is still strong, analysts are unlikely to go out on a limb and downgrade their estimates. As analysts and companies engage in the guidance dance, it’s always possible that corporate management is shading the truth and telling a more bullish story than the company’s underlying fundamentals.

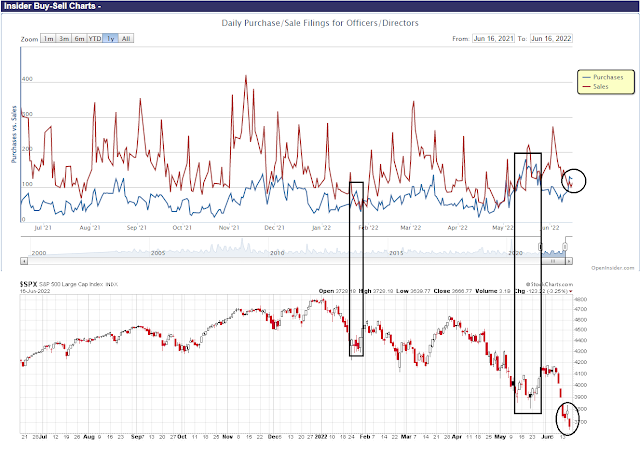

What they are unlikely to lie about is how they manage their own finances. The most constructive news for equity investors is insiders are turning more confident. This group of “smart investors” is buying the recent dip. Either the group doesn’t seem to believe the recession narrative, or it believes that slowdown fears are overblown and valuations are becoming compelling.

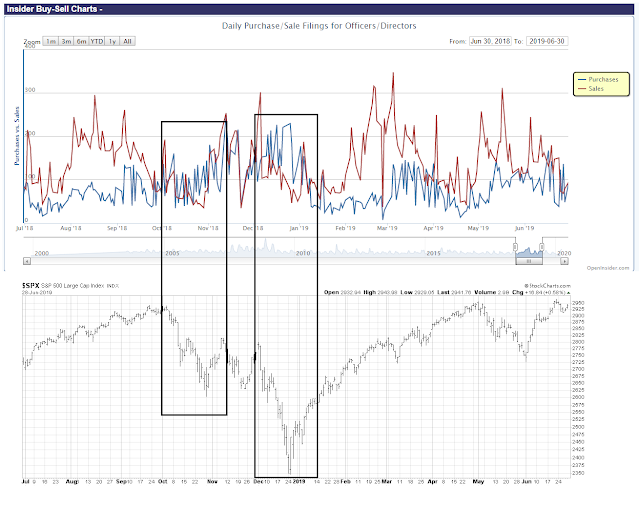

To be sure, insider activity is an inexact market timing indicator. Insiders were overly eager to buy in 2008.

In a more “normal” bear market like 2018, insider activity can be useful signals.

Recessions serve to unwind the excesses from the previous cycle. The good news is there is little evidence of too many excesses. A lot of the speculative money has gone into crypto. While the right tail of crypto returns were spectacular during the bull phase, any possible collapse is less likely to threaten global financial stability as crypto has largely existed in an offshore and unregulated market. This makes the left tail of the unwind less risky to asset prices.

Even if investors were to see a recession induced bear market, it shouldn’t last too much longer. My base case scenario calls for a slowdown to begin either in Q1 or Q2 2023. Historically, recessions last about 6-9 months. As markets look forward about 6-12 months, and the stock market peaked in January, this puts the timing end of the bear market between now and late Q3.

In conclusion, the Fed appears intent on tightening policy to fight inflation. It is focused on headline inflation, which is expected to remain stubbornly high as the Russia-Ukraine war keeps energy prices elevated. It’s difficult to see how the US economy can sidestep a recession.

The good news is the S&P 500 is at or near fair value, as long as earnings don’t significantly deteriorate. Renewed insider buying as the market reached its recent lows is another sign that downside risk may be low.

Good analysis Cam. Between now and late Q3 seems right for a durable bottom but it will likely be a tough choppy road. Some good longer term values are beginning to emerge but too many trying to buy the dip and retail exposure is still high. VIX is too complacent for durable bottom although CBOE levels are elevated. All sectors are now participating in the selloff which may signal that at least an interim low is close. Utilities, REITS and even energy now rolling over. Bonds and bond proxies have been decimated and are beginning to look like an opportunity.

re: “Kaleckian Phillips curve”, the slope of which is determined by the bargaining power of trade unions. We show that a nearly 90 percent reduction in inflation volatility is possible:

Aug, 1981

Reagan fired 11,000 PATCO workers

Volcker raised the fed funds rate to 18%

Where is Biden going to find 11,000 union workers to fire?

You know, we make the mistake of interpreting outcomes to what we did. The hero of the times in Volcker, maybe he was just lucky.

Anyone who bought bitcoin at even the wildly inflated price of 100$ which was already up 200,000% from 5 cents (I have seen an even lower initial price, but you get my point) and held on even until now thinks he’s a genius…well he’s still up 20,000%…I think he’s lucky, but it is the outcome we judge things by.

Times change. Back in the depression era ,my impression is that Hoover was hawkish…but he is not viewed like Volcker…but in those days the USA was a global creditor and increasingly a manufacturing giant…dollar was backed by gold, so FDR did his 1933 trick to increase money supply, but we still had a depression.

Fast forward and Nixon closes the gold window, the era of balanced federal budgets fades into the night and those in Washington get to spending money that is not ours. What happened in the 80s? Aside from the digital revolution and communications upgrades, we began outsourcing manufacturing which could not have helped the unions, and was deflationary.So as rates came down this made borrowing easier to manage which meant more debt/credit which also increased prices of financial assets. This outsourcing continued because lower prices at the store win if quality is equivalent.

So we view Volcker based on what happened, just like we see Hoover in the light of the depression.

To paraphrase that famous line. “It’s the debt stupid”. We inflated this huge bubble on debt based on money that is not ours, and now we have inflation based on having sprayed huge amounts of helicopter money into the general circulation which many quickly spent, and there is the exogenous effect of Covid/Ukraine which has impaired the deflationary effect of outsourcing, so is it surprising that we have inflation?

So the Fed will raise rates, and we will get a recession. Recessions are normal, they happen with regularity most likely as a consequence of aggregate human nature. Over the last 35 years recessions have been handled with Fed easing. The common theme is increasing debt, and can you manage debt by raising rates? Hello Washington.

So I am skeptical about this, because we are not in the early 80s and Washington is not about to embark on 40 years of austerity. What will they do when unemployment spikes up and GDP tanks? Given that they can print more $ at will, and it’s not our money anyways, it’s simply a medium of exchange, they will crank it out and if high rates are killing the economy and creating social unrest, I doubt they will keep rates high, too much debt.

Can the Fed get Washington to go austerity? Nobody can because anyone who champions austerity will get tossed out of office and they all know this.

History does not repeat but rhymes…so the rhyme of the week is this one….When the Fed was talking about not buying MBS then what happened was that 30 year mortgage rates went through the roof. So what’s going to happen if the Fed stops buying treasuries, will there be a lineup for them? Of course the buyers at some level know that the Fed will have to step in to buy them. Even if we get a surprise mandate that a given % of our IRAs now has to be in treasuries, the trillions in deficits coming our way will be overwhelmed by this. If treasuries rip higher, what does this do for corporate debts? How quickly can this morph into a credit crisis? Depends on how debt has to be refinanced.

Powell will be the fall guy for our government’s spending sprees of the last 30 years.

Yes. The fall guys for the mid-term will be Putin and Powell. And who knows may be even Zelensky. Biden is not doing anything to control inflation, and has deferred it all publicly to Powell. You don’t hear much about the war in the MSM any more, let alone Zelensky (remember, he was a hero just a few months ago).

Voters will relegate the democracy (Jan 6th hearings) and women’s rights to oblivion with everyday inflation at the top of their minds.

Most investors only watch the Fed or know the inner workings. They are busy looking at companies. But the folks that study Fed policy and follow the data and where the data lead, are EXTREMELY worried about QT and subsequent nasty liquidity dominoes that will fall and engulf stocks, bonds and the economy. I suggest listening to Mohamed El-Erian as a key, rational observer of Central Bank Policy. He worked at the World Bank, the US Fed and at Pimco, the largest fixed income manager on earth. He knows and he is vocally saying to be risk averse as these forces unfold. On your browser you can set up a Google alert to receive an alert whenever a news item mentions his name.

I agree

I guess I have to read / listen his stuff again. His FT articles tend to regurgitate the most obvious things.

The crypto ecosystem is imploding much further this week. I have studied bubbles for 40 year after my first disastrous experience with one. As the crypto world was expanding with new investors, dip were to be bought. That has peaked when the last new investor got on board. Now we are in the contraction phase where dips will get lower and lower until prices and investor interest will wain.

The unintended consequences of this bubble could be huge and surprising give the last period when massive leverage was promoted to keep the bubble inflated. These crypto lending platforms are failing one after another. The fact that this area is unregulated makes it more prone to a run on stable coins. Owners of crypto assets should and will be nervous on getting their money out and will rush for the exits. It is VERY unlikely that the stable coins have one to one backing of real dollars as they claim. When the redemptions hit a critical point and can’t be met, we will have an Enron or Madiff moment.

The crypto problems could effect the real world in ways we can’t see now.

The entire market cap of the crypto markets has dwindled from $2.9trn to $850bn now.

And it’s not over yet. That’s a serious damage to their paper wealth.

When they started running all those ads it was over. Get the last suckers in so you can cash out. Unfortunate folks like Matt Damon and Steph Curry had to put their names on it. Steph’s ad was especially galling – “you don’t have to know anything about crypto to invest in crypto”. Yikes!

Given our sick society, I hope these two are physically harmed by some wackos who lost money following the commercials. On the other hand these two are already very rich. Is one more buck that important?

correction: not physically harmed

I won’t be surprised if they were the promoters as well as the victims of the same scheme.

What always was my break point for bitcoin was if the price goes below the cost of electricity to mine coins. Not the all in cost of buying the hardware, just the cost of electricity, when that exceeds to value of the coins, who will mine them? If nobody does the mining, nothing happens.

I don’t know the $ cost of the Netherlands electric use, but it must be a pretty big number, in the billions and with only 2 million coins left to mine over the next 15+ years, taking into account the decreasing number per year, say 200k coins this year, so at 10k a coin you get 2 billion…..netherlands electricity usage is 111,000 giga watt hours at a cost of approx 20,000 per gigawatt hour, so a little over 2 billion, which means the breaking point is somewhere between 10k and 20k because maybe only 150k are mined this year, and there is maintenance required. So what is the value of bitcoin if it can’t be processed? They can manipulate the price I guess, but what they can’t do is force people to buy it.

What is hard to know is how much money has gone into it compared to how much has gone out. Note that BTC has been over 30k for almost a year and a half, the rise from 10k took about 2 months and the fall from 50k has taken about 2 months. Must be a lot of crypto-pain and I doubt the Fed will ride to the rescue.

good discussion here:

https://www.youtube.com/watch?v=cwJRnfj1PCE

Envision analyst future estimates of earnings on the companies they analyze like a real estate agent telling you where house prices will go next year in your city. Both might even believe what they are predicting but they have a big vested interest on the listener staying positive.

Stock analysts work for companies that make or trade investment products for investors. They ere, way on the positive side ESPECIALLY when a recession is looming.

In the last month, I have unsubscribed from emails from every product producing company. They simply twist their narrative to get you to hold on. My suggestion is to look at YOY earnings not forward and ask yourself if the company you are looking at will earn as much in the next year as they have in the past year? We are galloping towards a hard landing. How will the company you are looking at, fare?

Cam,

Powell: “What we need to see is inflation coming down in a clear and convincing way, and we’re going to keep pushing until we see that.” He used that phrase three times in the interview.

Powell and Yellen have recently admitted that they were unable to see the inflation to be persistent. Given Powell’s statement above, don’t you think he will avoid making a mistake and continue the tightening until the headline inflation for the prior month recedes to ~2%. He would ground the world economy and stock markets by then.

I’m just wondering if we are close to “fair value” or “the bottom” yet given Powell’s intention to see 2% inflation headline before he ceases to tighten.

I interpret Powell’s statements to imply that he needs to see inflation trend to be decelerating in a clear and convincing manner; not necessarily get to ~ 2%. Since monetary policy works with a lag, it’s a judgment call. But, they can change direction as needed.

Geopolitical issues will have a great impact. What’s the point of driving the economy into a recession if it won’t bring gas and food prices down? Some issues need help from the administration too.

I was definitely exaggerating a bit. The economy is decelerating already (housing, restaurant spend, goods, etc.) and prices will also begin to drop as well. Lumber, natural gas, oil, copper etc. are all down. The prices of retail goods will come down in coming months and quarters as retailers clear their excess inventories. The economy may decelerate even more as the wealth effects force consumers to spend sparingly.

And while the economy is plunging into a recession, if not already into one, Powell wants to raise the FFR to ~3.50% by YE 2022. I think they will change direction but not until it is too late.

Yup! Agreed on your point about the gas and food prices. The administration has outsourced the issue of managing inflation to Powell so they can all blame it on him in mid-term election campaign.

The GDP was negative in 1Q and is predicted to be 0% in 2Q as per GDPNow. We may already be in a recession. Oil prices have already rolled over; XLE is down from $93 to $73.49, and crude from $122+ to $110.48. $XLY is down from $210 to $136 now. Home prices are sliding down as well. Many companies have hiring freezes and some are even laying people off.

And this is before the full effects of wealth destruction in the stock and the crypto markets (from $2.9trn to $850bn now) are endured by the people.

Inflation should follow the rest to the downside.

I think the Fed will definitely overtighten and throw the US economy into a severe recession, and not just a mild one.

A strong USD and a US recession as a consequence of the Fed policy may also cause a global recession, not just a US recession. We might see a crisis in the emerging markets as well, thanks to Powell.

There were a lot of newbie investors that got into the market in the past couple years. As I did in that time of my investment life, they probably sold some of what they earned, and then, as I did, plow it into something else equally as risky for “diversification”. Back in the day, a guy in the gym I befriended offered my friends and family stock of the internet company he worked for, which I bought 200 shares of and promptly went from 16 to 300. Wow, what a smart investor I was! Then I heard about another company from a co worker that was at 50 that he was in on the angel funding of. Can’t miss! It went to 100, then to .01 then gone. I was fortunate to only lose my $3200, which was an expensive lesson at the time that paid off in the long term.

How many kids like I was are out there? Having bought AMC or some other meme stock, maybe diversified to bitcoin, and now looking at their portfolios and thinking about the exit.

I think there are a fair amount of them, and others who took too big a risk. That’s likely the next wave down.

You and I, Livewell, were luck to learn these hard lessons at the beginning of our investing lives not the end when you have no time to recover.

If the dire scenarios posited above actually happen, what will the bottom look like? US equities? Foreign equities? Commodities? Gold? Cash? Bonds? Economic depression? Sovereign bankruptcies?

Anyone??

We have to wait and see how things unfold. Cam is watching and will guide us. There could all kinds of surprising developments. If the Fed errs and causes a deep recession we could make big gains in Treasury bonds even if corporate bonds do poorly because of credit problems. If the Fed gives up on the fight on inflation too early and we enter a lingering inflationary world, bonds will be terrible and inflation loving investments will soar amazingly. We could see a boom around EVs and the infrastructure to build them out. The war in Ukraine might end and everything returns to normal.

All to say that there are so many futures that can happen, we have to not be stuck in a forecast but adapt as needed.

Thanks, Ken.

At any given point a portfolio should have both strategic and tactical allocations. With so much uncertainty and volatility around all assets, it is challenging to keep your wits. Cash seems to be a safer tactical alternative ( I have more cash than I have ever had in my investing experience of over 40 years).

I am a big believer in the power of innovation to provide growth and societal benefits over the long term. But one has to get through the turmoil first.