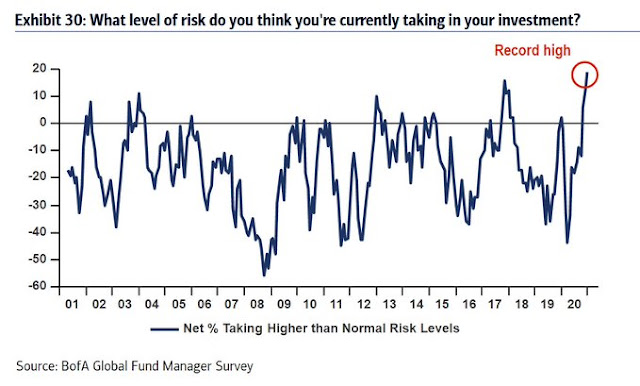

Mid-week market update: This market is in need of a reset in investor sentiment. In addition to recent reports of frothy retail sentiment, the latest BoA Fund Manager Survey (FMS) indicates that global institutions have gone all-in on risk. The FMS contrarian trades are now “long T-bills-short commodities, long US$-short EM, long staples-short small cap”, or short market beta.

Along with growing signs of deteriorating market internals, this market is poised for a correction.

More signs of froth

Here is how frothy sentiment has become. SentimenTrader recently reported sky-high call option activity by retail investors.

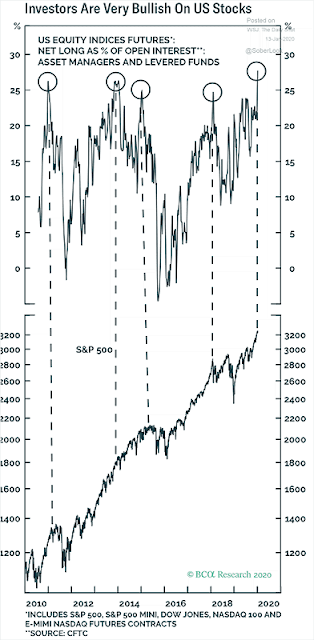

In aggregate, speculators (read: hedge funds) are very, very long equity futures.

This is the classic definition of a crowded long position by different constituents. Retail, hedge funds, and now institutions are all long risk up to their eyeballs. Who is left to buy?

Negative divergences

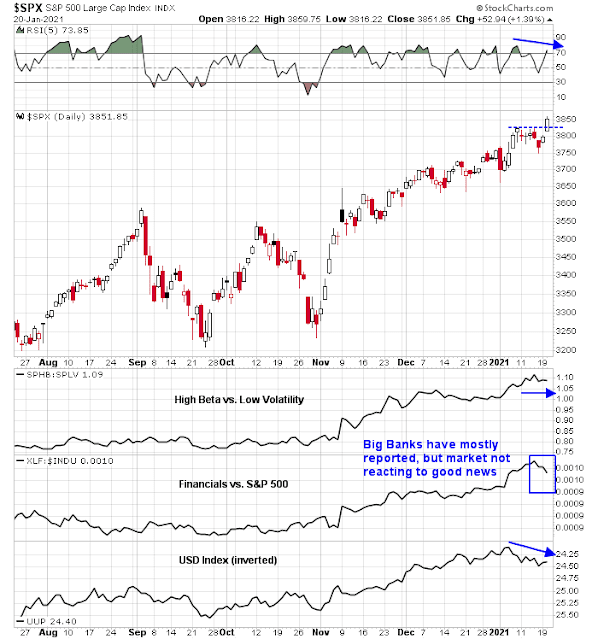

All the market needs to fall is a bearish trigger. Even as the S&P 500 staged an upside breakout to another all-time high, a number of worrisome negative divergences are appearing.

- Technical: A negative divergence from the 5-day RSI.

- Equity risk appetite: The ratio of high beta to low volatility stocks is trading sideways and not confirming the new high. This ratio is an important indicator of equity risk appetite.

- Earnings season reaction: Q4 earnings season has begun. Most of the large-cap banks have reported, and most have beaten expectations. However, financial stocks are lagging the market despite the beats. A market that does not react well to good fundamental news is a warning for the bulls.

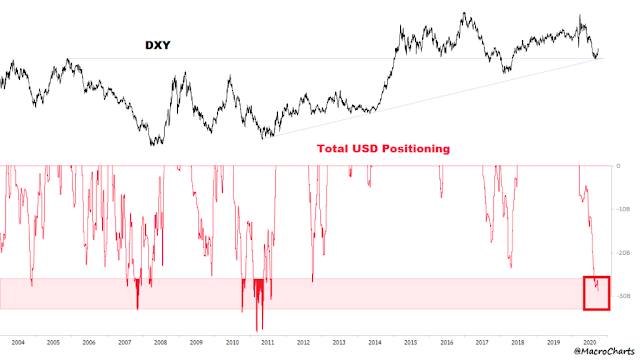

- Foreign exchange risk appetite: The USD has been inversely correlated stock prices. The USD began a counter-trend rally, which would put downward pressure on risk assets.

Macro Charts recently highlighted the crowded short positioning in the USD Index. This makes the EM assets especially vulnerable, and the long EM trade is a long risk and reflation trade.

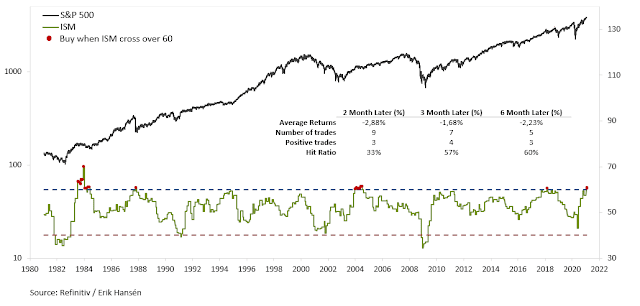

The cyclical and reflation trade is also in need of a reset in sentiment. Callum Thomas observed that the S&P 500 does not perform well when ISM rises above 60. Too far, too fast?

From a sentiment momentum perspective. the FMS shows that the expectations for the Goldilocks scenario of strong non-inflationary growth is rolling over. These are the kinds of conditions that can spark a correction.

In conclusion, the combination of giddy sentiment and technical deterioration is not a good recipe for further equity market gains. The short-term risk/reward ratio is negative and the market can correct at any time.

Disclosure: Long SPXU

If I had to guess – the market gaps up in the morning, then sells off hard.

Tomorrow is Flash PMI day.

After Trump’s inauguration the stock market kept on rallying throughout Q1. March 1st was kind of blow-off top, but it was not until March 21st before quarter-end rebalancing caused a more notable drop.

If you’re into gambling, a few lotto puts on GME might be worth checking out.

I have my own list of lotto plays this morning-> RIOT/ BTBT/ QS/ SOLO.

I exited all four positions within minutes – all for minor losses. I see it as a ‘tell’ re market complexion. I may opt to reopen, but only on signs that risk-on behavior is back in force.

I’ve done well for ~four months trading the long side, which is in my experience a longer-than-average period of time.

Adding a position in TLT to an existing position in RYGBX (which of course only trades end of day and doesn’t allow much flexibility in terms of timing).

I think that as far as the options volumes go, that robin hood has changed things….with commission free trades, you can make trades , or at least attempt them, where on 1 contract you make a few bucks….back before Robin Hood it all went to commissions….so it is no surprise the volumes are high.

That and the insane moves the market is making, makes it tempting to trade options.

Taking swings at XLE/ KRE/ XME – purely day trades based on the basis of prices recovering from significant intraday declines.

Reopened QS ~50 as it also seems to have found support in the upper 40s.

Keeping it small, as the bottom could drop out at any time. On the other hand, I’d hate to miss a bounce.

Adding OIH/ XME.

Adding a little GS as it climbs out of a 4-day funk.

No point in having more than a few positions and/or sizing up at this point in the game.

My largest position is TLT, which is taking it on the chin. It happens.

Missed the boat on SOLO.

I’m fully aware that we could see downside breakouts on all ETFs/stocks as well as TLT.

Probably what Jesse Livermore refers to as the last eighth.

Sized appropriately, sometimes it pays off with minimum risk.

Lotto spread in the final 15 minutes of the after-hours session, which may (or may not) be flipped in the premarket session on Friday. QS/ RIOT/ ACB/ XPEV/ NIO/ BTBT.

Almost feels like market is rotating back into big techs.

Red sky in the morning. If I were looking for a continuation of the rally, buying in the hole is an ideal setup. Right now, I’m expecting a decline, so the gap-down may lead to a bounce followed by more downside.

(a) TLT indicated higher.

(b) Taking gains in RIOT ~19.7x (opened in the last 5 minutes of Thursday’s extended-hours session ~17.9x.). It doesn’t always work out this well.

(c) XLE/OIH indicated lower. If i were bullish, I’d be adding. Instead, I’ll need to close on any intraday strength.

Taking profits on BTBT.

The opening selloff seems pretty contained – no panic whatsoever.

Closing all positions in XLE/ XME/ OIH/ GS/ KRE on ‘relative’ opening strength – relative because prices are one heckuva lot better than they were premarket!

Taking losses on all the above trades, but the portfolio is actually green at his point due to gains in RIOT/ BTBT + positive price action in QS/ NIO/ XPEV/ ACB and of course TLT.

All positions with the exception of TLT/RYGBX are now closed. Taking losses quickly when I’m wrong is how I handle things when I’m wrong. Taking advantage of an opening bounce is how I sometimes manage to trade out of a hole. Still green for the day, and now prepared for a downside move.

Looks like they’re continuing to buy the opening selloff.

Banks are down -5% for the week. Energy down -7% for the week.

Taking another swing at BTBT/ QS/ RIOT on their mid-morning pullbacks.

PLTR here.

SOLO here.

PLTR off. SOLO off.

All remaining positions off here, including TLT. Will close RYGBX end of day.

It wasn’t a spectacular week, but it was green. That’s good enough.