I recently made a presentation at a virtual conference, and an audience member asked me to name some of my favorite value sectors. I had a few answers, but let me start with what I would avoid, namely financial stocks.

Financial stocks are statistically cheap and comprise a significant weight in most value indices. However, they have a number of challenges not encountered by other value stocks. Bloomberg reported that the Biden transition team is made up of people with a bias towards greater financial oversight and regulation, such as Gary Gensler:

Gensler is the biggest name with Wall Street ties who’s part of the agency-review process. He is a former Goldman Sachs Group Inc.partner who joined President Bill Clinton’s Treasury Department. Gensler was later appointed CFTC chairman by President Barack Obama.

His role in Biden’s transition might make some on Wall Street uneasy. When Gensler led the CFTC, he implemented new rules that made him a scourge of banks’ lucrative swaps-trading desks. He also pushed investigations into the manipulation of benchmark interest rates that resulted in firms paying billions of dollars in penalties.

Others on Gensler’s team include Dennis Kelleher of Better Markets, a group that advocates for tougher regulation, and Amanda Fischer, the former chief of staff to California Representative Katie Porter, who also supports tighter market rules.

Energy skids to the smallest sector in the S&P 500

A different kind of Thanksgiving Turkey

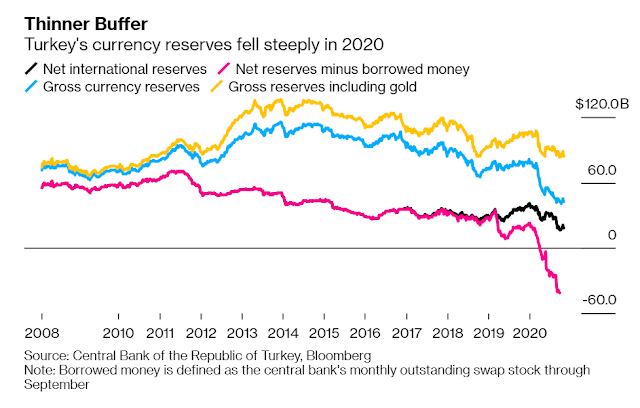

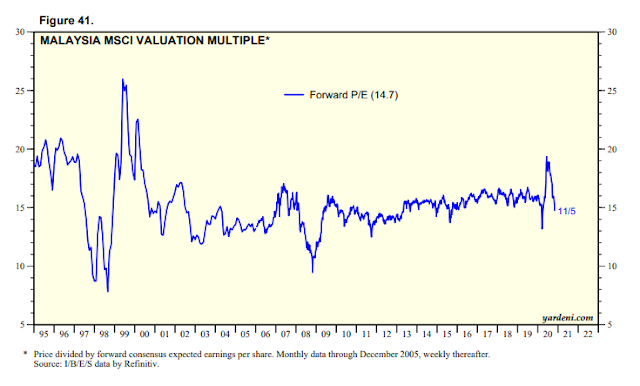

Turkish equities are cheap, both on an absolute basis and relative to their own history. This is a washed-out market. The Turkish central bank is expected to meet on Thursday, and the market expects a significant increase in the one-week repo rate. Watch for fireworks.

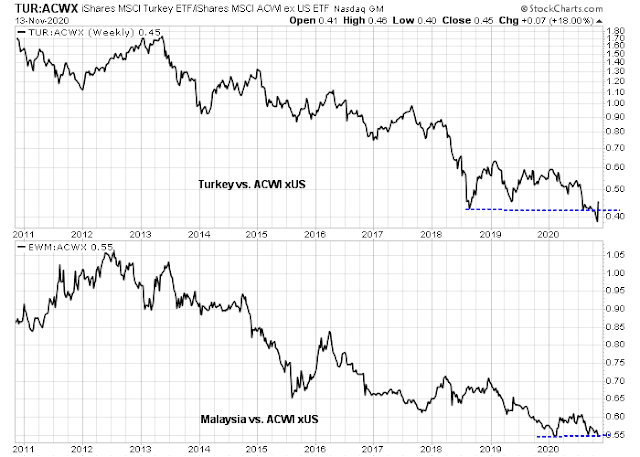

The relative performance of these two countries is tracing out constructive patterns indicating that they are becoming immune to bad news. Turkey rallied and regained a relative support level, and Malaysia is testing a key area of relative support.

Disclosure: Long TUR

Cam, do you have a symbol for any small cap energy ETFs?

Thanks

Here is one (PSCE):

https://www.invesco.com/us/financial-products/etfs/product-detail?audienceType=Advisor&ticker=PSCE

Thank you Sanjay!

My value suggestions are more basic, XME S&P Mines and Metals, XLI Industrials and DVY Select Dividend (lots of financials and utilities)

I expect these to have surprising upside. DVY seems too tame but it has underperformed for over a year which leaves it a long upward ramp to get back.

Thanks Ken! Good input.

Look at PICK: Global miners.

FWIW, PICK not behaving very differently than XME.

I watch both PICK and XME and have been surprised since the vaccine surge, XME is doing better. I would have expected PICK which is 88% non-US miners to do better. Go figure.

There aren’t that many big US-based mining companies anymore. XME therefore less diversified and missing the big ones like BHP and Rio Tinto. But they track each other very closely.

I ran the value proposition by a wealth manager that I do business with and he responded (in part) with this: Currently 43.2% of Russell 2000 Value companies are Non-earning companies, which is a staggering number, and it’s just 3% points under the highest reading of that figure dating back to 1990. The average is 24%.

Value stocks tend to be the ones undervalued for their stock prices, but when almost half the index doesn’t have any earnings, then maybe they’re undervalued for a reason.

This could be interpreted as a great time to buy or sell.

You can focus on the S&P 600 which has much stricter profitability criteria. S&P 600 value ETF is IJS.

BTW the Russell 2000 has beaten the S&P 600 since the March low. The junk is flying. IJS might be a better choice if you are worried about company quality.

Thanks Cam. Performance is virtually the same, even when you look at longer periods of time (pre-Covid through now) so you could infer that IJS gives similar performance with less outlier risk.

In case you missed it, Berkshire trimmed their holdings in major US banks, which confirms my cautiousness on the financial sector.

As well, we now have a classic Dow Theory buy signal. Both the DJIA and DJTA made fresh all-time highs.

If you worry about regulation of trading by big banks, buy the KRE, the Regional Bank ETF. They do basic banking which will do better once the pandemic is over and the yield curve steepens.

Global stocks are floating on an absurd amount of Central Bank liquidity. The Greek ten year bond is 18 basis points lower than U.S. Treasuries and their 2 Year is negative. This is the country where bond yields were 30% less than a decade ago. Much of the world’s government debt is sub-zero.

Using old valuation methods is just wrong. Momentum keeps you on the right side of markets and it has shifted from Growth to Value.

Any portfolio manager that still has a job has a portfolio very tilted to FAANGs and growth. Since, November 9, they have had their heads handed to them. A smart mutual fund manager I know, just underperformed by 5% last week. She had outperformed prior than that by the same 5% from the beginning of the year.

So many portfolio managers will have to shift from growth to value. This won’t happen overnight. It will be a trend for many, many months. They will be reluctant and this is why momentum works.

Here is an example of some resistance. Puru assumed some leverage a few weeks ago to invest more in the big tech stocks. He is shifting a bit now.

https://twitter.com/saxena_puru/status/1328310151913168897

And a few minutes later:

https://twitter.com/saxena_puru/status/1328472118690942976

Cam, Ken or anyone else,

If the momentum shifts from Growth to Value, what are the implications for the FAANG and Growth stocks? How far can they fall? Many are trading at 10-50x of their TTM rev.

And, as a corollary, how far can the Value stocks rise?

The Nasdaq 100 just broke through trendline resistance on the daily chart.

TSLA added to the S&P 500?

Cam, any ETF with Turkey and Malaysia (but ex China)? Thanks.

TUR for Turkey

EWM for Malaysia

Thanks!

Probably not the kind of headline you’d want to see right now:

https://www.marketwatch.com/story/fund-managers-are-believers-in-the-rotating-to-value-trade-latest-bank-of-america-survey-shows-11605618757?mod=mw_latestnews

FCEL – taking a swing ~4.

Off @ 4.23.

TLSA ~436 for a trade.

Adding ~438.

Off ~446.

XLE recovering nicely.

Keep seeing headlines about Iran. You think Trump is crazy enough to start something?

At least John “anyone can invade Baghdad, real men go to Tehran” Bolton isn’t in the administration there anymore.

Good chance the market sells off in earnest tomorrow, after sucking traders in today.

SNAP setting up again. Starter position after hours ~39.2x.

From Ken:

“Using old valuation methods is just wrong”.

“Global stocks are floating on an absurd amount of Central Bank liquidity”.

Thanks for all the insightful comments. Central banks have shredded all the rules we knew of traditional historic metrics. What can I say, except pinch your nose and start buying the dips.

https://www.marketwatch.com/story/fund-managers-are-believers-in-the-rotating-to-value-trade-latest-bank-of-america-survey-shows-11605618757?mod=home-page

Tough spot to be in cash right now. Do we break to the downside, or to the upside?

I’ll have to lean towards the upside. However, with less than usual conviction.

I’ve opened starter positions in VTV/ XLE/ XLI/ XLP/ IXJ/ IWM/ EEM/ FXI.

Financials? Not sure.

OK. Adding a position in KRE.

Reopening RYSPX at the 730 window. Adding a position in RYRHX (Rydex Small Caps).

The ONLY reason I can come up with for a downside move right now is sentiment. Apart from that, I think the two vaccines scheduled for release in December/January will be a game-changer.

Adding BA.

Adding a position in VXUS.

Adding to XLE.

Reopening a position in BABA.

SPX 3588 needs to hold.

rebalanced to and increased size in VT/RSP finally this week on that back test. Still think action is bullish even if we don’t necessarily hold support today. We seem to be consolidating for an upward move to at least 3660, but think we will go higher still.

Rx, Cam issued alert if you didn’t see it, just taking another swing long, but with stop at 3595, not sure if that means it would have triggered stop already, or this is an EOD trade.

OK, thanks Jarad.

Pretty sure CAM has stopped out.

Adding BAC.

Adding a second allotment to all existing positions.

Nice flush in XLE.

Adding a position in RYDHX at the close.

Now @ 50% exposure. If I’m wrong, will definitely be giving back some of my recent gains.

For some reason, it just feels ‘right’ that the market is shaking the tree here.

Badly played today, for sure.

Odds are 50/50 that I’ll need to cut losses tomorrow – not compelling odds at all.

this broke down a little further than i was hoping, but 3560 seems like as good a place as any to make a stand, see what happens overnight here, would like to see us back over 3580-84ish. Further supports below 3545, 3530 – 20 – 10. The “good” news, with a big maybe and we’ll see tomorrow morning, is a good portion of my trades were reallocation EOD trades, but yes, this is going to be uncomfortable if we want to bounce around in a lower channel before “hopefully” breaking out again. COVID wildcard – how much damage does this out of control virus cause before the vaccine on the other side of the valley can provide liftoff?

Is anybody not following the croissant guy?

https://twitter.com/jam_croissant/status/1328957673858084868