Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

A new bull?

Is this the start of a new bull market? Ed Clissold of Ned Davis Research got a lot of people excited when he pointed out that the percentage of stocks above their 50 day moving average (dma) had exceeded 90%. Such events are intermediate term breadth thrusts with bullish implications.

Does this mean we are witnessing the birth of a new bull market?

Bull or bear?

Not so fast. Urban Carmel observed there is a disparity between the percentage of stocks above their 50 dma, which is high, and the percentage of stocks above their 200 dma, which is not as high. The difference can be explained by the strong rally mounted by stocks since the March low.

When the difference of the two indicators (second bottom panel) is high, the signals can be somewhat hit-and-miss. It is an effective buy signal (shown in green) when stocks are in a bull market, and less effective (shown in red) when stocks in a bear market. So we are left scratching our heads. Is this a bull or bear market, and should we buy or sell? The new 52-week high indicator (bottom panel), which is weak, does not inspire a lot of confidence.

If this is a new bull, then it looks like a bull market with bearish characteristics.

On the other hand, if this is a bear market rally, there may not be much gas left in the tank of this rally. Going back to 1998, whenever the NYSE McClellan Summation Index (NYSI) has reached the unusual condition of -1000 or less, the weekly stochastic has always rebounded from an oversold to an overbought reading. We are nearly there.

Unfortunately, these signals (red for buy, blue for sell) tell us little about whether we are in a bull or bear market. Of the four signals, two were bullish, and two were bear market rallies.

How psychology changes

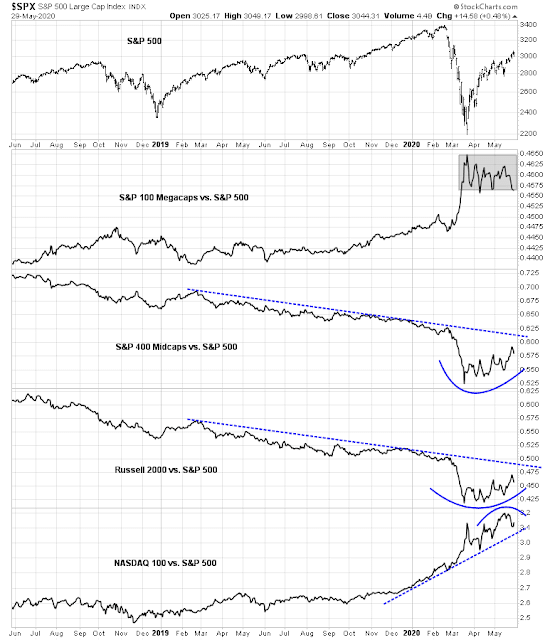

When a market transitions from bull to bear and back to a new bull market, the old leadership weakens to reflect the purging of excesses of the old bull. New leadership emerges to reflect the hope of the new bull. Instead, the analysis of market cap leadership shows that megacap stocks are plateauing. Mid and small caps are trying to turn up on a relative basis, but remain in long-term downtrends. NASDAQ stocks may be rolling over on a relative basis, but remain in a long-term uptrend. In short, the old leadership is still intact. If this is indeed a new bull, then this is another way the market looks an awful lot like the old bull, or a new bull with bearish characteristics.

As well, most measures of price momentum are still in relative uptrends, indicating that the old trends remain intact. Bull/bear/bull transitions usually don’t look like this.

The consensus V-shaped recovery

To be sure, the psychological tone of the market has changed since the March low. The prevalent view has gone from blind panic, to a belief that this rally is a bear market rally, to grudging acceptance of a more constructive view of stock prices. A May 12-27 Reuters poll of 250 strategists around the world found that 68% of analysts now do not believe the March lows will be revisited, and an overwhelming majority expect earnings will trough in either Q2 or Q3 2020. In other words, a V-shaped recovery is now the consensus view.

What drove this change in psychology? Certainly the tone of the newsflow. as measured by the San Franncisco Fed Daily News Sentiment Index, has bottomed and begun to improve, but there is still a high degree of uncertainty over the course of the pandemic and the likelihood of a second wave.

The change in psychology was attributable to rising stock prices, and analysts and managers hopping on the FOMO train. However, analysts at Citigroup discovered that most of the rally was driven by short covering. Is a short covering rally, however powerful, sufficient reason for analysts to turn as bullish as they did in the Reuters poll?

A more worrisome development is the Citigroup Panic/Euphoria Model is firmly into euphoric territory, which is contrarian bearish. As a reference, the Panic/Euphoria Model is reportedly based on the following factors:

- NYSE short interest ratio,

- Margin debt,

- Nasdaq daily volume as a percentage of NYSE volume,

- A composite average of Investors Intelligence and the AAII bull/bear data,

- Retail money funds,

- The put/call ratio,

- CRB futures index,

- Gasoline prices, and

- The ratio of price premiums in puts versus calls.

Other traditional market based sentiment indicators, such as the equity-only put/call ratio, is very low, which is contrarian bearish.

Jonathan Krinsky of Bay Crest Partners pointed out that the stock market has historically not performed well when the put/call ratio is this low after a strong 10-day advance.

More puzzles

Here is another chart that lends to differing interpretations. The ratio of high beta to low volatility stocks have been an effective short-term leading indicator of market direction in the recent past. The ratio is rolling over, which is short-term bearish, but it remains in an uptrend, which is supportive of the bull case. This is another indication of a bull with bearish characteristics. In all likelihood, we will see a near-term pullback, but the market can push higher until the rising trend line is violated.

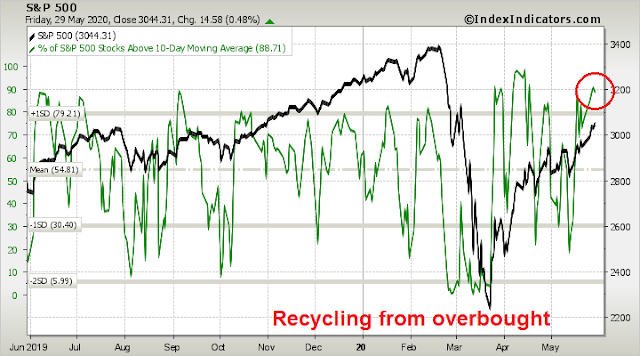

Short-term breadth is overbought and rolling over, which suggests market weakness early in the week.

However, the bulls may have one last gasp after an initial bout of weakness, and the bears should not get overly excited just yet. The different flavors of the Advance-Decline Line flashed negative divergences by failing to make new highs even as the S&P 500 broke above resistance and its 200 dma, which is bearish. However, as long as the A-D Lines remain in uptrends, the bulls still have control of the tape.

My inner investor is underweight equities, and he is slowly moving towards a neutral weight by considering buy-write opportunities (long stock or index, short call option) as a way of mitigating downside risk. My inner trader is standing aside and awaiting a better trading opportunity.

https://www.yahoo.com/news/us-food-prices-see-historic-144739052.html

In the previous post, we briefly discussed negative interest rates. I am somewhat worried about inflation in the pipeline, though I do not know how it would happen or why. Despite outward deflation, supply chain disruptions may cause shortages of food and energy, of manufactured goods, causing higher inflation.

Still not crystallized my thoughts on this. To be sure, Dollar index has come down, oil is up from its bear market lows, both pro inflationary factors; many things do not fit into this picture, including the bear in a bull market.

As long as the savings rate stays up, there will be no inflation threat.

Thanks Cam. Perhaps there may be small sectors of inflation here and there, but over CPI/Core CPI/PPI may remain stable to a deflationary pattern. We shall see.

Here is a great index to watch inflation. It operates like the CITI Economic Surprise Index. It is an Inflation Surprise Index. Keep it for future reference. It updates often. Tame at the moment.

https://product.datastream.com/dscharting/gateway.aspx?guid=b94657bd-60bf-49eb-92de-e564b501473c&action=REFRESH

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12331941

Covid 19 coronavirus: Overseas travel won’t return until 2023, experts warn!

Hi Cam, you mention the fact that a new bull market is characterized by new leadership. What about the fact that we just could be in a continuation of the old bull market 2009-2020 with the same leaders. The drop of February being a bear trap and an event driven correction…

If I told you that the global economy is going to hit a dead stop, and the unemployment rate is going to hit levels exceeding all records, except for the Great Depression, would you expect that the stock market to just suffer a brief downdraft?

Maybe not… but it is also true that the liquidity injection and fiscal packages are unprecedent too. Reason why we could eventually think that the negative impact of all this dead stop could come much later.

Here is a publicly traded company with 100’s of millions of already booked future delivery contracts that gets a Payroll Loan for it’s labor costs for 3 months :

https://www.snl.com/IRW/file/4413920/Index?KeyFile=403590367

Read the first two paragraphs to become convinced that the Fed does indeed furnish equity.

And, the equity supplied is completely tax free.

In addition (and JMO), I think tax-free stimulus payments are 100% justified. Backstopping companies that are in danger of failing due to govenment-mandated policies is absolutely the right thing to do. It’s one reason governments exist in the first place.

Bankruptcy of a company does not means its business failed. It means the company had too much debt and owners didn’t keep enough earnings in the company for a rainy day. That means in a bankruptcy the owners of the equity lose and the company comes out of bankruptcy with less or no debt and is back in business in a healthy way. BTW it can then pay taxes on profits to the government since losses because of heavy interest payments on debt is gone.

Bailouts of corporations are bailouts of owners who took a risk/reward chance. It bails out bad management decisions. Bankruptcy, gives a fresh start. It makes a company healthy again. It slaps the wrist of bad management that aligned with bad ownership.

Actually, there are two ways a business can go into bankruptcy:

1) Bad capital structure: Too much debt, falling sales

2) Failed business model

In the case of (1) a bad capital structure but a viable business model , you can keep the business going by injecting equity, either through a conversion of debt into equity, or a simple injection from an outside party.

In the case of a failing business model, e.g. AirBnB where demand evaporates, and the regulatory authorities crack down on what amounts to regulatory arbitrage of running unlicensed hotels, the business has to either shrink dramatically or simply fail. No amount of equity injection can save such a business.

CEO thanked “Administration and Congress for creating this much-needed safety net”. It’s a fiscal program, not a Federal Reserve program.

Almost no one believes a new bull market started on March 23. I don’t believe it myself. But I remain open to the possibility.

Philippe brings up a good point. The violent decline in February/March in response to an unfolding pandemic may have just temporarily derailed a powerful bull market (and of course, whether we entered bear markets in 2011, 2015/2016, and 2018 will probably remain open to debate indefinitely). The economic cost of the global response may ultimately be effectively contained via the trillions being supplied by global central banks. Money doesn’t solve all problems – but it solves a good many of them. The people I know who have lost jobs – they’re all ‘doing OK’ with a combination of state/federal unemployment payments and look forward to

easing back in to slightly altered work environments.

In which case, waiting for new leaders to emerge will result in misdirection.

Oftentimes, what works just keeps working. Is real estate a useful analogy when trying to understand investor behavior? Perhaps not ideal, but some of the same underlying psychology applies.

I’ve spent time in three different locations in the US – Pittsburgh, Ann Arbor, and the San Francisco Bay Area. In keeping up with old friends, it’s simply amazing how real estate prices have diverged in the three areas. There are home prices in the Pittsburgh area that have barely kept up with inflation over several decades, whereas prices in the Bay Area haven’t really looked back since the Sixties. My Dad’s biggest regret was selling a home in Atherton (a small community on the Peninsula) in 1970 when relocating to Ann Arbor. When he retired in the mid-Nineties, I convinced my folks to move back to the Peninsula. They were afraid of overpaying, to which I replied ‘I don’t think you have anything to worry about.’ If anything, prices have soared percentage-wise even more since then. Reversion to the mean may happen some day. but it won’t happen within his lifetime.

Companies started by visionaries who then attract/hire the best talent tend to keep winning. That’s why we bet on them. The pandemic will certainly lead to more than a few bankruptcies – but I think in most cases it will have simply hastened the inevitable. Smarter companies will have already moved to adapt to new work environments and position themselves to succeed. Investors (the younger ones in particular) understand this, and are probably betting not only on a recovery, but a more efficient and streamlined economy. In other words, is it possible that the economic response to the pandemic becomes an an opportunity to eliminate complacency and more quickly usher in a new era of innovative technologies and better ways of doing things?

I am in agreement. The winners this time may be new breed of companies that are addressing the future. Data analytics, hyper connectivity, clean energy, 5G, advanced manufacturing, Robotics, AI, bioinformatics, gene editing etc. are the new leaders. I believe earlier models of leadership are fading.

Arguably, some companies like AirBnB and Uber have used the pandemic as cover for slashing tons of dead weight. They may just emerge leaner and more profitable than ever.

Exactly. Both companies are conceptually sound. They’ll find ways to adapt to a new reality.

Momentum Factor has proven to be a successful Investment/trading strategy. It has it’s pitfalls. I think we are in a price momentum stock market. How far it goes, I think no one knows.

PS: Earnings momentum is a stronger factor.

https://www.yahoo.com/news/coronavirus-losing-potency-top-italian-184358113.html

Really?

Surprising but welcome if true.

I’m surprised there has been no mention of the social unrest. It seems to me that it is not simply about the tragic murder but also about Covid uneven impact on middle and lower classes, especially blacks but not only. This rage could escalate and have a growing impact on the economy and investor sentiment including the U.S. dollar and the desirability of American investments to international investors.

There is a lack of normal Presidential leadership and empathy during this time and the clear possibility of Trump calling out the military. I was around when National Guard soldiers shoot university students at Kent State. A mistake by a few young soldiers could send things into anarchy.

This will likely effect the November presidential election outcomes. Many investors expect Trump business policies to be much more profitable for investors than Biden’s.

The President calling out the Chinese government for using tear gas in Hong Kong against HK citizens who should have ‘freedom of assembly’ seems a bit hollow now that rubber bullets are flying in America along with the tear gas and curfew arrests.

How can there not be a huge surge in Covid with tens of thousands of people not social distancing? The young folk will bring back the virus to their homes and families. There is no social distancing and contact tracing in a riot. Mayors complain that actors from outside their cities are coming in a creating problems. These agitators will be going back to their home towns infected with the virus.

I pray things go well but ……

Also hard to get a V-shaped recovery if there are rioters in the streets

I’m a zero tolerance sort of guy when it comes to riots, looting and vandalism. If they put down a few of these people on the spot the problem will disappear. Harsh but true and is better than doing nothing like cities are doing now. These are not peaceful protestors.

I’ve seen people say on Twitter the riots will create jobs due to need for infrastructure and rebuilding efforts. As well as the belief that the riots will motivate more action from Congress to help average people, thus indirectly benefiting equities. Talk about euphoric sentiment! Very strong complacency and belief in the Fed put right now.

Lol! We need more civil insurrection!

The entire 2009-2019 bull market was littered with similar instances of social unrest.

Occupy Wall Street in 2011.

Flatbush Riots in 2013.

Ferguson Unrest in 2014

Milwaukee and Charlotte Riots in 2016

Charlottesville 2017

And now we have the George Floyd protests of 2020.

The added lost jobs stress on this event might make a big difference as to the depth of the crisis. Hopefully not but …..

Understood. At this point in time it’s unclear whether this weekend’s social unrest:

(a) will in fact lead to an increase in Covid-19 infections

(b) is being used as a cover by opportunistic looters

(c) will lead to another tragic standoff between protesters and the National Guard

I was a bit too young to fully appreciate the horror of Kent State – but I doubt anything close to it would occur today. Rubber bullets/ water cannons/ tear gas perhaps – but hard to imagine a scenario where lethal rounds would be employed.

My point was that social unrest itself does not necessarily impede stock markets. Kent State occurred against the backdrop of a +70% in the DJIA between 1970 and 1972.

I live across the Lake on the ground floor and couple thousands of Antifa and BLM took over the street and its looks like a big party (no cops around). I can’t see the smiles (mask on) but can hear the laughter a mile away. I am not assuming they are Antifa and BLM because their signs and speech identify them. They are not hiding it either. Got out and spend the night with my sister. As an investor, we try to remove our emotions from real life events but this time it is too close to home!!

Futures open down hard. Still fifteen hours ’til the open, but kudos to Wes for a slick after hours short.

Too funny:

Stalingrad & Poorski

@Stalingrad_Poor

BREAKING: S&P FUTURES WELL OFF SESSION LOWS AS RIOTERS BRIEFLY PAUSE THEIR CAMPAIGNS OF DESTRUCTION TO LOG INTO THEIR ROBINHOOD APPS AND BUY THE F**KING DIP

With regard to the PPP loans, in order for the loans to be converted to grants/equity, the companies have to retain/compensate employees. Once the loan becomes a grant, the compensation expense becomes nondeductible to the extent of the PPP grant. So it is not “completely tax-free.”

Interesting perspective on whether the debts created by central banks will ever need to be repaid:

https://www.scmp.com/week-asia/economics/article/3086759/why-china-japan-neednt-worry-about-paying-all-debt-back?utm_term=Autofeed&utm_medium=Social&utm_content=article&utm_source=Twitter#Echobox=1590968575

That’s the beauty of MMT. It is like your left hand paying your right hand. But it is only for those debts in your own currency. And it only goes as far as inflation (currency debasement) can tolerate. Anyone who has a rudimentary knowledge of how CBs work understand this. But those bloated debts in USD still will cause trouble for other countries.

Why US politicians still want to emphasize fiscal responsibility to the masses? This is the only way they can still play their game and put on a show. In other words, the dumber the Americans become the easier they can profit themselves. Seen any congress man or woman who is not rich? Not a chance. Teach our children to be a politician. That’s the best career advice there ever is. My kid’s classmate is going to Cal to study political science this Fall. Other kids are going to Cal to study STEM majors. These kids (including my kid) are not getting it. I told my kid this guy someday will be a dirty and influential politician and more successful than all of you even though he is in no way in the same league in terms of IQ level. But he has a thick skin and is a natural liar.

There’s definitely substance to your career advice. The prevailing backstory behind the construction of a 20,000 square foot fitness center (inside a local community college) with expansive views of the bay funded by tax payers-> our Congresswoman, who resides within walking distance of the gym, wanted a convenient place to work out.

You may want to call it “illusionary debt”. That said, Germany tried it and took it on the chin.

I know investors are tired of hearing about treatments in the nascent stages of clinical trials, but I think that at some point they’ll come up with something that really makes a difference.

https://scitechdaily.com/new-research-points-to-treatment-for-covid-19-cytokine-storms-solution-to-global-pandemic/

‘Patients taking ruxolitinib were randomly selected to receive two daily 5mg oral doses of the anti-inflammatory drug, plus the standard of care treatment for COVID-19. A randomly selected control group of 21 patients received a placebo along with the standard of care treatment.

‘“Ruxolitinib recipients had a numerically faster clinical improvement,” study authors write in their report. “Significant chest CT improvement, a faster recovery from lymphopenia and favorable side-effect profile in ruxolitinib group were encouraging and informative to future trials to test efficacy of ruxolitinib in a larger population.”

‘Patients treated with ruxolitinib saw a shorter median time to clinical improvement compared to the control group. Patients treated with ruxolitinib saw a shorter median time to clinical improvement compared to the control group. Researchers reported that 90 percent of ruxolitinib patients showed CT scan improvement within 14 days, compared with 61. 9 percent of patients from the control group. Three patients in the control group eventually died of respiratory failure. All the severely ill patients who received ruxolitinib survived.’

Hang Seng +3.5%. What are the odds that CCP family members shorted ahead of last week’s announcement of a national security law, and then bought the Hang Seng Index on Thursday and Friday?

You are trapped in a room with a lawyer , a deadly snake, and a deadly tiger. You have a gun but only two bullets. What do you do ?

You shoot the lawyer.

Twice.

A lot depends on why you find yourself trapped in a room with a lawyer, a deadly snake, and a deadly tiger. Not to mention a gun with only two bullets. Deductive reasoning might conclude that the lawyer, the snake and the tiger are already dead.

You know why a rattle snake won’t strike a lawyer?

Professional courtesy.

Cam and others, have you seen a market environment like this in the past in which every microdip is bought? I think it has a strong effect on sentiment and psychology that allows participants to overlook the backdrop of economy, bankruptcy, second wave etc.

Also any insights into near-term direction of the VIX?

Yes, the late 90s. The joke at our Boston condo meeting when the building needed money was “that’s 2 weeks of investing in Qualcomm”

Thanks! So I guess it might remain bullish? I guess we will see, VIX still high…

Agree with Cam. A guy at work watched the price YHOO climb day after day, week after week. One day, he finally gave in – ‘I can’t stand it anymore!’ And he ended up making a lot of money!

Hi Cam, just curious what indicators are you following that will make you turn bullish in short- and intermediate-terms?

To be short term bullish, I need to see more signs that this is a 90s style bubble.

Trimming 70% of positions opened on Friday here.

Down to one position in SPY – if it manages to close above last Thursday’s high of 306.84, I’ll continue to hold the position. Otherwise, I plan to close.

The challenge with momentum trading is trying to discern whether there’s enough momentum to drive prices further, or whether a pullback is needed to launch a new leg higher (ie, the pause that refreshes). The thresholds are somewhat arbitrary – in this case I’m going with a close >306.84.

Thoughts on this view on earnings Cam? https://twitter.com/EarningsScout/status/1267549327934853123?s=20

I agree. Q2 is mostly a write-off.

It’s the trajectory of earnings for the rest of this year and early next that matters the most.

Thanks!

Dr. Morrow is both level-headed and a very good writer. His June 1 statement summarizes the situation in San Mateo County better than any other communication/ article I’ve read:

Health Officer Releases New Statement on COVID-19 Pandemic & Shelter in Place Order. The third modification of the shelter in place order is being made on June 1, 2020. These modifications are being made in attempt to strike a balance. They are an attempt to find a way to increase the immunity of the population (in public health terms, this is called “herd immunity”) slowly and methodically, while minimizing premature death, with equity in mind, while not overloading the healthcare system, and minimizing economic damage.

Many of these considerations work in opposite directions. Of important note, the macroeconomic concerns are also working somewhat in opposition to the microeconomic ones. These modifications are NOT being made because it is safe to be out and about. The virus continues to circulate in our community, and the increase in interactions among people that these modifications allow is likely to spread the virus at a higher rate. Whether these modifications allow the virus to spread out of control, as we saw in February and March and resulted in the first Shelter in Place order, is yet to be seen. The risk of exposure to COVID-19 looms large for all of us. The public and open businesses need to fully do their part to minimize transmission of the virus.

As the governmental public health measures and restrictions imposed during to the first wave of this pandemic are slowly easing, the power to control the spread of the virus is moving to you, the individual, and you, the community. You get to decide what future you want. Your collective behavior will determine our destiny.

If enough people, businesses, or organizations in the community do not follow the protective recommendations, the virus may spread with abandon. Our best estimate of the Re (the effective reproductive number) after the first Shelter in Place order was 0.9, down from between 3 and 4 in the weeks prior to that. Anything above 1 is not good, and the higher it gets above 1, the worse it is in an exponential manner. After the several rounds of loosening of restrictions, it is now estimated at 1.3. That means without everyone doing their part, and maintaining an Re closer to 1, the virus is set to explode again. That scenario benefits no one.

We are already seeing an upward trend in hospitalizations with the modifications that have already been made. This means the virus is likely now circulating at higher levels than before.

While we will certainly recover, the world will look different in the future. If you are feeling on edge, out of sorts, a bit unhinged, these feelings are completely normal. We are certainly in the midst of the biggest disaster of our lives.

Pandemics destroy human made systems. Pandemics damage the economy in many ways, but primarily through demand suppression. Pandemics threaten all manner of stability. Pandemics unearth hidden strifes and conflicts that we thought were long buried. Pandemics are a spark that can, if not carefully managed, cause a global conflagration.

The profound economic shock of this pandemic will be larger than the Great Depression. (For those of you who believe that the public health restrictions caused the economic shock, evidence suggests otherwise. Fear plus mass death — which we, very fortunately, did not experience here most likely because of the public’s compliance with the restrictions — causes far greater and longer lasting demand suppression than fear alone).

The pandemic came on with great speed, like a natural disaster such as an earthquake or a massive hurricane. It has caused the largest change in consumer behavior ever measured. It will cause a larger mass reallocation of labor than occurred in World War II. Many people understand this, try to be good citizens and follow the recommendations. For some, it is too much to bear and they are in deep denial. There are some who are experiencing direct and deep economic harm due to the restrictions put into place to slow the pandemic. To those folks, I would say, I’m trying to ease restrictions as fast as I can without being reckless.

And then there are some people who don’t understand, some who think Darwinian concepts should rule the day, some who have completely different views on how the world works, and some who simply don’t care. These people are very frustrating to people who care about their responsibility to others.

Since it is always tricky to try to influence other’s behavior, the best you can do is to do the right things to protect yourself, your family, and those you care about. If you have any worry at all about the virus and its effect on you, your family, friends, colleagues, neighbors, or others, you should know, it is not completely safe to be out, it is even less safe to attend gatherings of any size. If you are at risk from serious complications of the virus, you should continue to take all measures to ensure your safety.

Please read or reread my previous statements below to get a better understanding of where we find ourselves today and actions you can take to protect yourselves and your family: https://www.smchealth.org/health-officer-statements-and-orders.

Scott Morrow, MD, MPH, MBA

San Mateo County Health Officer

Public education on stemming the spread has not been clear or effective.

My own locale has started to return to normal. Some mask wearing and social distancing, but nothing close to ideal. The protests over the weekend were not helping either.

Looking objectively at the SPX (currently no skin in the game) – the odds-on bet would be a spike to 3100. The flip side, however, would probably be a sharp break lower as momentum fades.

Re Goldman’s change in view:

https://www.bloomberg.com/amp/news/articles/2020-06-01/goldman-rolls-back-its-pessimistic-outlook-for-american-stocks?__twitter_impression=true

I don’t have a problem with it. They’re simply doing what we all do – changing their take on the market in response to changing market conditions.

Goldman has a terrible track record. Do the opposite of what they say.

Goldman out with a year-end target of SPX 3000.

https://www.marketwatch.com/story/heres-why-the-unloved-but-welcome-us-stock-market-rally-from-march-lows-wont-last-goldman-says-2020-06-01

It’s almost always the case that I regret not having had more faith in my sixth sense. On the other hand, by the time I jump into an irrational trade for which I have no explanation it’s usually close to a reversal point.

I can definitely relate… it seems like either we stay on the sideline until now or go in gradually from the start, both takes conviction. Seems like most of the money lost are those who are not fully convinced or disciplined.

Right. It’s almost impossible for investors to have captured the entire +35% rally off the lows, unless they also fully participated in the -35% decline in Feb/Mar.

Wally- I think it’s difficult, if not impossible, to predict market movements. Reacting to price movements is more effective. All the indicators in the world pale in comparison to price movements – simply because all the indicators in the world are based on…price movements!

Like the old song, RX, When You’re Hot You’re Hot and When You’re Not You’re Not.

Now that I’m rereading my earlier comments, I should add:

(a) It is very difficult to predict market movements.

(b) I’ve followed dozens, if not (at least temporarily) hundreds of traders over the past thirty years. There are about a dozen traders that have not only done well, but continue to do well. So I’ll amend my earlier statement from ‘it’s difficult, if not impossible’ to ‘it’s ALMOST impossible’ to predict market movements.’ Some people have the right mix of experience/ knowledge/ discipline/ research/ intuition to get it right most of the time. Obviously, Cam is one of them.

(c) I started tracking Cam on Twitter about two years ago. He’s made some really good calls. Check out his performance record – if you know anything about market timing, it’s superb.

(d) In the end, it’s up to each of us to pull the trigger. I read/listen to a lot of news and media reports in order to gauge investor psychology. I read a lot of analyst comments for the same reason. I read more carefully the comments from the dozen guys/gals I follow – and sometimes it’s a simple one or two word reply to a question that catches my eye and IMO makes the call. Finally, I turn it all off and spend time in the evenings/ early mornings putting it all together and usually winnow things down to Plans A and B. Sometimes there’s a C.

Not seeing a compelling setup today. My sense is that today’s rally is a better sell than it is a buy. I’m mentally targeting 3085 to 3120, but we probably need a pullback in order to get there. And of course, I always plan for the very real possibility that I’m wrong.