Mid-week market update: What should investors do when faced with competing narratives and historical studies with opposite conclusions?

The major market indices made another all-time high today. Ryan Detrick pointed out that ATHs tend to be bullish. That’s because of the price momentum effect that is in force which propels stock prices to new highs.

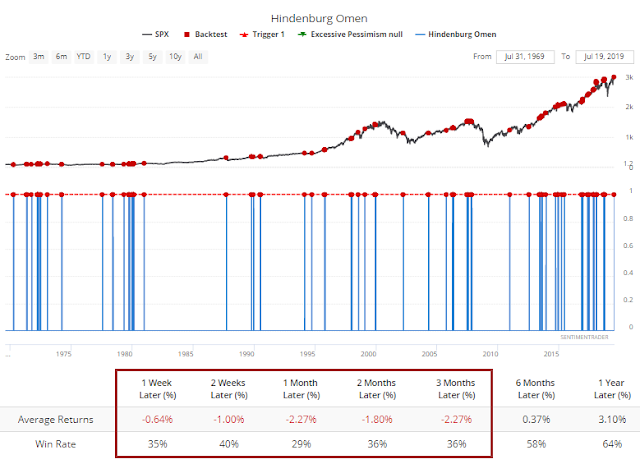

On the other hand, SentimenTrader observed last week that the market has flashed another series of Hindenburg Omens. Subsequent to that tweet, Tom McClellan pointed out that there was another Hindenburg Omen on Monday. Historically, clusters of Hindenburg Omens have resolved with a bearish bias.

Should traders be bullish or bearish?

Here is some out-of-the-box thinking. I would argue that the stock market rally is actually the result of a fear. Yes, you read that correctly – Fear.

The bull and bear cases

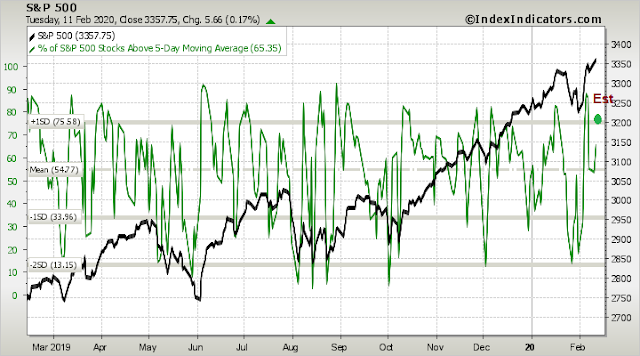

There is little doubt that the market is overbought. The bulls will argue, however, that the market could be just starting a series of “good overbought” readings that accompany a slow grind upwards.

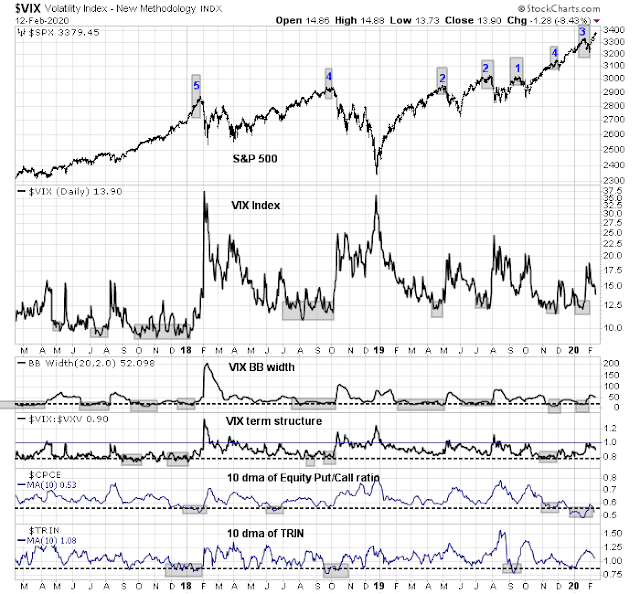

SentimenTrader also warned about the precarious and complacent state of the put/call ratio, which has always resolved with a market decline over the next two weeks. Some of the excess bullishness to retail buying of TSLA call options, which SentimenTrader referred to as a “speculative spigot”.

From a broader sentiment context, my suite of non-survey sentiment indicators do not reveal excessive bullishness other than the put/call ratio. In the past, short-term tops have been marked by these indicators flashing complacent readings, or near complacent readings. That does not seem to be the case today.

A fear trade

Instead, I would argue that the relentless bid in US equities is reflective of fear – yes, fear. Global investors have been piling into US stocks as a safe haven trade in the face of coronavirus risks. The rally has been misinterpreted by American investors as an unsustainable on fundamental, technical, and sentiment metrics.

Sure, the market is overbought today, and may see a brief 1-2 day pullback. That is why we are seeing the narrow leadership, the Hindenburg Omens which are reflective of a bifurcated market, and selected signs of sentiment excess, such as extreme lows in the put/call ratio.

It may seem obvious, but when the market doesn’t fall after a rally leg, it usually means it wants continue upwards with the rising trend. My inner trader remains bullishly positioned, but he recognizes that this is an environment characterized by high volatility. Traders should therefore properly adjust their position sizes in light of elevated risk levels.

Disclosure: Long SPXL

Very insightful. The fact that buying is generally associated with complacency leads us to overlook unconventional driving forces – and there’s no greater driving force than fear. The rally may be sustainable solely on those grounds. It’s fear of failure that drives many successful people to great heights and then keeps them ahead of their peers for long periods of time – little to no ‘reversion to the mean.’

Are things in fact different this time (notwithstanding the adage that things never change when it comes to market behavior)? I think COVID-19 is a game-changer, but perhaps in ways we don’t foresee.

Hubei province changed their reporting methods and reported a 10 fold increase in coronavirus cases and double the deaths overnight. This might cause a market concern Thursday. The S&P 500 futures are down about 9 as I write this.

https://www.scmp.com/news/china/society/article/3050354/coronavirus-hubei-province-reports-sharp-spike-new-confirmed

Goldman Sachs had this to say today about the China Bat Flu.

“The temporary hit from the virus outbreak should be about 10 times as large as the disruptions from a major U.S. hurricane,” wrote Zach Pandl, a strategist at Goldman Sachs. He says the virus’ outbreak, which has paralyzed economic activity in China, will reduce annualized global output by 2 percentage points.

C’mon Wally, if ES futures were down were down 50 points, it would wake me up!

“Global investors have been piling into US stocks as a safe haven trade ”

I think you are bang on!

1. Bernie Sanders effect.

2. More CB easing coming from JPN , CHN, and EUR, plus more fiscal stimuli, because of new CoronaVirus.

3. Likely Fed QE soon.

4. Market can go up for a long time in the presence of all these liquidity.

In the year 2000 a pension committee on reviewing the 1999 portfolio performance of investment management firms hired to manage portions of their pension fund made a brilliant decision to fire the best performing ones. The logic was that performing well in the insanity of the 1999 Dot.com bubble was a major strike against an investment firm.

We know how that work out so well as investment firms who stayed with sound investment styles that were out of favor outperformed mightily thereafter.

Just imagine how unique the pension fund’s decision was to go against the pull of the crowd.

The current FAANG craze seems to rhyme with that past era although these companies certainly have real value compared to the Pet.com types back then. Any investment manager that has outperformed last year must be a FAANG believer.

My suggestion – fire them. If that manager of your real money (not fun trading) is you, fire yourself and hire a boring underperforming portfolio manager.

Looking back a couple of years from now, you will be thankful.

My friend, the underperforming manager, today, would be buying energy, staples and tobacco, and some big pharma wouldn’t s(he)? What else is there left, that is underperforming? This is not a rhetorical question and I would love your opinion. Thanks,

Agree with monthly overbought and that the bull market just got started. I expect at least another year of bull market.

Detrick data alines well with CCM demographic study.