I received a ton of comments from my post three weeks ago on the energy sector (see Energy: Value opportunity, or value trap?). I engaged in multiple long email discussions with several readers on different aspects of that post. This is a follow-up to the publication address two main issues that were raised:

- The impact of the solar cycle hypothesis on the Earth’s climate, and as a bullish catalyst for the energy sector

- How to investing in energy stocks in the new ESG era.

To briefly recap, the solar cycle hypothesis postulates a link between the Earth’s temperatures and the degree of sunspot activity. We may be undergoing a period when sunspot activity is diminishing, which would serve to counteract some or all of the effects of anthropogenic (human made) global warming, or AGW. This assertion upset a number of readers, and made the analysis verge into political territory.

The mandate of this site is a focus on investment, and not politics. I am not here to advocate for candidate X over candidate Y, or party A over party B. Instead, I try to analyze the likely trajectory of each candidate or party, and try to position for how changes in policy might affect asset prices.

Solar cycle analysis

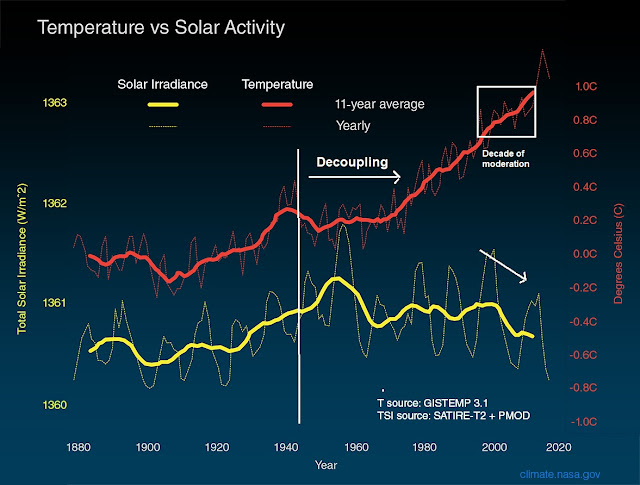

I am grateful to a meteorologist reader (thanks Dean) who directed me to an analysis by NASA which studied the relationship between the solar cycle and the Earth’s temperature and concluded: “It is therefore extremely unlikely that the Sun has caused the observed global temperature warming trend over the past half-century.”

I never said that the solar cycle caused warming. However, a review of the chart below (annotations in white are mine) reveals several insights. First, the solar cycle and the Earth’s temperature tracked each other very closely from 1880 to the late 1940s, when the relationship decoupled. This suggests that there was a close correlation and probable cause and effect relationship between the two data series. When the decoupling began, another factor contributed to changes in the Earth’s temperature, which most climate scientists today attribute to AGW. Nevertheless, analysts should not totally ignore the effects of the solar cycle. In particular, the Earth went through a decade of moderation (shown in white box) when temperatures did not rise as forecast in most climate models (though average temperatures kept rising). That decade of moderate could be explained by the cooling effects of the solar cycle.

A picture tells a thousand words. The solar cycle hypothesis remains valid based on the data, though not proven. A simple glance at the chart supports a simple model is T = S + A, where T=Temperature, S=Solar cycle function, and A=AGW function.

We will note really know for another 5-10 years until we see additional data. Even if the hypothesis is correct, the consensus will not change for another decade. For energy investors, that’s a very long time to wait.

That’s the investment conclusion. Don’t get too excited about the politics about the model. Nothing will happen for another 5-10 years.

Sector outlook: An ESG stampede

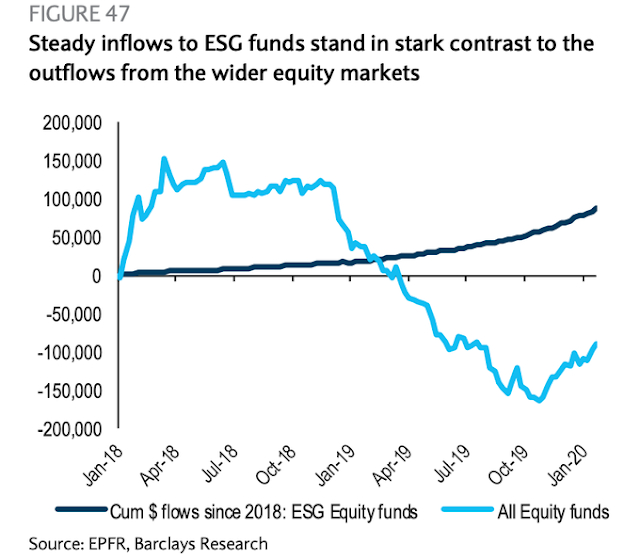

The recent stampede into ESG (Environmental, Social, and Governance) investing is more interesting. It’s no wonder why asset managers are interested in ESG. Fund flows into these funds have been rising steadily, even as other funds lose assets.

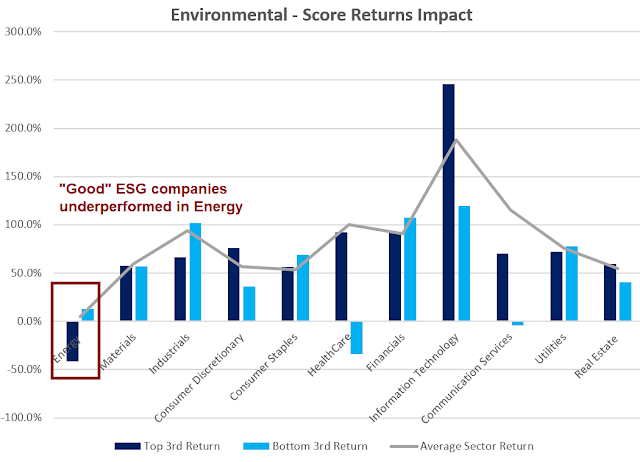

How important are each of the E, S, and G factors in ESG investing. To answer that question, FactSet showed the returns of companies with good MSCI ESG scores compared to companies with bad ESG scores within sector. While most sectors showed positive selection effects from ESG within sector, it was negative within energy stocks. I interpret this to mean that the entire sector was shunned by ESG investors, indicating that the E (environment) in ESG was far more important for sector selection

On the flip side, Tesla is the epitome of an ESG darling today. Kevin Muir at The Macro Tourist suggested that the recent parabolic rise in Tesla is attributable to buying by an ESG institutional manager who had an imperative to achieve his desired portfolio weight in the stock.

The moral of the story? When the big accounts come for a stock, it doesn’t matter how stupid the price, they just need to get it in. They are the scariest ones out there because they can keep buying for days, weeks, months and sometimes even years.

Which brings me to today’s Tesla price action. Yes, retail option buying is helping push it higher. And of course, the big short base previously helped the rise accelerate.

But this move is being driven by big real money.

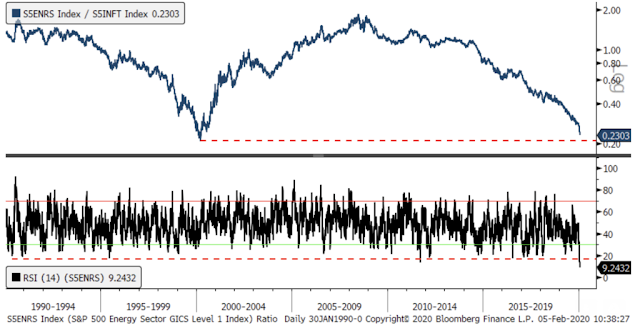

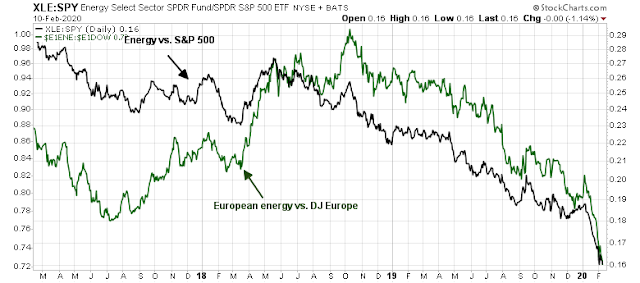

Josh Brown recently featured a chart from technical analyst Jon Krinsky comparing the relative performance of technology and energy stocks. Josh Brown characterized is as the “mean reversion trade of a lifetime”. In light of the continuing flows into ESG investing, and FactSet’s analysis that ESG investors are shunning energy stocks, mean reversion investors may have a lot longer to wait before the trade pays off.

For now, energy stocks are being shunned by both American and European investors.

Energy investing in the ESG era

How should energy investors approach the sector?

It depends on your style. Momentum investors can jump on the ESG bandwagon by buying into clean energy stocks. While most of the holdings in clean energy ETFs are comprised of industrial and technology stocks involved in clean energy, e.g. wind power, etc., it is one way of gaining exposure to the theme.

The chart below shows the relative performance of energy stocks and clean energy ETFs. Energy stocks have been lagging the market, and they are likely to continue to lag owing to the secular shift towards ESG investing. However, clean energy ETFs have performed considerably better than the energy sector. The worst ETF is Cleantech (PZD, bottom panel), which lag the others because it does not hold TSLA.

For patient value investors, consider commitments to well-capitalized integrated oil companies. A recent interview with Bob Dudley, the now former CEO of BP Amoco, reveals the challenges that energy companies have with regards to ESG pressure from investors. Before he became CEO, Dudley headed BP’s ill-fated venture into solar energy, which was devastated when Chinese producers entered the market and drove down the prices of solar panels.

Dudley gave a nuanced response to a question about the pressure on energy companies to meet green targets. Having experienced the disastrous solar venture, Dudley responded that companies need to have a strong enough balance sheet to respond to these challenges, otherwise it may not exist if the technology fails:

Interviewer: There’s pressure on companies like BP to show that long term investment plans are aligned with two degrees on these targets [of providing energy and reducing CO2 emissions]. Even though, most nations not just a Trump administration, most nations policies are not yet ambitious enough to meet those targets, so what does that mean for how fast a company like this thinks about moving?

Bob Dudley: Well we certainly need to move fast and change our mindset to adopt and invest in new kinds of things and experiment, maybe small and then, for us, given our challenge decade after the events in the Gulf of Mexico. I’m of the belief if we understand where the technologies are going and we invest, the best thing we can do strategically is have a very strong balance sheet, so then when it becomes really clear, certain technology is going to move very quickly and be profitable, then we’ll be able to make that shift. So I’m not worried that we may not be fast enough turning over the portfolio, it’s more making sure our balance sheet is strong and then we’ll be able to move in these areas.

Dudley did describe climate change as an existential threat, but waffled about how the Big Five should address the problem, because of the market presence of large national oil companies that are answerable to political masters, e.g. Armaco, Petrobras, etc.

Interviewer: So I want to ask you about what’s not on this timeline, which is where the energy industry is headed in the future and you’ve often talked about the dual challenge of meeting the world’s rising demand for energy and also decarbonization to address the threat of climate change. You said something at ADIPEC in Abu Dhabi this year. On your panel, climate change is an existential threat. If we as leaders don’t leave the companies, right, we could put ourselves out of business and other people will replace us. What’s the role for an oil and gas company like BP in solving climate change?

Bob Dudley: Yeah, it was in response to, you know, my view the great dual challenges, though, as many as 2 billion more people on the planet in the twenties, forties than there are today, the energy needs will be up by a third which is about the equivalent of another United States and another China entering at the world stage in terms of energy demand and I find the debate on climate issue which is and it is also an existential issue, the rising climate conditions, you also have to take care of nations who will improve their prosperity and move people out of poverty and the debate becomes often polarized of Northern European view and West Coast US view as sort of extremes view of the world who are very privileged in this area and don’t really understand when you travel to places across Africa and India, South Asia, all across it and we need to debate it and discuss and decide, make big decisions with both positions in mind.

It’s very easy; it’s very polarized issue, so I think as leaders, the existential thing, a little bit of what we learned back in the Beyond Petroleum days, if you go too fast and you don’t get it right, you can drag yourself out of business. Say the Big Five Energy Companies that we all know, you know, the Exxon’s, the Chevron’s, the Shells, and Total’s, and BP, just take those. We are only responsible for producing about 8% of the world’s oil, so a lot of the focus is on course on these kinds of companies, because working through the corporate governance of it, but if we were all driven out of business, that oil will still be produced and it is National Oil Companies around the world and countries who will do that. So I see we’re being used as leverage and we want to be leaders in this and we do enormous amount as companies, for example, through the Oil and Gas Climate Initiative, OGCI, to try to help develop technologies will change the world going forward, but we’re not the epicenter of these issues.

He eventually conceded that the world needs to put a price on carbon:

So I think the industry together, not just the companies I mentioned, but others as well, including National Oil Companies need to drive towards policies that can actually head towards solving the issue, the dual challenge about providing the energy and reducing emissions. One example is I cannot imagine how we’re going to get there without a price on carbon, you know, that you and I’ve talked about it before, 200 years of economic history says unless something has a price, you can’t change the behaviors around its use. So getting a carbon pricing system, not a global one, I don’t think, some places would be taxation, you can’t have a ultimately global trading system for carbon because as you get into the currency issues effectively, but we need to lead and work and help shape policy issues and we have to enable and work to develop the new technologies. We’ve got to be incredibly responsible at everything we do, methane for example, methane detection, monitoring, reducing, eliminating, flaring all those things. Natural gas has half the co2 of coal, for example and so

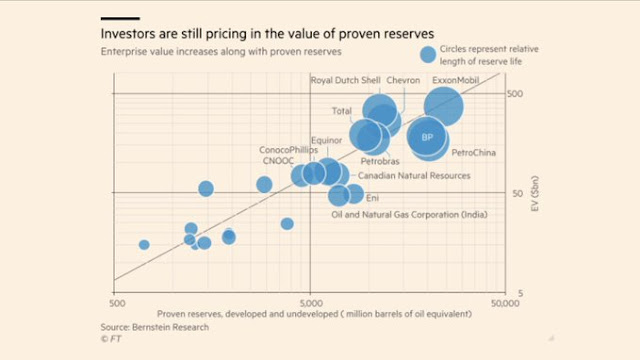

Insightful comments from the former CEO of a company whose shares trade at a juicy dividend yield of 6.8%. The dividend yield may rise even more, but the market is still paying for companies with well-proven reserves.

Value investors should focus on quality. That means strong balance sheets, and paying the right price for proven reserves.

Comments are closed.