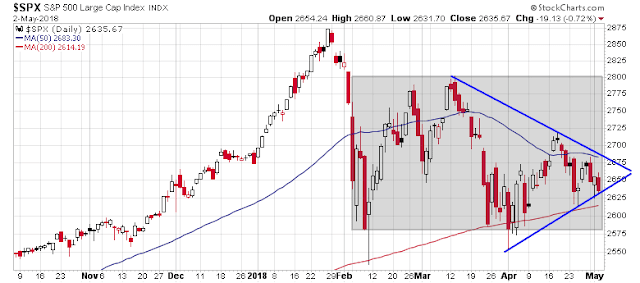

Mid-week market update: Stock prices are still consolidating sideways. The technical pattern could either be described as range-bound, or as a triangle. The market tested the bottom of the triangle this week, but support held.

The market indecision could be traced to the continued disagreement between fundamental and technical investors. Several weeks ago, I highlighted a Callum Thomas weekly (unscientific) poll of market sentiment showing a record level of technical bears combined with a high level of fundamental bulls (see Technicians nervous, fundamentalists shrug). The latest reading shows a continued bifurcation of opinion, though the difference in opinion is not as extreme.

The market may continue to trade sideways until fundamental and technical opinions begin to agree again.

A bullish bias

I continue to believe that the consolidation is likely to resolve itself in a bullish fashion. I have detailed the many fundamental and macro reasons why I am bullish, so I will not repeat them here (see How much does 3% matter to stocks?). However, there are many technical reasons why the intermediate term trend for stock prices is up.

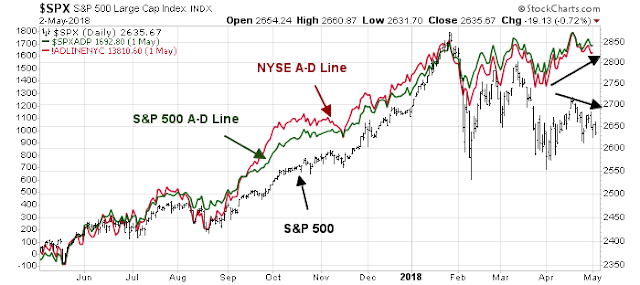

For one, market breadth is supportive of the bull case. Both the NYSE and SPX-only Advance-Decline Lines are exhibiting positive divergences.

The price momentum factor remains in a long-term, albeit choppy, relative uptrend.

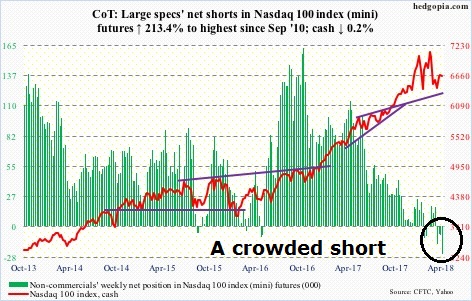

The uptrend in momentum has not been reflected in sentiment models. The latest update of the Commitment of Traders data from Hedgopia shows that large speculators, or hedge funds, are in a record crowded short position in the NASDAQ 100, which forms the bulk of the momentum stocks.

The latest II survey shows that % bulls have been declining and % bears rising. While these readings are contrarian bullish, sentiment may have to become more extreme for a durable bottom to occur.

The short-end of the term structure of the VIX is also telling a similar story. Short-term VIX (VXST) is trading above the VIX Index, indicating elevated fear levels and reflective of the anxiety evident in Callum Thomas’ technician survey. While readings are not at panic bottom levels, they do suggest limited downside equity risk.

My inner trader is bullishly positioned. In this choppy environment, he is inclined to buy the dips and take partial profits on the rips.

Disclosure: Long SPXL

Hi Cam Thank you for the mid-week update. As a suggestion it would be nice to see either at the end of week or the mid week update your thoughts of the different sectors and you using the RRG charts. You have done this in the past and I found it quite helpful. Thank you. AJD.

Coming up this weekend

Agree with AJD

I like the RRG as well

Cam, do you still think we are in late cycle? While the consensus is with you, Oakmark’s Bill Nygren and Thomas Lee of Fundstrat disagree with the market consensus.