The probable outcome of that path is stagflation.

Rising stagflation risk

An analysis shows that market leadership is starting to discount a stagflation scenario. I have lamented the lack of strong market leadership. The relative performance of megacap growth stocks, which led the latest bull phase, has gone nowhere since June.

As one sector or group falters, another usually rises to the occasion and assumes the mantle of market leadership. This time, the relative performance of the cyclically sensitive value industries is weak.

The only sign of emerging leadership can be found in the relative performance of inflation hedge vehicles, such as energy, mining and golds. As clarification, I use global mining and global agricultural producers in my analysis instead of their U.S. counterparts because of the lack of breadth in those industries in the U.S.

Normally, strength in inflation hedge vehicles is a sign of a reflationary rebound or a late cycle inflation boom. However, the lack of relative strength in cyclical industries is the market’s message that it is anticipating stagflation.

Vibecession = Politicized slowdown risk

Additional economic and political risks are emerging in the current environment of elevated inflation. The Economist recently highlighted a possible “vibecession” in the air. Modeled U.S. consumer sentiment based on economic variables is diverging significantly from actual consumer sentiment.

What could account for the discrepancy? More detailed analysis of economic factors that go into the model shows that inflation and petrol (gasoline) prices are negative correlated with consumer sentiment (annotations are mine).

Here is how economic risk translates into political risk with negative growth implications. The Economist also highlighted in a separate article how the hard right is getting closer to power in Europe and cited rising inflation as one of the causes: “Populists…tend to do well in times of economic upheaval, and so are benefiting from the high inflation that has plagued Europe for the past two years, and especially from soaring energy prices.”

Populism at the country level is at an all-time high, with more than 25% of nations currently governed by populists. How do economies perform under populist leaders? We build a new long run cross- country database to study the macroeconomic history of populism. We identify 51 populist presidents and prime ministers from 1900 to 2020 and show that the economic cost of populism is high. After 15 years, GDP per capita is 10% lower compared to a plausible non-populist counterfactual. Economic disintegration, decreasing macroeconomic stability, and the erosion of institutions typically go hand in hand with populist rule.

The paper, which defines populism as “as a political style that centers on an alleged conflict between ‘the people’ vs. ‘the elites’”, found that populists depressed economic growth from its potential when compared to a synthetically modeled growth path of similar countries without populists in power, though left and right-wing populist governments tended to exhibit different growth patterns.

The study had other interesting findings. Debt-to-GDP rose for all populists, regardless of ideology.

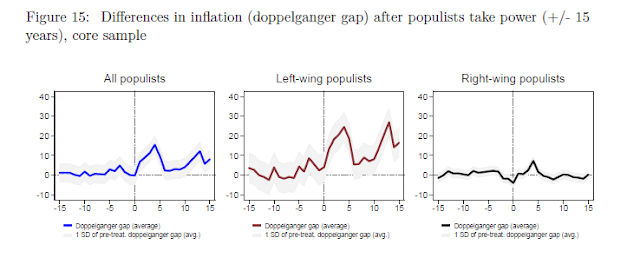

The one key difference was that inflation was significantly worse under left-wing populists.

As inflation remains elevated and above central bankers’ 2% target, the risk is that vibecessions cause the electorates of different countries to turn to populism and depresses the long-term economic growth path. While these political developments are not necessary for stagflation to occur, they would exacerbate the effects.

An IMF inflation warning

Independent of the paper by Funke et al, the IMF published, “One Hundred Inflation Shocks: Seven Stylized Facts”, as a warning to policy makers. The IMF studied inflation shocks in the past and came to the following generalized conclusions.

- Inflation is persistent, especially after a terms-of-trade shock.

- Most unresolved inflation episodes involved “premature celebrations”.

- Countries that resolved inflation had tighter monetary policy.

- Countries that resolved inflation implemented restrictive policies more consistently over time.

- Countries that resolved inflation contained nominal exchange rate depreciation.

- Countries that resolved inflation had lower nominal wage growth.

- Countries that resolved inflation did not experience lower growth or higher unemployment over the 5-year horizon.

Coincidentally, the Fed has reacted to the risk of stagflation, in a fashion. The September Summary of Economic Projections showed that the median assessment of the economy had improved and indicated a soft landing, but FOMC members raised their median rate projections for 2024 and 2025 by a full 50 basis points and opened the door to a higher r-star, or neutral interest rate. The WSJ summed it up best with an article headline of “Higher Interest Rates Not Just for Longer, but Maybe Forever”.

As a consequence, the 2-year Treasury yield surged to a new cycle high. Historically, peaks in this yield have either been coincident or led peaks in the Fed Funds rate.

Hedging against stagflation

Should the stagflation scenario become reality, how should investors hedge against such an outcome? Here are a few suggestions.

This is a neglected asset class. The BoA Global Fund Manager Survey shows that global investors are underweight commodities (annotations are mine).

Stagflation is the combination of inflation and slow growth. In a growth-starved world, investors will pay a premium for growth stocks. The Artificial Intelligence revolution is real. It will disrupt the way we work in the coming years and U.S. megacap growth holds much promise as an investment theme.

Tactically, if the “buy growth in a growth-starved world” thesis holds any water, megcacap growth stocks need to break up and exhibit strong leadership. Here is what I am watching. The top panel shows the relative performance of U.S. large-cap value/growth, which is in a trading range. The second panel shows small-cap value/growth, which is turning up in favour of value as small caps don’t have much weight in AI-related plays. The acid test can be seen in the bottom panel. Can large-cap growth break out against small-cap value, which would be a signal of sustained megacap growth leadership.

From a trader’s perspective, it may be too early to buy growth stocks as they could need more time to pull back and consolidate their gains. The dark line in the bottom panel shows the relative performance ratio of the NASDAQ 100 to the S&P 500, normalized to its 52-week average. The NASDAQ 100, which represents growth stocks, was on a tear. Even though they pulled back on a relative basis, these stocks are still a little extended. Don’t be surprised to see a period of more relative weakness or consolidation before they can become the leadership again.

Outside the U.S., which has relatively few AI-related plays, the factor return patterns are very different. The leadership has been in value and quality. Investors should therefore diversify their exposures with non-U.S. value and quality stocks.

In conclusion, stagflation is not our base-case scenario, but a review of market leadership shows that stagflation risk is rising and needs to be monitored carefully. In addition, stagflation could be exacerbated by disgruntled electorates turning to populist governments, which have shown to depress economic growth. Investors can hedge against a stagflation scenario with a barbell exposure to commodity producers, U.S. megacap growth stocks, based on the theme of buying growth in a growth-scarce world, and value and high-quality outside the U.S.

“disgruntled electorates turning to populist governments, which have shown to depress economic growth.” Trump is a populist, under him the economy was better and markets rose. Was he an exception to the trend?

I think both political parties are populists if one thinks of people as a good force juxtaposed to ‘elites’ as a group interested in their interests only. The methods are different. I just abhor the identity politics as a tool for populism.

I don’t see any political outcome that changes that with current slate of leaders.

If Cam’s hypothesis is correct, we are looking at subpar growth. Inflation may get better under that scenario.

Regardless, I think Fed will keep it’s foot on the brakes till inflation is considerably lower. SEP’s have been all over the lot. How much faith does one have in the current one?

Ravindra you are right. US has always been an oligarchy. Except in the old days our overlords at least tried and was able to hide it. People have a lot information today so it is getting harder for elites to get their way. The response is that the elites doubled down the efforts to gain wider control. it is now a global cabal, UN+WEF, which sets the world policy. Globalization the way it was implemented has given to rise of populism in many countries. Everyone knows which group of people benefited the most. It is as obvious as nose on a face. Let’s see what happens. The world is changing ever faster. An interesting time.

As for the Fed’s whatever plots, the hit rate is about 27% on average, based on a fact-finding article I read. Right now it is about 77% in CBOE future bets that short rate stays the same thru the end of year. Whatever happens in the future slower growth is the default.

Please read the study in full. The standard is not whether any single government was able to generate growth, it’s whether it was able to outperform a similar proxy if that government wasn’t in power.

I keep saying there is a horse and cart problem. Why does populism happen? Is it because times are good? I don’t think so, so why say that growth following these times is reduced? Of course it is because whatever caused times to be harder and populism to rise has not gone away. It’s the same story with debt…why does debt increase? Who borrows when they don’t need to? Having a credit history is fine, but other than that and self liquidating debt, debt is because of not enough money and that persists. So I view populism as a sign of the times, times that are associated with poor growth.

Ya I agree. The populist “study” reminds me of an old “study” of how women CEOs often result in inferior stock/company performances.

Turned out companies in already-shaky shapes tend to hire female CEOs for “change”.