The International Monetary Fund published its latest

World Economic Outlook. It cut its global GDP growth estimate by 0.1% from 2.9% in January to 2.8%. More ominously, it issued a warning about a growing risk of recession in the advanced economies from financial instability risk from bank failures: “A hard landing — particularly for advanced economies — has become a much larger risk”

In light of the risks of a substantial slowdown, how should investors position themselves?

Signs of a U.S. Slowdown

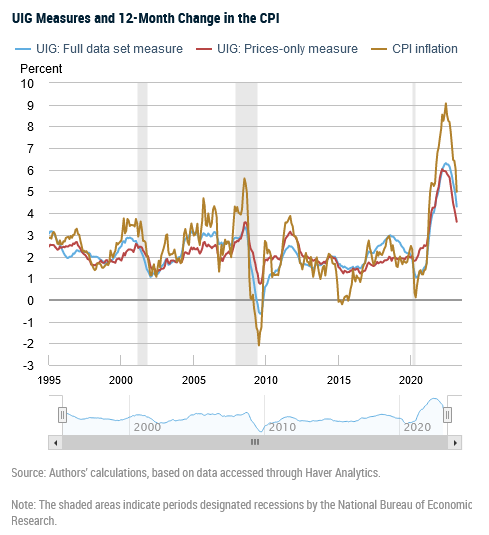

In the U.S., signs of a slowdown are appearing everywhere. The March CPI report came in a little on the soft side, but decelerating inflation is a two-edged sword. The New York Fed’s Underlying Inflation Gauge shows slowing inflation, but sharp declines are consistent with a recession or economic slowdown.

Even though the Fed’s official position is a soft landing, the New York Fed’s yield curve-based recession probability estimate has spiked substantially.

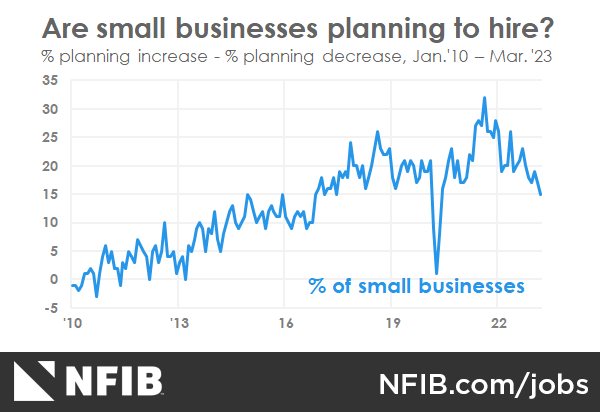

The NFIB monthly survey of small business sentiment is revealing, though the readings have to be interpreted carefully as small business owners tend to be small-c conservatives whose sentiment rise when a Republican is in the White House and falls when a Democrat occupies the Oval Office. Nevertheless, the survey is useful as small businesses lack bargaining power and they are therefore sensitive barometers of economic conditions.

The latest sentiment figures show optimism has fallen substantially to COVID Crash levels.

Even before the onset of the banking crisis, small businesses reported tightening credit conditions.

Moreover, hiring plans are softening.

As we approach Q1 earnings season, FactSet reported an elevated level of negative earnings guidance…

<

…and a depressed level of positive guidance.

Putting it all together, this spells an economic slowdown ahead.

Real-time Market Warnings

In addition, I am seeing real-time signs of a slowdown from market data.

Gold acts as a risk-off asset and performs well when stress levels are high. By contrast, the copper/gold ratio is a cyclically sensitive indicator and rises when market expectations of economic growth rise. The accompanying chart depicts past periods when the copper/gold is rising, which coincided with a falling gold/CRB Index ratio. @here are we today? Gold is rising relative to the CRB, indicating a risk-off environment, and the copper/gold is flat to down, indicating a period of softness in the economy.

During periods of economic stress, investors favour high-quality stocks at the expense of high-flying unprofitable companies. We measure the quality factor in several ways. One way is profitability. Standard & Poors has a higher profitability inclusion criterion for its indices than the FTSE/Russell indices. Therefore, the return spread between similar S&P and Russell indices could be a measure of profitability quality.

As the accompanying chart shows, investors have been accumulating both large- and small-cap quality stocks, which is a signal of a risk-off condition for the economy and stock market.

Investment Implications

We began this publication with the rhetorical question of how investors should position themselves in light of the risks of a substantial economic slowdown. The coming environment is ideal for a 60/40-style balanced portfolio of equities and fixed income instruments.

Last year was difficult for the traditional 60/40 portfolio as both stock and bond prices fell together, but the relationship and correlation between the two asset classes have begun to normalize in 2023 (bottom panel). The accompanying chart shows the stock/bond correlation in the bottom panel and the shaded areas represent past major bear markets. It was only the double-dip recession of 1980–1982 during the tight Volcker money era that stocks and bonds exhibited positive correlation. Much like the Volcker era, the correlation is falling and the historical diversification effects of the two asset classes are re-asserting themselves.

While reasonable people can debate about the near-term trajectory of Federal Reserve monetary policy, there is little doubt that global central bankers are nearing the end of their tightening cycle. Historically, peaks in the 30-year Treasury yield have either been coincident or led peaks in the Fed Funds rate – and falling bond yields are bullish for bond prices. By contrast, peaks in the 30-year Treasury yield have shown a spotty record of calling equity market tops or bottoms.

The 30-year yield appears to have already peaked, which should be bullish for the bond price outlook. If history is any guide, the outlook for stocks is less certain.

In conclusion, the risk of a substantial economic slowdown is rising based on our review of macro, fundamental, and real-time market factors. Investors should position themselves by holding a diversified portfolio of stocks and bonds to protect themselves from possible future asset price volatility.

Hi Ken, do you still see this market in “winter“ mode? Or you have changed you view on it since your prior post. Thanks a lot!

When I think of all that seems to be wrong, yield curve inversion, zombie companies, debt and deficits, interest rate hikes of epic %, and yet the market is way higher than it was pre-covid at it’s all time high, I think of Michael Burry in the Big Short trying to wrap his head around the price action that was contrary to what should be happening.

Of course they will print, the gov’t deficits are not going away, and when the gov’t runs a deficit doesn’t that balance with the private sector and trade? So there should be more money in the private sector because even the trade deficit is less than 1 trillion a year and gov’t deficits are way higher than that. This money in the private sector goes somewhere.

I accept the stagflation story, because the debt is so high, the gov’t cannot afford to carry the interest burden without getting into a debt spiraling out of control, so if interest rates come down, then we have inflation unless we get crushed by a nasty recession/depression causing aggregate demand to crater.

Perhaps it is time to look at bonds strictly for their safety, in other words not for capital appreciation. This would mean short term for now, buying long term bonds for potential appreciation is a gamble on rates, what if rates go higher. We never would have guessed negative rates or zero rates, so what makes higher rates impossible? Take the short end and when things get more settled go for the longer duration bonds? I must say that precious metals may have a place in a long term plan, short term is anyone’s guess. A bad market crash and everything gets sold, but long term, debt will be monetized until it no longer can be.

I am hoping there is more guidance in the coming posts on the kinds of equities and bonds that have the best likelihood of navigating through a slowdown/contraction.