Mid-week market update: Investors and traders have been waiting for the moment of the FOMC announcement and subsequent press conference. How does the Fed respond to the twin challenges of a banking

John Authers highlighted analysis from Bespoke indicating the market was entering a period of extreme volatility in Fed Funds futures.

The fluctuation of fed funds futures has been so extreme that, since their inception in 1994, the only other months to see such volatility were: January 2001 (when the Fed started to hike); September 2001, month of the 9/11 terrorist attacks; January and October in the crisis year of 2008; and March 2020, when Covid-19 arrived. This is according to an analysis by Bespoke Investment Group. In contrast to the Fed’s current tightening regime, all those months saw the central bank cutting rather than hiking in response to clear crisis conditions. Over the last month, the gap between the highest and lowest fed funds rates that have been predicted stands at 77.5 basis points:

The Fed has spoken, It raised rates by a quarter-point and the statement changed from it expects “ongoing increases” to “some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time”,

- Lower GDP growth in 2023, but

- A hotter economy, in the form of lower unemployment rate and higher PCE inflation rates,

- The same terminal rate of 5.1% for 2023 and a higher rate in 2024 compared to December.

During the press conference, Powell pushed back against market expectations of rate cuts: “Rate cuts in 2023 ‘Not our baseline expectation’”,

He further hedged his past expectations of a soft landing as it’s too early to know if recent events change the odds of a soft landing. A pathway to a soft landing still exists and we are trying to find it. His remarks are in direct contradiction to the New York Fed’s yield curve based recession model showing surging recession risk.

The banking crisis and aftermath

As a reminder, this is what a banking crisis looks like. The KBW Regional Banking Index skidded with almost no warning to test its long-term support. After UBS agreed to buy Credit Suisse, regional bank shares stabilized and rebounded.

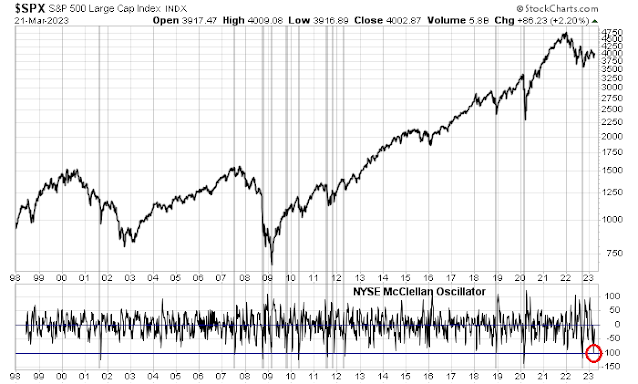

That said, the stock market reaction to the FOMC statement was initially bullish, but turned negative when Powell said that rate cuts were not their base case. I remain constructive on this market.The banking panic had pushed the stock market to an oversold extreme. The NYSE McClellan Oscillator had fallen to -100, which historically had been a signal to buy for a bounce.

I expect that the market will chop around for the next few weeks but grind higher as it works off its oversold condition. Subscribers received an email alert that my inner trader had exited his long S&P 500 position when the VIX Index reached the midpoint of its Bollinger Band and the S&P 500 tested its 50% retracement level. The index is probably on its way to re-test the 200 dma, which should hold as support, and eventually work its way higher.

‘ I remain constructive on the market’ – Cam. I hope there will be more in-depth analysis in Saturday’s post supporting this view.

I continue to be cautious! My 10 year Treasuries are working as a great ballast. The yield curve has steepened after peak inversion. Another reason for staying cautious.

Finally, bonds are now an uncorrelated and diversifying asset to equities!

I was mistaken.

The market weakened during the FOMC press conference when Yellen said separate that Treasury had no plans for a blanket deposit insurance backstop.