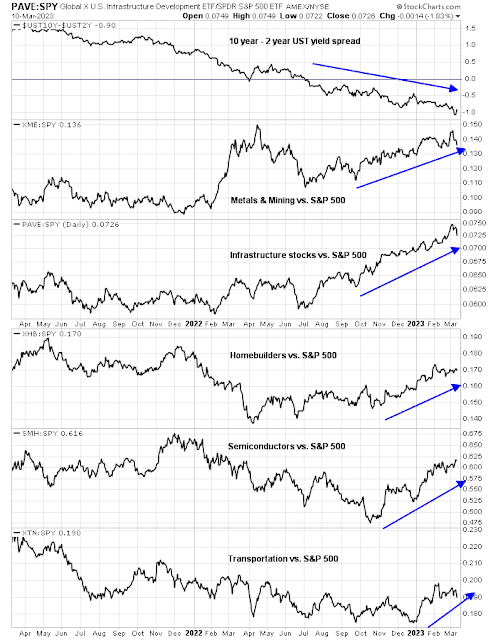

One of these cyclical indicators is not like the others. While many cyclical industries are in relative uptrends, which is a technical signal of economic expansion, the 2s10s yield curve is deeply inverted and shows few signs of steepening. This is one of those occasions when the stock market and bond markets disagree.

Which market is right? Maybe they both are.

What’s Fed thinking?

Let’s start with the economy and the Fed’s reaction function. Fed Chair Jerome Powell and other Fed officials have been repeating the mantra that the Fed will continue its inflation fight until the job is done and inflation is at 2%.

Here’s a quick snapshot of the economy. The Atlanta Fed’s

GDPNow estimate of 2.6% is signaling a strong expansion.

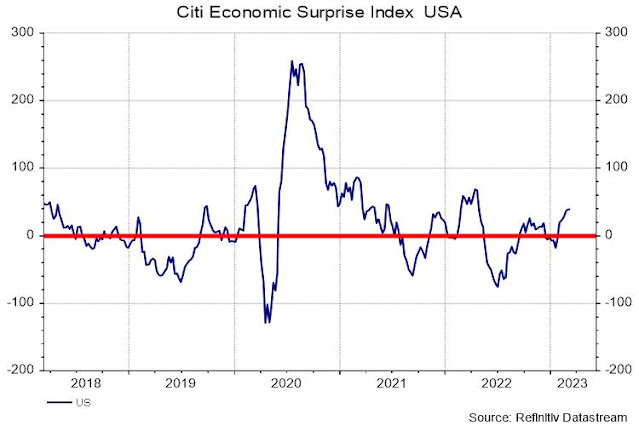

In addition, the US Economic Surprise Index has been rising, indicating economic data is surprising to the upside.

As the Fed has indicated it’s focused on the jobs market and wage growth in its inflation fight, here are some metrics to consider. Initial jobless claims have been flattening out and show uneven signs of rising even after all the monetary tightening.

Average hourly earnings, unit labor costs, and the employment cost index are all decelerating, but readings remain elevated. While recent signs of disinflation are welcome, services inflation has been sticky on the way down and the journey from 4-5% to 2% inflation could be much harder than anyone thinks.

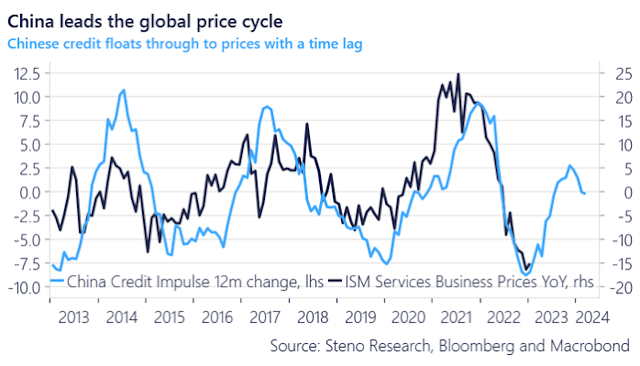

That’s because, in light of the Fed’s hyper focus on wage and services inflation,

Steno Research argues that China’s credit impulse leads ISM services price. That makes China’s recent stimulative policies bad news for inflation in H2 2023.

As well, San Francisco Fed President Mary Daly warned that reshoring could raise the demand for labor and push up inflationary pressures:

If firms decide to reshore some or all of their foreign production facilities, costs and prices are likely to continue to rise. My conversations with business leaders suggest that some of this is already happening…a trend toward less global competition could mean more inflation in the goods sector and more pressure on overall inflation going forward.

Moreover, the combination of a decline in the labor force participation rate and low immigration is restricting labor supply and putting upward pressure on wages.

Another potential factor affecting future inflation is the ongoing domestic labor shortage. Labor force participation fell precipitously during the pandemic and has been slow to recover, especially among workers aged 55 years and older. These developments exacerbate the already significant downward drag on participation related to population aging. Absent a substantial pickup in the share of working-age adults looking to be employed or a large change in immigration flows, labor force participation will continue to decline and worker shortages will persist, pushing up wages and ultimately prices, at least in the near and medium term.

She concluded that “further policy tightening, maintained for a longer time, will likely be necessary”.

Even more worrisome is a

Kansas City Fed study that linked tight labor markets to rent inflation. With the Fed focused on services inflation, rents have been a major component of CPI and especially services inflation.

The study found that tight labor markets affect rent inflation because of “greater demand for rental units afforded by job gains and wage growth”.

Rent inflation responds more to labor market conditions compared with other components of inflation. We attribute this link between labor market tightness and rent inflation to greater demand for rental units afforded by job gains and wage growth. Although online measures of asking rents currently suggest official measures of rent inflation will decline, we caution that rent inflation is likely to remain above pre-pandemic levels so long as the labor market remains tight.

As a consequence, Fed Chair Jerome Powell sounded a hawkish tone during his Congressional testimony and put a 50 bps rate hike on the table for the next FOMC meeting.

What’s bond market thinking?

Here’s one way of squaring the circle of disagreement between the stock and bond markets. The accompanying chart shows two cyclical indicators, the 2s10s yield curve and the copper/gold ratio. The historical evidence shows that the 2s10s yield curve normalizes about 1-3 before a recovery in the copper/gold ratio.

Fast forward to 2023. As investors have already observed from stock market internals, cyclical industries are roaring ahead, just like the copper/gold ratio. This presents a problem for the Fed. How can it control inflation when readings at still elevated and, if current signs of an expansion are correct, it would lead to further inflationary pressures? The answer is more monetary tightening that’s beyond market expectations. Current conditions are reminiscent of the double-dip recession of 1980-1982, when the Fed reversed its accommodative policy and tightened to extremely painful levels. Instead of a double-dip, current recovery expectations are likely to be a false dawn.

Bond market expectations are already reflecting the false dawn scenario. The 2-year Treasury yield, which can be thought of as a proxy for market expectations of the terminal Fed Funds rate, is making a new high for the cycle. Historically, peaks in the 2-year rate have been either coincident or led peaks in the Fed Funds rate, though the signal has shown a hit-and-miss record on stock market timing. Bottom line, the peak in the 2-year rate is ahead of us, which raises the uncertainty of any Fed Funds forecast.

Will the Fed break something?

In the past, Fed tightening cycles always breaks something. Nothing has broken yet in the current cycle, but the behavior of bank stocks is concerning. Banks tend to borrow short and lend long, and therefore the shape of the yield curve affects profitability. It’s no surprise that the relative performance of banks is correlated to the yield curve, but the recent violation of relative support by bank stocks and the SVB Financial Group and Silvergate Capital debacles could be the signal of rising stress in the banking system.

These circumstances lead me to believe that the combination of a cyclical rebound and elevated inflation rates raises the odds of a double-dip recession. While history doesn’t repeat itself but rhymes, the 1980-1982 experience may be a useful template to think about the stock market. In that case, current market conditions puts is at about Q2 or Q3 1980. Brace for volatility.

In addition, the 2s10s yield curve is also pointing toward a false dawn recovery. In the past, yield curve normalization leads the copper/gold ratio, which is a key cyclical indicator, by 1-3 years. The 2s10s yield curve hasn’t even begun to normalize in any signification fashion yet but the copper/gold ratio has turned up. This “false dawn” pattern is highly reminiscent of the 1980-1982 experience.

In conclusion, current equity market expectations of a cyclical recovery is simply unrealistic in light of the Fed’s focus on 2% inflation. Any signs of growth will be met with tighter monetary policy that will have the effect of pushing the economy into recession. While history doesn’t repeat itself but rhymes, the current situation is highly reminiscent of double-dip recession of 1980-1982. While the technical conditions are still constructive for stock prices, investors are advised to be prepared to revise their risk profile as conditions may change later this year.

The shock of Silicone Valley Bank failing is a financial earthquake.

Thursday and Friday drop in December 2023 Fed Funds Futures was historic. The two day decline was a 0.66% drop with Friday alone a half percent drop. The year end rate went from 5.6% to 4.94%.

2y yield has moved down 44bps since Wednesday. Only larger declines:

Oct 19, 1987 Black Monday

Oct 13, 1989 (6% down day)

Sept 14, 2001 Dot.com Crash

Sept 15, 2008 (Lehman)

Sept 29, 2008 (TARP failed)

March 9-10 2023

The next few weeks are up in the air. How much contagion will we have with other banks?

If we have hot inflation numbers this week, will the rate outlook go back up. Will investors expect a pause by the Fed with only a .25% or none, the next meeting?

If the Fed backs off it’s program because of bank liquidity problems, it will signal 3-4% inflation going forward just as many experts have predicted since the 2% number has too much hardship.

Will interest rates snap back up if people see the bank situation is relatively small and local to Silicone Valley?

Is this just an American problem or will it effect non-US and to what degree?

Lot’s of VERY big questions that we will see answered this week.

Mohamed El-Erian said a few months ago when someone said they hoped rates would drop to send markets higher. “Be careful what you wish for. The rates to drop now will be because something breaks and that leads to nasty outcomes.” As always, he is wise. Are we seeing things starting to break?

Initial reaction to SVB is of panic. Panic about financial system stability and who else has idiosyncratic risk. I think systemic risk to financial system is remote. It will likely lead to reevaluation of balance sheets and appropriate adjustments. No one can predict idiosyncratic risk till it actually happens. I was fortunate to have exited my position about a month ago after January data.

Fed in recent years has been very transparent ( as opposed to the Fed in earlier years). Banks and other institutions knew about the rate trajectory. How the institutions managed the interest rate risk was a management decision. To put it on the Fed is incorrect. Matching liabilities duration with asset duration is a key risk management function. To take undue risk is a failure of the management.

If Fed comes to a similar conclusion, they will continue with the rate path to bring inflation down to 2%. Inflation at 3-4% must be rejected as insidious to long term health of the economy.

I do not understand the double dip recession analogy. That happened because the Fed panicked along with the markets.

One thing is certain. There will be many narratives along the way. The only one that matters is what the Fed has laid out.

Welcome back, Cam! Hope all is well.

From JPM:

silicon-valley-bank-failure-jpmwm.pdf

The SVB debacle and the Fed will dominate the news and the market in the coming weeks and probably months.

Powell used the word ‘disinflation’ probably 10-15 times during the last FOMC meeting. I think he’ll use the SVB debacle to maybe make one last hike and pause. Higher rates and lower bond prices affect everyone who purchased them near the highs last year. There can’t be just one casualty of the fastest rate hikes in the history of the Fed. There are many more shoes to fall unless some remedial action is taken promptly.

Moreover, because of the lag effects of the monetary policy, Powell (or anyone else) knows the real effects on the real economy. Maybe the Fed has already pushed the economy in the ditch. It may be time for the Fed to pause, recover its senses, take a pause and surveil the damage already done to the economy.

The pause will also reverse the decline in the bond prices and partially repair the damage to the balance sheets of the holding entities.

Since the Fed is in the quiet period, we need to watch for their favorite source to leak the vital information, Nick Timiraos.