Mid-week market update: As the S&P 500 consolidates just below its 50 dma, here are some considerations that make me constructive on the stock market. The index is exhibiting an oversold condition on the percentage of stocks above their 20 dma and a minor positive divergence on the 5-day

Bullish factors

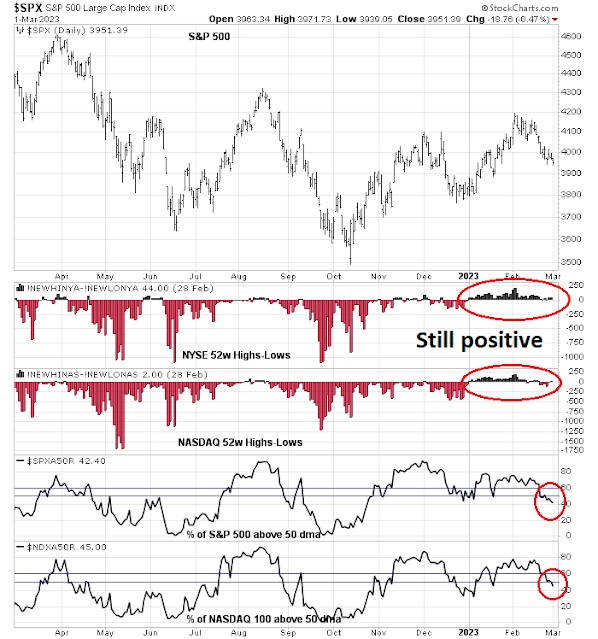

The analysis of market breadth yields a mixed, but nuanced picture. The percentage of stocks above their 50 dma has fallen below the 50-60 range, which is concerning. The question is whether this metric will fall to an oversold condition, as it did last April and last September, or recover as it did in early January. The net 52-week highs-lows indicator gives investors some clues. During the declines in April and September, net highs-lows were deeply negative, indicating breadth deterioration. By contrast, the January rally was signaled by a positive net highs-lows. This indicator remains weakly positive, even for NASDAQ stocks today, which makes me constructive on the direction for stock prices.

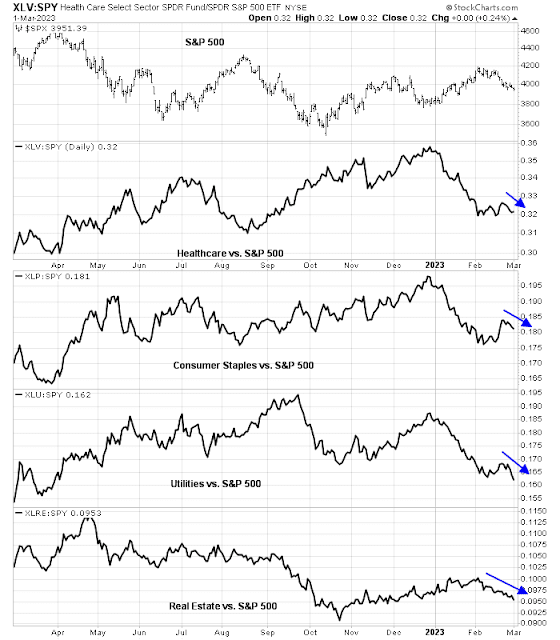

Other market internals are also signaling limited downside risk. Even as the S&P 500 traded sideways, the relative performance of defensive sectors are weakening, which is an indication that the bears are losing control of the tape.

Moreover, my equity risk appetite indicators are also flashing positive divergences.

From a longer term perspective, the (bullish) trend is your friend.

Seth Golden pointed out that the S&P 500 has spent 18 days above its 200 dma. If history is any guide, the index hasn’t made a new low and it’s been higher on a three, six, and 12 month horizon.

Liquidity headwinds

I don’t want to give the impression that the stock market is about to take off like a rocket. Fed liquidity has been flat this year while stocks have risen. The lack of liquidity in the banking system will be a headwind for stock prices.

In conclusion, barring any unexpected shocks, US equities are likely to move upward over the next few weeks in a choppy fashion. My inner investors is bullishly positioned, and my inner trader is tactically long the S&P 500. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Publication note:

I am scheduled for a cataract operation on my eye Monday. There will be no mid-week market update next week as I expect to be out for the week. I will try to publish at least an abbreviated note next weekend, but that will be dependent on the progress of my recovery.

Disclosure: Long SPXL

There are a few points I would like to make:

1. A market or stock that reacts positively to negative news normally is considered bullish i.e. – a buy. Since the hot CPI number the market has reacted very negatively to any detrimental news. Not a good sign. Till that changes we can expect more of the same.

2. Over bought over sold indicators work better when you are trading in the direction of the intermediate trend. If you notice the chart of the RSI (14) above the tops above 70 are spikes . In the bottom the RSI keeps on staying for a longer period of time. Meaning a greater over sold. So it is possible that the rally starts when the number of stocks above the 50 day moving average drops to between 5-20.

3. Any indicator one uses is a matter of probability. It helps to measure the odds of success but does not guarantee it. Therefore, it is imperative that one uses a stop loss strategy. It is an insurance against a catastrophic failure – similar to a car insurance or earthquake insurance.

Cam,

Good luck for your upcoming surgery. Take the time to heal well.

Regards

Hi Cam, wish you a good surgery and recovery. Take good care.

Hi Cam,

My best wishes. Recover and heal quickly.

sanjay

Hi Cam,

I wish you a quick and good recovery.

Take care.

Angelo

Good luck with the surgery Cam!

Cam, When turning positive on the Ultimate Timing Model, you commented. “The caveat is most of the strength is likely to be found outside the US, in Europe, and in emerging markets.” Valuations have somehow caught up. Is this still your view?

Sorry, when did I say that valuations have caught up? The US is still trading at a significant forward P/E premium to the rest of the world.

Best wishes for your surgery.

Good luck Cam!