Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

So much for the BoE

The market took a risk-off to begin last week until the BoE announced a surprise intervention to buy gilts with maturities of 20 years or more “on whatever scale is necessary” in order to stabilize markets. Global markets rallied for all of one day and the S&P 500 weakened for the rest of the week. So much for BoE intervention.

As the S&P 500 violated support on Friday, the midcap S&P 400 and the smallcap Russell 2000 did not confirm by holding their respective support levels. Should you believe the breakdown?

Here are seven reasons why traders should grit their teeths and buy stocks.

Buy signals everywhere

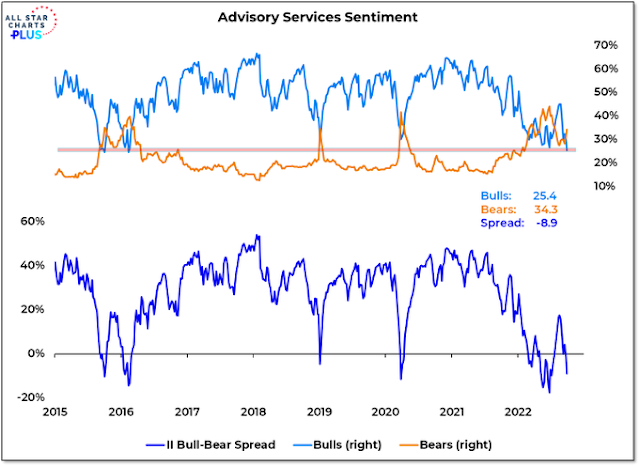

I am seeing short-term buy signals everywhere. Investors Intelligence bull-bear spread has turned negative again, which have tended to signal good long entry points. Bullish sentiment has fallen to lows not seen since 2016.

The AAII bull-bear remained roughly unchanged at an extreme bearish reading for a second consecutive week.

Bloomberg reported that four out of five components of Sanford Bernstein’s Composite Sentiment Indicator, volatility, put/call ratio, investor survey and equity fund flow data, have reached negative extremes.

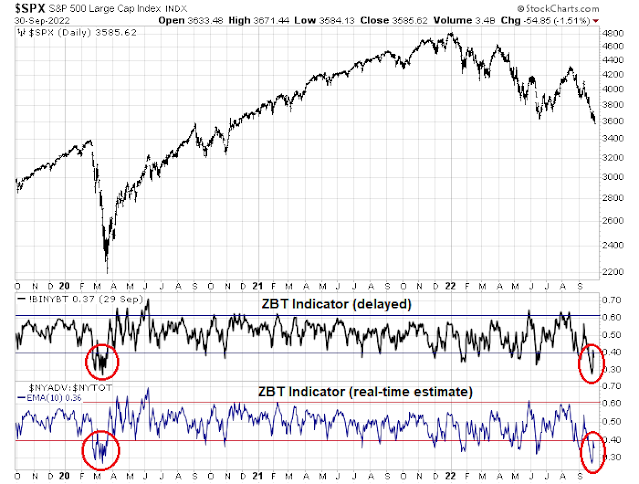

The Zweig Breadth Thrust Indicator reached an extreme oversold level comparable to the levels last seen during the COVID Crash. Readings recycled to neutral on the day of the BoE intervention but returned to oversold the next day. While there is no guarantee that oversold markets can become more oversold, the odds indicate a favorable risk/reward for bullish positions.

Rob Hanna of Quantifiable Edges reported that his Capitulative Breadth Indicator (CBI) reached 13 last Tuesday. Historically, readings above 10 have been strong buy signals.

As the S&P 500 probed its lows last week, improvements in breadth appeared beneath the surface. Net NYSE and NASDAQ highs-lows turned up even as the market weakened, which is a constructive sign for equities.

Best of all, insiders are buying as the market fell.

Bullish, but beware of tail-risk

In conclusion, market omens are lining up for a strong relief rally. While the intermediate-term trend is still down after a bounce, traders should be prepared for a rip-your-face-off rally that could happen at any time. The Trend Asset Allocation Model has finally turned risk-off. In light of the likely relief rally and the poor performance of the bond market which has not been diversifying for equity holdings this year, I am putting the signal change on hold. I will re-evaluate market conditions in two weeks and make a decision on the model signal.

To be sure, tail-risk is still present. The Guardian reported that Ukrainian intelligence believes the threat of Russian use of tactical nukes are “very high”.

In an interview, Ukraine’s military intelligence put the threat of Russia using tactical weapons against Ukraine at “very high”. A nuclear weapon is about 100 times more powerful than the type of rockets Russia has used against Ukraine so far, said Vadym Skibitsky, Ukraine’s deputy intelligence chief.

“They will likely target places along the frontlines with lots of [army] personal and equipment, key command centres and critical infrastructure,” said Skibitsky, about Russia’s use of tactical nuclear weapons. “In order to stop them we need not just more anti-aircraft systems, but anti-rocket systems.

“But everything will depend on how the situation develops on the battlefield.”

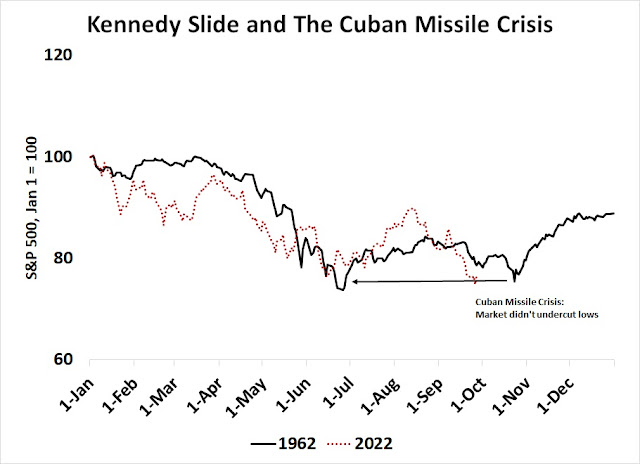

In that case, the 1962 Kennedy Slide and Cuban Missile Crisis market template could come into play. As a reminder, the market tanked in early 1962, rallied, and fell again into a second low that coincided with the Cuban Missile Crisis. But the Cuban Missile Crisis low did not undercut the initial low.

Disclosure: Long SPXL

With all due respect, I have one counter-argument to the fact that ‘bullish sentiment has fallen to lows not seen since 2016.’

In 2016, the 1-year CD rate was 0.3%. Today it’s 4%.

Of course, I’m speaking from the standpoint of someone who will retire within the next five years – the ‘grit my teeth’ days are over 😉

fwiw – I just filled up @ 6.69/gal. Can’t say for sure whether that’s the highest I’ve paid for a gallon of gas, but it’s pretty close. A week ago I filled up @ 5.49/gal, and two weeks ~5.09/gal.

Sir, with due respect, California is very different than the rest of the US. Our friends from Caliphornia tell us they don’t live in America, but I do (this is not a political statement).

🙂 😉

I was in Menlo Park earlier in the month where oil change costs 100$. In my nick of the woods, it is 30$. 🙂

According to the chart the insiders are not buying, they just stopped selling…

Does anyone believe that only 1 side can use tactical nukes?

This is all depressing.

Hmm, maybe Moscow and the Kremlin can be put on wheels and move around so they are not sitting targets.

It’s akin to someone saying we should nuke the Kremlin first, ya think that will work?

If they use tactical nukes, there will almost certainly be escalation. Again, depressing.

Expert says that Putin calling up 300,000 troops means that nukes will not be used until spring and only if the fresh troops fail. Let’s worry about that in the new year.

No reason to believe that there is a real danger for Russia to use nuclear weapons based on what Putin and Medvedev have stated (not western or Ukrainian interpretations of their speeches). Russia’s security policy with respect to the use of nuclear weapons, which is public, allows for their use in cases when: (1) it’s attacked with nuclear weapons, or (2) in a conventional war if Russia’s existence is in danger.

The opinion of the Ukrainian intelligence quoted by the Guardian makes no sense if one considers: (1) how restrained Russia has been so far in attacking civilian targets and infrastructure, and (2) that a lot of the “places along the frontlines” are considered now by Russia to be Russian territories populated by Russian citizens.

It’s still depressing, but yeah the propaganda and fear mongering is exploited by both sides. It’s still pretty messed up.

Gold Miners ETF GDX had a TWIST on the day of the UK bailout. Gold might finally be starting up. UK is the first country to bail out of the inflation fight when the going got tough. Gold buyers might be sniffing out the start of the demise of fiat currencies during a global economic shit-show.

This same week, Utility Sector has had a major Factor and momentum failure. Here is the negative narrative that might be hitting. The dividend yield of the Utility Index is 3.4% and a PE of 18. That was great in a low interest rate world but now the FED is calling for 4.5-5.0% rates that will stay up. To rxchen2’s point, there could be lots of income investors switching out of utility stocks into CDs with better interest and no downside risk.

There are many risks with utilities such as fires, hurricanes and when the economy is in recession people don’t pay their bills.

Regulators are loath to grant rate increases. Utilities get squeezed by low revenue growth and higher costs in an inflationary environment.

Ken, I agree with you on gold. The relative strength of gold etf (GDX) is showing strength when compared to $SPX. I am waiting for further weakness in the dollar to go long GDX. This might be a long term change in trend. In my previous note I had mentioned that Bitcoin had been discredited as a substitute to fiat currency as it was just Nasdaq on steroids. Investors might revert back to Gold and Silver. Incidentally, silver is stronger compared to gold as of now.

Another gap-up open – probably not an ideal scenario for the bulls.

D.V. – Yes, I began to realize that California was an entirely different state of mind when we moved from the Bay Area to the Midwest in 1970. (I think the correct term is Kalifornia 🙂 ) When I moved back in 1990 it felt like coming home.

$100 for an oil change in Menlo Park? Must have been synthetic. I don’t think the price differences have become that extreme – not yet.

Looks like today’s rally will hold.

Do you think that the rally will continue, … what is your target price?

Despite what you may hear from some bears on twitter and others, both SPX and NDX summation indices showed on track improvement and bottoming today, an action similar to the presumptive bottom in June 17, 2022 which wasn’t one but nevertheless gained 17.3% over 40 trading days. There is absolutely no guarantee that that is going to happen this time but the short term rally for 6/17/22 was 6 tdays, including the first day. There is a gap down at 3750 that could be filled and the 20 DMA that could be touched in this first go around. If there is a large loss of market breadth, that may be a sign to get out – such a strategy was described in reader comments in the previous subscriber post (Oct 1, 2022).

This modified twin summation indices showed both SPX and NDX summation presumptively bottomed on 9/27 and their spread bottomed on Friday. The last time we saw such low levels was about one week from the March 2020 pandemic bottom. BTW, nobody I know use something like this in this way so take that for what it is worth.

https://i.imgur.com/yH4Vn5i.png

KWEB is down a lot and seems to be bottoming. There are persistent rumors of relaxation of the Zero-Covid policy post CCP conference in mid-Oct.

Any thoughts?

Dear Cam, looking forward to your todays analysis. The most important for me would be a question how far will this rally go – some estimation. Thank you. Petr

I’ve heard comments that describe current market action as ‘predatory.’ That sounds appropriate – the trading algos have gotten better at gaming the emotional responses to price movements.