Mid-week market update: Yesterday’s hot CPI report finally convinced the market that the Fed is serious. For weeks one Fed official after another gave the same message: We will raise rates to about 4% and hold them there while we evaluate the inflation picture. We don’t want a repeat of the 1970s when the Fed prematurely eased while inflation pressures were still strong.

Former Fed Vice Chair Richard Clarida said in a CNBC interview, “I think they’re going to 4% hell or high water, if I had to put it into two boxes. They are data-dependent, but that’s why they’re going to 4%. Inflation is way too high.”

The market is now discounting a 75 bps move next week with about a 25% chance of a 100 bps. The terminal rate is rose to 400-425 bps from 375-400 bps before the CPI report.

Not unexpected

While the intensity of yesterday’s slide was a surprise, a stock market slide was not unexpected. I pointed out that the market was vulnerable to a setback. The VIX Index had recycled from above its Bollinger Band, which is an oversold signal for the market, to its 20 dma. Such events have typically resolved in a stall in rallies. As well, yesterday’s sell-off left an island reversal top, which is also an ominous technical sign.

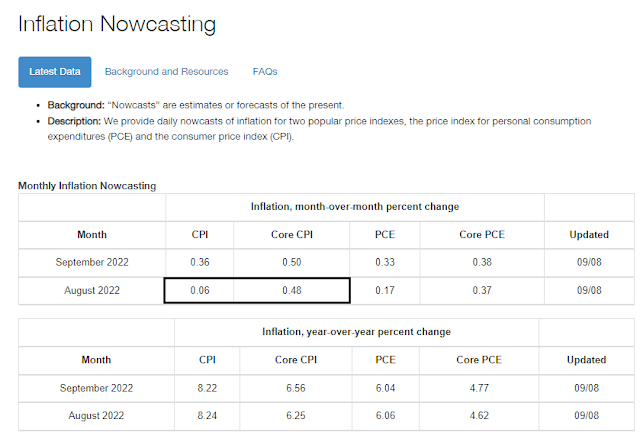

I also alerted readers that the Cleveland Fed’s August inflation nowcast was above consensus expectations. Ahead of the CPI report, my social media feed was filled with chatter about how soft the print was going to be, indicating excessive sentiment for a dovish pivot and risk-on rally.

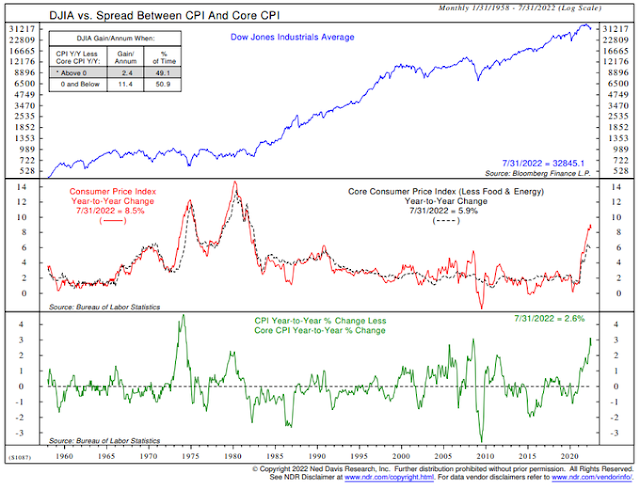

Ed Clissold of Ned Davis Research found that, historically, the DJIA struggles but is marginally positive whenever headline CPI is higher than core CPI, which is the case today.

More downside potential

Traders were undoubtedly disappointed by the CPI report and the overly bullish positioning led to a -4.3% skid in the S&P 500. While the TRIN spike was a sign of a selling stampede, none of my other tactical bottom indicators are flashing buy signals. I interpret this to mean that there is unfinished business to the downside. The market’s inability to stage any meaningful reflex rebound after yesterday’s massive down day is disturbing.

Nautilus Research pointed out that there is a 50-day VIX cycle, with the scheduled top on Monday, September 19, 2022, which is just before the start of the two-day FOMC meeting.

This is consistent with the FOMC cycle that I’ve noticed in 2022. The market has tended to weaken and bottom either just ahead or coincident with FOMC meeting day.

My inner investor remains neutrally weighted at roughly the weights specified by investment policy. My inner trader remains hesitant about taking a position. The usually reliable S&P 500 Intermediate-Term Breadth Momentum Oscillator (ITBM) just flashed a buy signal when its 14-day RSI recycled from an oversold condition. In light of the bullish headwinds that I just outlined, the risk of a buy signal failure in the manner of the model choppiness during the August-September 2020 period (circled) is a strong possibility.

My inner trader concludes that the prudent course of action is to stay on the sidelines. It’s probably too late to sell but too early to buy.

One country is hitting all my checkmarks (Factor, Technical and Momentum) including a great narrative of economic growth and a shift of manufacturing to them from China. They are also neutral and courted by all major powers even as they buy oil at a discount from Russia. I expect a lot of foreign investment is going their way.

Can anybody give me positive thoughts to double my holding?

Sorry what country? India?

India has good demographics also if I am not mistaken, but that is a slow one

Morgan Stanley thinks India will get capex growth. They favor banks and industrials.

Scaling back slowly into SPY/ TLT.

Adding a second allocation of SPY here.

Opening VT.

Additional allocations here.

Can anyone suggest good ETF’s for India?

I track EPI the Wisdomtree managed fund.

Thanks!

It is hard to say the markets are selling off when the RCD (discretionary) to RHS (staples) moving average ratio is still firmly in the green as opposed to earlier in the year and late 2021 when it was firmly red. Although in the shorter 30 minute time frame, one could see it weakening at around 14:00 today, it is not dropping off like it did on CPI day for example.

https://i.imgur.com/2H10djY.png

Yes I know it is said: “Relative strength in a bear market sucks!” — WALTER DEEMER

Losing less money than a benchmark means you’re still losing money.

Relative strength actually doesn’t suck when you are trying to determine market direction with two instruments and one is still trending up for weeks. It is when you are trading daily or lower time frame on relative strength that you can be mislead. If the weekly of RCD ends badly this week and closes sharply down below its moving average (dotted gray) , then the bullish thesis may be nullified. So far RCD is +0.12% for the week. Such an analysis would have kept an investor out of SPX since 12/3/21 or 12/10/21 and stayed out until reentry on 7/22/22. Similar analysis works for the pandemic sell off and bottom.

RCD and RHS both had large losses this week and RCD lost ground to RHS today but for the week their ratio is only down -0.43% so far if market closes at 15:30. This will not change the weekly picture of relative strength of RCD to to RHS, making it green, above its now flattening moving average, suggesting a continuation of mid June- early July pattern but with more side way choppy trading.

For what it is worth, the intraday breadth thrust short term that can revert quickly has now pointed to a buy at 3869.25 at 11:36 AM. RCD (discretionary ETF) is only down 0.27% for the week. Still hard to tell if the bullish trend is over.

https://i.imgur.com/5y8AC3Z.png

Correction, RCD is down 0.27% currently for the day.

OK. I’m out. That’s two busted trades in a row trying to time a bounce.

I think investors are correct in saying the FedEx news should be taken seriously.

A -1.17% hit for the two trades combined. I was actually initially in the green both times – but made the mistake of thinking upside momentum would carry the positions higher.

Time is on our side in bull markets. In bear markets, it can kill you.

If I net the last three trades – two losses against a gain two weeks ago – it’s -0.72%. Just my way of managing the aftermath of a loss. It’s a mental game, and rearranging results in ways that mitigate negative emotions is one way to create an edge.

Having actively traded through four bear markets (including this one), I can attest to the importance of creating an edge whenever/wherever possible.

The current bear may last longer than any of us expect. What if it’s a multiyear bear?

As a general rule of thumb. in bull markets one should buy sharp dips and in bear market sell sharp rallies. But there is also a saying all rules don’t apply all the time and there are exceptions. The edge is the main thing however one gets it.

You’re right – I should have sold into both of the very short sharp rallies that followed both of my losing trades. I’ll keep that in mind next time.

Re the edge. Other true edges are honesty, transparency, and humility – and the first two lead directly to the third. I admit it when I’m wrong – and generally publicize it to any relevant listener/audience. I also comment on trades in real time. Both lead inevitably to humility – but that’s the real edge.

For someone who’s wrong as often as I am, it’s a miracle that I’ve been relatively successful as a trader. So I chalk it up to a combination of luck and humility.