Why are stocks rallying? Maybe it’s because for much of this year, corporate insiders have been stepping up to buy dips in the stock market. The purchases have occurred in the face of growing recession risk and apparent challenging valuations.

What does this group of “smart investors” know that we ordinary mortals don’t? An analysis of valuation and the technical backdrop reveals some pockets of value in the US equity market.

A challenging environment

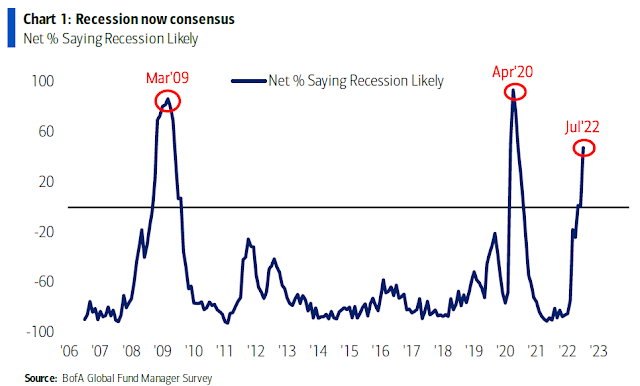

This has become an increasingly challenging environment to be taking risk. The latest BoA Global Fund Manager Survey found that a recession is now the overwhelming consensus view among institutional investors.

The Citigroup G10 Economic Surprise Index, which measures whether economic releases are beating or missing expectations, is nosediving.

As the Fed and other major central banks tighten monetary policy, yield spreads are widening, indicating tightening financial conditions.

Treasury settlement fails have increased to levels last seen during the GFC, indicating a severely compromised bond market liquidity. High yield spreads are especially sensitive to bond market liquidity, which has the potential to set off a doom loop in the credit markets.

The S&P 500 is trading at a forward P/E of 16.7, which is below its 5 and 10-year averages. However, the E in the forward P/E ratio is at risk of compressing as we progress through Q2 earnings season.

The latest update from earnings season indicates that both the EPS and sales beat rates are below historical averages, which raises the risk of earnings downgrades. Historically, stock prices have struggled whenever forward EPS has either flattened or fallen.

Why on earth would corporate insiders be buying the dips?

A valuation analysis

For some clues, I use the Morningstar fair value analysis tool to calculate valuation. While it doesn’t represent the Holy Grail of valuation analysis, it is a consistent metric for comparing value over time and across different parts of the stock market. A preliminary analysis of the Morningstar stock universe shows that the market appears to be cheap, but it doesn’t represent screaming value compared to past major market bottoms in 2009, 2011, and 2020.

The intent of this analysis isn’t to exhaustively enumerate all the ways the Morningstar fair value tool measures different pockets of the market. Here are some highlights.

An analysis by sector shows several standouts. Technology stocks are more undervalued compared to the overall universe and they haven’t been this attractive since the GFC.

Communication services are at an “off the charts” undervaluation reading.

By contrast, the consumer defensive stocks that investors have bought for their low-beta characteristics, are slightly overvalued.

The other sectors, which consist of basic materials, consumer cyclicals, financial services, real estate, healthcare, utilities, energy, and industrials, don’t show as extreme in over and undervaluation. However, wide-moat companies, or high-quality companies with strong competitive positions, also show a high degree of undervaluation that was only exceeded by 2009.

A technical view

The Morningstar fair value analysis is consistent with SentimenTrader’s observation of heavy insider buying in NASDAQ 100 names. These stocks are concentrated in the technology and communication services sectors and they tend to be high-quality with strong competitive positions and cash flows.

The relative performance of the NASDAQ 100 to the S&P 500 is trading in a relative support zone that hasn’t been exceeded since the dot-com bubble bust. I would add the NASDAQ 100 is very different compared to the 2000-2003 period. Today’s companies have far stronger cash flows and competitive positions compared to their predecessors.

The technical position of technology stocks shows that the sector is bottoming on both an absolute and relative to the S&P 500. As well, the sector is enjoying strong positive relative breadth (bottom two panels).

The technical position of communication services stocks is not as strong, but they do show a similar bottom pattern and improving relative breadth.

Good reasons to be bullish

In conclusion, corporate insiders have good reasons to be bullish. Valuations are reasonable and there are pockets of value in the stock market concentrated in the large-cap NASDAQ 100 names. Here are selected large-cap stocks that have shown insider buying in the last six months: CHTR, INTC, MSFT, NFLX, and PYPL. This is not a complete list and it is only a quantitative screen. You are advised to perform your own due diligence.

From a technical perspective, the bull case for equities is institutions and hedge funds have all sold and the only sellers left are retail investors. The BoA Global Fund Manager Survey shows that risk appetite is lower than Lehman Crisis and GFC Crash levels.

Equity futures positioning tells a similar story of a historic crowded short reading.

Retail positioning is cautious, but it has room to capitulate further.

As I pointed out about a month ago (see Why last week may have been THE BOTTOM), the mid-June breadth wipeouts are setups for a durable market bottom. While there is no guarantee that the major market indices won’t retreat and re-test the old lows, risk/reward has become increasingly bullish for equities.

Buy the dip.

Hello Cam, I hope you are well! It seems you are front running your trade and trend models?

Thanks for all of your insight!

Mike

I am expressing an opinion and an analysis that’s outside of the trend following principles of the models.

Trend following models are by design late. They don’t spot exact tops or bottoms. That’s a feature, not a bug.

Maybe because all of this has been so telegraphed to the market. I mean, is anyone surprised rates are going up? We knew it was coming. We expect a recession, so the market looks ahead.

Maybe it is looking at once things break we get a fed pivot, in which case we could get a crazy move like Dave Hunter says. But then he says he expects a monstrous crash. So what kind of scenario could do that.

This is my take on what could happen….we have the problem of inflation and this debt bubble….so the fed will raise rates until something breaks, so expect the market to be weak until the pivot…at the time of the pivot, inflation will not be gone, but the pain that something breaking, rates being higher, unemployment rising etc etc will get the fed to pivot, like countries have always done (we don’t even have to debase the coins like the romans did or those who followed)…so we get a pivot in the face of inflation…this causes the final big move up, but what follows is the bond vigilantes….when those companies with poor credit want to roll over their debt while inflation is high, what’s gonna happen? Will the fed buy all the junk bond universe? They supposedly are not allowed. Will we get tons of helicopter money just because we can?So anyways, if the fed does not do crazy and the bond vigilantes want more, then there will be many zombies in trouble, and this could make for the big crash. Just something to watch for when we get the pivot. For now I expect more downside, but we could easy chop around sideways, I don’t expect a break to the upside before the pivot, but what do I know?

Russia signs an agreement and within hours bombs the primary port for grain exports out of Ukraine. So much for this catalyst. Extreme heat in South and Western US. Likely to affect the crops. Stories of cattle herds being culled. The food inflation may have peaked but normal is not within sight. Same for energy. Rent and housing hasn’t peaked. So, we may have a peak in June but we are likely to have persistent higher inflation. Fed is not likely to stop raising the rates though the rates may go up only 25-50 per meeting post July.

Economy is definitely slowing with some lagging indicators still showing strength. Overall economy is likely to go into a recession. When will that happen? Forecasts are from now to some times in 2023. If we assume that it’s in the first quarter of 2023, then about now is the 6-9 months time when market historically bottoms. So, corporate insiders have figured this out but not the institutions.

I think risks are tilted to the down side.

Morningstar’s overall valuations are for a longer time frame, not for here and now. It does not tell you where the risks are near term. If one has 2-5 year or longer timeframe, it may be worthwhile to take a dip in the markets.

Fidelity thinks that for a 12 month out time frame, discretionary, financial, biotech and energy are most likely to outperform while technology and defensive underperform.

Same market, different perspectives and approaches!!

Cam

Doesn’t the data you have discussed suggest recent bias? The linear way of thinking would suggest we are closing in on a bottom in stocks. Agree.

However, core CPI/PCE is likely to run much hotter and longer, or so it seems. Based on your prior articles, the 10 year treasury yield and also the Fed funds rate, money policy etc. has a direct correlation to stock market valuations. With Core inflation running as high as it is, and the Fed backed into a corner, shouldn’t the stock market valuations be much lower at market bottom?

* recency bias.

I agree. The macro and fundamental backdrop argue for more downside, but the technical picture argues that the market is bottoming.

¯\_(ツ)_/¯

I think the big money crowd (i.e. ex-Retail), has over the years converged, to a set of decently predictive models, techniques, indicators, etc. hence they’re all looking at the same things and bailed out at the same time leaving the retails holding the bag.

Things could get trickier when too many people are looking at the same things. This strange no man’s land that Cam described above may be a byproduct of that. E.g. I think someone here mentioned that there could be a relief rally followed by another ‘patch of volatility’ as the extent of economic weakness becomes more visible. Maybe it was Cam. So it’s not weird to think that this time these big money crowds will also focus on front running the ‘Fed Pivot’ before it happens and ideally when the retails are capitulating.

* recency bias.

The recent insider buys on the 6/13/22 report showed only 117 purchases vs 342 in Mar, 2020 and going back to a period with higher inflation such as the initial bottom in 2008, it was on 11/17/2008 at 362 purchases. As you can see, what we saw in May and June of 2022 are relatively low levels by historical standards, even going back to only 2020.

One should also take note that insiders are not bothered by a 24% drop in the markets in 5 months as in 2008-2009 where the bottom came in near a 289 purchases report on Mar 2, 2009.

The rich are indeed different from you and I – they got more money. They have the luxury of more money to buy stocks and they can keep buying while you and I run out and get stuck with a large draw down.

http://openinsider.com/charts