Mid-week market update: After weeks of documenting how oversold and washed out the stock market is, the S&P 500 staged a marginal upside breakout through a falling channel while exhibiting a series of positive 5-day RSI divergences. Equally constructive is the behavior of net new highs, which turned positive today.

Have the bulls seized control of the tape?

More signs of a sentiment washout

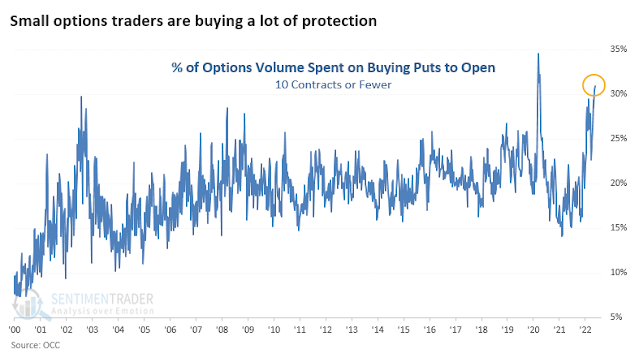

There have been more signs of a sentiment washout. SentimenTrader pointed out that small option traders (read: retail speculators) have been buying put protection at a level only exceeded by the COVID Crash.

Marketwatch reported that Kevin Muir at the Macro Tourist documented panic among hedge fund giants as a contrarian bullish sign. Bill Ackman sent out a tweet that Muir interpreted as a contrarian bullish signal: “Bill might be a brilliant investor, but the last thing you should do is trade off his emotional tirades. They are better fades than signals.”

In addition, Muir also highlighted George Soros’s Davos warning that “civilization may not survive” Russia’s war in Ukraine, with climate change taking a back seat.

Cam here: I have an acquaintance who worked at a hedge fund and he was on the same Bloomberg message stream as Soros and Druckenmiller during the GFC. After observing the messages that went back and forth, his conclusion was no one knew what was going on during periods of crisis.

As well, don’t forget the cover of last weekend’s Barron’s as a contrarian magazine cover indicator.

A fragile market

Despite the constructive signs of a rally through a downtrend, S&P 500 bulls aren’t quite out of the woods yet. The negative reaction to SNAP’s negative earnings report which cratered the social media stocks is an example of a fragile market that’s subject to a high degree of volatility. It remains to be seen whether NVDA’s decline from its weak guidance after the close will be a contagion on the general market tomorrw. We also have the PCE report Friday morning that will be a source of volatility.

My inner investor is cautiously positioned, but my inner trader remains bullish. The S&P 500 Intermediate-Term Breadth Oscillator recently flashed a buy signal by recycling from an oversold reading on RSI to neutral. The historical success rate of this buy signal has been very good (grey=bullish outcome, pink=bearish).

Assuming this rally continues, my inner trader will seek to exit his long position when RSI nears an overbought condition.

Disclosure: Long SPXL

Hi Cam.

Which RSI? $SPX or !ITBMRASPX?

Yes. Cam can you please specify this. Or return to this topic in your weekend post. We will highly appreciate it. Moreover, it looks that Ryan Detrick and Urban Carmel are both bullish on US indices till the year end – what do you think?

RSI is calculated on ITBM, not SPX

Cam,

You have remained long for the rally to occur for a while. The exit point on a rally is stated above. What about if there is no rally but sideways chip?

Both $VIX / $VIXX (volatility of VIX) and Up-volatility of $CPCE made new post-pandemic highs today, May 25, 2022 even as the $SPX closed up 0.95% and the $CPCE fell. Back on March 09, 2020, these values behaved similarly and the down trend -the primary trend, didn’t look back, reversing only on March 19, 2020, 2 trading days before the pandemic bottom.

Students of the market should ask themselves why these values are behaving this way.

Richard Russell had a saying nearly 40 years ago that basically said “the primary trend can be held back and manipulated, but ‘The primary trend will run to ultimate conclusion regardless

of any and all interruptions.’ Russell used a rather slow 89 day moving average but we have much better market internals now to see when a primary trend has stopped or reversed (it was 03/25/2020 for the pandemic trend). We will see a 2022 primary trend reversal when the markets are ready.

…as to !ITBMRASPX, see Oct, Nov, 2018. The primary trend was held back and interfered, but it didn’t bottom until it was ready on 12/16/2018.

..bottom until 12/26/2018, typo.

How good are back to back high up volume events such as 5/25/22-5/26/22?

Examples from end of 2015 and July 2016:

The first two events (7/13/15 and 8/27/15) were not useful, they reverted to the downside within 2 to 9 days. The last two in July 2016 were positive and continuted to higher highs. The lowest close of that period was on 2/12/16 during a fear of a mini-recession.

https://ibi.sandisk.com/action/share/6a77203e-7d4b-4577-9783-01e41c51db03

I have a very simple observation point about bottoming. It’s when NFT and cryptos are finally trashed and people are disgusted even talking about them.

Regarding Soros, something in Buddhism states that your face is recording everything you did in the past. When you reach certain age in your life all the deeds done will show on your face. Soros just looks like one Dorian Gray portrait hidden in that locked attic. People from central and eastern Europe probably know this guy very well.

Curious what prompted your observation regarding Soros?

Today is Day 9 of a potential ZBT buy signal.

Hope to see higher volumes in the second half of the session.

Cam-

Based on your head – shoulders analysis, the upside objective was 4370. Is this still in effect?

The downside target is no longer in effect. These targets are only approximate and the market came close enough to the number to qualify as hitting the target.

Hi Cam, it would be great if you can provide us on the update of the upside target on you Sunday post. I know that you do not have a crystal ball (unfortunatelly) but your opinion is very important to me. Have a nice weekend Petr

Despite the relatively low volumes on Thursday, it was a follow-through day.

A continuation of the rally today on high(er) volume is what the bulls need.

Max pain probably another ‘V.’ It’s usually a short squeeze that sparks the move.

Closing half of all positions in bonds/stocks here.

Closing the other half here.

The pain trade may in fact be higher. But it seems pretty overbought here.

Which probably means even more pain next Tuesday with a gap-up open. But I’m OK with having recovered most of my losses in May over the past three days.

This is late to the bullish camp of course, but better late than not being able to offer an explanation and this analysis took longer than expected.

The following chart may explain what some traders are seeing and why they are buying this week, based on up volume analysis of the $SPX. This market internal study must be well known among some traders and they understood the change in trend. This shows that the signal this week may possibly be held long term and not just days because this may be the beginning of a bullish primary trend. The signals are fairly infrequent but are reproducible after significant corrections and afford ample warning time to enter or close out trades if needed. The return from such a strategy is about 220% in 12 trades over 12 years with a 13% draw down.

There are no guarantees of course in trading.

https://ibi.sandisk.com/action/share/b44bf1ec-78f3-4555-b720-e53fcf106d6b