Mid-week market update: Will the S&P 500 hold support or will it break? The index is once again testing the neckline of a potential head and shoulders pattern while exhibiting a minor positive RSI divergence.

Here are the bull and bear cases.

Sentimental bulls

Short-term sentiment models look stretched to the downside, which is contrarian bullish. The bull-bear spread from the AAII weekly survey is at levels that have seen short-term bounces. Readings have only been exceeded to the downside during the GFC and the bear market of 1990. Similar readings were seen during the bear market low in 2002. Investors weren’t even as panicked during the Crash of 1987.

The latest update of Investors Intelligence sentiment shows a spike in bearish readings which resulted in the bull-bear spread turning negative. These are the kinds of conditions that have signaled previous bottoms.

Sentimental bears

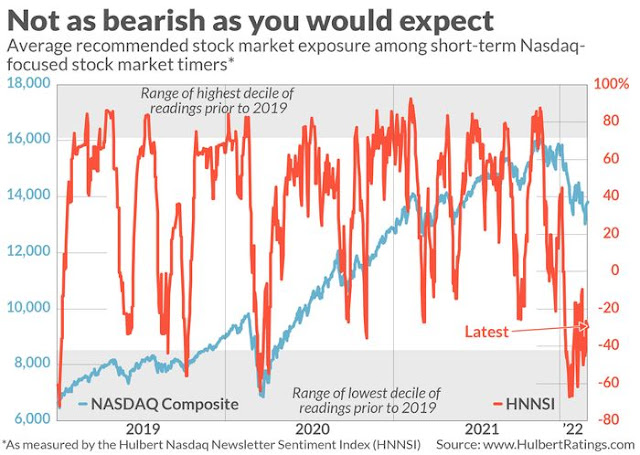

Does that mean it’s time to buy? Not so fast, says Mark Hulbert. His survey of NASDAQ market timing newsletters is not sufficiently bearish for a durable bottom.

Many market timers became more bullish during this period, with the HNNSI rising 57 percentage points. Though it has fallen back in recent sessions, it currently stands well above its late January low — at minus 29.7% versus minus 67.2%. The current reading puts the HNNSI at the 15th percentile of the historical distribution, above the 10th percentile which is the upper edge of the zone that in previous columns I have considered to represent excessive bearishness. (See the chart below.)

It’s amazing that the HNNSI is higher today than a month ago. Imagine being told in late January that the coming month would experience Russia’s invasion of Ukraine, Russia putting its nuclear forces on high alert, oil prices soaring to an eight-year high and U.S. inflation spiking to a 40-year high. I for one would have guessed that the HNNSI would fall even further — not jump more than 30 percentage points.

As well, the AAII monthly asset allocation survey reveals a bifurcated result. While the weekly survey is a sentiment survey that asks respondents about their views on the stock market, the monthly asset allocation survey asks what they are doing with their money. The allocation survey shows that equity weights have come down, but weightings are still elevated and there are no signs of panic that were seen at previous major market bottoms.

A bear market rally ahead

So where does that leave us? The market structure of technical deterioration is signaling the start of a bear market. That said, short-term conditions are sufficiently oversold and washed out that a bear market relief rally can happen at any time. Such rallies are usually short but intense in magnitude. The market is volatile because of its geopolitical risk premium and any hint of a ceasefire could send stock prices rocketing upwards.

Indeed, two of the four components of the Bottom Spotting Model flashed buy signals yesterday. The VIX Index rose above its upper Bollinger Band, indicating an oversold condition, and the term structure of the VIX inverted, indicating fear.

Investment-oriented accounts should continue to be cautious. My inner investor is positioned at a neutral asset allocation weight as specified by his investment objectives.

The S&P 500 rallied and unsucessfully tested a resistance level today. My inner trader remains positioned for a tactical market rally. Should the market follow through on today’s bullish impulse, he is looking for the VIX Index to decline back to its 20 dma before taking partial or full profits.

Disclosure: Long TQQQ

Cam,

=> The market structure of technical deterioration is signaling the start of a bear market.

Once we are past this short-term rally, your expectation is the start of a bear market?

Thanks!

Unless credit spreads get bad, I am not in the bear camp

Look at TLT. Look at what it did after oct 07, it went up, after oct 18 it went up, in 2020 feb it went up.

After mar 09 it went down, ditto jan 19 and after April 2020.

It has been going down, today it was down massively.

If you look at spreads like $$HYIOAS, these also are not sky high.

Of course things could be different this time, but consider the amount of bad news and we are not like at 3500.

I have said before that this whole thing has been too telegraphed, toss in a war which may get the Fed to ease on rate hikes, covid receding, we could get a surprisingly strong move, and if we crash through 4800, then 5000, we will have euphoria, then start getting worried

We are in a bear market (I agree with Ken). We are just setting up for a bear market rally.

Well a good point is that if one is holding large gains, take some profits.

I am extremely nervous about what I hold.

But I am referring to bear markets like 2000-2002, 2007-2009. What happened in 2020 was a freak by all accounts, it even had a recession for all of maybe 2 months.

$$HYIOAS is rising, but not insanely fast…it worries me.

What happened to it in 2014 to 2016 was even scarier than now.

One thing I read recently is about record put buying by retail which makes me think market makers should be selling in order to stay flat Delta.

I’ll take a bear market rally, but even though I think that everything is way too expensive to make sense, I think it might still go up

Like Yodic said, considering all the grim news (inflation, rate hikes, War in E Europe, Covid), the market is still hanging in there. I think ceasefire will be announced in coming days or weeks, and Covid is history unless a new malicious variant emerges. Probably, we will see fewer Fed hikes than the market expects.

I’m most concerned about the persistence of inflation (driven by commodities and wages). Wage inflation tends to be sticky. I think the auto and home prices will relent as the supply comes back and mortgage rates climb along with the Fed Funds rate respectively. Inflation certainly needs to be watched closely.

Housing is interesting. Remember the Zillow story? Many house are being bought to rent by funds, this has put pressure on prices…this is also a consequence of ZIRP. But builders will keep building as long as they can sell at a good price, what funds cannot do is increase the number of people needing homes. Then there is a parallel between homebuilders and shale drillers…drillers have DUCs which cost less to complete and extract oil, builders have land and they also wish to exploit it before the next housing bust. There are supply issues, but if they can build and sell, they will.

They also must be aware of the relation between stock market crashes and home prices.

I don’t have the data but do these funds increase supply of homes sufficiently to have an impact at a national level? I think they can definitely do it in selective markets.

They don’t increase supply, they buy existing houses to rent which makes the supply of houses to buy tighter, but there should be more for renting.

Will there be a liquidation at some point in the future? This I don’t know, but housing seems to follow a boom bust type of pattern. When rates go up and prices are high, there are less buyers that can afford to buy, so they rent. But what will happen if there is a housing bust? Will these funds gobble up houses and keep prices up?

With bear markets just about everything goes down, even gold had a decline of around 30% in 2008/2009…during a bull market in gold. See I would call that 30 % drop a correction not a bear. After 2011 gold got into a bear market, and may still be in one. Look how it is responding to war. How come it’s not 2500?

Take a 100 year chart of the $spx with a log scale and you can see 3 of them, after 1929, after late 60s to 1974 and of course 2000 to 2009….the markets went sideways for many years. But there were big moves in those periods. 2020, 1987 from this perspective were just corrections. Now maybe we are at the equivalent of 1968….mark twain time…russian tanks in Czechoslovakia…but note that in 1972 prices were higher before the plunge in 1974 and that 2007 also exceeded 2000.

What is really scary is the ADLine for NYA which after 1929 went negative, went from around 9000 in 1959 to negative in 1974 and in 2002 came close to zero. 2008/2009 was a sharp correction and then off to the races and now it is around 60,000. I can’t imagine it getting back to zero but it would take a horrible bear market. Things cannot go up forever.

It’s coming but I don’t think the monster is here yet.

Divergences exist, in 1929 the Adline was flat to lower for a couple years, in 1968 it was clearly lower than 1959, and in 2000 it was lower than it’s peak in 1998 ltcm crisis. Now it peaked in nov 2021 and the market peaked around new year, does that count? Another thing that does not fit with the big bear.

So, I don’t know, but I will tell you that if the market corrects hard and we get a Fed put and Powell caves and markets go higher and everyone is happy but the adline does not make a new high and the $$HYIOAS low is grinding higher then I will be thinking of buying beans and rice.

CCC spreads have bottomed and are steadily rising, and they have a long way to go to recession levels.

https://fred.stlouisfed.org/graph?graph_id=582384

Cam has pointed out that once the uncertainty of war lifts the economic backdrop will reassert itself in the market’s action. That backdrop is: Fed hiking cycle, QT (running off the Fed’s balance sheet), sharply higher energy and food prices, recession in Europe, reshoring supply chains and building resiliency, higher defense spending in Germany and elsewhere driving govt bond issuance which either increases long rates, drives monetization, or both. Notice that TIP and STIP have been hot the past week.

When I reality check that against what’s happening in my portfolio, pretty much nothing has worked the last two months. Bottom fishing in tech and allocating to blue chips (SCHD and QUAL) hasn’t worked (yet), nor LIT (yet). Not EM, not EWH. COPX has been working.

Given all that, I must accept Ken’s winter scenario, and use Cam’s bear market rally to lighten up.

Just my perspective. I read all of your posts carefully and appreciate the time and transparency you put into them. Thank you.

There is what could be called a cup and handle on the 4 hour chart from feb 21 to today.

There has been a lot of S/R in the last month at current price levels, so stalling today is no surprise, also if the resistance holds, no surprise.

The target for the cup and handle would be around 4670 . 4700 has seen a lot of action since early November, back in the pre omicron days. 43 thousand new cases yesterday compared to over 800 thousand before Christmas.

The neckline of that head and shoulders is at 4280 or so, we are above it for now. The resist line from the high of 4808 through the subsequent highs is at around 4470 which has also been a busy spot since September, so it is also likely to be a point of resistance

The VIX index trending upwards since late last year, bond vol index MOVE has been rising for the past year, HY spread also rising reliably along with yield curve flattening. Those are concerning. Hopefully there will be clarity in the war in the next two weeks.

As our eyes are glued to Europe, there is nasty development in China. I watch the Asian Junk Bond ETF (KHYB).

https://refini.tv/3pzpOFS

It had plunged (Evergrande etc) from mid-year 2021 to January and it was attempting to base but the last week as seen a nasty breakdown. In my opinion, the bear market in China (likely Far East too) will only end when their junk bonds turn up strongly. This is a reliable indicator for developed world markets to mark their bear markets lows. I expect it will work in China too. Makes sense. Keep the link. It updates nightly.

This also has me cautious about industrial commodities since China and the Far East region are massive buyers of metals et al.

Agriculture companies like fertilizer giant Nutrien, have massive demand that are recession proof and vitally needed.

The best advice I’ve seen recently is to own things people ‘NEED’ rather than the old winners of companies selling things people ‘WANT’

I agree. Get what people need.

I think that china with evergrande they are in a credit squeeze that dwarfs what we see in JNK. So far the lows of JNK do not come even close to the low of 2020. KHYB has eclipsed the lows of 2020…thin market though.

But there are a lot of zombies in the S&P, our day will come.

Anyone buying RSX?

You are a blood in the streets guy!

Maybe buy one share on Robin Hood for the casino feeling.

Putin has painted himself into a corner, and he knows it. He needs to decide whether to up the stakes (and ultimately lose anyway), or suck it up and back off.

This is on Barron’s

As long as Vladimir Putin remains in power, Russia remains “uninvestible,” says David G. Herro, the celebrated portfolio manager and chief investment officer for international equities at Harris Associates.

Russia will also become increasingly isolated as more countries line up in support of Ukraine.

“The only resolution from the world against Russia is for Putin to somehow leave,” says Herro, who has managed the Oakmark International fund since 1992. “As long as Putin is there, it will be the world against Russia.”

Sun Tzu, of Art of War fame, says to leave your foe a golden bridge to retreat.

If the West leaves Putin none, the danger multiplies.

Well,

I think it’s Putin who is making sure that he has no Bridge left. West has been letting him do whatever he does for now. This is a bad decision of his own making. And yes, I agree, a Cornered Rat becomes more violent, because there is no way out, so might as well take everyone else down with it. Hopefully, his own Oligarchs or Troops take care of him.

Back in December Russia demanded that NATO retreats back to 1997 positions, leaving the Baltic states and eastern European nations open for Russian aggression, that kind of solution would be difficult and listening to what Putin said last monday leaves the impression that this is not just about Ukraine.

They are offering him a way out…negotiations, but that is not acceptable to him it seems.

We have seen Hitler, Stalin, Al Capone, they are all cut from the same cloth.

As far as Sun Tzu is concerned, weren’t the generals there near the troops, and there has to be a point where there is no bridge

In 1962 cuban missile crisis, there was an order to fire, which was ignored, or so the story goes, but giving in to a tyrant gets you nowhere, you just get the “this is my last territorial demand”

Napoleon was defeated twice, trips to St. Helena and Elba, these guys don’t change.

When Iraq invaded Kuwait he was given a second chance when the US forces stopped when the Iraqis were booted out, did that work?

Hopefully Ukraine can hold out until the sh#tstorm in Russia causes enough problems for him that he gets outed, but a lot of people will suffer.

Well, the world just proved that it won’t do anything as Putin’s army marches on. I think this is proving more than anything to Putin else than he can next take Moldova or even NATO countries without a lot of resistance. I don’t think he cares about the suffering of Russians anyways since he won’t be running for elections.

As far as negotiations go, my understanding is he was looking for a guarantee that Ukraine won’t join the NATO that the allies did not want to agree to. Ukraine is a free country and should be allowed to join any block but we have to live in real world.

It is heartbreaking to see the loss of life and destruction in Ukraine. I’m afraid this is not the end. Even if Putin installs a puppet regime in Kiev, a guerilla warfare will continue for long.

Amazed to see the bravery of Ukrainians!

The way I see it – which is why I’ll never be a politician – is the global community standing aside and watching while Russia bombs and murders their Ukrainian neighbors. Sure, we’re throwing money and weapons their way – but that’s not nearly as helpful as joining the fight. Reminds me of the security guards inside a Manhattan building who stood and watched while an elderly woman was repeatedly kicked on the sidewalk outside.

So Powell was asked the Volcker question today and he did not rule out playing that kind of role to bring down inflation. Should investors take a wait and see approach or freak out?

He said to mark his words “YES” he would fight it even if the economy weakened.

Folks, Heed that. The war on inflation is on and D-Day hitting the beaches is their March meeting. Lot’s of tough battles after.

Putin will blame the Ukrainians for attacking their own nuclear plant, forcing him to use his weapons. He wouldn’t have put his nuclear troops on alert if he would not have intended to use them.

This may be the kind of provocation needed to end the invasion. Putin is often cited as a master of brinkmanship – in this case, he’s fatally miscalculated.

There will be lies of course, but damaging a nuclear plant has no value as a weapon unless it is in enemy territory.

This invasion pushed the europeans to activation….like anything else, from chemical reactions to divorces , there is a barrier to action, it’s why we don’t burst into flames, or gasoline for that matter. I think that Putin has lit a political reaction.

Oil is a big one. It is only a matter of rerouting oil supplies. If only china buys oil from Russia that puts Russia in a weak position. Do you think China would pay Brent prices if they are the only buyers of Russian oil? So this may displace oil that would have gone to china, to Europe or wherever, but I think the Chinese would pay less than global prices and if Russia did not like it they can pound sand. A recession and a drop in oil prices, Russia gets even lower prices. When the strait of Hormuz is blocked oil does not cross, this will not be the same thing, it is just the west saying they won’t buy Russian oil

So, just like North Korea, another Chinese vassal state in the making…

Well, at least Putin has made the Mother Russia (partially) whole again!

he will fail, but many will suffer.

I have survivor’s guilt of a sort