Four weeks ago, I suggested that investors buy to the sound of cannons. Now that the cannons have sounded, is that still a good idea?

Yes, but there’s a catch. A detailed list of past crises from

Ed Clissold of Ned Davis Research reveals that stock prices usually rebound strongly after sudden shocks such as war. On average, the DJIA is up 4.2% after a month and 15.3% a year later.

Here’s the catch. Consider the following: Jeremy Siegel observed that stocks return about 7% real per annum. Supposing your distant ancestors had invested $100 in equities or equivalent at the time of Augustus Caesar and held the investment for the last 2000 years. Your family would be so obscenely rich that it could have rescued the entire global financial system during the GFC with the proceeds of less than one day’s interest.

The key caveat to event studies such as the effects of war and historical analysis of long-term returns is they suffer from survivorship bias. A past study from Credit Suisse of cumulative real returns illustrates the risk from the permanent loss of capital from war and rebellion. Simply put, a lot of people died in very nasty ways and they never lived long enough to enjoy the use of their assets.

Exhibit A is Germany, which was extensively involved in both World Wars.

China and Russia are even more extreme examples of the permanent loss of capital. Had you been living in those countries, the last thing on your mind would have been the value of your investment portfolio. If you were lucky, you escaped with your life.

The inflation fallout

How do these studies apply to the current circumstances? As NATO has repeatedly asserted that it will not militarily intervene and send troops into Ukraine, the tail-risk of a global catastrophe is off the table. Investors can rely on the plain vanilla analysis of how markets reacted in past conflicts.

Nevertheless, there are several important fallouts from the current war. As the West rolls out sanctions on Russia, an article in the

Economist outlined Moscow’s possible retaliatory steps that could dent the global economic outlook.

Such tougher sanctions would have several drawbacks for the West. They might prompt economic retaliation from Russia, in the form of cyber-warfare or restrictions on the sale of gas to Europe. They would impose direct costs on Western economies. Russia remains the eu’s fifth-largest trading partner, for instance. European banks have $56bn-worth of claims on Russian residents. Cutting Russia off from swift could cause instability in the financial system. And energy bills in Europe would probably rise further. Furthermore, to be truly effective the West would also need to ensure that the sanctions are globally enforced: that means either persuading or coercing Asian countries, including China and India, to abide by them, perhaps by threatening secondary sanctions on them if they refuse. Without this any stronger sanctions regime would be a leaky bucket.

The most obvious problem for investors is soaring energy prices which puts upward pressure on inflation. As Russian troops crossed the line of control, Brent prices spiked to over $100, which will both raise inflation and dent economic growth.

Less noticed by the Street is the importance of Ukraine as the breadbasket of Europe. Ukraine is the top global producer of sunflower seed and a major producer of corn, barley, and wheat.

In short, the war will spark an inflation problem. How will the fiscal and monetary authorities respond?

Rally around the flag?

It depends on the jurisdiction. The EU had long been a collection of bickering countries, but its response has been remarkably united. The German decision to suspend approval of the Nordstream 2 pipeline was a demonstration that it was willing to bear substantial pain.

Count on a strong fiscal response where Berlin exempts military spending and energy diversification initiatives from eurozone deficit targets. While this is highly speculative, the war will accelerate Europe’s transition to green energy, which is a bullish factor for capital spending and investment in the region. The ECB should cooperate and decline to offset any fiscal expansion with monetary tightening. Peripheral country bond spreads will narrow. We saw this movie before in 2014.

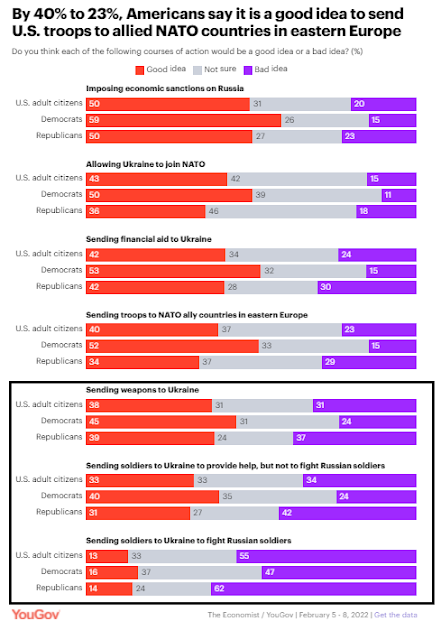

The situation across the Atlantic is another matter. It is unclear how much of a rally around the flag effect the US will see in light of the divisions in the American electorate. While both Democrats and Republicans called for the government to support Ukraine, a division is appearing between the supporters of the two parties about the degree of support. A recent

YouGov poll sponsored by The Economist reveals an elevated level of opposition to different degrees of military aid and support to Ukraine and divisions between Democrats and Republicans about these issues.

These divisions in the electorate make a fiscal response, either to offset the inflationary effects of war or increased military spending, less likely. Any rally around the flag effect in America is likely to be far more muted than in Europe. The fiscal drag is projected to be negative and the war is unlikely to move the needle significantly.

As for the Fed, it continues to be worried about inflationary pressures. Fed Governors Michelle Bowman and Christopher Waller recently suggested a half-point rate hike could be on the table at the March FOMC meeting. The market continues to discount seven quarter-point rate hikes this year.

In the meantime, the 2s10s yield curve continues to flatten, indicating expectations of a growth slowdown.

Investment implications

In conclusion, buy the war dip is the order of the day in the absence of risk of a total loss of capital from war and rebellion. Take note, however, that macro conditions still dominate in the long run. The Afghanistan War began in 2001 shortly after 9/11, which was in the middle of a recession. While stock prices rebounded, they continued to decline after an initial rebound as economic conditions deteriorated.

The S&P 500 forward P/E has declined to a more reasonable 18.5, which slightly below the 5-year average of 18.6 but above the 10-year average of 16.7.

I continue to favor large-cap high-quality growth stocks in the NASDAQ 100, which have become extremely oversold on a normalized historical basis. As economic growth becomes scarce, expect investors to bid up the prices of cash generative growth stocks.

While the primary focus of my analysis is on regions, countries, sectors, and factors, investors may wish to consider the top half of the

RRG chart for FANG+ stocks for inclusion in their portfolios.

I expect the market will recover from the war scare in a short time, but I reiterate my views from my recent publication (

A 2022 inflation tantrum investing roadmap). The Fed is undergoing a tightening cycle. Stock prices will not bottom until the inflation outlook improves and the Fed stops removing monetary accommodation.

Buy the market panic for a tactical rebound, but don’t overstay your welcome.

Disclosure: Long TQQQ

Excellent trade entry on NDX, nice call! One question, what are your expectations of the long end of the yield curve? Would expect in a growth slowdown and flattening curve environment that the long end would at least be anchored or decline from here, or is this too simplistic?

Growth slowdown and flattening yield curve should see long yield decline.

What has amazed me is that despite a relatively normal correction of -10% in the SPX (close to -15% at the intraday lows on Thursday), sentiment levels were back to March 2020 levels.

Here is how I see it with the usual caveat that I could be wrong.

1. All stock indices in a Bear Market. All of them are trading comfortably below their 200 day moving averages. The QQQ’s are going to have a crossover of the 50 day below the 200 day. Tremendous overhead resistance. At the right time I will look to short it again.

2. Gold and Oil both in up trends. They both are trading above their 200 day moving averages.

Long Term Strategy for me: Buy gold on dips. Short S&P and QQQ on rallies till the long term changes.

Thanks for sharing your views as well.

Are you comfortable holding gold for long-term? Is there a concern that the gold price is elevated because of Russia-Ukraine war, and will plunge once the situation stabilizes?

Thanks again for sharing your views. I appreciate a good debate.

I’m slowly transitioning from bear to bull – also with the caveat that I could be wrong. At the very least, I’m leaning toward pushing the bear scenario out to H2.

(a) It would be unusual to see sentiment more negative than it has been. I think that needs to be worked off.

(b) Thursday may have been the lows for this correction. A retest and undercut with that will potentially carve out a double bottom.

(c) Absolutely no one is calling for new highs anytime soon – and most traders are presumably positioned accordingly.

(d) The war trade may have peaked – I don’t generally pay much attention to gold, but my bet would be that oil has peaked in the ST.

Either way – it’s always good to have a real time sounding board.

As a short term momentum trader my opinions are not cast in stone. I trade both sides of the market. This year I have been both long and short the qqq’s. What I do is have an over view of trends. Here is how I am seeing it now:

S& P 500 and QQQ

Short term: Up

Intermediate term: Down

Long Term: Down

Short term the intra-day reversal was impressive. I would not short the market till it gets overbought at which point I will see if it makes sense to trade it from the short side.

As I have stated earlier there are many ways to trade. One has to trade with a style that they are comfortable with keeping in mind the statistical odds of being right. In other words having an edge.

Thanks for the time frame clarifications. I would agree with the long term outlook.

=> Count on a strong fiscal response where Berlin exempts military spending and energy diversification initiatives from eurozone deficit targets.

Cam, this is very interesting. Any timeframe for this response?

Is it fair to assume that this will be negative for Euro?

Of course, great for weapon and green infrastructure suppliers!

#EU, #USA, #France, #Germany, #Italy, #UK, #Canada agree to disconnect some of #Russia’s banks from SWIFT international banking system

https://ec.europa.eu/commission/presscorner/detail/en/statement_22_1423

I don’t think it will impact energy payments to Russia yet. Those banks are likely exempted.

https://www.wsj.com/articles/eu-leaders-weigh-cutting-russia-out-of-global-payment-system-swift-11645888337

Unfortunately, it is not the end for Putin/Russia and there are workarounds – according to the article above.

Fitch Ratings said banks could use other—albeit less efficient and more expensive—messaging systems such as telex. Russia also has developed its own payment system. While it currently has only 23 foreign banks connected to it, more could join if Swift is no longer an option.

Beijing has its own payment system, too, with more take-up by international banks than Russia’s.

“It would cause the Russians a lot of headaches, but I think its (SWIFT’s) value has been dramatically overstated.”

The good news is that we are already at the end of Feb, just a few more weeks of winter left.

https://www.theguardian.com/world/2022/feb/23/europe-winter-gas-reserves-russian-imports-german-analysis-ukraine

Economic institute says current levels of gas enough for six weeks if mild temperatures continue

#EU, #USA, #France, #Germany, #Italy, #UK, #Canada agree to disconnect some of #Russia’s banks from SWIFT international banking system https://ec.europa.eu/commission/presscorner/detail/en/statement_22_1423

They are also imposing restrictive measures that will prevent the Russian Central Bank from deploying its international reserves.

I don’t think it will impact energy payments to Russia yet. Those banks are likely exempted. https://www.wsj.com/articles/eu-leaders-weigh-cutting-russia-out-of-global-payment-system-swift-11645888337

Unfortunately, it is not the end for Putin/Russia and there are workarounds – according to the article above. Fitch Ratings said banks could use other—albeit less efficient and more expensive—messaging systems such as telex.

Russia also has developed its own payment system. While it currently has only 23 foreign banks connected to it, more could join if Swift is no longer an option.

Beijing has its own payment system, too, with more take-up by international banks than Russia’s. “It would cause the Russians a lot of headaches, but I think its (SWIFT’s) value has been dramatically overstated.”

The good news is that we are already at the end of Feb, just a few more weeks of winter left. https://www.theguardian.com/world/2022/feb/23/europe-winter-gas-reserves-russian-imports-german-analysis-ukraine

Economic institute says current levels of gas enough for six weeks if mild temperatures continue

DJIA futures via weekend bets on on IG pulled back sharply (about -500 points) on the SWIFT news. But that’s a highly unreliable reflexive reaction.

Re the risk of a recession – I just don’t see it as being a high-probability bet. US consumers/companies are sitting on record amounts of cash/ low levels of leverage. Companies have locked in LT debt at very low rates. Unemployment is low and job openings are high. Will higher rates really pose a problem?

I’d think that not all businesses will have access to LT debt. Probably only Fortune 500, maybe even 1,000.

Most small companies I follow can hardly get any debt. Yup, high-quality S&P500 companies can survive and thrive. Not sure about the rest if the inflation stays high and the Fed or the market compensates by hoisting rates!

And, forget about small, private businesses.

I think the trend of de-globalization (and all its benefits in terms of low inflation) will only accelerate from here. Expect more local manufacturing and supply-chains in coming years, and hotter, sustained inflation. The latter part is scary. Imagine the impact on home prices when mortgage rates hit 15%.

I don’t think we’ll see rates @ 15% again in my lifetime. Even if we do, home prices will ultimately inflate along with everything else. Buying a home is IMO one of the best ways to keep up with inflation.

I used to subscribe to Louise Yamada’s technical publication a few years ago. She had been forecasting a long-term bottom (a 40 year cycle) and then a gradual rise in rates over the coming decades.

I think David Hunter is also forecasting 15-20% by 2030.

This is scary. Not sure if this true. So far, this source has been pretty good.

MACRON CLAIMS MOSCOW HAS BEEN GIVEN THE ‘GREEN LIGHT’ TO DEPLOY NUCLEAR ARMS IN BELARUS, DEMANDS THE BELARUSIAN LEADER ORDER RUSSIAN TROOPS OUT OF THE COUNTRY –

https://mobile.twitter.com/The_Real_Fly/status/1497756439099715586

IG bets now at -400 points. Perhaps the initial drop was a reaction to the news re nuclear weapons. That would make it reminiscent of the Bay of Pigs incident – which would make it another buying opp.

You’re assuming Putin is a rational actor. What if he doesn’t give a damn? What if he just wants to achieve the former glory for USSR at any cost, and doesn’t care if the whole world goes to hell?

If that’s true, then as they say neither stock prices nor the value of our portfolios will matter.

True. Maybe use our funds to buy a farm in a remote corner of the world with very low odds of radiation reaching…

I remember about how in the 80s this group of people wanted to get away from it all, so they moved to the Falkland Islands. At the same time I knew a man who was an importer of clothing, he was down in Argentina concluding a deal and supposedly at the end when both sides agreed on the terms, one side asked if this was certain and the other said “What are we going to go to war?” I’m not sure if there was embellishment to that story or not.

The reason why nukes work as a deterrent is because the elites would also die, they don’t want that.

Putin may be paranoid, power mad, but I don’t think he wants the world to end, that card belongs to some future fringe nut jobs that will engineer something that would make covid look like the tooth fairy.

There is no point in being elites if there are not ample minions to do all the work. Who wants to go back to the Stone Age and give up the elite life? I am not talking about giving up the job at Walmart, I’m talking the private jets, caterers from places most of us don’t even know about etc.

Anyways, I remember how we had drills in my small town where they tested this nuclear attack sirens, so we could have like a 5 minute warning….wow that would help me choose where I want to die.

One side of the media no doubt wants things to plunge so scary news is a given. But if you knew it would all end Tuesday and the markets globally would go to zero or more likely just stop, would you short the market to die rich? Would you run to the bank to get cash to buy gold before the nukes hit? I would wager 99+% would not.

The reason the soviet bloc happened was because when Germany was defeated the elites split the spoils and kept Western Europe and gave the soviets the rest, which was occupied by the soviets anyways, so they had control. My son says that in Kiev waiters in restaurants won’t even speak Russian even if they know how. This is I think a reason why Russia is concerned about countries like Ukraine joining NATO, because the formerly occupied countries really don’t like them. Trade is one thing but liking is different.

I didn’t expect Putin to invade Ukraine and cross that line. The media and the politicians in W Europe didn’t expect that either despite constant warnings from the US intelligence and the Biden administration.

Putin has invaded Ukraine and his elites are nowhere to be seen.

I don’t expect Putin to drop nukes but there is a tiny chance. I hope the elites in Russia will wake up and take some action before Putin does.

This is a line Putin would not cross, nukes. Whatever you saw on Twitter is likely misinformation warfare. People involved in this conflict, from both sides, have thought about this already. I can assure you that right now the activities are dialing up on how to deal with a mentally unstable deranged leader, consensus from both sides. Russian inner circle is a mafia, foremost a profit-driven group. When money stops flowing, someone needs to pay.