I must admit, the bears are trying their best. They’ve thrown everything but the kitchen sink at the stock market: The prospect of a half-point rate hike, an inter-meeting hike, and the looming risk of an armed Russia-Ukraine conflict.

Despite all the bad news, the S&P 500 is holding above its January lows. What’s next, an asteroid from outer space?

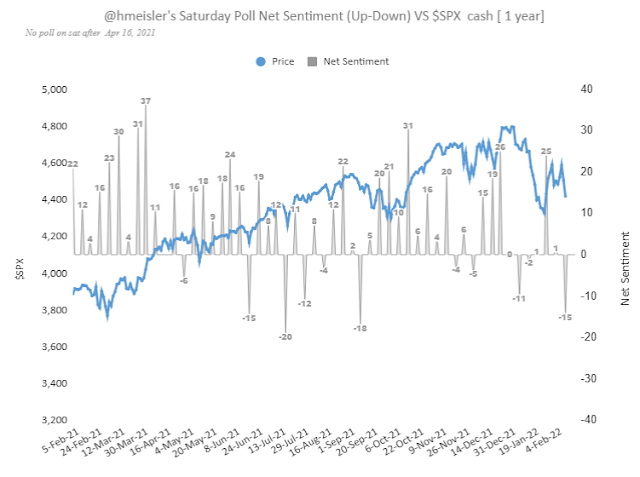

Depressed sentiment

Short-term sentiment is certainly depressed. Two (unscientific) weekend Twitter polls tell the story. Helene Meisler’s weekly poll readings show a high level bearishness.

Callum Thomas’ weekend poll tells a similar story.

How far will the Fed go?

St. Louis Fed President James Bullard appeared in a CNBC interview this morning in which he defended his views and did not walk any of hawkishness back. Over the weekend, San Franciso Fed President May Daly called for Fed actions “measured in our pace and importantly, data-dependent”. Kansas City Fed President Esther George dismissed the idea of an inter-meeting rate hike.

In response to the contradictory messages from Fed speakers, the market turned even more hawkish. Fed Funds futures are now discounting six rate hikes in 2022 for a total of 1.75%, up from five rate hikes for a total of 1.50% on Friday. Expectations for a half-point move at the March meeting remain intact.

The key question for investors is whether the Fed will push back against the notion of such a steep interest rate path and, in particular, a half-point move in March. There will be lots of Fed speakers in the coming weeks and we should get more clarity on that question.

Ukrainian offensive: Now or never

The newsflow from the Russia-Ukraine situation is chaotic and confusing. I am not a military expert and I don’t even play one on TV. However, the window for an armed conflict is closing quickly for two reasons.

Reports emerged in late January that the Russians had moved medical units near the Ukrainian border. More alarmingly, blood supplies were also being deployed to the frontlines in anticipation of possible casualties. According to the

American Red Cross, the shelf life of whole blood is 21-35 days, depending on blood type. The shelf life of red cells is up to 42 days. Frozen blood plasma is good for up to a year. Based on that report and assuming that the Russian High Command is planning for a quick two-week offensive, the window for a full attack closes in late February before their initial blood supply runs out, though undoubtedly they can get more if the conflict continues.

As well, Russian forces will have to contend with the dreaded Rasputitsa, the season when the spring thaw turns the region into mud, which dramatically slowed the German offensive from 1942 onwards as tanks got stuck and supply lines shortened.

CNN reported that the region is experiencing a mild winter and above-average temperatures.

Social media videos from several areas where Russian forces are deployed — some posted by soldiers themselves — show soft and flooded ground, and plenty of mud.

Data from Copernicus, the EU’s Earth Observation program, shows that much of eastern Europe experienced well-above-average temperatures in January. Ukraine saw temperatures between 1 to 3 degrees Celsius higher than the average of the past 30 years, one of many changes that the climate crisis has brought this region.

Copernicus also notes that in January, “eastern Europe was predominantly wetter than average” and the soil in Ukraine was wetter than normal. The combination means less frost and more mud.

For the Russian military, it’s now or never for an offensive.

The open question for investors is what has already been discounted in the market. An article in

The Economist speculated that a limited offensive to recognize and annex the breakaway regions of Donetsk and Luhansk as independent republics might be a cause for relief that a full-blown conflict did not emerge.

If Russia were to formally recognise the two self-proclaimed republics, as independent entities, or even station its troops and military infrastructure there, it would amount to something not far short of annexation, since the “republics” would be full of newly minted Russian citizens, and be unable to stand on their own feet without substantial help from Moscow.

Ukraine and the West would object loudly to the redrawing of international borders by force. But the move would also lower tensions, because the immediate excuse for an Russian invasion was always likely to be a “provocation”, allegedly by Ukraine, in Donetsk or Luhansk. Even as it protested, the government in Kyiv might therefore heave a sigh of relief, and so would the rest of the world. The danger, however, is that Russia may not stop at that.

The

NY Times reported this morning that tensions had ratcheted down a little. The path for negotiation is still open. If military action remains on hold until early March, any Russian offensive will have to take place under less than ideal conditions.

Speaking in what appeared to be a carefully scripted televised meeting with President Vladimir V. Putin of Russia, Foreign Minister Sergey V. Lavrov said that he supported continuing negotiations with the West on the “security guarantees” Russia has been demanding of the United States and NATO.

“I believe that our possibilities are far from exhausted,” Mr. Lavrov said, referring to Russia’s negotiations with the West. “I would propose continuing and intensifying them.”

Mr. Putin responded simply: “Good.”

The televised meeting was a signal that Russia might continue using the threat of an invasion of Ukraine to try to squeeze diplomatic concessions from the West, rather than resorting to immediate military action.

I interpret current conditions as constructive for risk assets, though event risk remains high. If you are short here, you need a catastrophe within the next 10 days, otherwise, you run the risk of a rip-your-face-off relief rally.

Presently I am flat in the market. What I am watching to see a turn in the market:

1. A sharp drop in the Vix and Vxn.

2. Drop in Oil and Gold which will be the tell that the risk premium of war has been removed from the market.

On a positive note the ARK fund has started to stabilize. It is possible that the worst is over for the lower tier tech stocks. However, MSFT does not trade well. It needs to find a bid.

https://mobile.twitter.com/annmarie/status/1493308697115865088

Some clarity— the comments President Zelenskiy posted in English on his Facebook page are from a speech he gave in Ukrainian hours ago. The former comedian’s sarcastic sentiment was lost in translation and has thus spooked markets/ media.

Reopened a small position @ 435-and-change, but closing it here. No conviction.

They keep tossing bad news, I’m skeptical, hope I’m not wrong

Higher than average volume, although with HFT I don’t know how reliable a sign volume is anymore

Russia retreats. SPX +1.6%.

Three out of three:

Oil – 3.5%

Gold -1%

Vix -9.18%

The rally I think will be multi-day. I am planning to trade it from the long side.

Thanks for sharing your thoughts.

Scaling back into SPY/ QQQ. First allocations on the minor pullback from 446+ to 444+/ 355+ to 353+.

Too much FOMO for my tastes here but we all need to start somewhere.

I’m more concerned about the PPI numbers than futures are discounting.

SPY/ QQQ at premarket levels are ~ -7.5%/ -13.5% off ATHs. Also more or less in the middle of last Friday’s range.

Adding a bit more SPY @ 443.8x.

I think we’ll see better entries within the first hour of the regular session.

Then again, we may not. Which is why a starter position keeps FOMO at bay.

50/50 odds the indexes pull back into the red before the day is out. I just don’t think a Russian retreat is that big a deal.

Adding a position in VT ~102.0x.

Adding to SPY/ QQQ here.

Starting to feel like a runaway train…

Too many traders waiting to buy the dip. At some point they’ll get burned.

Of course, if you’re a longer-term investor I think today is a decent entry point.

Hope to see more confirmation that we’ve bottomed.

For instance, a contraction in new lows.

How many times will we be hearing today that inflation is peaking/will be peaking/is about to peak?

Has anyone said that google searches of the word inflation have peaked? We are not yet at peak “peaking?

Despite a hot PPI number the market has been able to hold on to the gains (so far) – that is a positive, even though I believe the evidence for a negative economic backdrop is increasing.

That’s actually v good. The Fed will not have to raise the Fed Funds rate which would be very positive for stocks.

Quite frankly, looking at consumer confidence, PPI and CPI and recent retails sales numbers, there is reason to believe the economic slowdown will be much worse compared to what investors are currently positioned for. At least in terms of durable goods demand, which is even less positive for the market if service demand outweighs those effects.

As for the central banks, the negative effects of staying too accomododative are clearly evident by now. And the central bankers will weight the labor market much more heavily compared to durable goods sales. It is the exact opposite of “goldi locks” for the stock market.

From Helene Meisler:

‘Yesterday’s put/call ratio for ETFs was 1.61, which is the highest since it was 1.63 on 10/6.’

There may be a stronger floor under this market than I expected.

Here’s the pullback.

Added a bit further.

There’s really no system that works perfectly. Just need a directional bias and add on pullbacks. I anticipate a move to 442 later in the day – but that’s only a guess.

next move will be strong….not sure if up or down of course, but if up I think we get new highs. Hard to believe we are only a month or so from the ATH

US Covid numbers under 100k for 2 days….what happens when they start talking about covid being done? Market reaction to Russian troop movements could be a hint.

In December we were getting over 800k new cases a day, maybe Omicron is finally burning itself out. 🙂

Most of the Bay Area has either already rolled back indoor mask mandates (with the exception of schools/health care facilities/ government facilities) or planning to do so soon.

It seems many companies that are dependent upon semiconductors are guiding 2Q 2022 lower. They are also expecting the supply-chains to improve in 2H 2022.

Just wonder if the market is already looking past 2Q and valuing improvements in 3Q and 4Q.

Adding to QQQ this morning.