Mid-week market update: I wrote on Monday (see Everything but the kitchen sink) that market sentiment was overly stretched on the downside, “If you are short here, you need a catastrophe within the next 10 days, otherwise, you run the risk of a rip-your-face-off relief rally.”

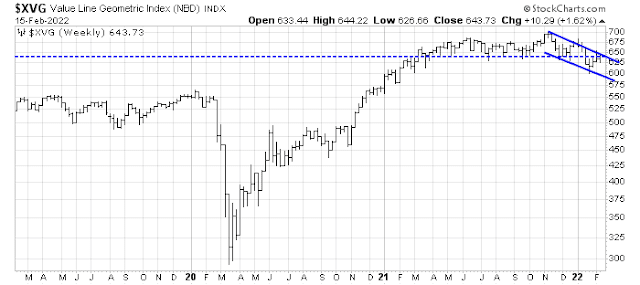

The relief rally appeared right on cue on Turnaround Tuesday and prices stabilized today in the wake of the release of the FOMC minutes. Before the bulls get too excited, don’t forget that the intermediate trend is still down. The Value Line Geometric Index, which measures the performance of the average stock, broke a long-term support level and is tracing out a falling channel.

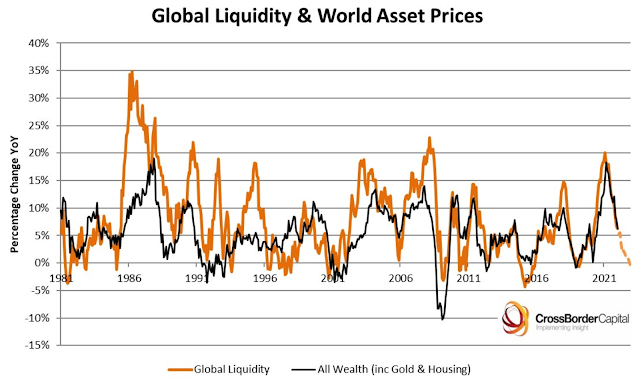

Mike Howell at Crossborder Capital also pointed out that global liquidity is drying up. Changes in global liquidity is historically correlated with asset prices, such as stocks, bonds, gold, property, and so on.

Positive seasonality

Tactically, the market may still see an upward bias as it rebounds from an oversold extreme. If seasonal patterns hold, the market should be positive for the rest of this week and then correct and bottom in early March.

This week is also option expiry week. Historically, February OpEx has exhibited a bullish pattern.

Short and long-term sentiment

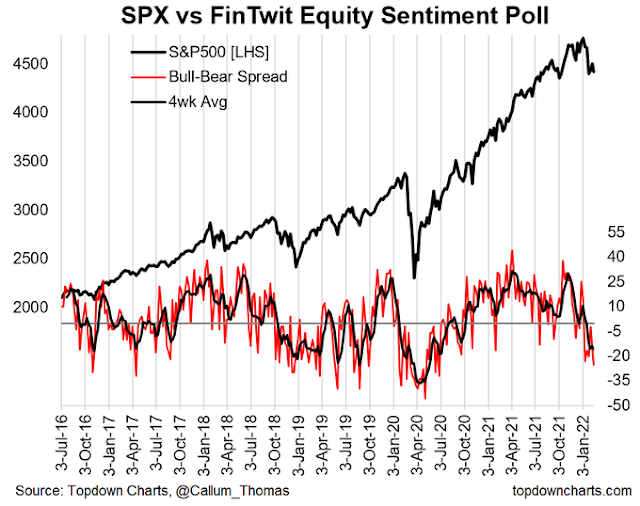

Short and long-term sentiment models present a mixed picture. Short-term sentiment, such as Callum Thomas’ (unscientific) Twitter poll, shows bearish extremes.

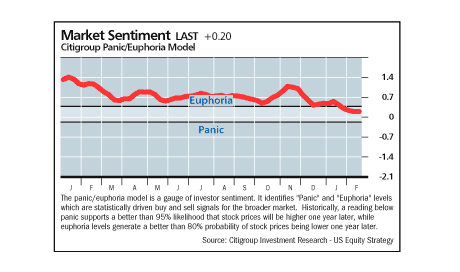

By contrast, longer term models such as the Citi Panic-Euphoria Model is in neutral territory. There is lots of downside before a long-term washout low can be declared.

Technical damage

Broadly speaking, the stock market has sustained too much technical damage for it to roar back to test the old highs. The S&P 500 may be forming a head and shoulders formation, but H&S patterns are incomplete until the neckline breaks.

I expect the S&P 500 to encounter resistance at the 50 dma, which also coincides with last week’s highs. My base case scenario calls for a continuation of the choppy range-bound market that has frustrated both bulls and bears this year. Nevertheless, I do find it constructive that the S&P 500 has managed to find its footing and hold above its January lows in the face of potentially catastrophic news.

My inner investor is neutrally positioned at roughly the target asset allocation weights specified by his investment policy. My inner trader is standing aside. There is no need to take excessive exposure in the face of wild volatility.

Team Bears are sending the Bullard tomorrow.

You mean Bearard, Bullard’s evil twin.

I am starting to think that this is the most anticipated ‘bear market’ in recent years. No one is forecasting a recession till sometimes in 2023, Fed hasn’t begun to raise rates(market has done it for them), earnings are still rising, margins are holding up in spite of the increasing costs, labor markets are healthy, consumer spending is strong and credit is still healthy.

Maybe this is volatility till the March meeting is over?

Maybe not a recession, but economic indicators are pointing to a severe slowdown in growth later this year, with inflation taking its toll and consumer spending likely to shift to services (this effect is somewhat delayed in non-US markets I believe) we are likely to see some payback in demand in durable goods spending.

Aside from the Russia drama, we have seen the stock market play catch up to the bond market recently, but the good news is that there are signs of selling exhaustion in the latter – paving the way for a relief rally in rate sensitive sectors. I would imagine staples and other defensives to outperform but with everyone being so underweight in growth maybe those stocks can run too after some mild retracement.

See, jawboning works. What if Bullard is just acting, part of Fed jawboning show?

I started to think that as days drag on Putin is getting himself into a more awkward no-win situation. US/UK is turning this potential conflict into a reality show the whole world in tuning in. This might be the first conflict on real-time streaming, starring Russian soldiers. They might start to ask: ” Who the f**k is Putin? Why are we risking our lives for him?”

The first rate hike and the Ukraine conflict (whether or not an armed invasion takes place) have been priced in.

It may be time to prepare for positive surprises – eg, 25 basis points rather than 50 – to jumpstart the next rally.

My gut feeling tells me we are going to see what is priced in when the puts expire.

I’m adding somewhat more aggressively to positions in SPY/QQQ here. We may not have the sound of cannons, but I believe we’re looking at a good buy point.

Pretty dreary action. I still think we’re in the buy zone.

The time to buy is when the VIX is high. JMO.

Increasing long exposure in the after hours session. Am I worried? Of course – but it’s the kind of concern I experience at every buy point. I may in fact be wrong – but the odds of being right are high enough to risk capital here.

No way around it. If I’m going to try timing the market, there will be days when the market makes feel like an idiot. Whereas with buy-and-hold one will never be in that position.

One way to minimize the problem/avoid trying to time the exact bottom is to scale into positions as the market continues to decline – a form of dollar-cost averaging if you will. How do I differentiate that from trying to catch a falling knife? I don’t. The only way to avoid a falling knife is to buy on rallies, and that’s not my style.

What makes me so sure we’re in a buy zone? There’s no certainty in the markets, only probabilities. I rely heavily on sentiment as a gauge, and on that basis I’m fairly confident that current levels are a decent entry point. I could be (and often am) wrong. There’s nothing wrong with being wrong – if you’re never wrong then you’re not on the playing field (which is my opinion of media commentators who are never wrong).

The Market is closed on Monday. With the prospect of a war, I don’t think investors will put risk-on. Tomorrow’s close may also be in red.

So much for a possible growth stabilization. Failure to hold the 4380-4395 support area opens the way down to 4280. I see today’s action as the market signaling its willingness to finally head to the SPX 4000 area.

I’m watching for a flush to SPY 420 (and perhaps an undercut).

At this point further adds are unlikely to make much of a difference. I changed my scale-in percentages in January to smaller increments of 2% to 3% (from the higher percentages I formerly used) which has helped somewhat – but I’ve added several times and now at 35% exposure. Higher than I would want if the decline transitions into a full-fledged bear – but I think that’s an unlikely scenario.

I want to be positioned for the next rally – but not at the risk of a sizeable loss. 35% feels about right-sized at this point.

Still ahead of the SPX ytd by ~+7.5%.

There may now be a greater than 50/50 chance we close green.

The way I see it –

(a) How many traders believe in a rally? Not many.

(b) How many believe in a durable rally? Almost none.

(c) How many believe in a rally that resumes the LT bull. None.

Thus if the market is able to stage a rally (yet to be determined), traders will be quick to short/ slow to embrace, and the train will leave the station with mostly empty cars. That’s the train I want to be aboard when the time comes.