Mid-week market update: The most recent stock market downdraft was sparked by the news of a new virus variant that was initially identified in South Africa and the Fed’s hawkish pivot. As evidence emerged that Omicron is more transmissible but less deadly, the market staged an enormous rip-your-face-off short-covering rally. Today, Pfizer and BioNTech reported that lab tests showed that a third dose of its vaccine protected against the Omnicron variant. A two-dose regime was less effective but still prevents severe illness. Here we are, the S&P 500 is within 1% of its all-time high again.

Omi-what?

In the wake of the relief rally, the bulls still face the challenge presented by next week’s FOMC meeting. The risk of a hawkish Fed still looms.

Here are the short-term bull and bear cases from a chartist’s perspective.

The bull case

One positive sign from the market’s exhibition of positive price momentum is the Dow traced out a bullish island reversal pattern, which is defined by the index falling through a downside gap and then reversing through an upside gap. The measured minimum upside target is roughly its all-time high.

The Omicron/Powell downdraft saw two down days on significant volume which is indicative of strong selling pressure. It began on Black Friday, which had 90.1% of NYSE volume on the downside. It was followed on Monday with a 89.4% downside day (red down arrows). According to Lowry’s, closely spaced downside days can be ominous if not quickly negated by a 90% upside day or two consecutive 80% upside days. Fortunately for the bulls, the market flashed two 80% upside days on Monday (80.0%) and Tuesday (85%, marked by blue up arrows).

In addition, the market flashed a possible setup for a rare Zweig Breadth Thrust buy signal on December 2, 2021. A ZBT buy signal is triggered when the ZBT Indicator moves from an oversold condition to an overbought reading of 0.615 or more within 10 trading days. In all likelihood, the ZBT buy signal setup will fail. A buy signal would be unabashedly bullish for stocks, but a failure should not be interpreted in a bearish manner.

There have been six ZBT buy signals since 2004. The S&P 500 was higher in all cases after a year. The two “momentum failures” saw the market correct before prices rose. The rest continued to rally after the buy signal into further highs.

The end of the 10-day window is next Wednesday, which coincides with the announcement of the FOMC decision. Brace for possible fireworks.

The bear case

While the bulls have staged an impressive show of positive price momentum, the bears may still be able to make a goal-line stand and turn the tide. The bulls can argue that the large-cap S&P 500 and mid-cap S&P 400 have held above their breakout levels. The bears can argue that the high-beta small-cap S&P 600 is struggling below resistance after a failed breakout.

Equity risk appetite indicators are exhibiting a minor negative divergence. Keep an eye on this should these indicators deteriorate further.

As well, the risk of a hawkish Fed hasn’t disappeared. Fed Funds futures are anticipating three quarter-point rate hikes in 2022, with liftoff at the May FOMC meeting. Since the Fed has signaled that it will not raise rates until the QE taper is complete, all eyes will be on the pace of the taper and the expected pace of 2022 rate increases in the dot-plot next week.

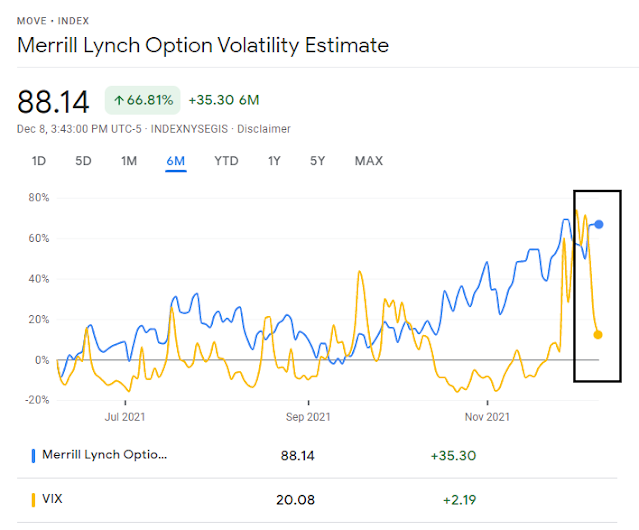

There is a severe disagreement between stock and bond market option markets. While the VIX Index has fallen dramatically as equities rallied, MOVE, which is the bond market’s VIX equivalent, has risen and remains highly elevated.

In conclusion, the S&P 500 is undergoing a high-level consolidation as it works off an overbought condition.

Much depends on the FOMC decision next week and how much tightening has been priced into the market. My inner trader remains bullish but he is becoming more cautious. Traders should properly size their positions in light of the increasing market.

Disclosure: Long SPXL

The US megacaps and especially Apple may be supported here by stock buybacks which are still running until Dec 10. Nikkei failed to recapture and closed below the 200d, Europe turned negative after an initial attempt to extend Tuesday’s rally. I think there is worry about China as several property developers are now in trouble and the Pfizer news was really trying to give a positive spin to the information that 2 doses do not seem to offer a lot of protection against Omicron. A separate study published today said that there is no protection at all against Omicron with 2 doses after 6 months. This is adding to increasing evidence that vaccine protection may be less durable and reliable than anticipated.

No protection at all? I doubt that’s going to be true. Let’s see where the numbers come in at. To me it looks promising.

As far as needing additional shots, this isn’t a surprise, is it? We have the tech to avoid the worse outcomes.

We do need to pivot to getting those who are making the “personal” choice not to help themselves to make a smarter choice. We do need to pivot towards helping those with less means to get access. These are the things that are prolonging the pain of this pandemic.

Sorry for replying so late, here is one of the studies I am referring to, it was a German study and in the news here so – it seemed to me that the Pfizer study seemed to have more media presence in the US.

https://www.medrxiv.org/content/10.1101/2021.12.07.21267432v2.article-info

Noteworthy of course that the study is only referring to antibody reaction not t-cell response. We don’t know how important the t-cell response is going to be.

Second link:

https://twitter.com/CiesekSandra/status/1468465347519041539?s=20

yeah, you need to get a booster after six months.

It also looks like another booster (after the third dose) will be necessary in order to combat Omicron. While all this is possible and we are better prepared than March 2020 the outlook is far less positive for poorer nations and even in rich countries it is not working as smooth as we had hoped for and new partial lockdowns have to be imposed.

I would also add that severity from COVID is much lower than a non-vaccinated person even after six months.

The outcome of a vaccinated patient with COVID-19, both delta and omicron, is much better than non-vaccinated patient. In the US, this can mean not dealing with a monstrous hospital bill vs mild cold symptoms.

That Omnicron needs a third dose is like saying to the people in the non-developed world who are lucky to get one, you are screwed.

That is tragic from a humanitarian and Christian bases.

If we look at this selfishly from an investment perspective, this cannot be good for long term global growth.

West, and in particular US, has been myopic and timid in their efforts outside of their borders. Biden boasts that US has provided more vaccines than all of the developed world combined. Probably right but tragic when one finds out that US has donated roughly 250 million doses!!

The situation is more nuanced. India has sufficient vaccines but has logistical challenges and distrust of the government. South Africa has vaccines but a challenge outside of urban areas. US has it’s own share of nonbelievers.

Omicron and mutations down the road will challenge our ability to return to a normal. But humans have survived and adapted with far less at their disposal. I am hopeful of a better tomorrow.

Opening positions in VT and SMH here.

Reopening a position in QQQ as it breaks below 394. This may (or may not) be the best reentry we see.

Does this thing not look like it has topped?

holding until next Wed.

Not yet 😉

I would agree with Alex1 – hold until at least next Wednesday, if not next Friday.

A rather interesting article

Xi faces the dilemma of China’s imperial rulers

https://www.ft.com/content/5c0a12f3-bc3a-4d13-b9f7-302f3f6dc59b