Risk-off came to the crypto world on the weekend as all cryptocurrencies took a sudden tumble. Bitcoin fell as much as 20%. Prices slightly recovered and steadied, but all major coins suffered significant losses.

How should investors analyze the crypto crash and what does it mean for equity investors and other risk assets.

Asset return profile

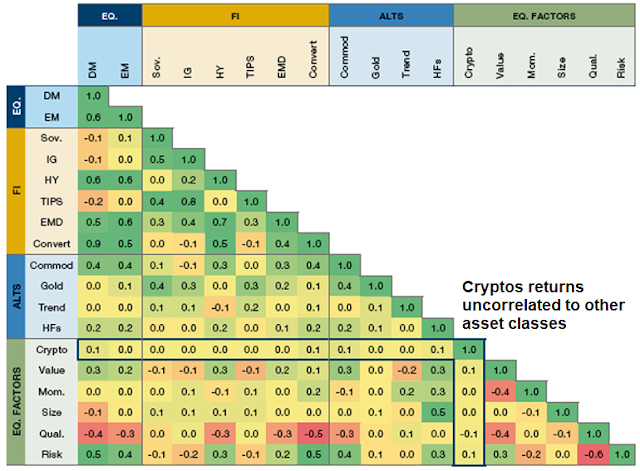

Will there be any fallout from the crypto crash? A MAN Institute study of cryptocurrency asset returns found that cryptos are uncorrelated with other asset classes.

While overall correlations are low, the researchers also found higher correlations during periods of equity drawdowns.

In the 6% of instances where the equity market sold off 5% or more over a one month period:

- The average performance of Bitcoin was -13%;

- Bitcoin registered a negative return 86% of the time

- The left tail correlation was 0.3.

Although these statistical studies are interesting, they don’t tell the entire story.

Profile of a crypto investor

To fully analyze the possible fallout of crypto volatility, it’s important to first understand the demographic profile of a crypto investor. A recent Pew Research survey found that “16% of Americans say they have ever invested in, traded or used cryptocurrency”. A closer examination found that crypto investors and traders are mostly young and male. 43% of men ages 18 to 29 are or have been crypto participants. The next largest demographic group are men ages 30 to 49.

Crypto bros ~ YOLO speculators

While they don’t exactly overlap 1 to 1, the young and male demographic is highly similar to the “get rich quick” and “you only live once” (YOLO) psychology Robinhood traders. It is therefore not surprising to see the high correlation between the price of Bitcoin as a proxy for the crypto complex and the relative performance of the ARK Innovation ETF.

Similarly, the performance of meme stocks as measured by BUZZ is also highly correlated. From a factor perspective, this is all the same trade. Investors should also distinguish between speculative growth and large-cap high-quality growth, as measured by the NASDAQ 100. Speculative growth is breaking down against both the S&P 500 and NASDAQ 100 FANG+ stocks, which are cash generative and enjoy strong competitive positions.

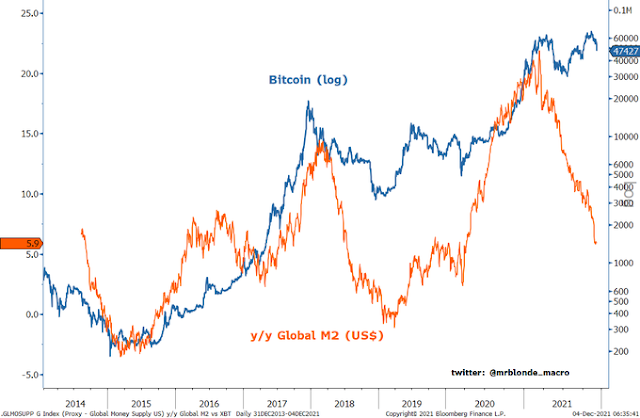

A sentiment-driven explanation of last weekend’s crypto crash is Crypto.com’s purchase of naming rights to the now “Staples Center” in Los Angeles. A macro explanation is a deceleration in global liquidity, as measured by changes in M2 money supply, which has shown a rough but uneven correlation with Bitcoin prices. The recent hawkish pivot by central bankers around the world is likely to put downward pressure on crypto assets. Add to the mix the 5x and 10x leverage available to crypto traders in offshore markets, downside volatility episodes such as the one this weekend is not a surprise. If leveraged crypto traders need to sell other assets to meet margin calls, the most correlated assets are speculative growth equities, as evidenced by the poor performance of ARKK today.

A Christmas present under the tree?

I suggested yesterday that small-cap stocks are beaten up and could see further selling pressure during the tax-loss selling season, followed by a rebound in late December and January (see In search of the next bearish catalyst). An even more speculative play for traders would be speculative growth stocks, as represented by ARKK and BUZZ, later this year. If leveraged crypto traders are forced to liquidate their stocks to meet margin calls, expect further selling pressure in the coming days, followed by a rebound soon afterward.

For small-cap investors, this means the lower quality Russell 2000 should lag the higher quality S&P 600 in the first half of December, followed by a relative relief rally.

I just discovered that somewhere along the way I became crypto bro. in the demographic and own all of the ark funds as well as crypto as my only non-boring investments. hanging in despite the recent weakness cause yolo!

These are correlates assets that are being taken to the woodshed, as Powell announces monetary tightening.

I still don’t see how value can be assigned to stuff that has no earnings, has no industrial application, isn’t pretty, isn’t backed by anything or anybody and will have to compete with ever other computer generated “coin” on the planet: Any one want to by a pet rock?

It is the insanity one finds in a bubble. Just because there is a limited amount to be produced means little other than if people want to insanely buy, the supply is limited. You can buy for 2 reasons. First because you think someone will pay you a lot more for it, or second to preserve wealth. How does it preserve wealth if some day it is no longer in favor? It’s a bit like in the Middle Ages when you could buy a plenary indulgence…yeah buy your way to heaven from your church.

I read that what caused the crash was the transfer of some 800 million from one wallet to another. So 16,000 bitcoins did that? Imagine a panic and the aggregate trying to unload 500,000? Self reinforcing panic.

As a trade I idea I suggest watching BTC and if it ever really totally wipes out, go long gold because I think BTC has distracted people from gold.

“when you could buy a plenary indulgence…yeah buy your way to heaven from your church”

Did it harm the Church or the Church went into oblivion? Let me know. Thanks.

https://www.nytimes.com/2009/02/10/nyregion/10indulgence.html

“Bishop Announces Plenary Indulgences.”

Any takers?

“According to church teaching, even after sinners are absolved in the confessional and say their Our Fathers or Hail Marys as penance, they still face punishment after death, in Purgatory, before they can enter heaven. In exchange for certain prayers, devotions or pilgrimages in special years, a Catholic can receive an indulgence, which reduces or erases that punishment instantly, with no formal ceremony or sacrament”.

Yodoc, I can and will give you a discount on the price of entry to Heaven. Anyone else intrested?

“Dioceses in the United States have responded with varying degrees of enthusiasm”.

Anyone reading this signed up? How much did you pay to get your sins absolved? Please let me know. I have a lot of sins I need to wash!

Under the rules in the “Manual of Indulgences,” published by the Vatican, confession is a prerequisite for getting an indulgence.

https://www.amazon.com/gp/product/images/1574554743/ref=dp_image_text_0?ie=UTF8&n=283155&s=books

I am not promoting Amazon.

Can I hack someone’s crypto wallet to help pay for my plenary indulgence?

The value comes from the network effect and a call option on the massive adoption of blockchain technology in real commerce. The network effect may come from yolo’ers, speculators, anarchists, etc.

It surprises me how long bitcoin have been able to exist with the false premise that it can circumvent government intervention. The early adopters certainly think they can circumvent governments but now its getting clearer that’s not possible. But during the blissful days of ignorance the idealists were energized and came up with ingenious innovations that kept the blockchain hype alive. Also, bitcoin has limited supply and it’s also somehow programmed to have its mining cost increase significantly every 4 years, iirc. The supporters then kept the price rising and hence kept fueling the crypto frenzy every 4 years. As blockchain’s potential becomes evident with time we’re now at a point where the false promise of true decentralization doesn’t really matter that much since it is now catching the attention of massive institutions. Also, there may be a perspective that real world use cases are not far away.

I’m not sure when crypto can be used for commerce ubiquitously since it has many technical challenges to solve (e.g. speed, privacy, transaction cost, etc.). I also don’t know which crypto coins will win in the end but so far the market sees bitcoin and ethereum as the proxy. So I see hodling bitcoin and ethereum as investing in a high growth startup.

“About that crypto crash…”

Cam, I am sorry but I do not understand the conclusion of your article,

What is your conclusion?

I think Cam has concluded that he was born too late to have experienced free love, and too early for YOLO 😉 He’s simply a solid and sensible upper-middle class guy who’s learned how to create wealth one trade at a time.

Lol.

Was it just a coincidence that crypto assets had a rough weekend before further stress materialized in the Chinese property sector?

These are correlated assets. Hard to prove the conjecture.

Re yesterday’s entries (AND exits) on QQQ/SMH.

Always tough when I end up forgoing 80% of potential profits. Sure, I ‘should have’ held the positions overnight – but overstaying my trades either intraday or overnight is what killed the vast majority of them recently.

That’s how the market works. Suck it up and move on.

Our approach to setbacks in trading is inseparable from our approach to setbacks in life, which is why setbacks are one of the most valuable experiences we can have. At least that’s what I teach my kids.

How many of you remember Mary Decker’s fall during the 3000 meter race at the ’84 Olympics? To her credit, she ultimately forgave Zola Budd and took responsibility for her role in what she originally described as being tripped by Budd. However, her immediate response was to be carried off the track in tears and claim she was robbed of a victory. That image has always stayed with me – helpful both as a reminder to take things in stride and also to keep things in perspective. After all, it was only one race out of a career of memorable wins for Decker – and she would have been remembered much differently today had she simply picked herself up and continued the race even for a loss.

A great deal of today’s gap up is undoubted driven by short-covering. A ton of traders must have shorted yesterday’s close.

What if there is a free way to tell if new all time highs are a bull trap and subsequent pull backs are continuations or reversals such as the last two days? Well, there is and it is free and I am not selling anything. Just go to barchart dot com and pull up their $NALC symbol which is the 52 week new lows in NASDAQ100. It is a warning when new all time highs of the index is accompanied by greater number of new lows, the divergence triggered selling. And the value of $NALC today? 0.01 which should be zero. The data only goes back to 2016 but that is good enough for these kinds of trades. The salient features are highlighted manually.

Keep an eye on $NALC next time you see a new high.

https://i.imgur.com/hceTCiB.png

That was a classic fake breakdown below 4670 support, recapture and rally. Same trick as in the last few minutes of Friday’s trading sessions. Should set us up for at least 4720-4725, would not be surprised if this strength persists until Friday as traders try to front-run the seasonally strong second half of December.

So we now have our follow-through day.

If you’re upset (as I am) at having missed one of the best upside moves of the year- my bet is that we see an attractive reentry point before the end of week. Maybe even more attractive than any entry point on Monday. That’s hard to believe right now, but I’ve seen enough crowd behavior to think it’s not only possible – it’s more than likely.

Never chase. Another opportunity lies around the next corner.

Mr. Bond is not feeling well today…