What’s wrong with value stocks? The accompanying chart shows the relative performance of the Russell 1000 Value to Russell 1000 Growth Index ratio (bottom panel, solid line) and the closely correlated S&P 600 to NASDAQ 100 (bottom panel, dotted line). When the dot-com mania peaked in 2000, value stocks initially rocketed upward relative to growth stocks. The relative ascent began to moderate in 2001 but continued for several years.

Fast forward to 2020. The growth style had been dominant for 5-7 years and value/growth relative performance had become extremely stretched. Value recovered in 2020 but fell back in 2021.

History doesn’t repeat, but is it even rhyming this time? What’s wrong with the value style?

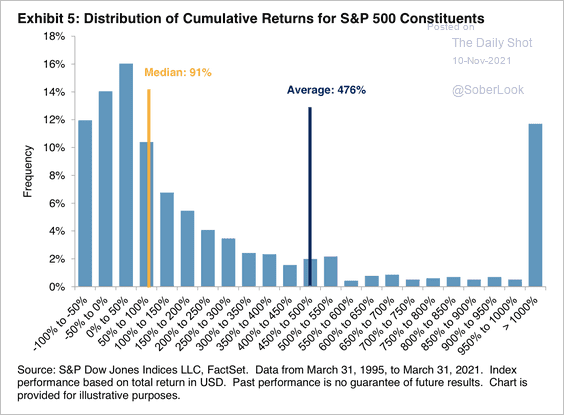

Unbalanced return profiles

First, factor returns have been distorted by the outsized performance of a handful of stocks. Analysis by S&P Global found that a small number of stocks perform extremely well and raise the average index return significantly above the median.

One prominent heavyweight that has performed well and distorted factor returns is Tesla (TSLA), which has crept into the top 10 stocks by S&P 500 index weight.

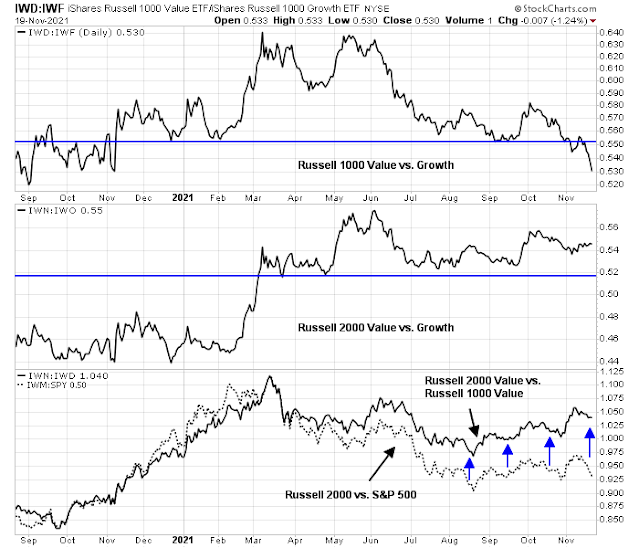

As an example of how TSLA has distorted factor return calculations, the accompanying chart shows the relative performance of the Russell 1000 Value to Russell 1000 Growth ratio (black line), which TSLA has influenced, and the relative performance of banks to software stocks (dotted red line), which has no TSLA. The two lines tracked each other well for some time, until they began to diverge.

Similarly, a comparison of the Russell 1000 Value to Growth ratio and the Russell 2000 Value to Growth ratio shows that small-cap value has performed better than large-cap value. The bottom panel shows that the size effect within value is outperforming the simple size effect as measured by the Russell 2000 to S&P 500 ratio.

While this analysis of the value/growth ratio shows that a pure value factor has performed better, its recovery remains disappointing. On the other hand, the superior performance of growth stocks is not as widespread. The relative performance of speculative growth, as measured by the relative performance of BUZZ, which are mainly meme stocks, and Cathie Wood’s ARK Innovation ETF, are flat to slightly down YTD.

Macro uncertainty

The lack of a value stock recovery can partly be explained by macro cross-currents. An analysis of the relative performance of cyclically sensitive value sectors shows that most are trading sideways this year. In particular, the relative returns of financial stocks are highly correlated to the shape of the 2s10s yield curve. As banks tend to borrow short and lend long, a steepening yield curve boosts profitability while a flattening yield curve squeezes lending margins. The same influence can be said of the other cyclically sensitive sectors. A steepening yield curve is the bond market’s signal of improving growth and a flattening yield curve indicates a growth deceleration. Since the yield curve has been flattening, value and cyclical stocks are facing macro headwinds.

The market consensus is shifting towards stagflation. Economists are downgrading their GDP forecasts while boosting their inflation forecasts. It is therefore no surprise that growth stocks are getting a second wind. When growth becomes scarce, investors gravitate toward growth stocks.

This macro consensus scenario may be short-lived. The Economic Surprise Index, which measures whether economic reports are beating or missing expectations, is rising. This should put upward pressure on bond yields. At a minimum, stronger growth should steepen the yield curve, which would benefit value stocks.

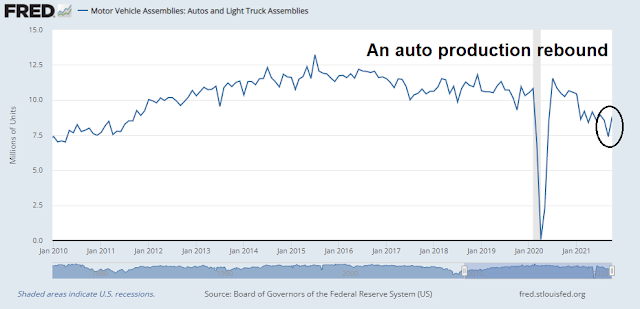

In addition, there are early signs that supply chain bottlenecks are easing. The semiconductor shortage is unwinding and auto production is showing preliminary signs of a rebound, This will alleviate some of the inflationary pressure in the coming months and lead to a reversal of the stagflation expectations.

Bull case for growth stocks

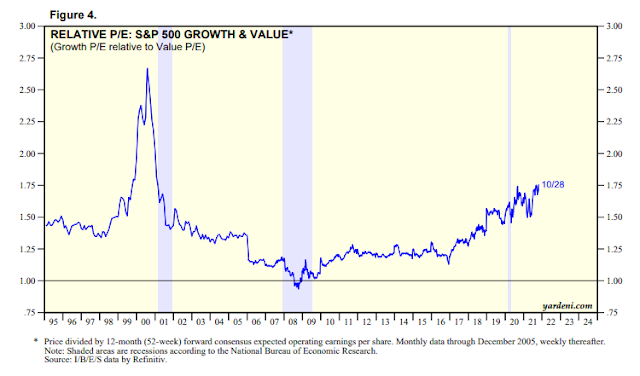

While the bull case for value stocks is based on cyclical factors, which appear to be turning up, the bull case for growth stock rests on solid secular factors. At first glance, the evaluation spread as measured by EV/sales, is at bubbly dot-com peak levels.

The relative P/E ratios, which stretched, are tamer than the EV/sales spreads suggest. That’s because large-cap growth stocks today have better margins and earnings than those of the dot-com era. The FANG+ companies tend to be cash generative and enjoy strong competitive positions.

An indirect way of observing the characteristics of large-cap growth stocks is through an ESG (Environmental, Social Governance) lens. ESG stocks have historically shown a growth tilt. That’s because it’s much easier for a growth company like Microsoft to qualifying under an ESG filter than a value company like Exxon Mobil.

Further analysis of ESG stocks reveals that they are asset-light companies which are more profitable, exhibit higher ROE and have fewer employees than the index.

Value or Growth?

In conclusion, value stocks have faced a few headwinds in 2021. Large-cap factor calculations were distorted by the strong performance of heavyweight Tesla, whose share price has risen strongly to affect factor returns. In addition, the growing belief in stagflation characterized by slowing growth and rising inflation has boosted growth stocks at the expense of the value style.

However, an analysis of stock price momentum shows that this factor has mainly trades sideways in the last six months, indicating a lack of style dominance.

I believe investors should adopt a balanced approach by holding both value and growth stocks in their portfolios. Tactically, value should start to enjoy a revival in H1 2022 as inflation expectations ease and growth expectations rise. However, there are considerable macro risks to this scenario and investors should practice risk mitigation with commitments to large-cap growth stocks.

Seeing more bears coming out of the woodwork calling for a top.

I don’t see it though.

The penultimate line should presumably refer to H1 2022, or maybe H2 2021?

Yes, H1 2022

I think our fellow readers here should be aware of the market dynamics which has, in my personal opinion, at least semi-permanently changed how market pricing works compared to in the past. Price discovery is not dead, but at least severely impaired.

The rise of options swarming has distorted the price movement of many stocks and consequently the related indices. Last week we witnessed a good example, leading into options expiry. So looking at PE and other metrics, like traditionally, when trading/investing, is increasingly ineffective.

In essence, equity spot price has become derivative of its own derivative, aka tail wagging dog. That’s way there are so many charts with BB-riding upward and waterfall drop movement. Once starts, with algo trading, it will go much longer than usual. Same as higher occurrences of gap ups and downs.

Knowing this fact then we can take advantage of the movement and dramatically increase the profit in much shorter time frame. Now matter how absurd the price is detached from fundamentals never bet against the swarming options traders, e.g. case of TSLA. Next target should be NVDA. With metaverse mania it could go years. Praise the Lord: time compression.

Interesting observation. thanks calling it out.

Would you mind elaborate on the logic and impact on price movements from the rise of swarming options traders (are they mainly instos?)

Logic is quite simple. The usual targets are heavily shorted names. All you need is a bunch of small call options to ramp up the spot price due to dealer hedging. Note that dealers also benefit from continuous price rising. As it goes on it will attract more call options buying, and short covering will accelerate the price movement. On and on. Look at TSLA as an example.

It is also not limited to heavily shorted names. It has evolved to include meme and concept stocks and future-trend stocks. As for who are the players, small retail traders (e.g. redditers) started the trend big-time last year and now it probably attracts all types of market participants. The money is so big now nobody can afford to ignore it. Fundamentals be damned.

This is the main reason the indices will rise a lot more than most folks expect. Be flexible. The world is your oyster.