Mid-week market update: Is market psychology cautious enough? A recent Deutsche Bank survey of investors reveals that not only is a correction the consensus, correction sentiment rose between September and October.

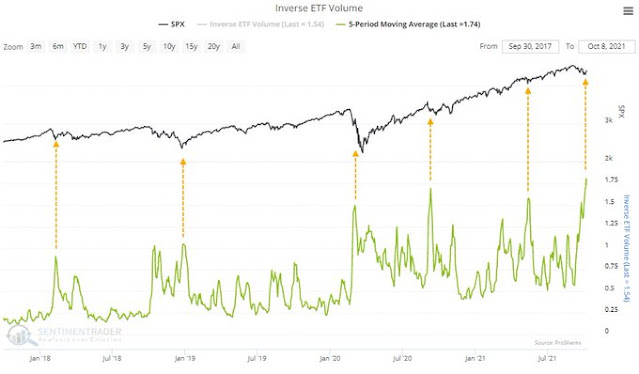

SentimenTrader also observed that inverse ETF volume has spike to a record level. Is this cautious enough for you?

Supportive internals

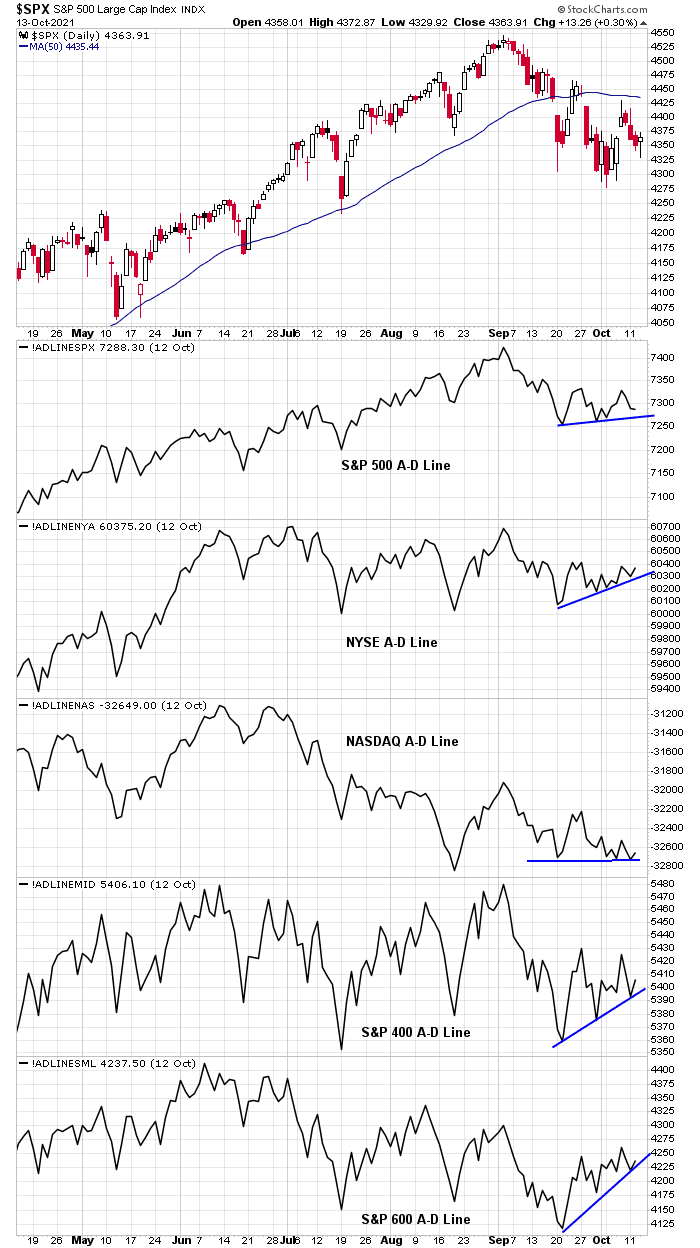

The analysis of market internals reveals a number of supportive elements. A survey of Advance-Decline Lines show that all flavors except for the NASDAQ are exhibiting minor uptrends. The NASDAQ A-D Line is testing support, which is consistent with the recent lagging nature of large-cap growth stocks.

High beta small-cap stocks are also outperforming, which is another indication of improving equity risk appetite.

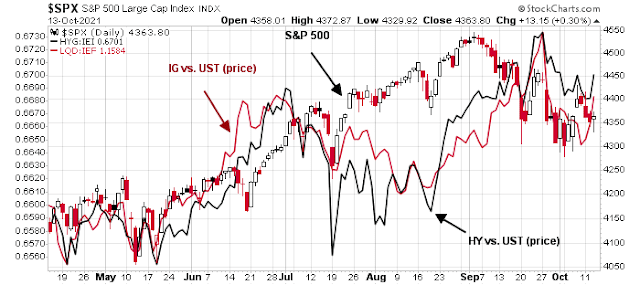

Credit market risk appetite, as measured by the relative price performance of junk and investment grade bonds relative to their duration-equivalent Treasury benchmarks, are showing minor positive divergences.

In addition, SentimenTrader pointed out that there is extreme pessimism in the IG market.

In conclusion, market sentiment and internals have risk/reward tilted to the upside. At a minimum, don’t be short.

Disclosure: Long SPXL

Also looking at the SP-500 it appears that we have put in a higher low at 4330 vs the previous low at 4280 which is quite positive.

Another data point from SentimenTrader, as of 10/12:

The aggregated put/call ratio among Nasdaq 100 members is the highest it’s been in over a year.

Trimming positions into premarket optimism->SPY/ QQQ/ IWM/ DIA. Hoping to reload on intraday weakness.

All positions off here. The gains are good enough versus my expectations at this point.

If you’re a ST trader, another reason to lock in a few profits today can be found in the Quantifiable Edges table – October Opex is bullish, but historically the highest weekly gains are seen on Day 4 (ie, the Thursday prior to Opex).

Take into account that DIX was above 45 yesterday – very positive signal for next 30 days. Moreover seasonality is another positive factor till year end.

Left a significant amount of gains on the table for sure.

We’re never going to catch 100% of any move. I did manage to book most of my gains on FXI/ ASHR/ EEM/ BABA/ NIO/ QS before they started slipping away this morning.

In some ways it works better for me if I simply focus on my P/L and forget about the +/- from each individual trade.

It was a +1.4% two-day gain, which equates to 14 days of my day-trading target.

Brilliant call by Cam to stay bullish here, no way around that. Goldman now says lower jobless claims and decelerating PPI is the opposite of stagflation. Still want to see consumer inflation expectations and retail sales tomorrow, but it seems the stagflation fears may have gotten ahead of themselves.

S&P futures gapped up to 4450 in early European trading, taking another short here. US stocks closed at a short-term overbought reading and bonds hit resistance. Thermal coal futures in China limit up again.

YoY as of today:

Thermal coal (China) +158%

Steel +153%

Natural gas +152%

WTI Crude +97%

Aluminium +73%

Coffee +65%

Cotton +59%

Copper + 48%

Zinc +43%

Corn +30%

Wheat +16%

If commodities are performing well, why are emerging markets stocks performing badly?

Closing positions in the premarket session on Thursday was obviously a mistake on my part.

I’ll have to adapt and move on. Not sure what my next move will be.

One thing I always look for (from a psychological perspective) is any silver lining to a mistake – apart from all the usual ‘lessons learned’ stuff that really does little to restore my edge in the immediate aftermath. In this case, it was a 50% allocation to China and emerging markets on Wednesday morning both premarket and in the opening minutes. While the US indexes sold off hard and recovered to finish flat on Wednesday, the international positions closed up ~+2% and allowed my portfolio to post a +1% gain for the day. So diversification (unexpectedly) allowed me to stay abreast of the markets despite exiting early on Thursday.

Cam nailed the launch. I’ll need to find a way to reboard.

Taking a swing at BABA here.

Out of BABA.

No point chasing the market today. My expectation is that we’ll see a good entry point next week.