- Ultimate market timing model: Buy equities

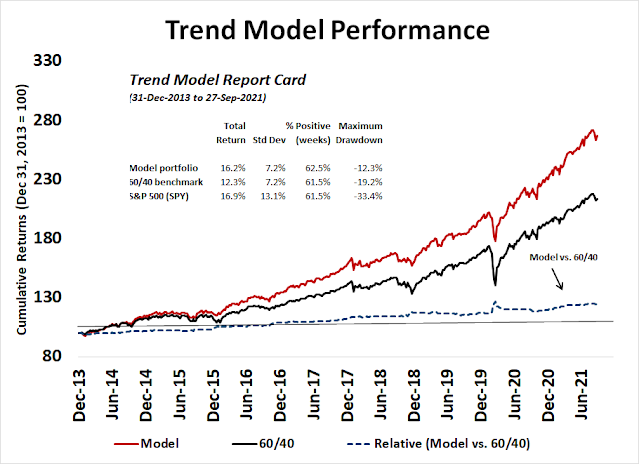

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The 2011 template

The market action today is somewhat reminiscent of 2011. Then, the macro backdrop was characterized by a debt ceiling impasse in Washington and a Greek Crisis in Europe that threatened the very existence of the eurozone. I can remember endless European summits and plans to make plans for Greece. The news flow worsened and it seemed like no one was in charge in Europe, but the S&P 500 tested support multiple times while exhibiting a series of positive RSI divergences. The logjam was finally broken when the ECB stepped in and announced its LTRO program. Stocks bottomed and never looked back.

History doesn’t repeat itself, but rhymes. Today, the market has been beset by a debt ceiling impasse in Washington and concerns over inflationary pressures which may or may not be transitory from supply chain bottlenecks. The logjam appears to have been temporarily broken when the Democrats and Republicans agreed to kick the can down the road and revisit the debt ceiling question in December. Stock prices duly staged a relief rally.

Does 2011 rhyme with 2021?

Supportive sentiment

Sentiment models have been signaling a market bottom. The latest readings from Investors Intelligence showed that bullish sentiment has tanked, which is an indication of capitulation. The S&P 500 has only weakened by only -5% and this level of panic is unusual for such a shallow pullback.

Even as the market began to rally, the CBOE put/call ratio remained elevated and above 1, which is an indication of fear. I interpret this to mean that the market is climbing the proverbial Wall of Worry.

Growing signs of transitory inflation

In addition, inflation fears may be at a zenith. The latest global PMI report shows that delivery delays may have peaked, indicating an easing of supply chain bottlenecks.

This is confirmed by reports that the semiconductor shortage problem is peaking.

The IMF forecasts headline inflation in advanced economies will peak soon and fall to an average of 2%. As the Fed prepares to begin tapering its QE purchases, tamer inflation readings should alleviate the pressure to tighten. In addition, the resignation of Rosengren of the Boston Fed and Kaplan of the Dallas Fed will lower the number of hawks at the FOMC table.

Nevertheless, I believe the Fed taper is on track at the next FOMC meeting despite the wide headline miss in the September Jobs Report. As a reminder, here is how Powell set the bar for a taper at last FOMC press conference:

So, you know, for me, it wouldn’t take a knockout, great, super strong employment report. It would take a reasonably good employment report for me to feel like that test is met. And others on the Committee, many on the Committee feel that the test is already met. Others want to see more progress. And, you know, we’ll work it out as we go. But I would say that, in my own thinking, the test is all but met. So, I don’t personally need to see a very strong employment report, but I’d like it to see a decent employment report,

Even though the September NFP missed at 194K compared to expectations of 500K, most of the miss was attributable to government job losses, specifically in education owing to unusual seasonal adjustments. August NFP was revised upward. Private employment, as measured by ADP, was strong. So were average hourly earnings and average weekly hours. Ex-government employment and the unusual education seasonal adjustments, the September figure qualifies as a “decent employment report” by Powell’s standards. The Fed will regard the headline report as an anomaly and stay the course on its taper plans.

Supportive valuation

As well, the equity risk premium (ERP) estimate from NYU Stern School professor of finance

Aswath Damodaran rose to 4.93% at the end of September.

This ERP reading is roughly equal to the level on October 1, 2017.

A rocket on the launch pad

I interpret these conditions as a rocket on the launch pad. While the engineers may have ignited the engines, takeoff hasn’t been confirmed but the meltup scenario remains in play (see

A Q4 meltup ahead?).

Here is what I would like to see to sound the all-clear signal. First, the S&P 500 needs to convincingly reclaim the 50 dma level of 4438. The small-cap Russell 2000 and S&P 600 need to stage upside breakout from their trading ranges. The upside breakouts should preferably be accompanied by small-cap outperformance.

Finally, I would like to see the growth cyclical semiconductor industry to stage an upside breakout relative to the S&P 500 (bottom panel), which would be a signal of a revival in reflationary market expectations.

Options expire in the coming week. Historically, October OpEx has been one of the most bullish OpEx weeks of the year.

In the very short term, the S&P 500 is recycling off an overbought extreme and it could weaken early in the week. Traders should regard any pullback as a buying opportunity.

In conclusion, the US equity market appears poised for a strong rally into year-end. While last week’s relief rally in the wake of a temporary debt ceiling deal is constructive, I am waiting for further confirmation of technical strength before calling an all-clear signal.

Disclosure: Long SPXL

Rising energy prices are causing economic stress, especially in Europe and Japan. We may need to see them fall to solidly kick off the usual yearend rally.

Cam, do you think the international agreement reached last week, to tax multi-national companies will have a negative effect this week? 15% doesn’t seem large.

Both oil and nat gas are at strong resist …or should be…nat gas is at the high of 2014 with a small rsi divergence, while oil is at what was support in 2010 to 2014 or so, which gave way when prices plunged going into 2015/16 but then was a high in 2018, so it is not unreasonable to expect a pullback, or maybe it just keeps ripping up. Volatility! Oil prices went so low last year and spiked so hard this year. It’s not because there is no oil left in the ground. This is the problem with volatility, you never know how far things can go, but this may be why a meltup is possible.

I think there is a structural change in the energy sector. Clean and renewables are the focus of the policy and investments. Companies are focusing on profitability rather than assets. Supply destruction in fossils will continue apace. Increase in clean infrastructure and storage will be somewhat chaotic.

I think that during this decade, both fossils and clean energy can provide good returns, short term volatility notwithstanding.

15% isn’t large but it will affect Big Tech and Pharma the most. If anything it will exacerbate the value-growth rotation that you have been observing.

Let’s see if the US signs on. Not holding my breath here.

Unless this is a tax rev sharing, nobody will actually follow the agreement. It is a nonstarter. Moreover what country will be willingly relinquishing its taxing sovereignty? How is it going to be enforced? Is there going to be a super-agency with taxing authority globally? Even more powerful than IMF and WB? A first step toward global government? It is a legitimate concern it will be hijacked by globalist elites to advance their agenda. US should be more concerned with the rampant corruption and waste it currently faces.

It is an agreement in principle that has a long road to hoe. Without a detailed agreement on revenue sharing, implementation, enforcement etc., it is unlikely to get Senate approval. In the meantime, Euro Zone will happily fine and collect money from global tech companies on antitrust, privacy, and god knows what charges. That should aggravate Americans but not likely to happen in the current administration.

Scaling into SPY ~436. Going with Cam’s call. Will size up as the trade unfolds.

Opening FXI/ EEM/ ASHR on intraday pullbacks.

Overnight decline in ES to 4317 represents ~ a -100-point pullback from Monday’s high in the SPX. That’s a sizable move which has hopefully reset sentiment to a significantly negative level.

Added to SPY/ ASHR premarket.

Opened starters in QQQ/ IWM/ DIA/ PLTR/ NIO/ QS.

Added a little BABA on the opening drop.

Here’s hoping the dreary action on Tuesday sets up a liftoff today.

International stocks (China in particular) and technology holding up well on inflation news. So the numbers were likely already priced in.

The other thought that occurs to me – the market will always do its best to dissuade traders from boarding prior to a run-up. That may be what we’re seeing right now.

Dislodge and/or dissuade. Mission accomplished.