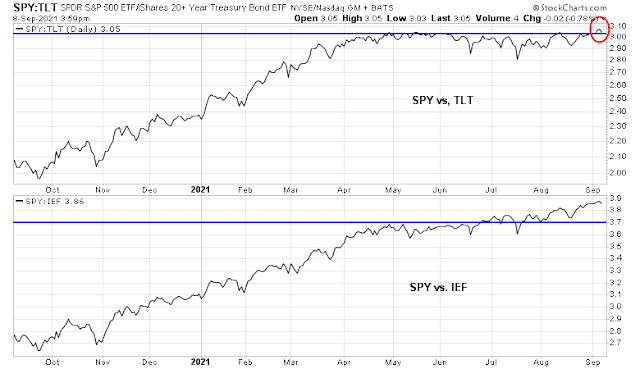

Mid-week market update: There have been two breakouts that may be of significance. The first is an upside breakout of the SPY/TLT ratio. The ratio is pulling back to test its breakout. The SPY/IEF already staged a convincing breakout in late June.

The second and more obvious breakout is an upside breakout by the 10-year Treasury yield against a falling trend line.

Here are my interpretations of these events.

Risk-on?

The SPY/TLT upside breakout should be a risk-on signal. While I am keeping an open mind, I am a little skeptical of this signal.

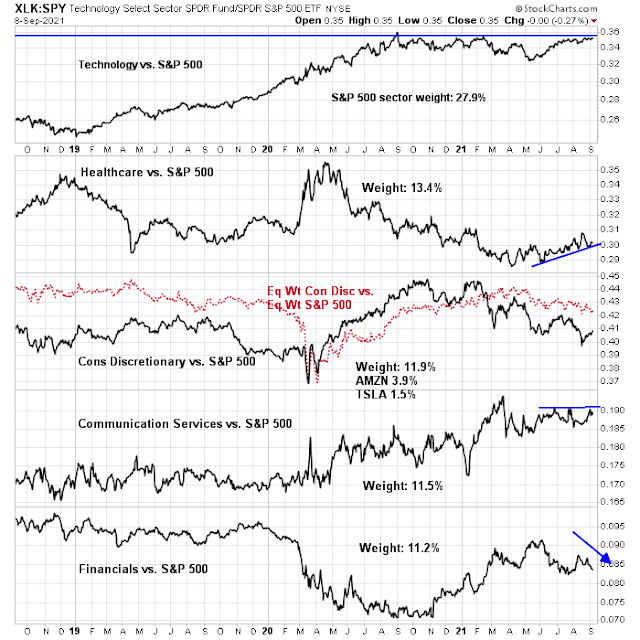

A review of the relative performance of the top five sectors is uninspiring. The top five sectors comprise about three-quarters of the weight of the S&P 500 and it would be difficult for the market to advance or decline without the participation of a majority. Technology, which is the largest sector, is trading sideways relative to the S&P 500 and has unsuccessfully tested a key relative resistance level. Healthcare is in a minor relative uptrend, but all of the others are either flat or falling relative to the S&P 500.

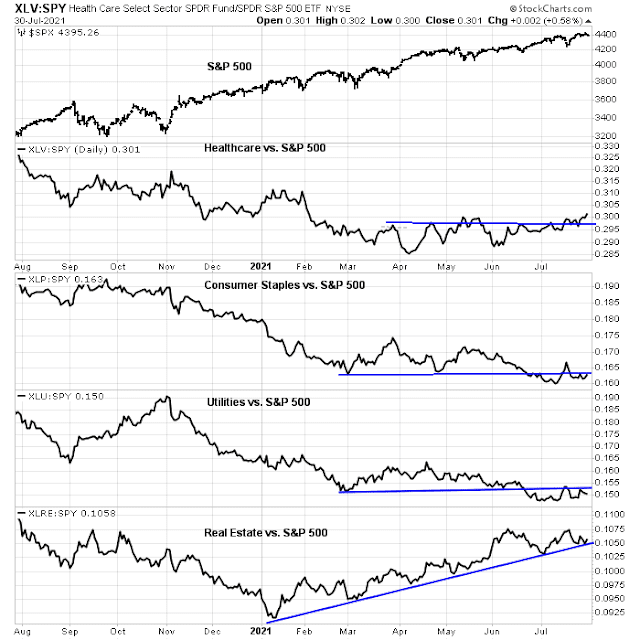

The relative performance of defensive sectors is not showing a bearish bias either. I have already highlighted the relative uptrend of healthcare, but consumer staples and utilities have not staged upside relative breakouts. Real estate had been in a relative uptrend, but the sector violated a relative uptrend and it is now consolidating sideways.

Neither the bulls nor the bears have seized control of the tape.

Rising yields

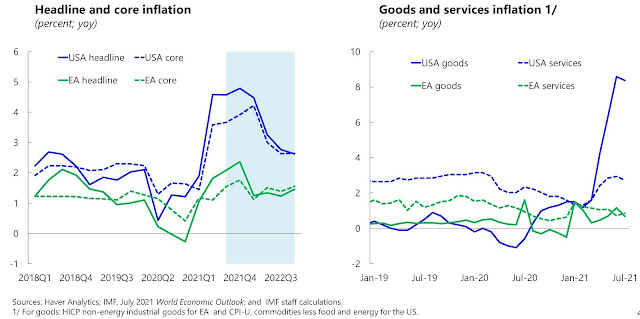

The more significant upside breakout may be the action by the 10-year Treasury yield. IMF chief economist Gita Gopinath recently discussed the IMF’s forecast of “transitory inflation”, which she defined as quarters and not months.

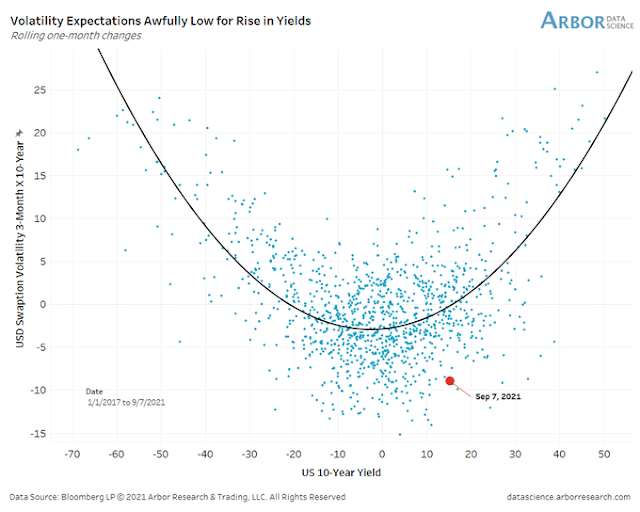

While the current uptick in the 10-year yield has been relatively minor, a prolonged period of elevated inflation readings has the potential to spook the bond market. Historically, changes in yield has corresponded to rising market volatility.

Subscribers received an email alert that my inner trader had exited his long position in the S&P 500. While I am not bearish, the environment is turning less friendly for the bulls. My base case scenario calls for a sideways market marked by increasing volatility in the coming weeks.

Breadth is fading out – beware.

We may finally have a decent correction that sticks. Of course, since I’m not the only trader who feels that way it’s less likely to happen.

I’m not smart enough to try predicting when or where the pullback ends so will be relying on sentiment as a guidepost.

A Goldman note from 1981:

Since 1975, stocks have advanced an average of 17.5 per cent per year while bonds have declined 1.0 per cent annually; in no other five-year holding period since 1960 has the spread been this large. Furthermore, except for the three-year period 1978-1980, bond returns (since 1926) have never been negative for three consecutive years. The end result of this disparity has been a dramatic shrinkage in the equity risk premium, which is estimated (on March month-end prices) at 0.7 per cent based on 13.5 per cent bond rates and negative 0.5 per cent based on the current 14.75 per cent.

One reason for the present absence of an equity risk premium is the increased absolute and relative volatility of bond returns. And investors appear to believe that this will continue-after all, this is what is implied by equity prices. And if this is so, then investors are really suggesting that inflation will continue to be high, rising, averaging above consensus expectations, and volatile, as it has for the last five years.

In other words, in times of “uncertain” inflation, the equity risk premium may shrink and even go negative. For stocks to be more attractive than bonds during periods of inflation, it is not necessary that stocks be perfect inflation hedges. All that is required is that stocks be better inflation hedges than bonds.

Jan, it is also important to own inflation-loving companies not inflation-hating ones. In the 16 years from 1966 to 1982, the inflation take-off period, the DJII started at 1000 and ended at 1000 and never went higher (low was about 700 in 1974. The Canadian (inflation loving) Index quintupled, yes up five-fold in the same period. I was a rookie stock broker in oil-country Alberta Canada then and I can say we had a party that made the Dot.com era look tame. BTW the subsequent oil commodity bust was just as bad as the Dot.com bust 🙁

Gosh, I remember Dome Pete, was around 90 bucks a share, my beef was no dividend so I never bought it. I think it went bust…so smiling Jim Gallagher may have stopped smiling. Ah the good old days when Massey Ferguson had an 8% dividend….pension funds in those days had an easier time.

Hanging on to CCJ, the uranium spot market is tiny, I wonder if they can corner it and drive the spot price crazy..we are in crazy times…why not in my favor?

Smiling Jack

there seems to be lack of love for oil & gas names in Alberta, which will be flushed with free cashflows (after both annual expenses and capex)

Contrarian bullish to me.

The inflation loving sectors tend to have these wild swings that can shake investors out. For now I could only convince myself to hold some Japanese aluminium stocks, but aluminium in general looks attractive with production likely being limited due to high energy consumption. Cement producers may equally benefit from the physical constraints that the world is imposing on us. No matter what kind of position one has on climate change and the political consequences that follow, I encourage investors to read the latest IPCC report just to get an idea on what kind of projections are out there. At least until the US-midterm elections there is a high likelihood that the world continues to agree on reducing CO2 emissions and we are now entering the time when these things are really starting to get implemented. It has already started in a meaningful way with China reducing steel and aluminium output. A ceiling on CO2 emissions may turn out to be the physical (and/or political) limit that the world encounters that will be limiting supply of those materials.

What about other resource countries like Australia, Chile, Colombia, EMs in general? They all do well when inflation is up and $ down.

Usually inflation is bad for the market, just like deflation. I guess in the past, if there was inflation, they raised rates…not sure they will do that now, but if they don’t most likely things will break anyways. For now credit is loose so things should go up….”should”. There is no way this ends well, only when? Could be years.

In terms of sentiment, what am I looking for? It’s one of those ‘I’ll know it when I see it’ type decisions. Fear and greed in the twenties might be a target.

No one believes a bear market is around the corner. My take on that? Disbelief in the markets often leads to higher odds of any given outcome – a demonstration of market perversity.

Opening a few positions as we exit contra-hour.

VTV/ FXI/ EEM/ EWZ/ XLE/ XLE/ KRE/ GDX/ KWEB/ JETS/ XLI.

It feels like we got a decent flush this week, which should be supportive of a bounce.

Taking losses on all positions here. I wasn’t expecting the selloff to accelerate into the close – so basically my premise was wrong.

Fear and greed has ticked down -8 points relative to yesterday’s close. That’s a good start. I’ll revisit the possibility of reopening positions in the hole on Monday.

Still longer-term bearish, but I will be gaming snapbacks as best I can.