When Trump began his trade war with China, the Street’s narrative was “decoupling”. It took a few years, but it’s finally happened. As China’s economic outlook and market deteriorated, it did not drag down the economies of Europe and North America.

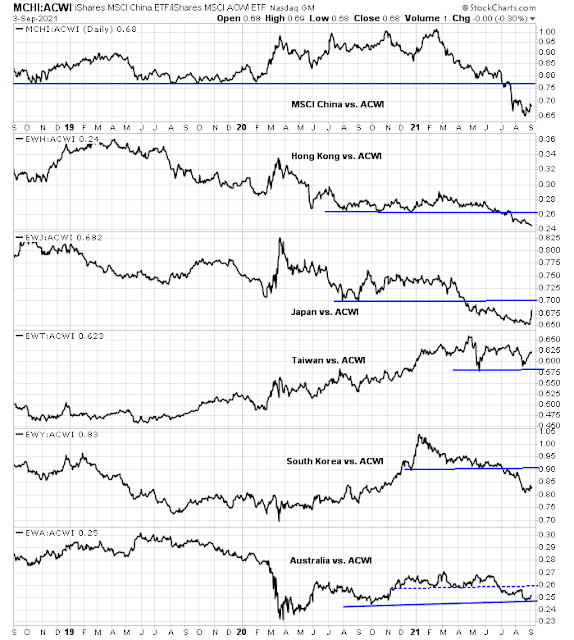

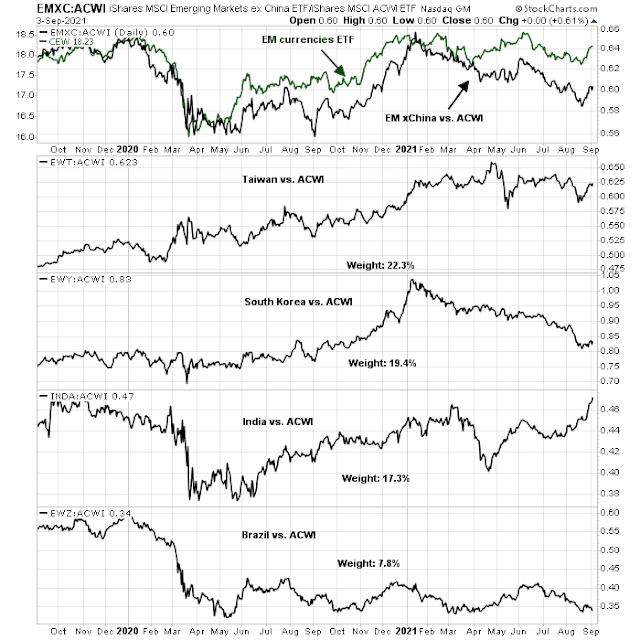

To be sure, the news out of China is grim. A series of “common prosperity” crackdowns, financial restructuring, and a slowing economy have combined to tank Asia’s stock markets. The relative performance of the markets of China and her major Asian trading partners against the MSCI All-Country World Index (ACWI) has been weak. With the exception of Taiwan, all have broken key relative support levels indicating relative underperformance against global equities.

The good news is other developed markets have held their ground. That’s what decoupling looks like.

Zhejiang is an ideal test case because it is the home of Alibaba and one of the most prosperous provinces in China.

The central coastal area is home to Alibaba Group Holding Ltd. and Zhejiang Geely Holding Group Co., among others. Four of the 10 richest people in China have based their businesses in the capital city of Hangzhou. The private sector accounts for 66% of provincial gross domestic product, compared with around 60% nationally.

The objective of the plan is to address income inequality, but not through a Europe-style redistribution, but growth.

The Zhejiang plan suggests Beijing wants to raise incomes through private sector investment in poorer areas, and to encourage rural residents to start their own businesses. Radical wealth redistribution, or a European-style welfare state funded by strong taxes, isn’t in the cards.

Bloomberg outlined the goals of the plan.

- Rapid Bottom-up Growth: “Zhejiang’s top official Yuan Jiajun has described economic growth as the ‘cornerstone’ of common prosperity, and a growing economy makes it easier to reduce inequalities without causing conflict.”

- Cooling Housing Prices: “Rising housing costs have been a source of discontent across China since the country created a commercial market two decades ago. Zhejiang, where real estate prices grew at an average annual rate of about 6% over the last decade, doesn’t want to see homes get any more expensive.”

- Rural Development: “The Zhejiang plan calls for support of existing rural service businesses as well as the return of manufacturing.”

- Strengthen Education: “Zhejiang will spend more on healthcare and education in order to strengthen the workforce…With healthy, qualified workers, there should be no need for state welfare, officials say. China can’t afford ‘to feed the lazy,’ Han Wenxiu, a senior official in the party’s top economic affairs committee told reporters last week, describing ‘welfarism’ as a ‘trap.'”

- Charitable Giving: “The plan also calls for wealthy entrepreneurs to donate more of their wealth to society. Zhejiang is home to at least 10 multi-billionaires, according to data collected by Bloomberg, with a combined net worth of $236 billion.”

The “common prosperity” measures have targeted a series of industries that have shocked the markets, such as for-profit education, technology through data privacy edicts, and gaming by restricting the ability of teenagers to play online games. The list goes on and investors are uncertain as to what will happen next.

In addition, the Huarong Affair made market participants reassess what constitutes a “too big to fail” enterprise. For the uninitiated, China Huarong Asset Management Co. was one of China’s “bad banks” designed to clean up the banking losses from the Asian Crisis. Instead, Huarong reported a $15.9 billion loss through mismanagement of assets by its chairman, Lai Xiaomin, who was convicted of corruption and executed in January. After months of bureaucratic infighting, CITIC announced that it would rescue Huarong with an equity injection.

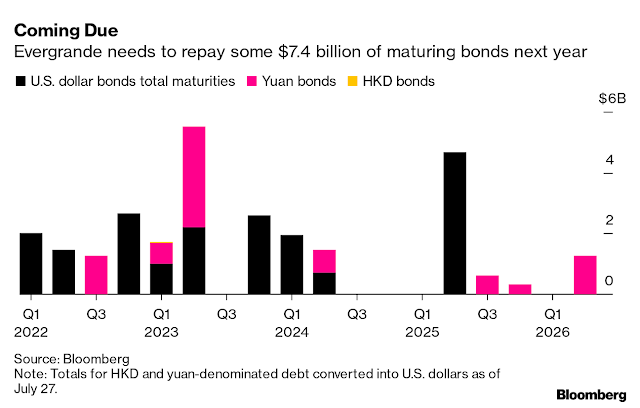

The Huarong bailout sparked uncomfortable questions about what constituted a safe credit in light of the company being a SOE created by the Ministry of Finance. The elephant in the room is China Evergrande, a private company controlled by billionaire Hui Ka Yan. Evergrande is a highly levered property developer with $300 billion in liabilities to banks, suppliers and homebuyers in an industry is in the crosshairs of the “common prosperity” initiative to control real estate prices. Evergrande is now forced to fire-sale its assets, possibly at large discounts, in order to lighten its debt load. The combination of the Huarong and Evergrande troubles had the potential to spark a Chinese Lehman Crisis.

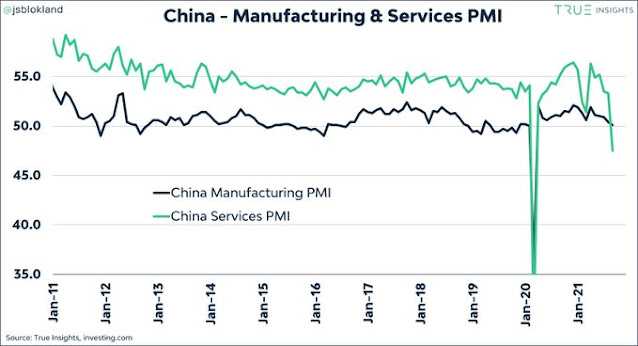

In addition, the economy is slowing. The latest release shows that both Manufacturing and Services PMIs have fallen below 50, which indicates contraction.

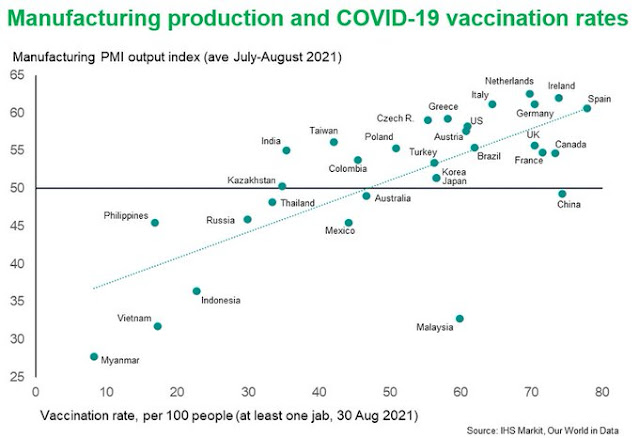

Slowing Chinese growth has dragged down most of her Asian trading partners. It also doesn’t help that most of Asia suffer from low vaccination rates, which has been a drag on PMI readings.

European decoupling

In a globalized economy, one would think that a teetering China would throw a scare into global financial markets and become a drag on the economic growth of other trade blocs. That doesn’t seem to be the case.

Consider Europe. The demand for workers has recovered to pre-pandemic levels for most eurozone countries.

Bloomberg reported that the European banking system is awash with liquidity in a highly unusual way.

The Targeted Longer Term Refinancing Operations currently provide more than 2.2 trillion euros of cash to the region’s banks. Demand at the regular Longer Term Liquidity Operations, which provide money for three months has completely evaporated, with the July 1 scheme only attracting 3 million euros from one bidder.

Even more unusually, banks are so flush with liquidity, they are now giving the ECB cash as collateral for the loans they receive. Yes, you read that correctly. Banks have borrowed money from the ECB — and given the ECB the money back as collateral for the loan.

We can see this in data provided by the weekly financial statement, which has a line item called “deposits related to margin calls.” In any other time, an increase in this line item would be a sign of severe stress, as it would mean the collateral banks had posted with the ECB to secure their lending had fallen so much in value, the ECB has made a margin call — think Greek sovereign bonds circa 2011.

In many ways, the COVID Crisis is over in Europe.

Don’t bet against America

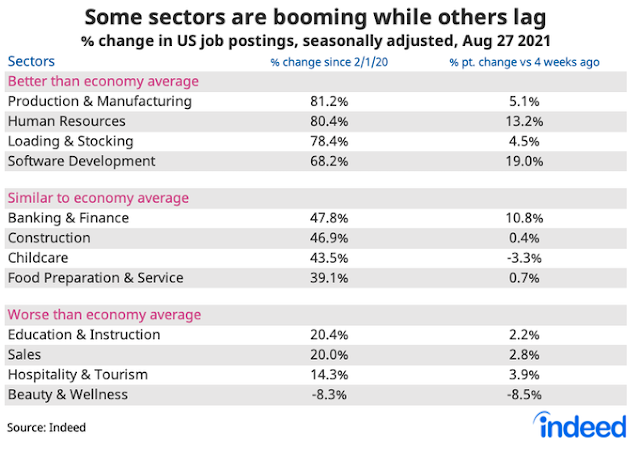

Across the Atlantic, the economy is showing signs that it is shifting gears from recovery to mid-cycle expansion. Indeed reported that job posting growth is shifting from low-wage reopening jobs to higher-paid manufacturing and software development positions.

Indeed’s readings are consistent with the disappointing August Jobs Report, which showed continued job gains in manufacturing and softness in retail and leisure and hospitality. Another silver lining in the Jobs Report was an increase in the prime age employment to population ratio, which is another sign of labor market healing.

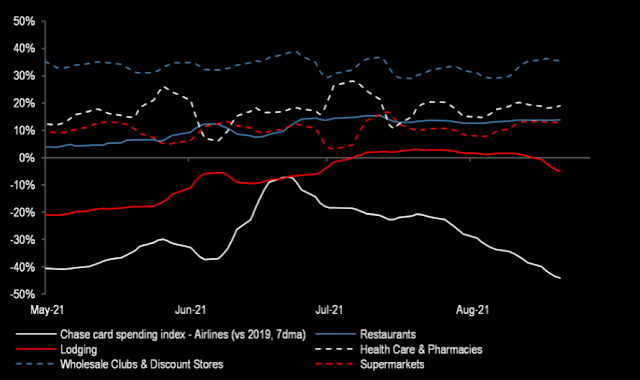

The latest Chase card spending data shows that recent softness is concentrated in travel-related services, but the other components are holding up well. Travel should recover once the effects of the Delta variant begin to dissipate. Already, new case counts are topping out. Don’t bet against the American consumer.

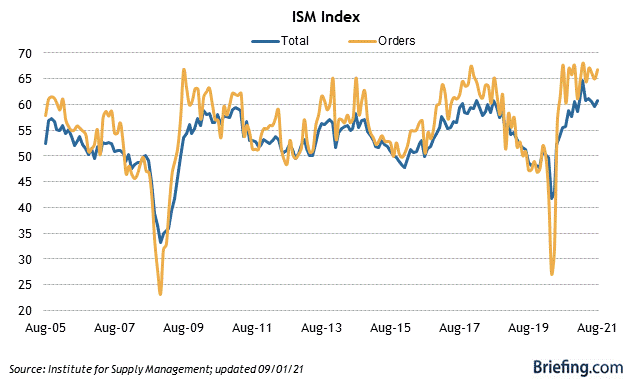

The latest ISM print shows that manufacturing is strong.

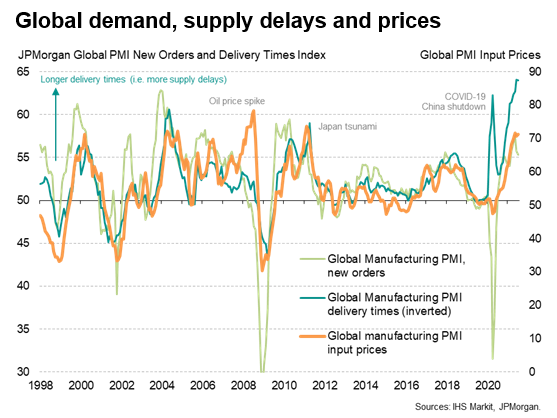

From a global perspective, global demand and manufacturing are strong, but supply chain bottlenecks are creating delivery problems that will temporarily spark inflation pressures.

The market’s message

Putting all together, market-based signals paint a picture of China decoupling and global recovery.

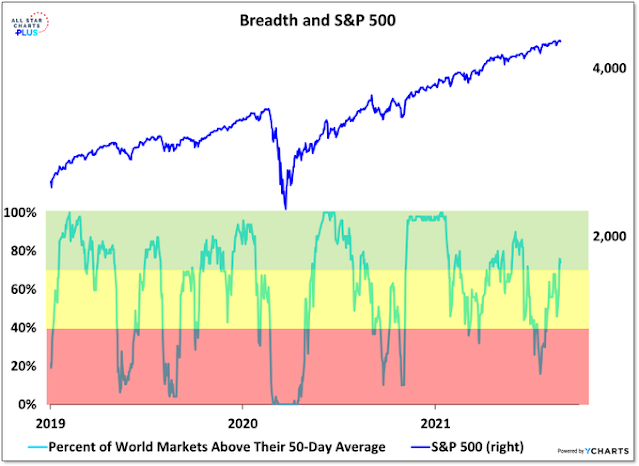

Willie Delwiche pointed out that three-quarters of ACWI markets have recovered to above their 50-day moving averages despite China’s obvious difficulties.

The MSCI Emerging Markets Index is suffering because of the one-third weight of China. However, the EM xChina Index is recovering in performance relative to ACWI even though the top two weights in the index are in PacRim Asia.

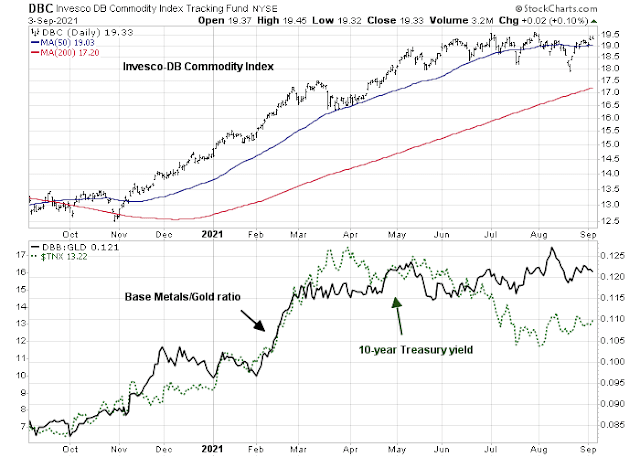

Commodity prices have held up. As well, the cyclically sensitive base metals/gold ratio has been trading sideways. In light of China’s voracious appetite for most commodities, this is another indication that the rest of the world is shrugging off China’s slowing growth.

This is what China decoupling looks like. This is what a global recovery looks like.

Sounds like Xi is drawing inspiration from his adolescence- he would have come of age during the Cultural Revolution. It’s not unusual for those of us in our sixties to revisit memories and/or reacquaint ourselves with friends from an earlier era when dreams were big and we felt invincible. Xi is now in a position to realize a few of those ambitions.

It’s actually a great time for someone who is able to foresee/accurately predict the fallout from ‘common prosperity’ to lay the groundwork for a new business in (or with) China.

The most astute business people are often found not in business schools (where MBAs are now a dime a dozen), but in language classes. I spent one summer and one winter fulfilling my language requirement at Michigan by completing two semesters of intensive beginning Chinese. I had a major advantage, having grown up speaking Mandarin with parents from Beijing and Shanghai- so obviously l didn’t need to spend much time studying outside of class. That afforded me the time/opportunity to tutor and interact with some of the sharpest classmates I’ve had the privilege to meet. The ability to speak and write Chinese undoubtedly enabled them to create their own jobs/write their own tickets in any of the torrent of US-China ventures that followed over the next several decades.

Teaching English via Zoom to the next generation of entrepreneurs from China might pay off well. It was a great side job in the Eighties and Nineties for ex-pats in Taiwan- whereas Zoom classes can be conducted anywhere/anytime.

Mr. Lai has 100 mistresses. Each one of them has a house provided by Lai. Each woman has her own kids. All of these 100 houses are located in the same subdivision developed by Lai’s friends. It is handy for Lai to visit his extended families. He just has to get to the subdivision and goes thru all 100 houses. It is energizing to see all your kids at the same time. I would like to know Mr. Lai’s secret to satisfy all of the women’s needs. It does not have to at the same time.

I would like to see Zhejiang Province make some progress in those bullet items. So we can have counter-arguments here against rampant welfarism and wokeism in the Western counties.

The following three numbers are from classified intelligence reports from Japan , Russia, and CCP respectively about China’s real population: 800-850M, 800-850M, 850-900MM. One professor from Peking Univ has his own research by visiting extensively grave sites across China, and with some statistical adjustments gets to the number around 850MM.

Absolute power corrupts absolutely.

Most religions have it right. We can’t take worldly wealth with us, so focus on the things that will have meaning in the next life: treating people right, forgiveness, and loyalty.

China decoupling (in this case) is a ‘bad’ case where the rest of the world market advances.

t?

Also, what does it mean for investing in Chinese tech BABA, Tencent, etc?

If CCP wants a co to be big, it will be big. Vice versa.