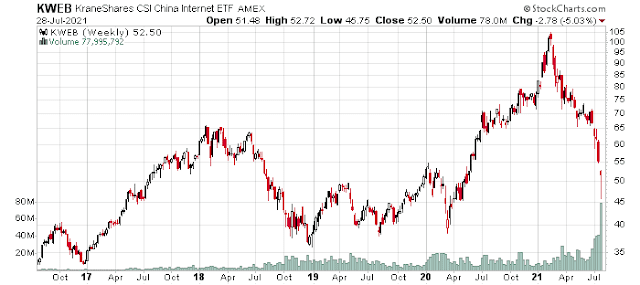

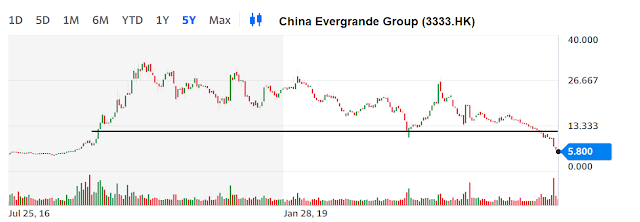

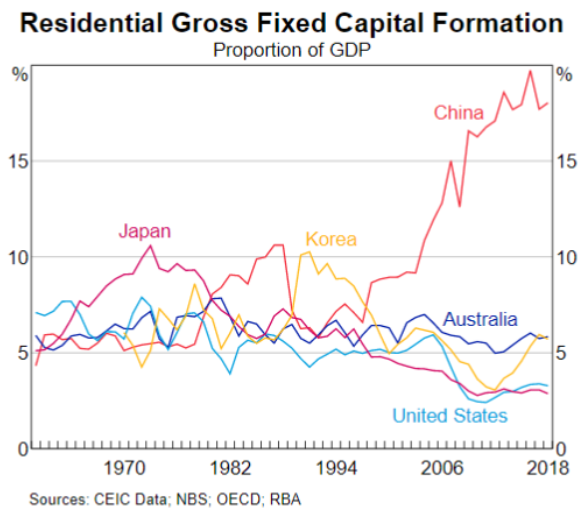

The Chinese markets panicked on the news of government crackdowns on technology and education companies. As well, Beijing has been working to restrict the flow of credit to property developers in order to stabilize real estate prices. In reaction, foreigners have been panic selling Chinese tech on high volume.

China’s about face

The new model appears to place common prosperity, as President Xi Jinping has put it, ahead of helter-skelter growth, investors say.

According to some analysts, it is the most significant philosophical shift since former leader Deng Xiaoping set development as the ultimate priority 40 years ago.

“Chinese entrepreneurs and investors must understand that the age of reckless capital expansion is over,” said Alan Song, founder of private equity firm Harvest Capital. “A new era that prioritises fairness over efficiency has begun”…

In the nine months that have passed since, developers, commodity speculators, crypto miners, other tech giants and, lately, tutoring firms, have all faced radical rule changes or had regulators aggressively poring over their businesses.

The policy pivot is “common prosperity”. Translated, this means the reduction of inequality in order to better support household sector spending.

Zhaopeng Xing, senior China strategist at ANZ, said the raft of policies, unveiled around the Chinese Communist Party’s centenary, underscores the political will to reinforce the Party’s roots.

“These policies were announced to reflect the Party’s progressiveness” and appeal to the masses, Xing said. “They send a message that China is not a capitalistic country, but embraces socialism.”

The messaging in the months running up to the Party’s July 1 centenary was also unequivocal, analysts say. “Common prosperity” is the over-riding long-term goal, Xi said early this year, and China’s development should be centred on people’s expectations of better lives, urban-rural gaps and income gaps.

Rather than blindly selling everything Chinese, investors should instead focus on the “Three Mountains”.

Investors have so far responded with alarm that tipped on Tuesday towards panic. They dumped health stocks (.HSHCI) in anticipation the sector will be next in the firing line, even as the property and education sectors reel.

Housing, medical and education costs were the “three big mountains” suffocating Chinese families and crowding out their consumption, said Yuan Yuwei, a fund manager at Olympus Hedge Fund Investments, who had shorted developers and education firms.

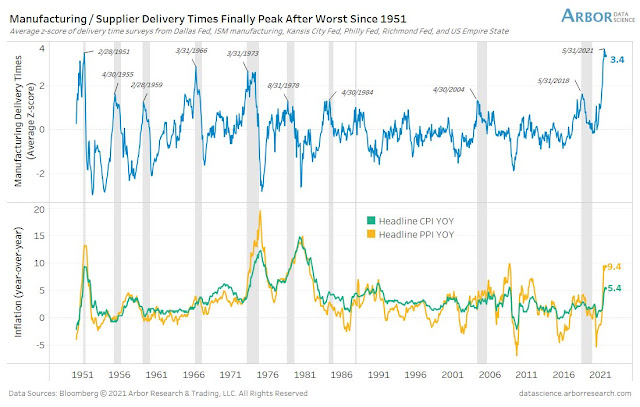

The word is “transitory”

We continue to see improved demand for legal services. The winter storm instigated a lot of legal work. We are continuing to see increases on the transactional side and perhaps a bit of a slowdown in large bankruptcy filings. There is huge competition for talent right now—particularly for corporate lawyers. There is a lot of pressure on associate salaries, and we have implemented a new pay scale for associates that will feature retroactive bonuses.

A shortage of technology professionals continues to impact the ability to deliver. Sales look like they’ll pick up in the fall based on more purchasing decisions being made.

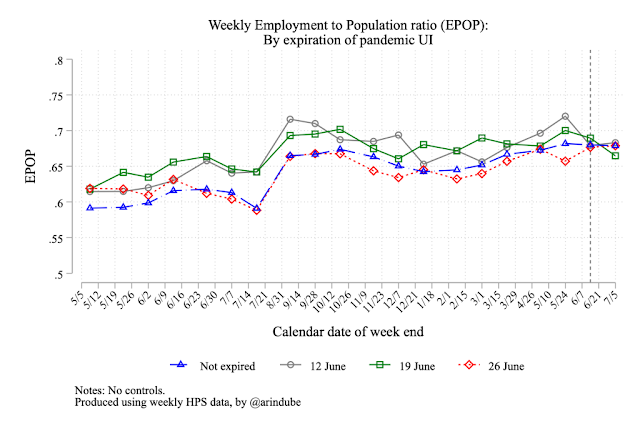

[Food services] We are hiring a few employees after the federal [unemployment] subsidy ended but continue to lose others oftentimes because they say they don’t want to work or decide to attend a social function and walk off. They know they can get hired again by walking down the street. Hire three, lose four. Hire two, lose one. I have never seen anything like this in my almost-40 years of working. We continue to turn away business due to lack of employees. Raw product prices continue to significantly increase. It is difficult to raise prices, but we will have to soon. Our downtown area remains sparsely populated with little activity, which is critical to our business.

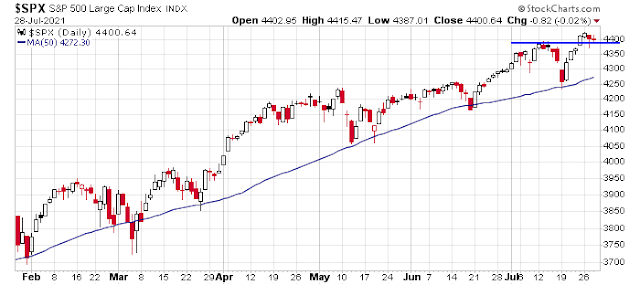

I think there is a Covid scare around the corner. Hospitals are reopening Covid wards. Shortly, there will be village fairs in America (late summer). Cases are already ramping up. Federal government is mandating vaccines as are companies in the US. There is some urgency behind these mandates, if not a panic. Timing is just convenient for a 10-15% correction, into October. Just a gut feeling.

Wall of worry? Just one data point, although worth paying attention to. Below is a quote from Potomac’s Dan Russo:

“With much concern in the media about the Delta variant, it is interesting to note that the S&P 500 Hotels, Restaurants, and Leisure Index made a 52-week high on a closing basis yesterday. The group has been moving sideways since April but now may be in the process of breaking from its consolidation zone after holding support last week. At the same time, the 50-day moving average is beginning to move higher.”

Here’s some good news re the Delta surge:

https://www.cnn.com/2021/07/28/health/pfizer-third-dose-data-bn/index.html

Excerpt:

During a company earnings call on Wednesday morning, Dr. Mikael Dolsten, who leads worldwide research, development and medical for Pfizer, called the new data on a third dose of vaccine “encouraging.”

“Receiving a third dose more than six months after vaccination, when protection may be beginning to wane, was estimated to potentially boost the neutralizing antibody titers in participants in this study to up to 100 times higher post-dose three compared to pre-dose three,” Dolsten said in prepared remarks. “These preliminary data are very encouraging as Delta continues to spread.”

As I’ve been saying, the economically sensitive Value groups might find a new powerful up thrust during the earnings season. That is happening especially with deep cyclicals and Resource Value. See Steels, Home Construction and Mining. There was nothing from the Fed yesterday to stop the cyclical recovery narrative. Plus Powell said that prices don’t have to fall to have inflation drop. That is fine with producers of goods.

It’s a relief for observers of the global scene to see China authorities try to quell the growing crash mentality around their recent policies.

Reopening a position in QS on the ‘day after’ pullback.

Re the post-earnings selloff in AMZN – just amazing how it’s able to singlehandedly take the QQQ/SPY down -0.6%/-0.3%.

Will traders buy the dip on Friday? IMO, they’re more likely to sell the dip/ mark an interim top in large-cap tech. If so, then we should begin to see clues as to where the money flows next.

We will be getting China PMIs over the weekend, this may give us some insight into how and if the recent deleveraging efforts in China are impacting their economy. EEM sends a message weakening global economic growth, but has tried to recover from tuesday’s lows.

Restarting a few positions in the premarket session.

FXI/ EEM/ BABA. PLTR.

Adding a second allocation to QS.

COIN/ RIOT.

JETS.

EWZ.

XLF/ KRE.

NIO.

XLE.

PICK.

Closing RIOT.

Closing NIO.

Adding to XLE.

Closing KRE.

All positions off here.

Only two reds->minor losses on XLE and EWZ.

Otherwise a pretty good morning!

I still think traders/institutions sell the dip – so naturally it’s in their interest to jack things up early. JMO.

Or maybe SPX will stay at 4400 for the rest of our lifetimes 😀

XLP outperforming today, usually not a good sign

Taking another swing at XLE/ KRE.

Reopening PICK/JETS.

BA.

XLF.

Trading in and out of NIO/ QS/ PLTR.

It feels as if the small-cap flyers are taking off again.

All positions off here. Once the secondary trades begin eating into earlier profits I switch to capital preservation.

Incidentally, EWZ is a perfect example of taking minor losses on positions that move against us quickly before they begin to cause major damage.

Good data on Delta and breakthroughs

https://www.kff.org/policy-watch/covid-19-vaccine-breakthrough-cases-data-from-the-states/

Excellent analysis! thanks !