The markets opened with a risk-off tone overnight in Asia, The selloff continued in Europe, and now it is in North America. The talking heads on television have attributed the weakness to COVIE-19 jitters over the spread of the Delta variant.

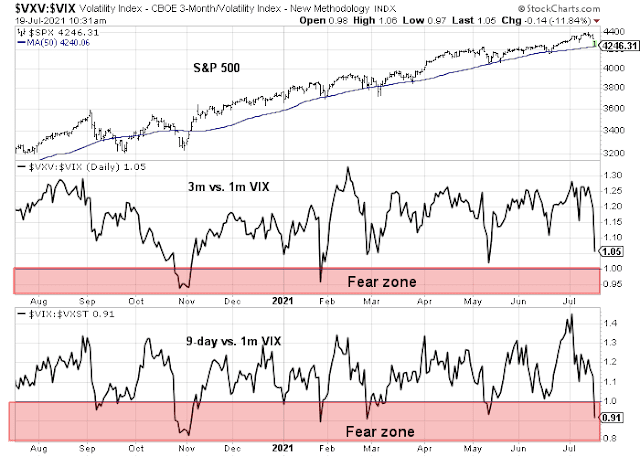

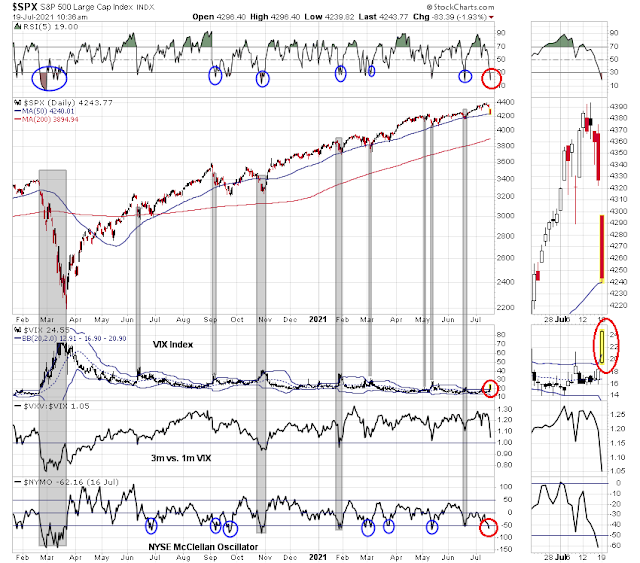

Panic is starting to set in as the S&P 500 approaches a test of its 50 dma. The term structure of the VIX futures curve is starting to invert. The 9-day VIX is now above the 1-month VIX (bottom panel), though the 3-month VIX remains above the 1-month VIX.

Coincidentally, I also received this morning several emails raising concerns about the stock market. I would argue instead that this is not a time to abandon long positions. Instead, the market weakness represents an opportunity to tactically add to long positions.

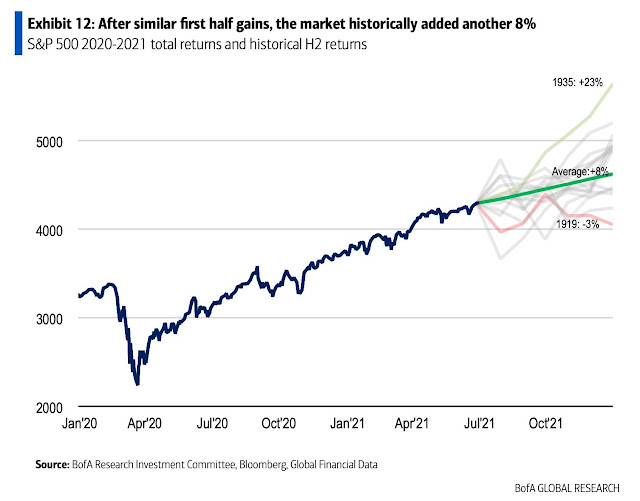

The primary trend

First, keep in mind that the primary trend is up. Jared Woodward at BoA pointed out that “Years that begin this well tend to end well, too. Since 1871, for the 16 years with similar starts, the average second-half return was 8%, with more upside potential than downside risk.”

Bottoming models

Tactically, three of the four of my bottoming models are flashing buy signals. The 5-day RSI is oversold; the VIX Index has spiked above its upper Bollinger Band; and the NYSE McClellan Oscillator is oversold. The only indicator that has not signaled caution is the 1-month to 3-month VIX term structure, though I pointed out that the 9-day to 1-month VIX has inverted, indicating rising fear.

As well, I monitor the Zweig Breadth Thrust Indicator for a secondary purpose other than the original formulation. As a reminder, a ZBT buy signal is generated when the ZBT Indicator rebounds from oversold to overbought within 10 trading days. This is a rare condition that only happens every few years. What is less rare are ZBT oversold signals – one of which was just generated today.

I am in no way implying that we will see a ZBT buy signal in the near future. However, the market is sufficiently oversold that a tactical buying opportunity is presenting itself. The real test for the market is how it behaves after the rebound. My base case is still calling for a trading range for the next few weeks. The market is just at the bottom of its range right now.

Disclosure: Long SPXL

Thanks, Cam.

Kicking up exposure in the form of VT.

Bot QUAL at the close. It’s my favorite all weather ETF.

That’s a reasonable way of gaining exposure. The auality factor has been performing well through thick and thin.

Here’s to Turnaround Tuesday.

Cam,

To clarify:

when you say ‘tactical’ opportunity to add to long position, the timeframe is short-term (next few days / next week) or medium term next few month till end of year?

Tactical = a few days

Cam, I remember how you brought China Evergrande as “the canary in the Chinese coalmine” to our attention – in light of their quickly deteorating situation, would it not be appropriate for investors to be concerned?

More on that soon. Writing a longer comment.

For writing covered calls, is ITOT a better ETF than VTI? Thanks.

PS: A total market index is an anchor position in my portfolio.

Adding a second tranche to FXI in the premarket session.

I’ve closed 50% of my positions in the premarket session. A bet I’ll be able to reopen lower during the regular session.

Reopening COIN/ NIO.

Replacing the XLE closed earlier.

PLTR/ QS.

Opening SMH.

All positions with the exception of EEM/ FXI/ NIO/ COIN off here.

Probably premature, but back to a slightly bearish stance.

EEM/ FXI off here.

COIN off for a minor loss.

A one-day +0.7% overall gain for the port. Nothing spectacular, but I’ll take it.

Taking another swing at GDX.

Opening a position in TLT.

Reopening NIO.

Closing TLT.

Closing NIO.

Closing GDX for a minor loss.

PLTR/ QS/ NIO.

Restarter in TLT.

Taking gains on NIO here.

Taking gains on QS/PLTR.

Taking the (very small) gain on TLT here.