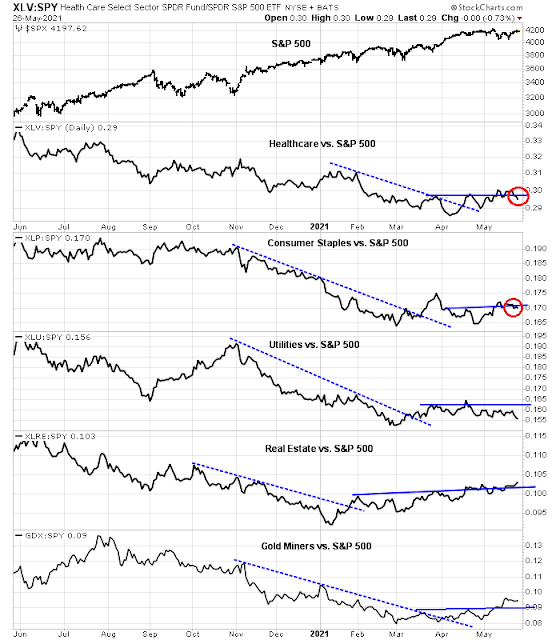

Mid-week market update: I wrote on the weekend that one of my bullish tripwires were violations of relative support by defensive sectors (see Is the pullback over?). The bulls have largely achieved that task.

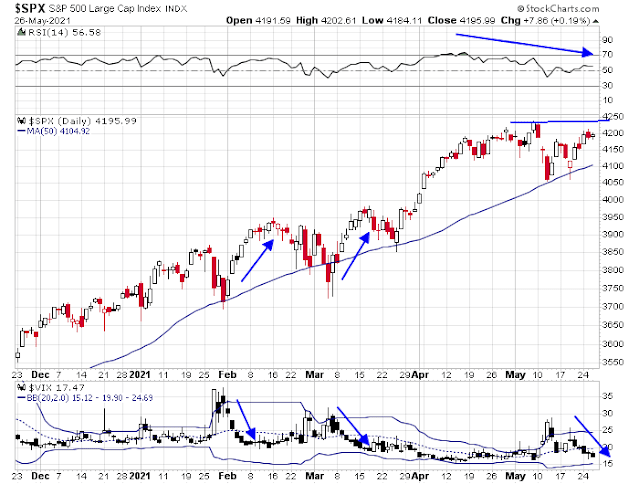

The S&P 500 appears to be on its way to a test of the old highs.

In addition, the VIX Index has decisively fallen below its 20 dma, which was another of my bullish tripwires. However, the S&P 500 is exhibiting a negative 14-day RSI divergence. Should the index rally to test its old highs, the signs of deteriorating momentum are likely to limit the market’s upside potential.

Due for a pause

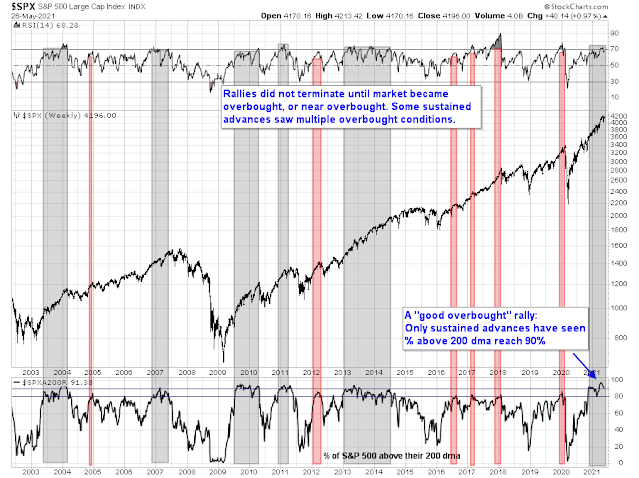

The stock market is acting like it’s due for a pause in its bullish impulse. I have highlighted this chart before. Market breadth, as defined by the percentage of S&P 500 above their 200 dma, has risen above 90%. In the past, this has been a sign of strong price momentum that accompanies a strong bull move (grey shaded areas). However, the advance has paused when the 14-week RSI recycled from an overbought condition, which it did recently.

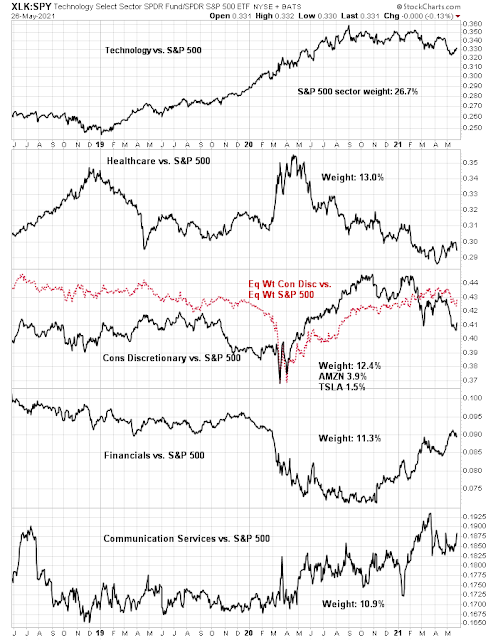

Market leadership has been lackluster, which is another argument for a period of either sideways action or minor pullback. The top five sectors comprise above 75% of S&P 500 weight and it would be difficult for the market to either rise or fall significantly without the participation of a majority. Of the five sectors, only Financials are in a relative uptrend, while the rest are either trading sideways or lagging the market. Strong bullish advances don’t look like this.

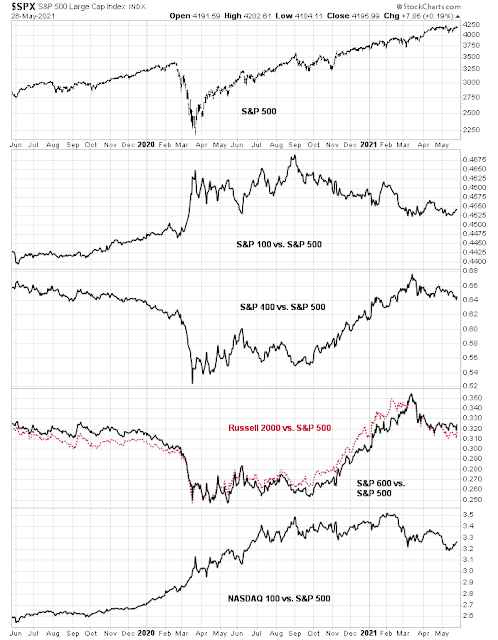

Similarly, the relative performance of the market by market cap grouping also shows a picture of uncertain leadership. Mid and small-caps are in relative downtrends, while mega-caps and the NASDAQ 100 had been in relative downtrends, but trying to recover.

In short, the leadership picture appears unexciting.

The MTUM shuffle

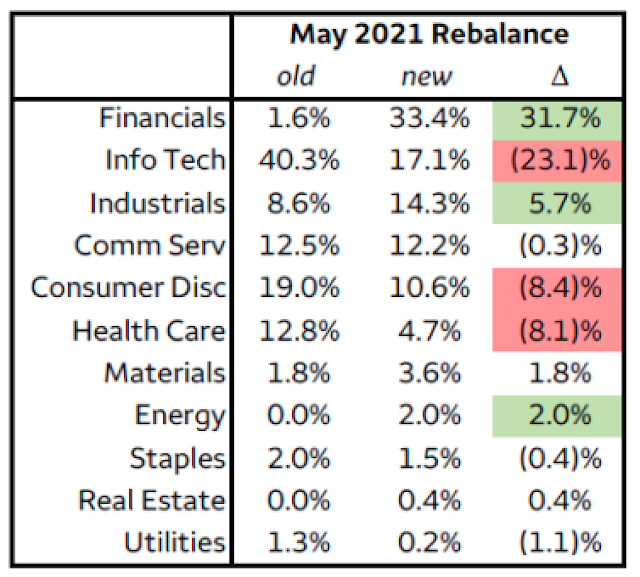

In the short-run, traders will have to consider market cross-currents as the $16 billion price momentum ETF (MTUM) re-balances its portfolio. Bloomberg reported that the ETF is expected to sell its growth stock holdings and buy value stocks.

BlackRock Inc.’s iShares MSCI USA Momentum Factor ETF (ticker MTUM) will see “an astounding” 68% of its portfolio holdings change in order to hold the market’s top performers over the past year, according to Wells Fargo estimates.

The rebalancing of the quant strategy, due on or around Thursday, will push the weighting of financial stocks to a third from less than 2% currently, the strategists reckon. The technology sector will slide to 17% from 40%.

It all underscores the intensity of the risk-on stock rotation, away from pandemic-induced economic misery to vaccine- and stimulus-fueled optimism. The rolling one-year performance of the value factor — which bets on cheap-looking shares and against expensive peers — is near its strongest since the global financial crisis.

“We expect MTUM to morph from an expensive, high-growth play to a higher-mo’ basket with benchmark-like growth/value characteristics,” Wells Fargo analysts led by Christopher Harvey wrote in a note. “The fund’s Quality drops somewhat.”

My inner investor remains bullishly positioned, though he has sold call options against selected long positions. My inner trader is bullish, and he is waiting for the S&P 500 to test resistance at its old highs before he starts to take some profits.

Disclosure: Long SPXL

If one believes like I do that the bull market will last until the business cycle come to an end with economic stress followed by a recession, then we can expect a general uptrend (as Cam’s long term portfolio) with occasional 5-10% corrections. So buying the dip is what one should do.

If we were at the end of the bull market, the current dips in various sectors would be the ominous start of something really bad. But since the business/stock market cycle has a long way to go, it is a buy-the-dip gorgeous pattern to behold.

The CCC junk bond spreads have fallen to absurd lows and stayed there for the last few months. They show not a slight hint of economic stress with corporations that would be the first to feel problems. Time to look at Value stocks that are economically sensitive with rose colored glasses.

Thanks Ken, that’s an interesting statement. For quite some time investors have been reading junk bond spreads as a sign of complacency, but maybe the bond market knows something and those conditions are here to stay. Also, what if the new normal is that in future recessions there will be a coordinated monetary and fiscal response to get things going again? Certainly not unthinkable.

If that means, that even cyclical investors do not need to worry about future recessions – why are these stocks so much cheaper than tech stocks? The big plus of tech stocks during the last recession was that they were still earning a lot of money. This could work, as long as inflation does not sprial out of control.

Cam- What’s your take on how asset prices react to rebalancing moves?

(a) Do most fund managers opportunistically buy on weakness/ sell on strength ahead of time, or are they required to act on a certain date?

(b) Even if fund managers exhibit little inclination to game the rebalance, I’m guessing brokers will in fact game the process. In which case would you view the early morning pullbacks in energy/ financials/ industrials as having been a buying opp?

The shifts were not as great as expected for Financials and nothing for Energy.

https://www.ishares.com/us/products/251614/ishares-msci-usa-momentum-factor-etf

Thanks, Ken.

Cam- Is there some reason why this post displays only via your blog, and not on the main website?

There was a problem with categorization, which has now been fixed. Thank you for alerting me.

I wonder if they are thinking bailouts. Employment is a big deal and if these CCC rated companies go belly up, there is a job disruption but most of these places keep functioning GM, ToysRUs etc. But if things are bad enough and the CCC realm really implodes, there will be contagion and maybe we get GFC 2.0+. I read about a 65 billion$ of funds going to pensions, maybe this is a sign of the times. What’s another trillion or two? Yes those bond spreads are low, and as long as they stay in a downtrend we are ok…unless this time is different ofc

We can worry about the future all we want and I am panicked, but until the CCC yield spreads rise substantially we are in a powerful bull market for economically sensitive Value IMO.

Taking swings at NVDA/ RIOT/ JETS here.

Reopening XLE for a day trade.

PLTR on strength.

QS on weakness.

IQ on strength.

VTV.

QQQ not backing down.

Restarter position here.

Adding a second tranche to QQQ.

XLK.

Closing all positions here.

QQQ didn’t quite pan out.

A +0.06% gain for the day. At least it’s a gain.

Reopening positions in KRE and COIN.

QS.

VIAC.

XLE.

Out of all positions.

What’s my strategy? I’ve just noticed that many prices on my watchlist will unexpectedly drop in the first five minutes (probably traders selling gaps up to lock in profits). Buying into the declines will yield modest gains within the next 15-30 minutes.

The gains are nothing to write home about. But they’re still gains. This morning’s trades translate into a +0.04% gain for the portfolio. Note that yesterday’s +0.06% gain required a lot more work!