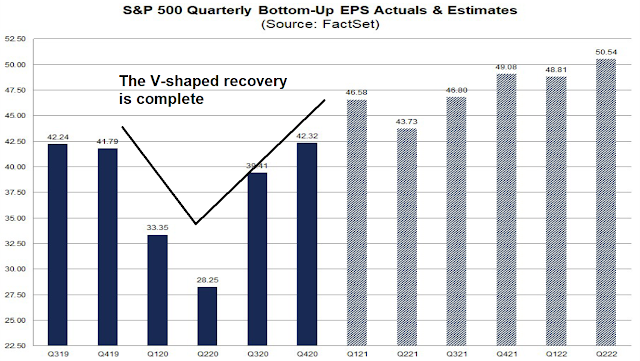

We are well into Q1 earnings season. 60% of the S&P 500 has reported their results and the top and bottom line beat rates are well above average. The V-shaped recovery is complete.

Here is the more difficult question. The six largest companies in the S&P 500 reported last week and all of them beat consensus EPS expectations. Why was the S&P 500 flat last week?

Supply chain bottlenecks

Even though FactSet reported that the market rewarded EPS beats and punished misses, there was a subtle component that can’t be seen in the statistics. The new focus of the market seems to be concerns over production bottlenecks.

The market reaction to services companies and companies with manufacturing components is revealing about market psychology. Alphabet and Facebook, which depend mainly on advertising revenue, reported strong sales and EPS figures. The stocks rose after their reports.

By contrast, Apple also beat estimates but reported production issues owing to the chip shortage. Its shares closed in the red the next day. Yahoo finance reported that Caterpillar, which is a global cyclical bellwether, also reported strong earnings, but warned about chip shortages constraining sales. Its shares also weakened after the earnings report.

Caterpillar Inc. is warning of potential impacts ahead due to a global chip shortage, putting a damper on better-than-expected earnings for the world’s biggest maker of mining and construction equipment.

“Although we haven’t been impacted yet, the global semiconductor shortage may have an impact later this year,” Chief Financial Officer Andrew Bonfield said in a Thursday interview. “It’s a risk and obviously we’re keeping a close eye on it.”

The cautionary words come after Caterpillar posted first-quarter revenue and profit that topped analysts’ estimates, in what Bonfield described as “very strong performance” for the start of the year fueled by construction growth in the U.S. and China.

Caterpillar joins some of the world’s biggest automakers and tech giants in highlighting the impacts of a chip shortage that’s already caused Honda Motor Co. to halt output at Japanese plants and Apple Inc. and Samsung Electronics Co. in flagging production cuts and lost revenue.

The shortfall comes as Caterpillar expects a big ramp up in machinery production through the rest of the year. While the company has been able to mitigate the issue so far, Bonfield said such shortages could mean Caterpillar may not be able to fully meet demand from its customers this year.

Caterpillar’s quarterly results surpassed Wall Street’s expectations, with sales jumping 12% to $11.9 billion in the period and per-share adjusted earnings of $2.87 topping the $1.95 a share average estimate of analysts’ estimates compiled by Bloomberg.

Not only are shortages of semiconductors creating supply chain bottlenecks, but other shortages such as lumber mill capacity and even chicken production are driving up input prices.

The challenge for the bulls

The bulls face a valuation challenge. The S&P 500 forward P/E ratio, which currently stands at 22.0, hasn’t changed much since the onset of the pandemic.

On the other hand, the S&P 500 has risen 90.1% since the March lows, excluding dividends. If the forward P/E ratio was largely unchanged during this period, that means it was rising EPS estimates whichhave driven the market rebound.

While forward EPS estimates have surged during Q1 earnings season, can they keep rising at their torrid pace as supply chain bottleneck worries emerge?

Priced for perfection

In short, the market is priced for perfection. Many market participants are already in crowded longs, which is creating headwinds for further price advances. Charlie McElligott at Nomura observed that CTAs are already at a crowded long and their positioning is highly correlated to PMI, which is already extremely elevated.

As I pointed out last week (see Q1 earnings monitor: Reopening giddiness), top-down and bottom-up expectations are coming into conflict. While bottom-up estimates are rising, the top-down outlook is more cautious.

As one of many examples, the ECRI’s Weekly Leading Indicator is rolling over and coming off the boil.

I reiterate my warning that risks are rising for the stock market. You can tell a lot about market psychology by how the market reacts to the news. The six largest stocks in the S&P 500 reported last week and they all beat consensus estimates, but the index was flat. This is a classic warning that expectations are too high.

Semiconductor stocks are important bellwethers because they are in a growth-cyclical industry. These stocks should be performing well as they are beneficiaries of the chip shortage. Instead, the Semiconductor Index (SOX) violated an important rising relative trend line against the S&P 500, and the violation is more visible when measured against the NASDAQ 100.

These are all warnings that the stock market is poised for a pullback. Expectations are too high and the market is priced for perfection. A “Sell in May” strategy may be a useful investment template for the next few months.

Every position I traded earlier this morning is now priced below both my entry and exit points.

One reason I often open positions early in the morning is to get a read on the market. Sure, I could use paper positions, but nothing beats the real thing.

Cam has been prescient over the years I’ve been following him. Sell in May it is for now.

I maintain my opinion that watching THE market is impossible to forecast. Today ARKK is down 2.6% and Internet ETF down 1.5% while Select Dividend ETF is up 1.4% and Value ETF is up 0.5% and Mines & Metals up 4%. SPY (S&P 500 ETF), THE market is up 0.23% between the the Growth and Value.

We have two markets, Value and Growth going in different directions. The Growth market is weakening (Innovative Growth bubble popping is worse) while the Value bull market is young and vital with its subgroup Resource Value looking like it’s starting a secular bull market.

If I said SPY would be down 0.5% over the next four days, do you expect Growth and Value would be down the same amount? How would the two sectors progress to get that 0.5% loss? Knowing ahead of time that THE market will fall 0.5% wouldn’t help you pick winners or avoid a loser. Tracking the momentum and narratives of Growth and Value separately is a better approach.

All depends on one’s trading approach. What if the SPX falls -10% over the next several weeks? Would it be on the heels of a +5% gain for value and -20% for growth? Or -10% for both? Or even a scenario where value (against all expectations) pulls back even harder than growth? We just don’t know.

Sometimes it’s easier to step aside when conditions call for lower exposure, let the market correct on its own terms, and then reenter at more attractive risk/reward entry points.

The key to outperformance is avoiding large drawdowns. Both you and Cam did a great job getting out ahead of the March 2020 decline.

There have been smaller corrections since then. I was able to sidestep the declines last September and last October, twice more in January, and a few minor pullbacks since. I credit a combination of luck/sixth sense. Of course, I’ve also been caught uninvested/underinvested when my intuition sensed only ‘false positives.’ We’ve all discovered what works for us – to each his own.

$XLB vs. $XLK

Basic Materials vs. Technology

It looks as if we are on the verge of a breakout from a large, 14-month base in this relationship…

https://twitter.com/the_chart_life/status/1389280069433036802

If this is confirmed, and we see continuation in the coming days and weeks, it could just be the straw that breaks the back of the Growth/Value camel. You can’t have Materials outperform Tech and then also expect Growth to top Value.

Could not agree more.

Cam- Do you have updated views on GDX/ TLT? You were correct re the upside breakout in GLD/GDX. Do you remain positive on the long bond?

A qualified bull on bonds but not willing to make a big commitment

The thing about corrections/ bear markets (and there are many stocks in a bear market right now) – when you think prices can’t go any lower, that’s exactly when the selling begins to accelerate.

Hi Cam

Is your inner investor moving towards a neutral position?

Thanks

In neutral

I have trimmed a bit, reducing my S&P exposure by about 4% while keeping my value/small cap positions intact. While I’m not a trader, I do think it’s wise to put some chips in your pocket after a run like this. Wondering if I should move back towards a more neutral position for the next few months.

We always knew it was a bubble…

Best performing sectors appear to be consumer staples and health care.

Probably looking at it on a longer time scale than you are, but OBV for XLV is flat for the last two months and the 50 day MA of the ratio of XLV to SPY is declining, so not looking too robust on an intermediate time scale. The RRG for XLV classifies it as “improving” which means it is still lagging $SPX, on the default timeframe tracked by RRG graphs although in the last few days there has been an upward bump.

Right. I’m sticking with Cam’s correction scenario.

By the way. Apart from 2020, which was a tough year for any analyst to make ST directional calls, Cam has an exceptional track record.

Me too. I was in the process of reorienting my portfolio toward value when he posted on the possibility of a 5-10% decline, so I left the sales proceeds from the sale of my remaining growth etfs in cash to see what would happen. The decline scenario is looking more and more likely as time goes by.

German DAX down more than the CAC40 indicates that there may be worries about a China slowdown. Nikkei has also been pulling back quite a bit.

Excuse me for boasting but I sold my ARKK May 7th 120 put today for a triple in four days. I don’t often do options but last Tuesday before the Fed meeting announcement and the Biden love-in speech the next day, ARKK was at 126 and I expected the rug might be pulled out from under the innovative growth sector. Sure enough, Wednesday was stable as the market absorbed the massive free spending and free money announcements. Then Thursday, bonds plunged and the growth stocks started into a tail-spin while economically sensitive Value went up.

I sold the puts today when T-bonds were rallying and ARKK and Clean Energy look like a possible capitulation low is happening. Also strength in banks and other Value stocks, tells me there is no economic stressors and it’s only an intermediate low in a continuing bull market. So I’m not crazy negative on Growth. I will stay in the Value camp rather than try to play the Growth swings.

Agreed, these relatively small pullbacks are very effective at getting everyone to the bear camp.

Master the art of the humble brag, Ken.

1. Never apologize!

2. Solid line drive opening ARKK May 7 120 puts ahead of the Fed/Biden’s Joint Session address for a 200% gain over four days. Position closed into this morning’s tailspin with Cathie Wood muted on Youtube in the background.

3. Didn’t quite hit the absolute bottom in ARKK as I was busy adding to existing value plays – now green!

DJIA closes green. The market never fails to foil expectations.

ARKK appears to have held an important support level ~112. If it breaks below, we may see an acceleration of the selloff. If it holds, then good odds for a decent bounce.

Tomorrow will be an interesting day for ARKK. Should the selling accelerate, I’ll be looking for a buying opp. Buying panic isn’t about price levels as much as it is about crowd behavior. I don’t have a price point in mind, but I usually recognize panic when I see it.