Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Theme du jour: Rebalancing

I had a discussion last week with another investment professional about the possible short-term asset price effects of portfolio rebalancing. Equities had handily beaten fixed income investments during the quarter, and balanced fund managers will have to rebalance their portfolios by selling stocks and buying bonds.

How important is the rebalancing effect? It seems that all the trading desks are talking about it. To add to the confusion, JPMorgan’s derivatives analyst Marko Kolanovic put out a research note stating that “there will be no monthly selling, and indeed there could be buying of equities into month-end. A lack of these flows, and broad anticipation of ‘month/quarter-end’ effect, could result in the market moving higher near term, all else equal.”

What’s the real story?

To answer that question, I conducted an historical simulation to measure the effects of portfolio rebalancing on stock and bond returns. I conclude from this study that fund flow concerns over quarter-end portfolio rebalancing are overblown.

An asset rebalancing study

To answer that question, I conducted a simulation to measure the effects of portfolio rebalancing on stock and bond returns.

I formed a portfolio consisting of 60% SPY (S&P 500 ETF) and 40% AGG (US Aggregate Bond Index). Portfolio weights are rebalanced to 60/40 on the last day of the quarter, but allowed to drift during the quarter. All returns used were total returns, which includes dividends and interest distributions. The study period spans the period September 2003 to December 2020.

I measured the possible effects of two rebalancing approaches. The anticipatory approach makes a decision on rebalancing the month-end before quarter-end. The reactionary approach makes the rebalancing decision on the last day of the quarter. In both cases, I measured the returns of SPY and AGG from the decision date.

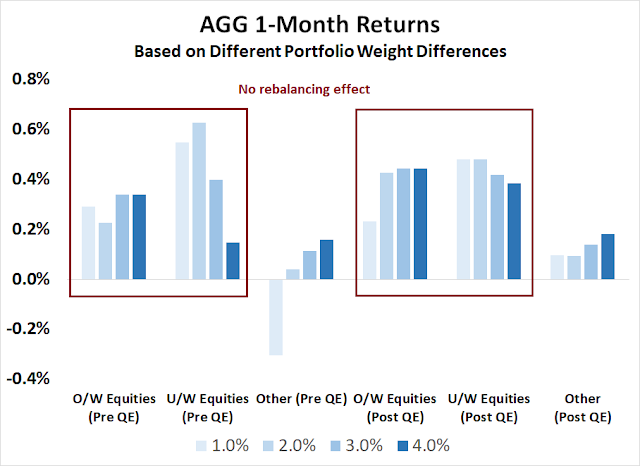

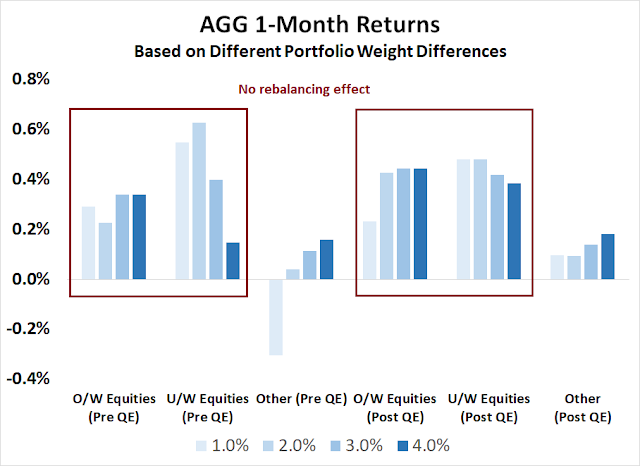

The following chart shows the median one-month SPY returns based on differing decision rules and further disaggregates each decision by the difference between SPY and AGG weights on the decision date. For example, the light blue bars show the returns when the difference in asset weights were +/- 1% or more, while the darkest blue bars show the returns when the weight differences were +/- 4% or more.

The surprising result from this study was there was little or no anticipatory rebalancing effect. SPY returns were not significantly different regardless of whether the portfolio approached quarter-end with an overweight or underweight equity position. However, there was a significant catchup effect in the following month if the portfolio was underweight equities. Other anticipatory tests using a two and three week lookahead time horizon, whose results are not shown, also displayed similar results of no rebalancing effect.

The study also shows that there was no significant rebalancing effect on bond market returns, either before or after quarter-end. Returns weren’t significantly different whether the portfolio was overweight or underweight an asset class. In fact, there was a slight perverse anticipatory effect that bonds outperformed when the portfolio neared quarter-end while underweight equities and overweight bonds. In that case, the normal reaction would be to buy stocks and sell bonds, but bonds showed slightly better returns under those circumstances.

I conclude from this study that fund flow concerns over quarter-end portfolio rebalancing are overblown. Investors need to recognize that institutional portfolios rebalance in two ways, at the discretion of the manager, and at the discretion of the plan sponsor. Managers will only have the discretion to rebalance a portfolio if they have a balanced fund mandate, and balanced fund mandates are usually only given out by relatively small funds. By contrast, a large asset owner such as a pension plan or an endowment fund hires managers based on individual mandates, such as US small-cap equities, venture capital, and international bonds. Each mandate has a very specific benchmark and managers are expected to be fully invested at all times. The large asset owner only rebalances very infrequently, mainly because the owner needs to undergo the unwieldy process of informing some managers that it is redeeming portions of the funds under management and informing other managers it is re-allocating to their funds.

A long-term study of public pension fund allocations shows that their aggregate equity allocations have been on the overweight equities compared to the conventional 60/40 model while fixed-income allocations is mired in the 20-30% range.

A “Great Ball of Money”

In the meantime, traders and investors have to be aware of what Tracy Alloway at

Bloomberg calls a “great ball of money”.

Years ago I wrote that “China’s markets resemble nothing if not a great rolling ball of money that moves from asset class to asset class, constantly searching for the next source of sizable returns.” In a country marked by capital controls, excess liquidity is effectively trapped and forced to ricochet like a pinball in a machine. Skilled investors in China’s markets are able to identify where this money will flow to next, scouring policy statements for hints of government initiatives or for signs that authorities might clamp down on a particular company or market, and watching message boards and the like for retail trends.

There are signs the U.S. is now going down a Chinese-style ball-of-money path too. Sloshing liquidity courtesy of a dovish central bank will probably end up ping-ponging between U.S. assets. While some of it might leak out of the States, viable alternatives to U.S. assets are limited with yields now low around the world (Chinese bonds and stocks are definitely an alternative, but there’s also limited supply for overseas investors). At the same time, investors will probably do well to eye increased government spending and fiscal stimulus for signs of where money might go to next. Money released by the state doesn’t flow evenly to all things and everyone. Pinpointing exactly where it’s going is getting even more important. In this kind of environment, market bubbles don’t necessarily burst so much as roll from one thing to the next.

The “great ball of money” has touched meme stocks, SPACs, and cryptocurrencies. The latest beneficiary appears to be reflation stocks. Compare the technical conditions of the DJIA, which is a proxy for value and cyclical plays, to that of the growth-heavy NASDAQ 100. The DJIA is holding above its 50 dma, while the NASDAQ 100 has been unable to regain its 50 dma. As well, the percentage bullish on point and figure are all significantly better for the DJIA than the NASDAQ 100.

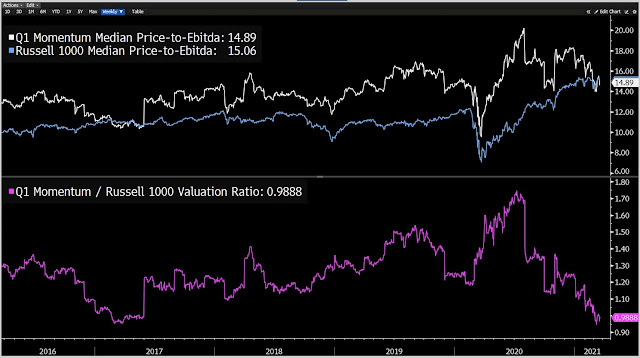

In addition, more value names are entering the price momentum basket. As the following chart shows, median valuations for the high momentum quintile (top 20%) are actually cheaper than median Russell 1000 valuations. This is an unusual condition that hasn’t happened since early 2017.

This will create a tailwind for value stocks as momentum players pile into them.

An upside breakout

Tactically, the S&P 500 is tracing out an upside breakout from a bull flag within a well-defined uptrend. Value stocks as leaders and growth stocks as laggards. The upside breakout was remarkable in the face of the reported forced large margin liquidation of Tiger Cub Archegos holdings on Friday. The affected stocks were mostly Chinese tech companies such as Baidu, Tencent and Vipshop, though ViacomCBS and Discovery were also hit hard, according to

Yahoo Finance.

A liquidation of holdings at several major investment banks with ties to Tiger Cub Archegos Capital Management LLC contributed to an unseen daily decline Friday in shares of stocks including Discovery, Inc. and ViacomCBS Inc., according to people familiar with matter.

Shares of media conglomerate ViacomCBS fell 26% while Discovery dropped 27% Friday, recovering from far steeper losses. The degree of the declines was unprecedented and occurred in an otherwise orderly market.

Early selling came through so-called block trades from Goldman Sachs & Co., which offered over 30 million shares of ViacomCBS in midday trading. Morgan Stanley, earlier in the day, offered over 15 million shares of Discovery, according to people familiar with the matter.

The NYSE McClellan Oscillator (NYMO) bounced off an oversold level last week. Historically, such conditions have been reasonably good signals for market bottoms and possible rallies.

While the market is short-term overbought and 1-2 day outlook probably indicates either a pullback or consolidation, the odds favor higher stock prices in the coming week.

Disclosure: Long IJS

I am moving to equal-weighted indexes. They offer a true look at an industry whereas the weighted is often distorted by huge companies that swing wildly as their popularity shifts. Here is a chart of Consumer Discretionary ETFs, the XLY weighted index that is most used (has 35% Amazon and Tesla) and the Equal Weight RCD.

https://refini.tv/2Px7C0q

The difference in performance is stunning. Before the Vaccine Twist, weighted was a huge outperformer and since then a huge underperformer.

If an investor is looking at consumer spending rising as the pandemic recedes and buying a stock for example like Target, the Consumer Discretionary GICS will lead you astray since Tesla and Amazon are working off their huge outperformance from last year. The equal weight on the other hand was and is a true indicator with stocks like Target among the equal weights doing badly until the amazing vaccines were announced and then are big winners as the return to normalcy is now in sight.

Here is the same chart but comparing S&P 500 weighted to equal weight.

https://refini.tv/3srUg46

My reaction when seeing this was WOW!

Now we can see how the markets are reacting to the real economic dynamics not just investor sentiment and meme swings.

Equal weight benchmarks are ok for individuals but obviously inappropriate for institutions investing in size owing to liquidity issues.

That’s the advantage that small investors have over large institutions.

Yes, size matters. Moreover when you start to switch it is usually the time the outer-performance starts to wane. You are not the only one noticing the spread. A lot of people have been front-running it already. That’s why a periodic two-year average returns study makes a lot of sense due to mean reversion. It would not be a surprise growth stocks start to run during the earnings season. Maximum randomness and maximum confusion.

FAANG stocks are holding at support now for a while. If they break down from here, Equal weighted indices will outperform, otherwise, Cap weighted indices will take the lead again.

A very good analysis from Cam. This past week has seen several fund blow-ups. The timing coincides with approaching end of month and quarter. No doubt the victims are mostly growth stocks. I would speculate that the picture is murky as to which is going to lead next, value or growth?

Last week started to see meaningful mixture of value and growth stocks going in their own directions, not following the basket moves. so we might see a confused market in the short term. But here comes the driver from systematic algos since vix is now firmly below 20. So probably all boats will be lifted by the rising tide.

It is the quiet period now before earnings season starting next month. A lot of movements are magnified because of reduced participation in the market. Let’s see what happens during the earnings season. It might create even more style confusion.

Chinese-style ball-of-money path implies frequent and violent rotations. Wise to bet on a specific style of investing?

Personally, I can’t shake the feeling that it’s not a great time to be fully invested. And if I were to invest, I’d be more inclined to take a look at sectors that have been recently decimated. Just my take – and happy to change my mind based on price action.

Opening ST positions in VIAC/ DISCA in the premarket session.

Restarters in FXI/ EEM.

Restarters in NIO/ QS.

Adding a position in EWZ.

Restarter in XLF.

Adding a position in IQ.

KRE/ KBE.

XLE.

VEU.

IXC.

EFV/ VTV.

ASHR.

Adding to XLE.

EFA.

VT.

QQQ.

IJS.

Starter in RYSPX at the 730 am window.

Adding to IJS.

Adding a third tranche to both IJS/ KRE.

Basically, I’m positioning for a bounce into April.

Buying when I can (today), rather than when I have to (too much FOMO last Friday).

PICK.

The bears had an opportunity to take the market down this morning, but it was apparent even from the overnight session there just wasn’t much power behind the declines.

At this point, I have to give the bulls the benefit of the doubt. I think we see SPX 4000+ before another decline.

Adding small positions in VALE/ AA.

Reopening a small position in JETS.

Reopening positions in VTIAX/ VVIAX/ VTRIX/ VEMAX at the close.

https://www.schwab.com/resource-center/insights/content/what-you-value-and-where-you-find-it

This is an interesting article that shows how some growth stocks are trailing down into value and the other way round. Cam had alluded to this a few weeks ago also.

Equal weight ETFs: Great idea that has been a move for the past two quarters also.

For those worried about growth becoming dominant, simply add RYT, QQQs or XLK etc. to balance out a portfolio.