It has been a week since Recep Erdoğan`s decision to fire Turkey`s central-bank governor, Naci Agbal, for raising interest rates. Both Turkey`s stock market and currency, the Turkish lira (TRY), have shown some signs of stabilization after a dramatic drop last Monday. However, TRY weakened today but the fall is likely attributable to the fears of a margin call contagion despite a Bloomberg report that the new central bank governor’s refused to commit to an interest cut.

Turkish central bank Governor Sahap Kavcioglu said markets shouldn’t take for granted that he’ll cut interest rates as soon as April, when he sets monetary policy for the first time since his surprise appointment.

“I do not approve a prejudiced approach to MPC decisions in April or the following months, that a rate cut will be delivered immediately,” Kavcioglu said in a written response to questions emailed by Bloomberg News, referring to monetary policy committee meeting next month.

“In the new period, we will continue to make our decisions with a corporate monetary policy perspective to ensure a permanent fall in inflation. In this respect, we will also monitor the effects of the policy steps taken so far,” Kavcioglu said.

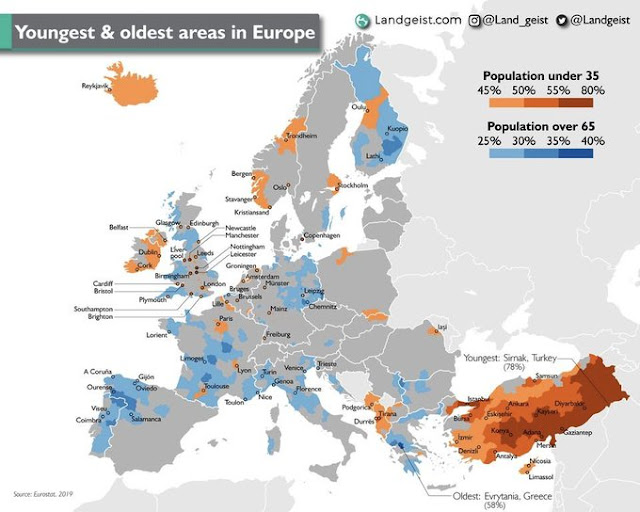

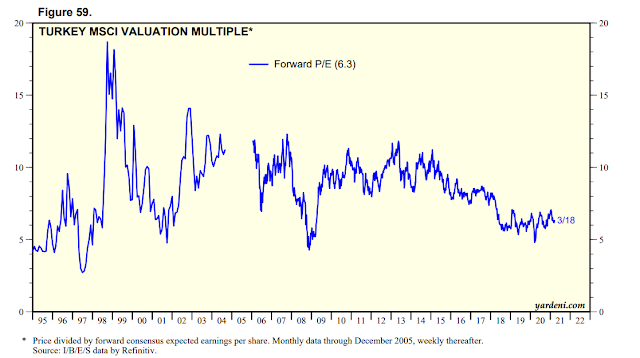

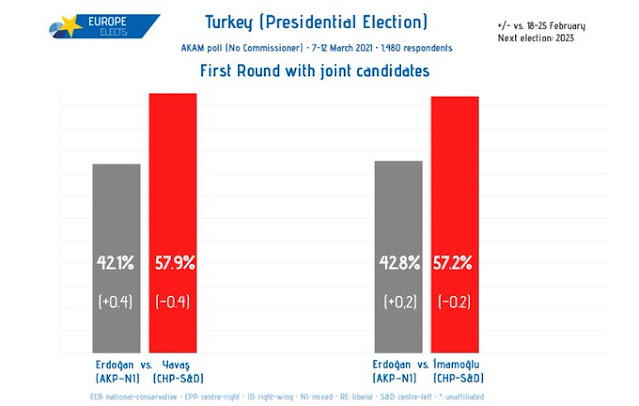

The bull case

Key risks

Mr. Erdogan’s macroeconomic muddles and meddling reflect both his own intellectual confusion and the inconsistent demands of his supporters. Turkey’s construction industry, which ensures growth and jobs, thrives on easy credit. That contributes to inflation and a flight from the lira. But Turks, especially merchants and small-business folk, who keep much of their money in dollars or euros, vehemently oppose exchange controls. The result is an unstable currency and unstable prices. Turkey is trying to emulate China’s growth strategy (featuring state-backed credit for property and infrastructure investment) without the benefit of its docile depositors and trapped savings.

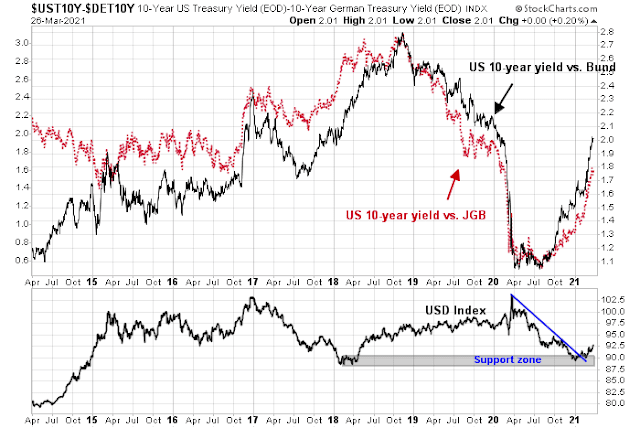

[Investors] should heed the country’s cautionary tale: if you rely on foreign capital it is risky to compromise central bank independence, especially when global interest rates are rising. Emerging-market investors will treat Turkey as an unfortunate exception only for as long as emerging-market policymakers learn from its unfortunate example.

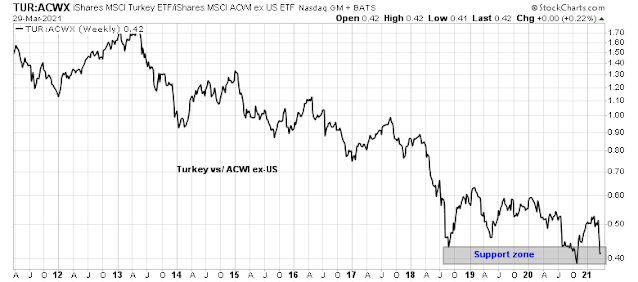

Blood in the streets?

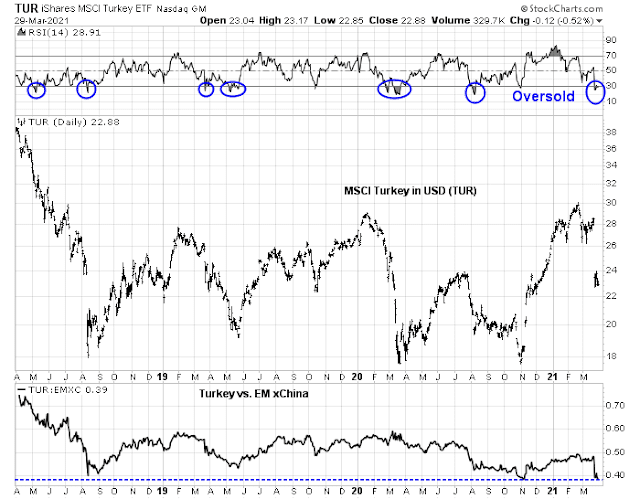

OK. Opening a position in TUR.

Adding to XLE/ IXC/ PICK.

VIAC/ DISCA/ IQ beginning to catch bids.

Paring back on VIAC/ DISCA/ IQ.

Cutting back on NIO.

Closing JETS.

Closing EWZ.

Closing AA.

Closing VIAC.

Trimming back on KRE.

Closing DISCA.

With regard to the sales – just the opposite of yesterday-> sell when you can, not when you have to.

All financials off here (KRE/ KBE/ XLF) for decent gains. Will revisit.

Reopening VIAC/ DISCA/ IQ.

Closing DISCA.

Closing IQ/ VIAC. These types of positions are not meant to be flipped, not held.

Meant to be flipped.

So, why does XLU and other dividend stocks not correct despite bonds selling off? What am I missing?

https://www.yahoo.com/news/bidens-spending-plans-could-mean-100055150.html?guccounter=1

Would such large amount of financing cause inflation?

Would it crowd out investments in the rest of the world, as the US becomes the only game in town (as it pertains to very large deficit financing)? This may mean no more $s left for the rest of the world (??).

On the other hand, higher growth rates may strengthen the USD and keep lid on inflation, bond rates. It is difficult to predict (?).

https://www.schwab.com/resource-center/insights/content/stimulus-payback-2023

Deficits galore, with increasing interest rates! How does one get both??

Nothing in the markets is an easy prediction. That’s by design. A predictable market is another term for easy money – and there’s no such thing. We all make the right call at times based on luck. Or maybe we call the move from point A to point B correctly – but the path from point A to point B will be convoluted and full of surprises.

The tedious action in the major indexes over the past two sessions may set up a quarter-end rally tomorrow.

Reloaded VIAC/ DISCA/ IQ on the early session pullbacks.

Pared back on QQQ.

Reopening NIO/ QS/ PLTR on early session STRENGTH. Maybe things play out differently this time.

All positions off here. Will likely close all index funds end of day.

Not exactly sure how I managed a +0.8% gain over two days trading mainly flyers in VIAC/ DISCA/ IQ and NIO/ QS, but I’m happy with it and unless we ramp into the close the outlook for Thursday just isn’t compelling enough for me.

Back in cash end of day.