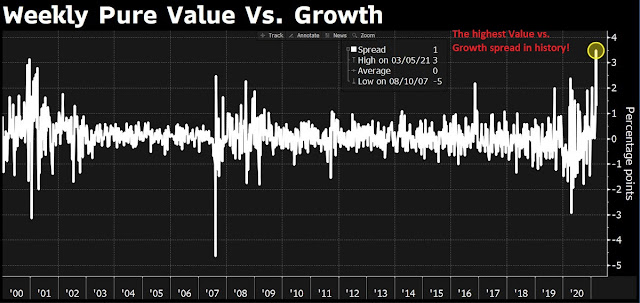

Mid-week market update: The rebound in the NASDAQ and growth stocks was not a surprise. Value outperformed growth by the most on record last week – and that includes the dot-com crash that began in 2000.

Make no mistake. Growth stocks are experiencing an unsustainable dead cat bounce.

Growth is oversold

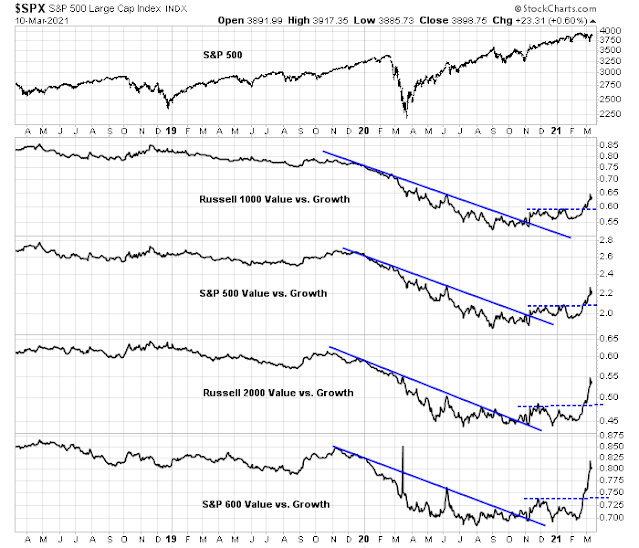

Here is another illustration of how much growth is oversold relative to value. No matter how you measure it, large and small-cap value had turned up decisively against growth. The uptrend appears extended, and a pullback was no surprise. Nevertheless, the intermediate-term trend favors value over growth.

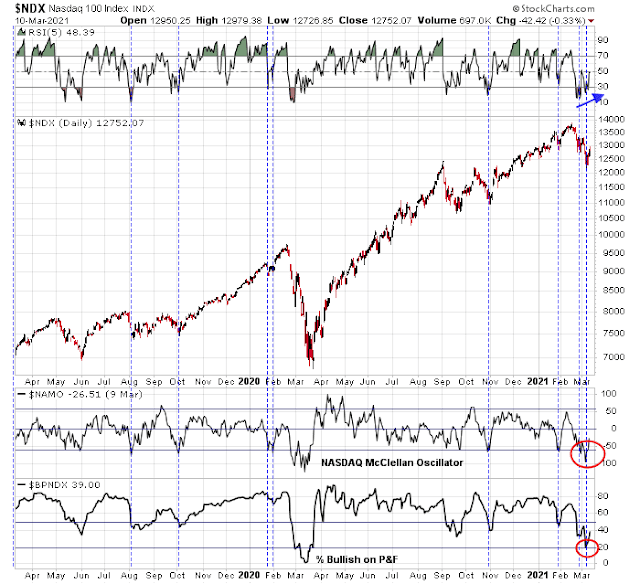

I had pointed out before that the NASDAQ McClellan Oscillator (NAMO) had become deeply oversold. As well, %Bullish on P&F had reached an oversold reading while the NASDAQ 100 was experiencing a positive 5-day RSI divergence. A relief rally was inevitable.

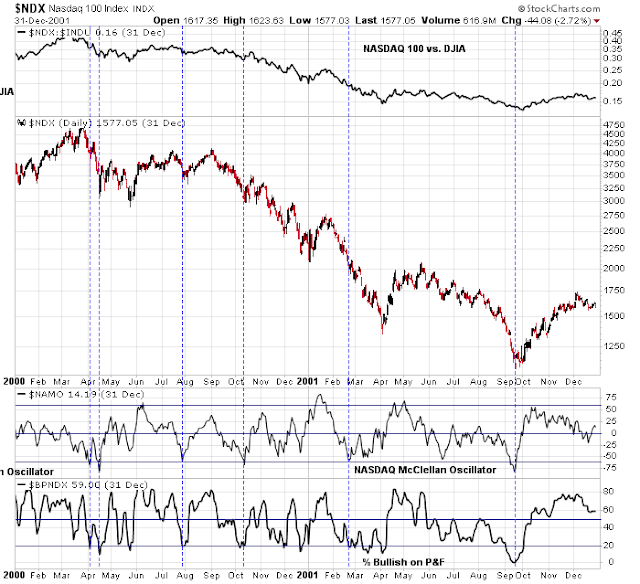

How far can the rebound run? For some clues, I looked at the behavior of the NASDAQ 100 in 2000 and 2001, which was the period after the dot-com bubble had burst. There were six episode during this period when NAMO had become oversold. The initial relief tally lasted between 4-7 calendar days. In three of the six instances, the index went on to rise further in the days ahead.

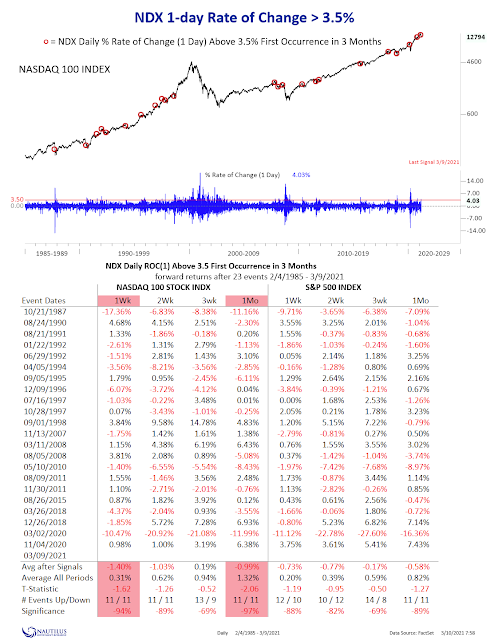

Here is further analysis indicating that the growth rebound is not sustainable. Nautilus Research studied how the NASDAQ 100 performed when it rose at least 3.5% for the first time in three months. The success rate of positive returns after one week was 50%, with an average return of -1.4%. The average after one month was -1.0%.

Growth bullish factors

I don’t mean to sound overly negative, there are some factors supportive of further gains in growth stocks. Risk appetite, as measured by Bitcoin is improving, though the relative performance of ARKK deteriorated today.

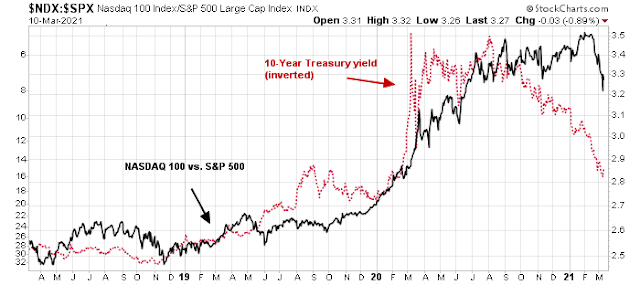

The relative performance of NDX is correlated with the bond market. The 10-year Treasury stabilized after a tame CPI print this morning, and the 10-year Treasury auction was relatively well-behaved.

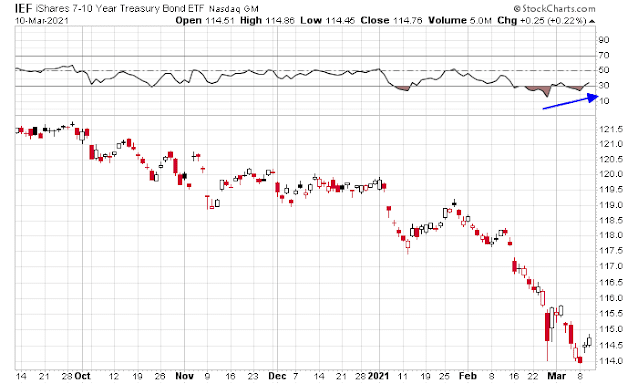

Bond prices appear to be bottoming after exhibiting a positive RSI divergence. This should be supportive of growth stocks in the short-term.

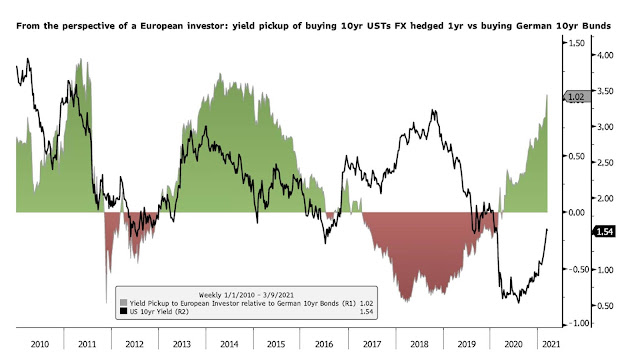

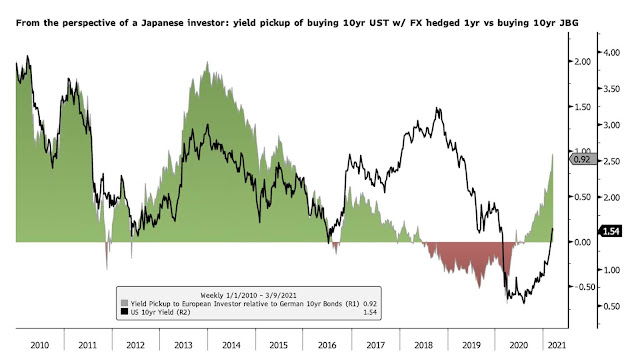

After the recent rise in yields, Treasuries should be attractive to foreign investors on a hedged basis (returns spreads are shown based on holding a 10-year Treasury with a one-year currency hedge).

S&P 500 outlook

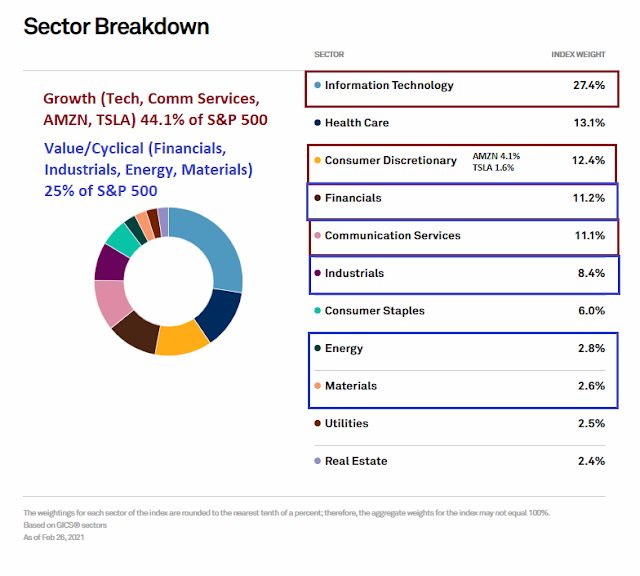

As growth and value markets diverge, forecasting the outlook for the S&P 500 is more difficult. Growth sectors represent 44.1% of index weight, while value and cyclical stocks make up 25% of the S&P 500. The 2000 and 2001 market template is not useful. The economy was just entering a recession then, but it is exiting a recession today.

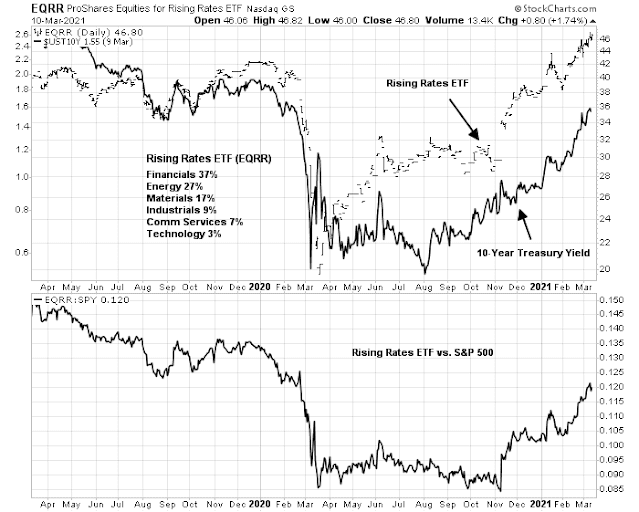

My best guess is therefore continued choppiness for the S&P 500 but investors should continue to overweight value over growth. The reflation and cyclical trade as represented by the Rising Rates ETF (EQRR) still has legs, and that will put upward pressure on Treasury yields which is bearish for growth.

Similar to what I noted about ten year yield on the previous post, EQRR is extended, and up to resistance levels. Will it ‘power through’, just like HRC?

https://www.youtube.com/watch?v=E96lAHygeIU&ab_channel=WashingtonFreeBeacon

I am closing my eyes, ears and brain while holding value and resources for the next while.

Whenever has the economy been goosed up with $600 Billion and then a further $1,900 billion (yes a trillion is one thousand billion) along with the normal $1,000 billion running deficit. That is $3.4 thousand billion in a country of 328 million (0.328 billion) or $10,700 for every man woman and child? No wonder Bitcoin is up.

Think of the young Robinhood crew getting another $1,600 check to reload.

Think of the Covid hospitalizations dropping toward zero.

Think of Powell and other Central bankers shouting they aren’t worried about inflation.

I’m forgetting technical and and any other types of analysis for a while and just looking to ride this enormous wave of cash like the Bosai waves of north Hawaii that come around not that often.

Ken

These guys are working to make the US Weimar Republic. Please don’t have any doubts. MMT is the new elixir, new fountain of youth (like estrogen was in the 1980s; not apologizing about estrogen as it was later redacted by “experts”)!

I hear you. But In the Weimar Republic investing in the Krupp Steel or Benz stock kept your wealth whole.

Agree. The stock market (and gold) did well. Eventually gold was the ultimate winner.

Remember when oil was worth -$5 /bbl

ARKK the new covid daily infections.

Bitcoin attempting to break out above 57K. But rally looks suspect to me.

GBTC at $50 trades at 4% discount to NA, not near previous high of $57. Maybe there is some arcane mechanical reason for this, idk, but not confirming bitcoin move. Maybe it reflects pessimism/skepticism, a good thing!

OBTC flat on it arse because opened at ridiculous premium, and still 20% over NAV.

Maybe one of the two Canadian BTC etfs will track better.

I don’t know many people that seriously thinks BTC is worth more than $1.

Agreed. Total scam. Worse than beanie babies.

Massive reflation coming, no doubt about it. Look at the soaring price of gold!!!

Gold gonna have to turn RIGHT NOW or looking like massive multi-year double top.

“turn RIGHT NOW”

Turn in what direction? Looks like you are saying turn “up”, based on next part of your statement (“or looking like massive multi-year double top”).

Yep, up. Daily chart:

https://tinyurl.com/a8uu73v3

The last ten bucks down looks like five waves to me. MACD ready for positive crossover? Double bottom in RSI? ROC holding above November bottom?

???

If the copper gold ratio favors copper, buy copper. Copper outperforms when the economy is expanding like now.

After first 13.8 million vaccinations, 640 serious adverse events reported.

https://www.cdc.gov/mmwr/volumes/70/wr/mm7008e3.htm

‘More reactogenicity was reported after the second dose of Pfizer-BioNTech than the first, particularly on the day after vaccination’

Can confirm. Felt nothing after the first shot, but had headache and felt lousy on the day after the second shot, on into the next day.

One year ago, the smart set was telling us to expect 5 million deaths, *likely more* because US has terrible, horrible, no good medical system. And fat cops.

“Felt nothing after the first shot”

Congratulations on your first shot. Hope you feel the same after your second shot.

because my friends after the second shot felt terrible!

Sorry, my Canadian friends who are waiting for vaccines.

“US has terrible, horrible, no good medical system”.

US has lost over 500K lives. That is just too many for an advanced, first world country. Perhaps for you, over half a million deaths indicates that US has a good medical system. I am not buying the argument.

Yes, relative to 5 million, 0.5 million is great. Honestly, US should have much much lower deaths.

Data indicates the US has a fantastic health care system when it comes to “acute care”. For chronic health care, the US is bad, just bad. There are better systems available.

“One year ago, the “smart set” was telling us to expect 5 million deaths”

You believe the “smart set”?

Its literally pay to live if you have a chronic illness. Out of money, out of time.

Ignore the “serious events”. This is known from the data published right out of the gate when Emergency Use approval (EUA) was given (see CDC website). There was never any questions about the adverse effects (except from the vaccine naysayers and there are plenty).

What would the bearish target be for the NDX ? A retest of the low? Or a break through the neck line (head & shoulder)?

As Charlie Bilello used to say:

Shanghaier (+2.36%)/ Hang higher (+1.65).

Trimming China/ Emerging Markets positions (to which I added on weakness yesterday)-> ASHR/ FXI/ EEM.

Closing EWZ for a total gain of +8.3% over two days.

Trimming NIO/ QS/ PLTR.

Trimming QQQ (basically, all the shares added yesterday on weakness).

Trimming GDX.

Trimming SMH.

The plan is pretty simple.

I added to many positions yesterday (emerging markets/ China in particular), and it makes sense to take profits on them. Brazil is an easy sell altogether @ +8%.

Trimming positions in growth/innovation in the premarket session (mainly positions added yesterday) gives me a buffer against which to manage the positions opened on Tuesday. I also have Cam’s dead cat bounce in the back of my mind – I think it’s possible to reopen all of them much lower in the coming days. So I may end up closing all positions at some point today.

Trimming ARKK.

All positions off here.

Still holding the index funds, which unfortunately (or perhaps fortunately) can’t be closed ’til end of day.

One-day/ two-day performances for the index funds:

(a) RYGBX (Rydex Long Bond): +0.3%/ -0.91% for a 2-day loss of -0.61%.

(b) RYOCX (Rydex QQQ): -0.35%/ +2.36% for a 2-day gain of +2.01%.

(c) RYPMX (Rydex Precious Metals): +0.74%/ +2.54% for a 2-day gain of +3.24%.

(d) VTIAX (Vanguard Int’s): +0.27%/ +1.39% for a 2-day gain of +1.66%.

(e) VEMAX (Vanguard Emerging Markets): +0.04%/ +2.81% for a 2-day gain of +2.85%.

It often pays to diversify. Gold miners performed best.

Overall a +1.7% 2-day gain for the entire portfolio.

Looking for another dip to reload.

That’s a great plan!

With S&P 500 above 3900, we may be looking at a break out. We saw this movie @ 3020, about 1000 points back.

With tech rallying today and bonds being bought, we are back to all time highs. Yes, we may retest the 1.65 on ten year note and that may give an opportunity to get into the market @ around 3720 level.

With 1.9 Trillion firepower, the call level activity is likely to remain high!

Watching a H&S formation on the Naz.

Right. So is everyone else, which can sometimes result in a curve ball. But I believe Cam has the ‘dead cat bounce’ right on this. A better entry/ reentry lies down the road – the trick is to discern how far down.

Personally, I tend to be early. Early in/ early out. I’ve learned to live with it. I’ll add further on weakness, which jacks up position size at an opportune time.

Off-topic day trades.

(a) GSAH. I traded a minor position in this SPAC yesterday from 11.20 (open) to 12.30 (close). Reopening a position here ~11.5x.

(b) AUPH. Opening a position ~13.5x.

GSAH off at 11.9x. Second round trades are usually less productive.

I plan to close VTIAX (int’l)/ VEMAX (emerging markets)/ RYPMX (precious metals)/ RYOCX (Rydex QQQ)/ RYGBX (Rydex long bond) end of day.

ARKK gotta be the short sale of the century here, amirite?

I don’t think so. The time to short ARKK was a month ago. Now that it’s corrected -30%, I really don’t understand why it’s suddenly a short.

ARKK and QQQ are not in short situation. It is possible for QQQ to make double top in todays situation. The rally or relief rally can last untill Monday. What do you think Rxchen2?

Well, my personality won’t be the same as yours. I’m more defensive than most. And as mentioned above, I tend to be early.

My take, fwiw-> take your gains today. Try reopening positions in the hole on Friday for another run-up on Monday. JMO.

I also tend to use a Rule of 3. Three up days, and I either trim or sell. Then reload. Hard to say whether Wednesday was an up day for the NDX – which is why I commented that the pullback may be bullish in the sense of setting up a more durable rally.

Well sure, a month ago, but now it bounced off the 200 day MA, and now it’s rallied up near declining 20 and 50 moving averages (coffin nail formation). Currently 128, MA 130-133. Should be free money shorting up a little higher. Next leg down coming up!

Just being devil’s advocate.

Reopening a few positions (sized down considerably, however).

EEM/ FXI/ ASHR/ BABA/ GDX. Proceeding with the assumption that early trades may fail, so keeping it small with tight stops.

Small position in RIDE, as it plummets -17%.

That was quick. Open 14.63/ Close 15.10.

All positions off for minor gains.

Some days it just feels like the market wants to suck you back in, and the right move is to walk away.

Starting a longer term position in Equal weighted consumer discretionary (RCD), trying to reduce exposure to AMZN.

This would fit into the reflationary, cyclical theme, but without mega cap tech, that is slowly wilting away, at least for now.

Gold is catching a bid here, despite treasuries selling off.