What should traders make of the pre-Christmas panic today? S&P 500 futures were down as much as -2.5% overnight. The market opened up down about -1.5%, but recovered most of its losses to a -0.4% retreat today. More importantly, the bulls were able to hold support at 3650.

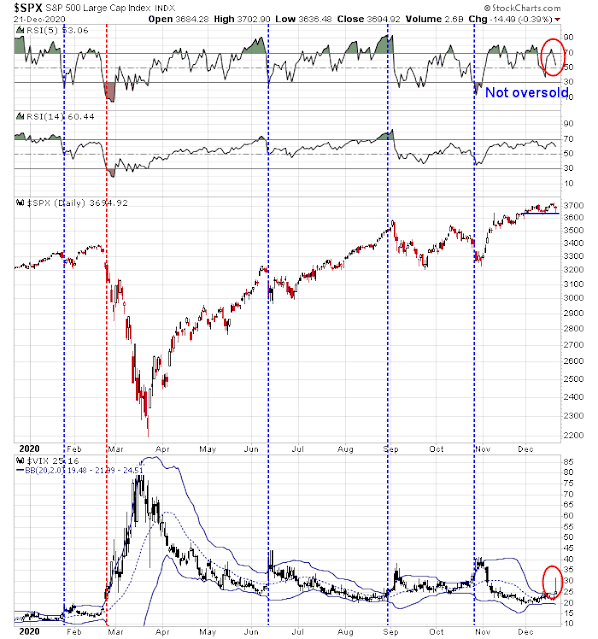

The VIX Index surged above its upper Bollinger Band, which is a sign of an oversold market. In the past year, most of the similar instances saw the market either rise or stabilize after VIX upper BB readings (blue vertical lines). The only exception occurred in February, when the market cratered as the news of the pandemic spooked risk appetite (red line). On the other hand, the 5-day RSI (top panel) is nowhere near an oversold condition.

The start of a major correction?

There is no doubt that sentiment indicators are greatly extended. It would be no surprise to see the stock market correct from these levels. Here is what I am watching.

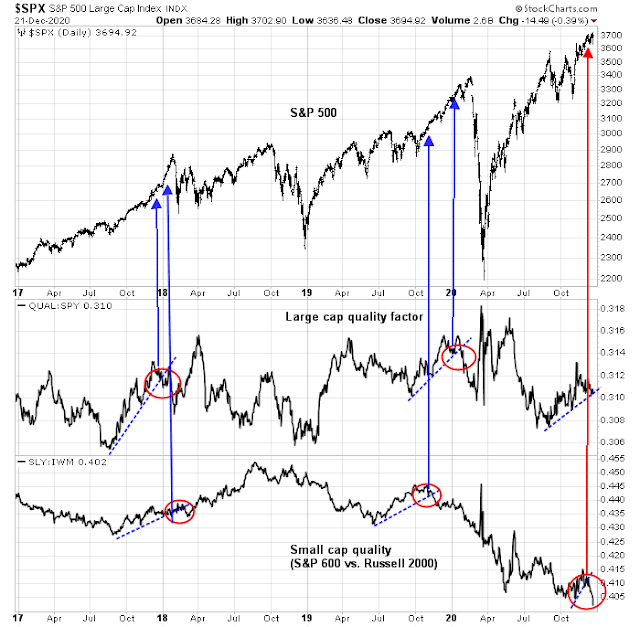

We already had an early warning from my quality factor tripwire. The past two melt-ups have ended with low-quality stock leadership. Low-quality small caps have already flashed a bearish signal. Large cap quality remains in a relative uptrend. Will it signal a correction too? The low-quality factor has been early to warn of market tops in the past.

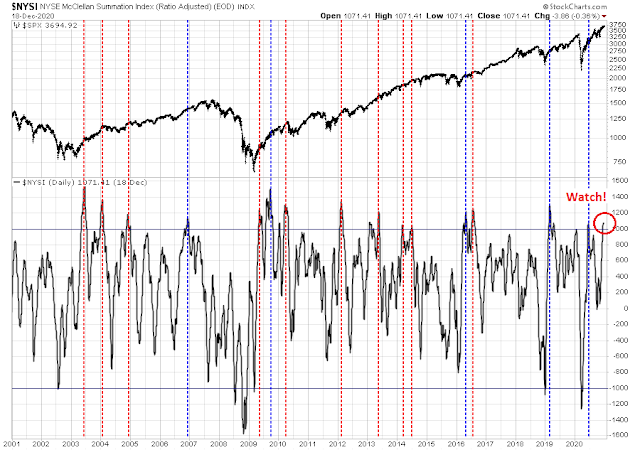

I am also watching the NYSE McClellan Summation Index (NYSI). In the last 20 years, NYSI readings of over 1000 have signaled either sideways consolidations or corrections about two-thirds of the time (red vertical lines). But market weakness does not occur until NYSI definitively rolls over. We are not there yet.

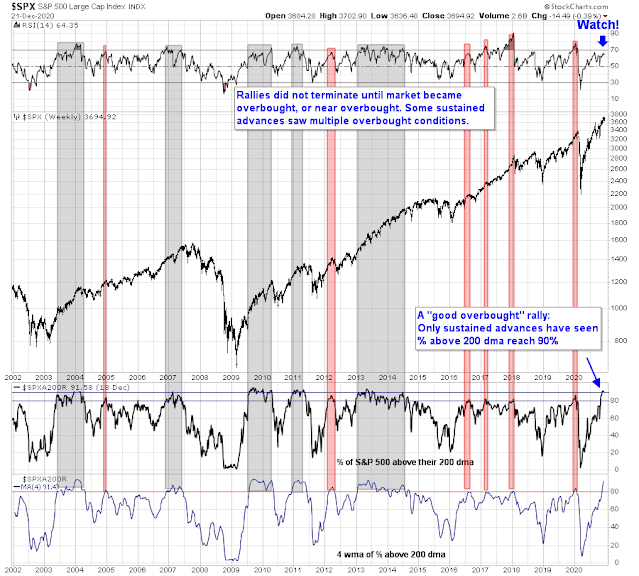

Finally, the % of S&P 500 stocks above their 200 dma surged over 90% recently. In the past, such conditions have been indications of a sustained advance. In most of all instances when this indicator rose about 80%, the market has not topped out until the weekly RSI reached an overbought condition of 70. This argues for further gains into year-end and possibly into 2021.

I am monitoring these indicators and keeping an open mind. In light of the seasonal tailwinds, my inner trader is giving the bull case the benefit of the doubt.

Disclosure: Long SPXL

What happens if the new strain Coronavirus reaches the US?

I guess we’ll just make another vaccine? The RNA vaccine tech is pretty amazing. Pfizer and Moderna were able to create a vaccine with a few weeks after sequencing the genome.

Its the safety trials and FDA approval process that takes about 2-3 years before public distribution.

“One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world.” – Jesse Livermore

I’m not necessarily convinced we’re in the eighth inning of the current rally, but if we use DeMark’s forecast of a two-week rally followed by a steep decline then the definition fits.

Purely from a common sense perspective:

1. We’ve had a great run off the March lows – against all odds.

2. The vaccine news + a second stimulus package are probably priced in at this point.

3. Now the virus has introduced the uncertainty of a mutation.

So the obvious move is to step aside, right? I think so.

That makes the contrarian trade a ST long.

Positions reopened in EEM/FXI/VEU/XLE/USO on pullbacks to the vicinity of yesterday’s lows.

Added a (re)starter position in RYSPX.

NIO.

GDX for an oversold bounce.

KRE.

VTV/ XLI.

Still waiting to see if the lows get retested. With AAPL trading up 3% today, I don’t think that’s going to happen.

Exactly. We all need to take a stand somewhere. If it fails, I trim/cut according to what I see on the tape. Right now, I’m adding back a few positions. The losses have been quite small, in the -0.15% neighborhood – I just don’t think it’s a great time to be aggressive. When the tape starts flying, so will I.

XME/ JETS.

That’s probably it. I just get the sense we have another ‘illogical’ move up in the offing.

Trimming back on a few positions.

Won’t be exercising much patience with today’s entries.

Sticking with about 80% of positions opened earlier today + adding a position in RYDHX (Rydex DJIA) at the close.

~25% invested, and currently -0.03% for the day (ie, giving back about 1/3 of yesterday’s gains) – that’s about as tight as leash as I’m able to exercise.

Bears were unable to capitalize on a -400-point decline in the DJIA amidst news of a coronavirus mutation.

I had expected perhaps a second attempt today to take the indexes down. That didn’t happen.

The path of least resistance now appears to be >3700 for the SPX.

Adding to a few positions on strength.

Hopefully traders finished testing the downside on Monday and Tuesday. Now they test the upside.

Trimming back on a few positions here ->USO/ XLE/ XME/ PLTR/ KRE.

Trimming back on VEU/ RIG.

Closing all positions in EEM/ FXI.

Closing all positions in VTV/ XLI/ XME.

All remaining positions off at the close.

QS @ 108.

QS off @ 113.

My sense is that traders fired off a great deal of bullish ammo today, and we may see another buying opp either tomorrow or next week.