Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

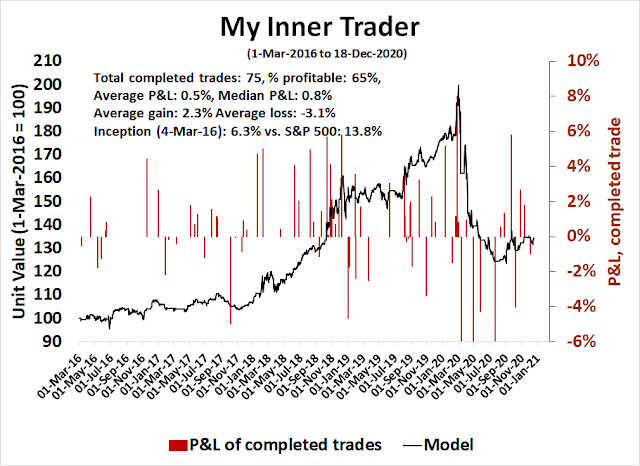

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The Santa Claus effect

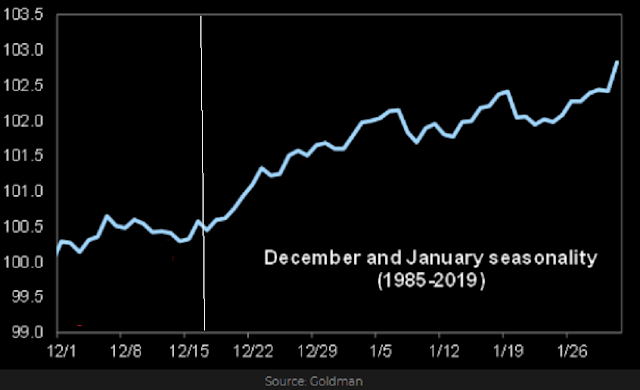

Is Santa coming to town? Historical studies have documented that seasonal strength usually starts about mid-December and continues into January.

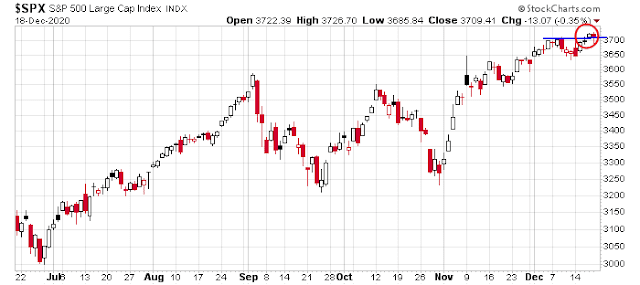

Right on cue, the S&P 500 staged an upside breakout to a fresh all-time high last Thursday, though it pulled back Friday and the breakout held, though just barely.

How to play the Santa rally

How should traders position for seasonal strength? The most straightforward way is to stay long the equity market. Global breadth is surging, and history has shown that to be intermediate-term bullish.

Georgia on my mind

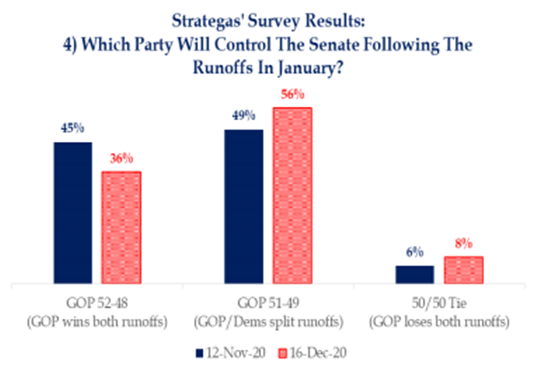

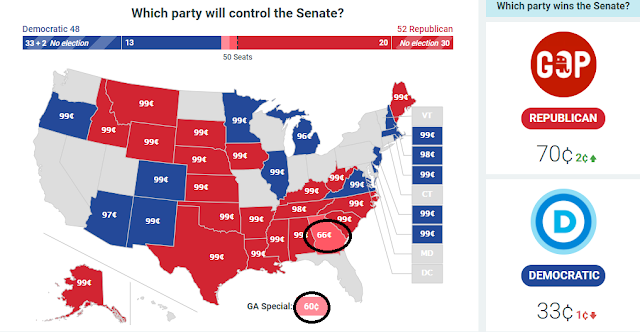

The market could see an additional boost from the Georgia senate elections, scheduled for January 5, 2021. Currently, the Republicans hold a 50-48 seat edge, and the Democrats need to win both Georgia races to win control, as Vice-President Harris would cast the tie breaking vote in case of a deadlock.

According to Strategas, the vast majority of institutional investors expect the Republicans to retain control.

Over at the PredictIt betting markets, the market is giving a 70% chance that the Republicans will retain control. Individual odds on the Georgia senate election vary between 60-65%. In practice, they may be thought of as a single race since the voting is expected to be correlated with the other.

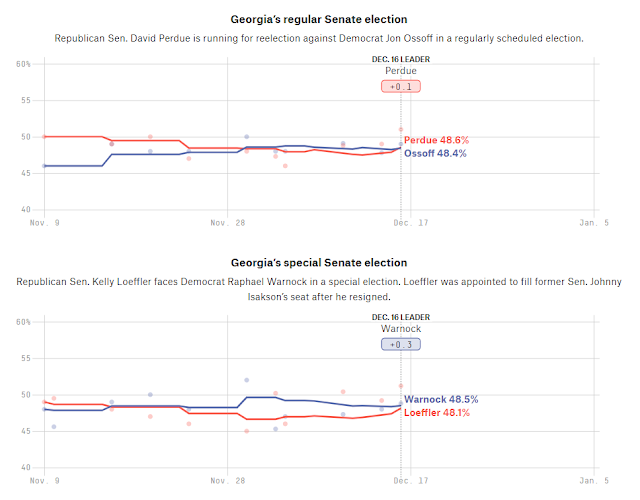

FiveThirtyEight’s compilation of polling averages show that the competing candidates are neck-and-neck and within a hair of each other. It wouldn’t take much of a swing for the Democrats to win both races.

A Democratic win would be interpreted as a somewhat unexpected positive surprise for the markets. Democratic control of all legislative branches of government would translate to a large stimulus bill much in the shape of the $3 trillion package passed by the House.

What’s the upside potential?

How far can a Santa Claus rally run?

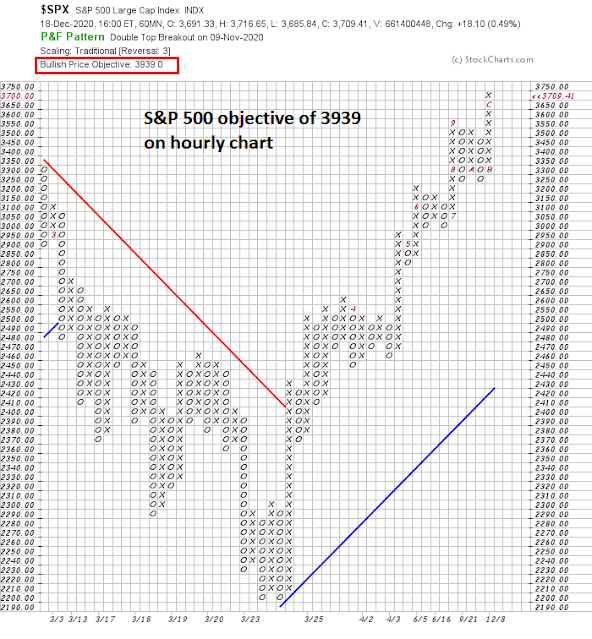

Marketwatch reported that technical analyst Tom DeMark has an S&P 500 target of 3907 two weeks from now.

Ask Tom DeMark how confident he is about his most recent equity-market timing call and he will imply that it is almost a no-brainer from his perspective.

“I’ve been stubborn and obstinate about 3,907 since November,” DeMark told MarketWatch in an exclusive phone interview Thursday morning.

However, he thinks that the January peak will represent the high for the first half of 2021.

But there is a catch to that late-year equity surge. The technical analyst says that it is likely to represent a top for stocks and estimates that the S&P 500 in the first half of 2021 is likely to decline by 5% to 11%, based on his models and the natural tendencies of assets in a downtrend.

A point and figure chart of the hourly S&P 500 indicates an upside objective of 3939. DeMark’s 3907 target is certainly within that ballpark.

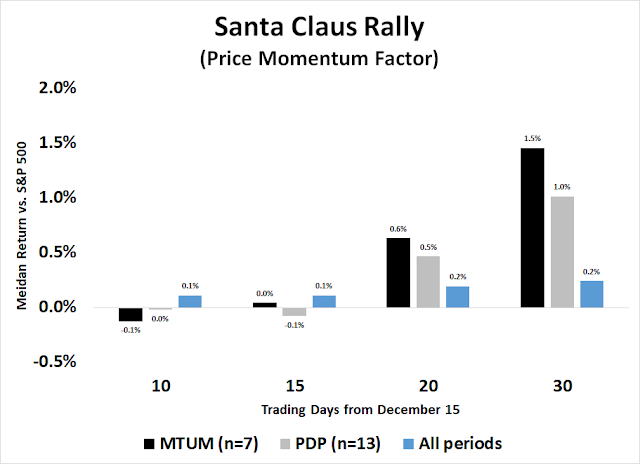

Outperforming the rally

Having established that the odds favor a Santa Claus rally, the issue of outperforming the rally is a little bit trickier. Here are some clues from history. I made a study of the price momentum factor during this period. There are several ways of measuring momentum, the two longest existing momentum ETFs are MTUM and PDP. I analyzed whether MTUM or PDP outperformed the S&P 500 over differing time horizons, starting from December 15. As the chart below shows, there is little or no price momentum or reversal effect 10 trading days (or approximately until year-end) and 15 trading days (first week of January) after December 15. However, momentum begins to assert itself after the first week, and continues to beat the market until the 30 trading days (end of January).

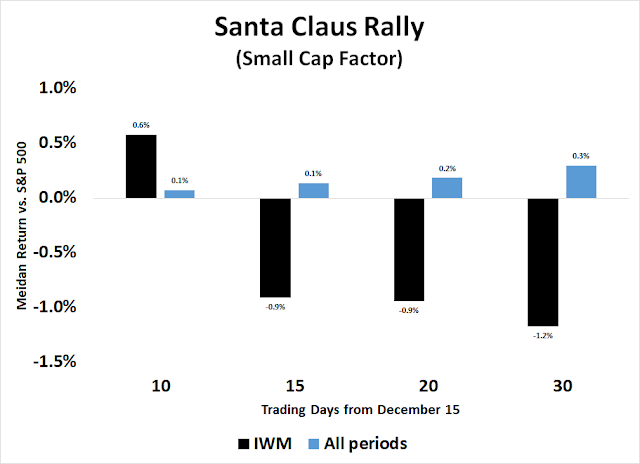

What about small caps? The return pattern is very different than price momentum. The Russell 2000 has tended to beat the S&P 500 into year-end, but reversed itself in January.

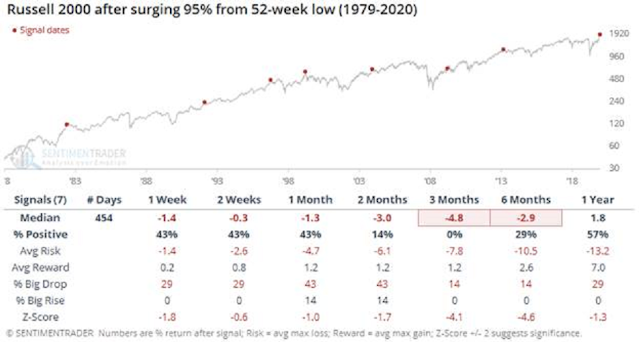

A word of caution is in order for traders thinking about jumping on the small cap bandwagon in 2020. The Russell 2000 has doubled since the March bottom.

Analysis from SentimenTrader showed that sudden surges in the Russell 2000 off a major low have resolved themselves with a period of correction and consolidation.

Trying to beat the market during a Santa Claus rally is at best a guessing game. In the spirit of the season, the following picture epitomizes the trader’s dilemma. Is this a simple nativity scene, or a picture of two T-Rexes?

Disclosure: Long SPXL

The Momentum ETF was outperforming until November 9, Vaccine Twist day, Here is the momentum analysis of Momentum ETF

https://product.datastream.com/dscharting/gateway.aspx?guid=34f8f86d-6de4-4349-bf4d-bc164b89ccdf&action=REFRESH

We are now in a classic French/Fama quant ‘Momentum Crash’ That is when the long high momentum/short low momentum index falls dramatically because the low momentum group surges up dramatically as the high momentum lags. This happens coming out of a recession as the stressed stocks in the low momentum shoot up. That is what is happening now as Value and Small Cap that used to underperform are flying after the Vaccine announcement and the Growth area that is in the high momentum is lagging.

If history is a guide, Value will lead for about a year and therefore Momentum ETFs will underperform. A year is about the extent of the Value outperformance in the past (2009-2010 and 2016) and ‘Momentum Crashes’

Here is a surprise that would get stocks going up.

Everyone believes the Senate split after the Georgia election will determine every vote. They see the Senate like a parliamentary system where all members must vote along party lines. McConnell has certainly forced this during the Obama years to shut him down.

In Biden’s past Senate days, Right leaning Dems and and left leaning GOPs would often support the bills of the other party. Many times, bill would be co-sponsored across the aisle. If Biden can get some shifting or compromising along those lines, that could mean great things for clean energy for instance or infrastructure. I believe the market would celebrate this.

This is from my Factor Observations piece this weekend.

Last week I wrote about why the Tactical Factor background was not indicating a peak in stock markets. I have also written about how this is a new longer-term bull market in Value Factor. Many investors sense that we are at expensively high prices for stocks. That is, in my opinion, because we are ‘anchoring’ on the low, March Covid crash prices and not on intrinsic value.

The S&P 500 general market index is up about 10% from its February peak price. Is that high or reasonable? In my mind it is very reasonable because we have some new and very positive information to factor into valuation. Central Bankers, we now know, will go to any lengths necessary to support liquidity in the economy and stability in debt and equity markets. That is new information that substantially reduces the risk of stock investing. Global governments, we also now know, will also unleash fast and effective amazing amounts of fiscal support to workers and companies. Another big reduction in risk of stock investing. We also now know that corporate dividends will keep being paid even during depression-like economic conditions. When the pandemic hit, analysts projected a decline of over 50% in dividend payments. The number will be very much lower. The current yield on stocks is much higher than government bonds and now will be seen as very reliable. Plus, we have a commitment by Central Bankers to keep interest rates extremely low for many years even if inflation rises. Stocks are an inflation hedge. Added to all these positives is the incredible geniuses in biotech industry mobilizing incredibly fast. Technology can solve problems.

Everyone interested in blockbuster returns should focus on biotech into the future. Moderna nailed down its target mRNA protein structure in two days from candidates of less than 10. This demonstrates how far we have advanced in the field of computational genetics. Other companies will no doubt develop similar capabilities in an accelerated manner.

It’s been 30 years since Craig Venter leading the genome decoding project to completion. With ever more powerful computers and ever more advanced algos (recursive and self-learning and self-replicating, in a word, like embryo growth process), the world is on the cusp of bio revolution which has the very high potential to completely change our concept of sickness, disease, death, and finally personal relationship/behavior.

Everything is on time-compression scale, include stock returns, with the aid of computation/big data. Be prepared for next wholesale change: regenerative medicine. It’s been 20+ years since the first false start, and this field should get out of consolidation right by now, scientifically speaking.

“Bubbles go to unimaginable extremes, then double.” –Doug Noland

Thank You Ken for your keen insights. We subscribers always find then useful and informative in our investments/trading. As opposed to Ken who is more long term oriented, I am a successful short term momentum trader. Trading mostly the indexes (QQQ). I spend most of the time looking for ‘tells’ and the markets reaction to them. Here is what I am presently watching:

1. The dollar index is very oversold and mostly likely will rally.

2. There is an RSI divergence between the QQQ making a new high and the 5 or 14 day RSI.

3. The new high in the QQQ has not been confirmed by the semi-conductor index i.e. SMH.

4. The market reaction to news, now that impasse for the additional funding has been resolved.

If the market ignores all these issues we will know that the rally has legs. On the other hand, if it stalls we will know it could be the start of a pullback. Again, I will look for the market pullback to tell me if it is a small correction or start of something big.

‘The big story of Q4 2020 is not sector rotation and it’s not Value > Growth (even though your favorite financial news network may paint it that way). The real story is a rotation away from Largecaps and into Smallcap stocks. ‘

https://murphycharts.substack.com/p/size-matters

A good TA post on commodities, uranium, emerging markets, etc.

https://allstarcharts.com/things-investors-dont-buy-bear-markets/

‘Red sky in the morning, sailors take warning.’ One of many nautical phrases that Bill Cara carries over into trading.

I think cooler heads will prevail.

Reopening a few positions premarket->XLE/ USO/ RIG/ JETS.

I notice the banking sector is holding up.

Adding EEM.

Placing low-ball offers for OIH/XME.

Buying the dip seems too easy.

Plan A will be to sell into a ‘buy the dip’ response in the first thirty minutes. Then buy again into the countermove.

Plan B is add to existing position on further declines in the first thirty minutes.

All positions closed. Will be looking for reentries – which also seems too easy, so I would give 50/50 odds that the market will even allow me to reopen lower.

I moved to the sidelines. This doesnt look like bullish price action.

Much of the buying this morning seems reflexive, as buying into a Monday selloff has worked so well this year.

But is it the right move this time around? The DJIA is now just -200 points, relative to a -500-point decline in overnight futures. I would be more inclined to open a longer-term position if it revisits those levels.

Reopening a few starter positions with the DJIA down now ~ -400 points.

KRE/ XLF/ XLI/ VT.

Taking +1% gains in KRE/ XLF.

Closing XLI also for a +1% gain.

FXI/ EWZ/ ETCG.

Yeah, weighing if that was the low for the week. It doesn’t seem like it

All positions off here.

I was able to add about +0.1% to the portfolio.

For some reason, I just don’t trust the morning bounce.

What exactly are the implications of a mutation in the Covid-19 virus – does anyone know?

https://apnews.com/article/new-coronavirus-strain-england-explainer-74ea2d47820b8dcac02f95ad9440f533

I see phrases like ‘unlikely,’ ‘probably not,’ ‘not “inexistent”,’ and ‘I’m not concerned.’ Which is the kind of thing that always concerns me.

The fear is the vaccine will not work on the new strains… but the vaccine hasn’t even gone into wide distribution yet.

I’m just going to wait and see. Not worth expending cycles gaming out another crash. Next year is less than two weeks away.

Anyone with a take here? Are ETFs (SPY/IWM/QQQ/VT/VEU) a buy? Or do traders caught on the wrong side this morning decide to sell? I’m not sensing a strong case either way.

What’s DeMark himself doing right now? Given his stated level of confidence, he should have backed up the truck this morning.

UK borders close

France closed its border with the UK for 48 hours

Dover closed

Kent Police, Operation Stack

Manston Airport site in Kent, 4,000 lorry park

About 10,000 lorries a day

Unaccompanied freight allowed

Eurotunnel, France

Eurostar, Belgium

Flights from UK suspended to more than 40 countries

Germany, Italy, Belgium, Irish Republic, Turkey, Canada, Switzerland, India, HK, Ireland, Israel, Saudi Arabia, Kuwait, Russia

Cases, + 35,928 + 33,364 = 2,073,511

Deaths, + 362 + 215 = 67, 616

Deaths, + 3,160 (7 days) = 76,287

Matt Hancock, new variant of the virus is getting out of control

London and south-east England

2020 12, N 501 Y mutation

Asparagine (N) to Tyrosine (Y)

Receptor-binding domain

Replacing other variants

D614G

Aspartate (D) to Glycine (G)

Right place at the right time – founder effect

More contagious

? more virus in upper airway

September, first detection

November, London, about 25% of cases

December, London, over 60% of cases

Where did it come from?

High levels of genomic monitoring in the UK

Has spread from UK to Denmark, Australia, Netherlands

Accumulated number of global mutations, 12,000

Viruses entered the UK 1,300 times

Mink mutation

Two amino acids deletion (69-70) same as 2020 12

Three amino acid replacements in position 453, 692 and 1229 (Y453F, I692V and M1229I) different to 2020 12

Not sure why, but today’s impressive recovery feels more like an opportunity to unload positions than it does a reason to get back in the saddle.

Do not forget momentum is strong and seasonality in December also.

Right. Thanks for the reminder!

Plan A for Tuesday = buying a retest of SPX 3636 – which seems unlikely right now, but today’s closing prices just weren’t that attractive.