Q2 earnings season is now past the halfway mark. So far 63% of the market has reported. FactSet reported the EPS beat rate rose to 84% from 81% the previous week. The sales beat rate was fell to 69% from 71% the previous week. Both the EPS and sales beat rates are ahead of their 5-year averages.

The bottom-up consensus forward 12-month estimate rose 1.03% last week after a strong 1.05% the previous week The market is trading at a forward P/E of 22.0, which is well ahead of historical norms.

Strong positive revisions

Wall Street analysts have been increasing upbeat on the outlook of individual companies. Though the weekly changes in quarterly EPS estimates can be noisy, analysts have upgraded quarterly earnings estimates across the board, except for Q4 2020 earnings. Q2 2020 revisions were especially strong.

Company earnings guidance offered a “good news, bad news” message. The good news is guidance has been extremely positive, compared to the historical experience of negative earnings guidance has swamped positive ones. The bad news is over half of the companies have withdrawn guidance, citing pandemic related uncertainty. Deprived of guidance, many analysts are flying blind, which creates greater uncertainty in EPS estimates.

From the ground up

Courtesy of The Transcript, which monitors the earnings calls, the main feature last week was Big Tech strength.

There were a lot of major data points about the economy last week but the biggest news of all seemed to be just how well tech companies did despite the massive economic dislocation. In a quarter where GDP fell at a 33% annualized rate, Apple managed to grow revenue by 11%! Stimulus probably played some role in tech companies’ strong performance, but beyond the stimulus is the fact that COVID has pushed everyone to spend even more time at home and on the internet. The behavioral shifts appear to be long-lasting too. 20 years after the dot com bubble, the internet is still not done reshaping society.

Here is a brief summary of the macro outlook:

- The current economic downturn is the most severe in our lifetime (Federal Reserve, BLS)

- Earnings reports are showing that many companies are under intense pressure (General Electric, Honeywell)

- But tech and payments companies are booming (Apple, Amazon, Shopify, Paypal)

- And housing is booming too (Redfin, Boston Properties, Freddie Mac’s)

- The economy has continued to improve in July (Mastercard, McDonald’s, Starbucks, Redfin)

- Thank you government stimulus (Apple, Facebook Snap-On, Redfin, United Parcel Service, On Deck Capital)

- However, the economy is still in a deep, deep hole (CBOE, Boston Properties)

- And COVID could continue to be with us for a while (Boston Properties)

The valuation debate

One nagging issue with the equity rebound off the March lows is valuation. The market is trading at a forward P/E of 22.0, which is well ahead of the 5-year average of 17.0 and 10-year average of 15.3. There has been much discussion whether these historically high valuations are justified.

One way of thinking about the market is to separate the large cap FANG+ names from the rest of the market. Assuming that 2020 earnings are a disaster that can be ignored and investors should consider 2021 earnings for a more normalized view of P/E multiples, the top 5 stocks in the index trade at a FY2 P/E of 31, compared to 18 for the rest of the index. We can make a couple of observations from this analysis.

- Top 5 stock FY2 P/E ratios are not high compared to the dot-com era. There is a difference between the 1990’s NASDAQ bubble and today. The dot-com bubble was dominated by companies with little or no profitability, which drove up P/E ratios, while today’s FANG+ stocks are profitable with competitive moats.

- The FY2 P/E of the bottom 495 is still quite elevated by historical standards.

One signal of an overvalued market is excessive equity financings. If stocks are expensive, then companies prefer financing with cheap equity over expensive debt. That was one characteristic of the dot-com era, whose financing landscape was flooded with IPOs that skyrocketed on the first day of trading. FactSet reported that IPO activity is not excessively high by historical standards.

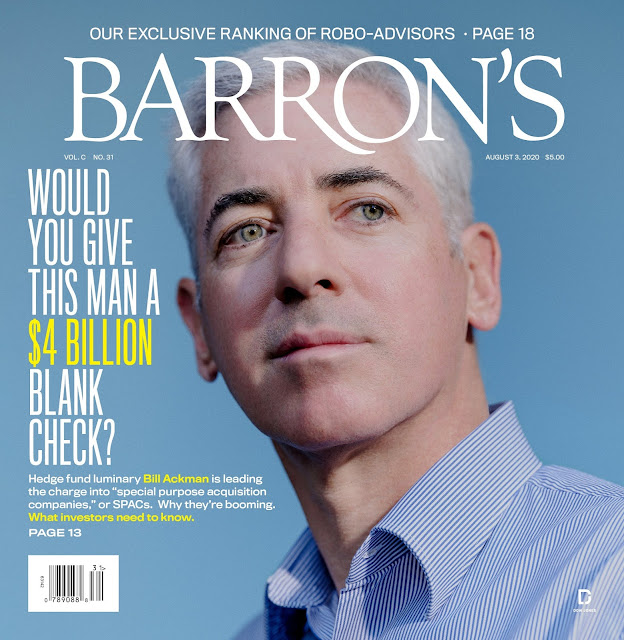

However, the froth in this market has turned from IPO to the SPAC, or “Special Purpose Acquisition Company”. The Economist explained the SPAC this way:

An empty vessel can accommodate all manner of dreams. This trait helps explain the growing allure of the “special purpose acquisition company” (SPAC), a shell company listed on the stock exchange with a view to merging it with a real business. Ventures such as Virgin Galactic, in space tourism, and Nikola, in electric vehicles, have become listed companies by this route. Silicon Valley’s dream factory spies a way to sidestep the trials of an initial public offering (IPO). Bill Ackman, a shrewd hedge-fund manager, has just raised a $4bn mega-SPAC. He is looking for a unicorn to make a home in his empty store.

The view in Silicon Valley is that an IPO is a rotten process. There is typically a fixed fee, of up to 7% of the sum raised. And the value of the company is lowballed, say tech types, to allow for a satisfying first-day “pop” in the share price. Yet cost is not the only bugbear—and, perhaps, not even the main one. What entrepreneurs and their venture-capital backers hate about the IPO is the loss of control. They are used to being big shots in Silicon Valley. They do not like deferring to Wall Street types at all.

In effect, the SPAC is an IPO hack. It’s a way to get around the fees of the IPO.

Enter the SPAC, which is a sort of pre-cooked IPO. A shell company is set up by a sponsor. The SPAC is listed on the stock exchange via an IPO. The sponsor then finds a private business for the SPAC to acquire with the proceeds. Typically this will be a late-stage (ie, fairly mature) private company, whose owners and venture-capital backers are looking to cash out. The private company merges with the SPAC, following a shareholder vote. It is then a public company.

The usual fee for the sponsor is 20% of the equity, which is a way of compensating him and the SPAC management team. The concept of the SPAC is not new. At the height of the South Sea Bubble, one company raised money “for carrying out an undertaking of great advantage, but nobody to know what it is”. For investors, they are bearing the risk of writing a blank check to a sponsor, and hoping that he can find the next Virgin Galactic, Nikola, or “undertaking of great advantage”.

Barron’s this week featured an article highlighting the issues surrounding SPACs. Reuters also reported that Billy Beane, of Moneyball fame, is looking to raise a $500-million SPAC.

Is the SPAC frenzy the 2020 version of the dot-com IPO bubble? Is SPAC activity a signal equity capital has become too cheap?

Another bull case for elevated P/E valuations is low interest rates. BCA Research pointed out that falling real rates are not only bullish for gold, but they are also bullish for P/E multiples as well.

Earnings risk

John Hempton at Bronte Capital had the following thoughts about P/E ratios, interest rates, and valuations. It’s understandable why high growth companies like AAPL and GOOG attract high P/E multiples, but what about boring businesses like KO?

Interest rates are indeed low. If you believe that interest rates stay at zero forever then stocks whose earnings are unlikely to decline much (such as say The Coca Cola Company) should be valued at very high PE ratios.

Rather than just focus on P/E multiples, Hempton thinks that earnings are at risk:

We think – instinctively – that the aggregate earnings capacity of US business is at risk…

The corollary is that profit share is at historic highs, indeed, astonishing highs. Almost everywhere you look in the US you see companies that earn more than you would expect. Our personal favorite is Lamb Weston, which makes wholesale potato chips (fries to Americans) delivered to restaurants that wind up on your plate/hips. The 2019 operating margin of Lamb Weston is almost 18 percent. The operating margin of Apple, by comparison, is under 25 percent. The idea that a company whose sole job is to buy potatoes from farmers, chop them up, freeze them and deliver them to restaurants can earn margins even close to Apple is astonishing.

But what we see for Lamb Weston we see right across American society.

The American market is at above-average multiples of massively-above-average profits. Competition should usually drive down profit share, and democratic politics has – at least in theory and cyclically – some kind of redistributive effect.

While Hempton is concerned about the long-term trajectory of operating margins and earnings, the near term earnings outlook also faces downside risk. US households are falling off a fiscal cliff (see Fiscal cliff = Double dip). At publication time, the White House is still negotiating with the Democrats on a rescue package, but there is an enormous gulf in each side’s budget priorities.

Setting aside the economic and political pros and cons of each side’s proposals, here is the legislative math. There are about 15-20 Republican Senators who are adamantly against any further stimulus for philosophical reasons. To pass a rescue bill, the White House and Republican Senate leadership will need substantial support from the Democrats. As an illustration of Republican disunity, former Fed governor nominee Stephen Moore wrote a WSJ op-ed that blamed both the Democrats and Senate Republicans for the failure to pass a relief bill [emphasis added].

President Trump needs to reset the debate on the latest coronavirus relief bill. Senate Republicans have scuttled their best pro-growth idea—a payroll tax cut—and instead released a $1 trillion spending bill. Last week Mr. Trump acknowledged that compromising with Speaker Nancy Pelosi is a fool’s errand, because the House won’t agree to anything that boosts growth and job creation. The Democratic plan includes a six-month extension of the $600-a-week unemployment bonus and $3 trillion in new spending. It would sink the economy and imperil Mr. Trump’s re-election.

The lack of a Republican united front puts the Democrats in the driver’s seat if a CARES Act 2.0 is to be passed. What will they ask in return? How about most of the provisions of the $3 trillion HEROS Act passed in the House? What about funding for the Post Office to facilitate universal mail-in voting in November?

The Washington Post reported that “Pelosi, Mnuchin and Meadows all appeared on talk shows Sunday morning and indicated they were not close to a deal”. At some point, each side will have to make the political calculation of what they want and what they are willing to give up in order to a rescue package, compared to allowing the economy to go over a cliff and blame the other side. Viewed from that perspective, the odds of a deal are slim.

Stresses are already appearing in the economy in the form of skyrocketing bankruptcies, and that’s before the economy fell off the fiscal cliff.

The July Jobs Report has the potential to be a big negative surprise. Indeed.com reported that, even in an outperforming industry like tech, job growth has been stagnant.

Something’s gotta give. Street analysts have been revising EPS estimates upward, but the near-term downside risk in EPS estimate revisions is enormous. If and when they start falling, expect stock prices to adjust downwards accordingly.

Chart Reader’s Take — My shorts felt pretty good last Friday up to 1:00pm with the S&P at 3220. Then the 50pt reversal to 3271 gave my shorts a wake-up call. Today with the S&P swooshing past the last real resistance level of 3280, my shorts have a real belly ache. Next resistance level is 3360, very close to the bull market high back on 2/21/20.

If Big Tech managed a few surprises, why not Congress? What about either the jobs report or the reaction to the jobs report?

1. Much of the talk show rhetoric may be verbal posturing – ahead of another last-minute record-setting stimulus package.

2. A jobs report that disappoints may be the catalyst for consensus re a pull-out-the stops package. Whereas a better-than-expected jobs report will fuel the recovery story. Either outcome may be enough to catalyze another leg higher.

I agree. It Is just usual posturing in any negotiation. Eventually, Trump needs to pass a relief bill. He cannot be seen doing nothing. He will capitulate and concede to most of the demands of the Democrats. Pelosi has been getting what she wants.

If the July Jobs Report is poor, it will galvanize both parties to act quickly. But the CARES 2.0 Act will be signed.

Imagine that the economic data looks catastrophic, but they need Democratic votes in the Senate to pass the bill. Imagine what the Schumer could ask for:

Funding for the Post Office and universal no excuse vote by mail?

What about a provision that any presidential candidate has to release 10 years of tax returns to be on the ballot?

We can all sit here and talk about what needs to be done, and what Trump might do to get a deal done. But what are his red lines?

Currently Pelosi and Schumer are pushing for US Postal Service and reinstatement of the SALT tax benefit. SALT changes really cut NY and CA budgets and despite the fact that NY and CA are revenue generating states more goes to Feds now in a time of dire need with state and local govts hurting. However USPS and SALT are super unpopular among GOP Senators. This may take awhile.

My personal view and position on the stimulus odds have changed in the past day. I think today’s talks signaled that she has the upper hand based on her statements, Mnuchin’s and McConnell’s. Think we are getting a ~$3T package and think Trump is in major trouble politically. The package is going to include mail in voting, and with Trump’s current polling he is not favored to win.

A $3T deal is possible if Pelosi plays her cards right. But given Trump’s past behavior pattern, I find it difficult to believe that he would drink from that mail-in poisoned chalice which he perceives to be electoral suicide.

Right now, you bet $0.60 and get $1.00 (minus fees) if Biden wins, and bet $0.42 and get $1.00 (minus fees) if Trump wins. These betting odds are not too far from 50/50, a coin toss.

The confidence in Biden victory is not shared by the betting markets. The bet amount should be closer to $0.90 for Biden and $0.10 for Trump if Trump is so likely to lose.

May be these markets are biased!

A question. Won’t Trump take the full credit if the Congress manages to pass a $3trn bill? Won’t this benefit him politically (with the except of funds for mail-in voting) as voters may consider this a munificence from him?

I doubt if an average American voter follows the sausage-making process so closely as to consider this bounty from Pelosi/Schumer vs. Trump.

Guys please check out this podcast. https://anchor.fm/chris-dark/episodes/25-Discussions-with-FedUpBizOwner-Part-1-of-At-the-Coal-Face-ehlsnl I found it really illuminating and helped me see the strength of Pelosi and Schumer’s position. What she has going for her right now:

-20 Tea Party GOP will not support any bill costing anything at all, so McConnell must partner with Dems

-Trump is behind 8-12 points in polls and highly unlikely to win unless they are allowed to defund US Postal Service

-Pelosi, Schumer, Mnuchin and Meadows meeting with US Postmaster General tomorrow. Mail in voting will absolutely be in this bill.

Now Mnuchin is signaling deal by Fri and Pelosi is very confident in her PBS News Hour interview today.

I think GOP comes out of this looking disorganized and Pelosi/ Schumer get their wish list in this bill. I don’t think Trump gets credit for stock market any more than they do, and he has 150K deaths on his watch which is harming his odds with older voters. What I’m not 100% sure on is timing of when it will be passed, but I think the GOP Senators are not aligning with Trump so it may come faster than expected.

Under what scenario can Congress and the White House achieve an agreement?

Elements of the Tea Party Senate Republicans will not vote for a rescue, which puts the Democrats in control. Pelosi and Schumer know that and they’ll ask for the moon. Will Trump and McConnell commit electoral suicide by giving the Democrats everything they want?

As we are getting close to the election, each side will be prioritizing their own political survival over the urgency of a rescue package.

I think both sides know the red lines for the other side, and they won’t cross it.

Pelosi and Schumer won’t ask for a provision to release 10 years of tax returns to be on the ballot. Trump, Mnuchin and McConnell know that Democrats won’t agree to an additional $200 per week of unemployment income either. May be they meet midway around $400/wk.

Democrats also know that Trump is still the President and has the bully pulpit. They may not want to give him a stick to beat Biden/Democrats with.

I am not privy to the details but I think it is in the interest of both parties to come to an agreement before the election. And, they will do so.

Sanjay agree that they will come to some agreement but every week that goes by Americans are not spending $600/ week that they previously had and are being evicted. The market consensus is currently that they will “work it out.” I think it is worth market participants following every bit of progress on this stimulus package. Today Meadows contradicted Mnuchin and said they are “very far” from a deal and McConnell seems even further from a deal than they are because of the 15-20 GOP Senators who said they will not sign any of these bills. No one has any idea when the market react (wish I knew) but fact is that is less liquidity to purchase iPhones, Amazon merchandise etc. In the meantime yes momentum is very strong but seems like complacency is too.

Yes, I expect there will be some delays which will unfortunately affect some people and also hold up some spending.

But I still expect a compromise and a bill in the next week or two.

My view on stimulus has changed as of today for what it is worth. Think Pelosi/ Schumer have the upper hand and will have a deal sooner than expected. Looks like GOP is caving.

Talk is that the President will do some magic with executive orders. What that will be I don’t know. They don’t plan to give in to Pelosi and will let her go on recess with a do nothing, impeachment sham Congress.

Cam,

How can we be sure that an adverse jobs report will have a negative effect on the stock market ? Under virtually full employment personal income has been 5% to more than 10% LESS than under roughly 30% unemployment.

Unemployment is what we’re being set up to vote for, and the case so far makes it look quite appealing.

Assuming that we do get a negative jobs report. The market consensus for NFP is a gain, what happens if we get a deeply negative NFP?

You are postulating that the market doesn’t react to bad news. That’s possible but with psychology leaning bullish, I wouldn’t count on it.

Bill Miller, the famed Legg Mason Value Manager who beat the market over 20 consecutive years and who now manages his own Miller Value Funds, was on Consuelo Mack a few weeks back.

He suggested a P/E ratio of ~50 (fifty) is not unreasonable given near zero interest rates and no inflation.

Seriously!

Led by FAANG and the tech stocks, the indices can go much higher.

Note both interest rates and inflation were much higher during the dot-com era than they are now. Comparing the P/E ratios in two very different regimes is not justified, IMO.

The music is on and I’m still dancing nervously but staying very close to the exit door just in case the music stops.

That’s a valid argument, but see John Hempton’s comments about boring cash generative companies like Coca Cola. Why isn’t its P/E stratospheric?

Because, I think, they are not growing and are even modestly declining. You can only eat and drink so much. Some of those dollars are even shifting from off-premise consumption in restaurants to homes via the grocery channel. Coke derives huge gross margins from soda fountains installed at national restaurant chains (lower COGS and lower distribution costs), not so much from the cans sold in the grocery stores.

Their leverage also comes at the operating level (after GM and Opex). So, an additional dollar of rev may give them (Lamb Weston in this example) $0.18 in incremental operating profit.

But for the tech / software businesses, as much as $0.90 of each incremental dollar in rev may fall to the bottom line. The operating leverage is just tremendous. The tech businesses make loads of money.

Moreover, businesses such as Lamb Weston can be replaced. Even if Coke goes away, there is Pepsi. They have very strong brands and distribution networks but consumer captivity is probably not as strong. Consumers and businesses will find a replacement for a coke or French fries.

On the other hand, it would be incredibly hard to replicate any of the FAANGS (and Microsoft). A better technology may take its place over time but you can’t replace the products and services provided by them in short order. It is very painful for consumers to switch from iPhones to Samsung Galaxy because everything is tied to the Apple ecosystem. Microsoft provides many software products (Windows, Office, browser, email, etc.) that are seamlessly integrated with each other. You can’t forklift this whole stack of software and replace with something else.

Satya Nadella said: “We’ve seen two years’ worth of digital transformation in two months.” With Covid-19 continuing for AT LEAST one more year before things get back to normal, we will see AT LEAST 12 more years of digital transformation in the next twelve months.

And, I think, the next “normal” will look quite different from the pre-Covid normal. We will spend more time at our homes. We will commute less. Corporations will lease a lot of less office space. The brick & mortar retail space will shrink dramatically as well. The tech businesses will continue to thrive and only deepen their moats over time.

Someone said a long time ago that we are all in technology business. We use tech to sell burgers, fries, shoes and homes. That is truer today than it was two decades ago.

Cam,

What’s your take on the future of interest rates and its effect on equities? I don’t recall 30 and 10 year interest rates this low before.

SPY 330 feels like a natural resistance level. If/when we break through – it may be clear sailing to 339.

3300 S&P 500. 10 year bond yield falling. May chop around here until the unemployment report.

Is the market setting itself up for an explosive bull move?

https://www.marketwatch.com/story/the-sp-500-is-setting-up-for-a-decisive-move-higher-2020-08-04

So first the bears get steamrolled as the SPX rockets to new highs. Then get out of the way as it rolls over and plunges to a new 2020 low. This guy has all the bases covered 🙂

And gold finally breaks the $2000 mark! Yeaaaa!

Why are energy stocks rocketing? My large cap is up 8% this morning. It pays 9% yearly div too.

Is oil going to $140 like McClellan and Elliott Wave are saying? Now?

I think mostly because of the dollar down trend being recognized. How much is from seeing inflation on the horizon is debatable. Falling interest rates, falling dollar and some seeing the possibility of inflation because of all the money printing are the reasons for commodities to be in a resurgence right now. IMHO

Bulls blitz in the final minutes. I think we’ll see SPY 330+ on Wednesday, and perhaps well above.

DIS reports a -$5b loss – and the stock trades up +5% after hours. A great deal was priced in on March 23, not only for DIS but for the entire market. Time to peer into the future and realize it may be much brighter than anyone is able to imagine right now.

https://www.youtube.com/watch?v=sg8pH1EgWss

https://www.marketwatch.com/story/white-house-democrats-agree-to-try-to-reach-coronavirus-aid-deal-by-weeks-end-11596583067?siteid=bnbh

Starting to sound a lot like the US-China trade negotiations last year.

Rumors and wild stories everywhere https://twitter.com/deitaone/status/1290681874982014977

https://www.yahoo.com/news/rescue-troubled-trucking-company-white-121253080.html

“That company, YRC Worldwide, had lost more than $100 million in 2019 and was being sued by the Justice Department over claims it defrauded the federal government for a seven-year period. But six weeks after the hearing, YRC received a bailout from the Treasury Department — a $700 million loan in exchange for a 30% stake in the business. The company’s stock price soared 74%, although it has come down since”.

Are there other companies of this nature that are going to receive buyouts for equity that would make for a quick 30%? I am only looking to make capital gains, all other allegations are just that. I do not want to get involved with speculation.

“The picture sketched by these three metrics of leading sectors of the economy is a strong rebound in manufacturing, a decent rebound taking shape in housing and cars, and a more slight rebound in trucks. Left to its own devices – I.e., if there were competent leadership executing policy containing the coronavirus – the economy wants to recover.”

http://bonddad.blogspot.com/

What would you suggest leadership do about the cronavirus, Min, that hasn’t been tried? I think the only solution is time or a vaccine for the U.S. because our open society won’t be shut down.

If you mean the riots around the country, there isn’t much can be done when the democrat mayors and city councils won’t let the police do anything and democrats in Washington won’t even condemn them.

don’t be silly again, Wally. Other countries are much more successful than the US. Where is the contact tracing app? Germany’s works fine. Why does it take so long to get test results? Other countries have them on the spot. Why aren’t masks compulsory? That’s normal practice everywhere C19 is under control. Three examples, you need more? BTW have you seen the Jonathan Swan interview with your man? Never seen such a damn fool outside a bar.

Martin, you need to open your eyes and not believe everything your democrat handlers are preaching to you.

https://canadafreepress.com/article/covid-case-numbers-far-lower-than-claimed

I don’t know what country you live in, Martin, but the United States is a unique country with unique freedoms. A lot of people won’t wear a mask, especially in the summer and the Constitution is pretty clear that you can’t force people to comply. If you think other countries are handling things better, you should move there and, apparently, save yourself if you believe that.

And, if you want to see a damn fool just watch Biden give a speech or answer a question. His dementia is so advanced he just utters nonsense. He’s trying to figure out how to get out of the debates and stay in his basement. He’ll NEVER get elected.

MAGA, buddy.

I’d be ashamed to make my case on this low a level. Are you sure you want to have this kind of reputation, Wally?

You: there is nothing Trump could have done against C19. Me: plenty of other countries have done plenty of things with success. You: if you don’t like it in the US, go live somewhere else.

Me: Trump made a fool of himself in the Swan interview. You: Biden is senile (with no evidence supplied).

Swan walked into a trap.

Both my wife and I thought Trump was a complete idiot in the interview. He appeared to be wholly unprepared and spent SIX minutes repeating “we have done the most tests -_-” like a broken recorder. But I believe it was all intentional.

The moment he demanded Swan go read the “manual” and a “book”, I realized what he was doing, he was goading Swan to be condescending and combative. And Swan fell for it. Granted, it’s nigh impossible not to, I would have done it, in fact, I prob also made all the facial expressions that Swan made throughout the whole video.

But therein lies Trump’s super power: his ability to make his opponents look worse than himself. We the viewers were supposed to walk away with the knowledge what a joke trump was being the president (as so many MSM articles would remind us this morning) , but what stuck with the crowd was the exact opposite:

I talked to 7 couples about the interview since then, FIVE of the couples (2 of whom have always been pro-trump), including one who has been super anti-trump found Swan to be rude, brash, and patronizing.

They all thought Trump performed horribly, but at the same time they all believed Swan was being unnecessarily rude and snobby and was more antagonizing than Trump. It also didn’t help that Swan sported an “foreign” accent.

Then there are those facial expressions that Swan made….which has become a viral meme. Trump’s hardcore base is prob THE group with the highest level of anger and resentment. Unlike the African Americans, they are the people we do not see or hear; not on TV, not in the polls, and def not represented in Congress.

Many of them will watch the clip, and remember when they were themselves ridiculed by someone like Swan and feel slighted. This is not some 4d or 5d chess, it’s what Trump was doing the first time he was elected.

“our open society”… no, rather, extremely divided.

A lot of things only work if there’s widespread agreement. Just wait til it gets labelled widely “the Trump vaccine”. Over half the country won’t take it.

Spot on, Allan. Sounds good to me.

Wally

Do open and free societies provide a right to spread Corona virus to other people?

Is that what freedom is all about, in your opinion or is freedom about taking responsibility?

Wally, I was only interested in the part about the economy seems to be recovering, not politics. I don’t live in the US so I don’t know enough. That said my dad is a hardcore Trump supporter.

Min, thanks for the response. Tell your Dad that Wally says, “Hi.”

There are also many Trump supporters in Hong Kong, my birth place. During peaceful protest, HK citizens carries American flags, sing the national anthem. Surprised me when I saw it.

NFP, will the market care? The weak ADP number caused stocks to dip for a good 30 seconds….

probably not, I think this market keeps rallying as the news gets worse.

Good observation. It’s scaling a vertical wall of worry.

It seems that nothing can derail the market advance. Just be prepared to slap on that hedge! I wish I had a bigger long position but already have enough trouble sleeping.

This is a strong market. SPY 340 is on the table by the end of this week.

Me Gold!! Me Gold!!! Ha ha ha ha ha ha.

https://www.youtube.com/watch?v=aPKQJQWQhKo

https://www.youtube.com/watch?v=LHOWq636CXo

Closing all positions end of day.

1. My version of buy-and-hold is a little different than traditional buy-and-hold. I am absolutely committed to the strategy until my sixth sense tells me it may be prudent to step out ahead of a minor pullback.

2. Latest entry was July 28. A +3% gain on a diversified basket of domestic/international stocks over six trading days is a good move. Why risk giving any of it back?

3. I’m free to reopen positions Thursday or Friday on a pullback.

4. If the market continues up without me tomorrow – is that really a problem? Only if it spikes another +2% or more. That may happen on Friday – but probably not tomorrow. I’ll accept the risk of being wrong.

Good luck, RX. Cam is feeling some relief that you are moving to cash for now. LOL

No offense, Cam, as you know I value your work. But it does seem like there is something overriding your analysis of late. Momentum, the Fed, money supply or something is being overlooked.