As we progressed through the pandemic induced recession, there have been much discussion about a second wave. Second waves appear in many forms, and they can threaten the current consensus expectation of a V-shaped rebound.

Here are some of the second wave risks the market faces.

- A second wave of COVID-19 infections

- A second wave of layoffs and wave cuts

- A second wave of bankruptcies

Finally, investors have to face the risk of permanent economic scarring that impair long-term growth potential. Under that scenario, slower growth rates will persist even after any recovery, and affect asset prices in ways that the market hasn’t fully discounted.

A second wave of infections

In all likelihood, there will be a second wave of COVID-19 infections. The Center for Infectious Disease Research and Policy (CIDRAP) conducted a study and believes the latest pandemic most resembles influenza pandemics in infectious characteristics. CIDRAP went on to examine eight major influenza outbreaks and found that there was always a second wave. The more disturbing finding was that pandemics since 1918 had larger second waves.

Of eight major pandemics that have occurred since the early 1700s, no clear seasonal pattern emerged for most. Two started in winter in the Northern Hemisphere, three in the spring, one in the summer, and two in the fall (Saunders-Hastings 2016).

Seven had an early peak that disappeared over the course of a few months without significant human intervention. Subsequently, each of those seven had a second substantial peak approximately 6 months after first peak. Some pandemics showed smaller waves of cases over the course of 2 years after the initial wave. The only pandemic that followed a more traditional influenza-like seasonal pattern was the 1968 pandemic, which began with a late fall/winter wave in the Northern Hemisphere followed by a second wave the next winter (Viboud 2005). In some areas, particularly in Europe, pandemic-associated mortality was higher the second year.

The current pandemic will likely last 18-24 months.

Key points from observing the epidemiology of past influenza pandemics that may provide insight into the COVID-19 pandemic include the following. First, the length of the pandemic will likely be 18 to 24 months, as herd immunity gradually develops in the human population. This will take time, since limited serosurveillance data available to date suggest that a relatively small fraction of the population has been infected and infection rates likely vary substantially by geographic area. Given the transmissibility of SARS-CoV-2, 60% to 70% of the population may need to be immune to reach a critical threshold of herd immunity to halt the pandemic (Kwok 2020).

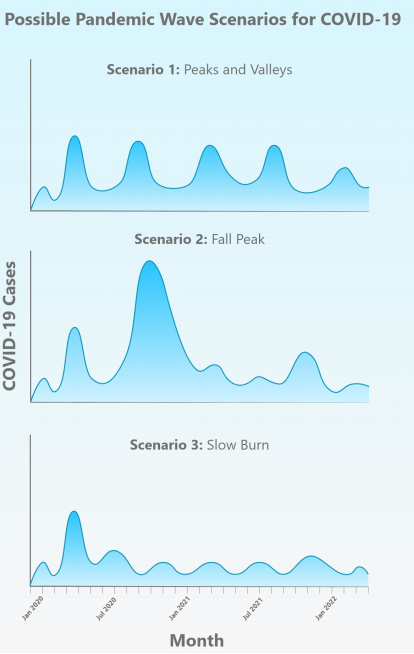

CIDRAP postulated three separate scenarios for COVID-19.

Here is the most worrisome development. Different US states are reopening their economies at different paces. The worst hit states like New York and New Jersey have constructively bent their new case curves downward. Many other states, like California, have only flattened their curves instead of bending them down.

What if a vaccine were to appear? CBS reported that a poll revealed that only half of Americans would get a COVID-19 vaccine, which is not enough to achieve herd immunity.

Only about half of Americans say they would get a COVID-19 vaccine if the scientists working furiously to create one succeed, according to a new poll from The Associated Press-NORC Center for Public Affairs Research.

That’s surprisingly low considering the being put into the global race for a vaccine against the coronavirus that’s sparked a pandemic since first emerging from China late last year. But more people might eventually roll up their sleeves: The poll, released Wednesday, found 31% simply weren’t sure if they’d get vaccinated. One-in-five said they’d refuse.

Here are some of the reasons cited.

Among Americans who say they wouldn’t get vaccinated, seven-in-ten worry about safety…about four-in-ten say they’re concerned about catching COVID-19 from the shot. But most of the leading vaccine candidates don’t contain the coronavirus itself, meaning they can’t cause infection.

And three-in-ten who don’t want a vaccine don’t fear getting seriously ill from the coronavirus.

While some of the issues cited could be addressed to raise the vaccination rate, this is nevertheless a disturbing development from a public health policy viewpoint. For investors, any hint of a second wave of infection will evoke a reaction from the health authorities to re-impose tighter stay-at-home policies, which would elongate the economic slowdown.

Layoffs and wage cuts ahead

In addition to the more obvious COVID-19 public health issues, investors have to be concerned about a second wave of economic damage. The effects of the first wave of layoffs are well-known. So far, most of the job losses have been concentrated among the low paying workers. Now reports are piling up that white-collar layoffs are ahead. The NY Times reported that Boeing is cutting 16,000 jobs. Bloomberg reported that Deloittes is preparing to lay off 2,500 employees. The list goes on, but you get the idea.

As well as layoffs, we now to worry about a new second wave, namely wage cuts. The Fed’s Beige Book reported a “second wave” of wage cuts is hitting the economy.

Wages and other benefits were lower than in our previous report; a payroll company reported a “second wave” of wage cuts, and reports across industries have mentioned cuts to benefits, including employer 401k matching. Some companies, especially those in competitive fields, have promised to repay lost wages at the end of the crisis; and others have increased wages to maintain morale and lure back hesitant workers.

The NY Times reported that some companies are considering wage cuts in lieu of layoffs.

Even as American employers let tens of millions of workers go, some companies are choosing a different path. By instituting across-the-board salary reductions, especially at senior levels, they have avoided layoffs.

The ranks of those forgoing job cuts and furloughs include major employers like HCA Healthcare, the hospital chain, and Aon, a London-based global professional services firm with a regional headquarters in Chicago. Chemours, a specialty chemical maker in Wilmington, Del., cut pay by 30 percent for senior management and preserved jobs. Others that managed to avoid layoffs include smaller companies like KVH, a maker of mobile connectivity and navigation systems that employs 600 globally and is based in Middletown, R.I.

None of these developments are conducive to a V-shaped recovery.

A second bankruptcy wave

In addition, we have barely seen the start of a bankruptcy wave in this recession. The combination of temporary fiscal rescue measures and Fed policy has served to put in a temporary cushion on the wave of bankruptcies that is likely to hit the economy. Unless Congress acts to extend PPP, the payments expire in July.

Already, credit quality is deteriorating.

A second wave of bankruptcy is almost impossible to avoid.

As the damage of these business failures hit the economy, the effect of this second bankruptcy wave is likely to be persistent.

The risk of permanent economic scarring

The persistence of economic damage is especially a worrisome problem for economists. A new IMF Working Paper addressed this issue of “hysteresis”. For the uninitiated, hysteresis in economics is the persistence of effect after the initial shock of the effect is gone.

The IMF paper is mainly a survey of past research, and there were many papers cited. In particular, the authors referenced the well-known Reinhart and Rogoff study of past financial crises:

Reinhart and Rogoff (2014) examine the evolution of real per capita GDP around 100 systemic banking crises and found that a significant part of the costs of these crises lies in the protracted and halting nature of the recovery. On average it takes about eight years to reach the pre-crisis level of income; the median is about 6.5 years. In a sample that covers 63 crises in advanced economies and 37 in larger emerging markets, more than 40 percent of the postcrisis episodes experienced double dips.

The IMF study concluded:

In the last 25 years we have seen the development of an alternative model of business cycle that emphasizes the effects that business cycles can have on the drivers of long-term economic growth. In these models GDP is history dependent and all shocks can have permanent effects on output, what we refer to as hysteresis. This represents a change from the traditional cycle-trend decomposition that defined cycles as deviations from a trend that was independent of any of the traditional demand shocks that could be responsible for economic fluctuations…

In the presence of hysteresis, the costs of cyclical shocks or the lack of action of policy makers are much larger because of the permanent scars they can leave on GDP through their interactions with the endogenous forces that drive long-term growth or the dynamics of labor markets. Aggressive and fast action during recessions becomes optimal policy. And during expansions, the cost of acting too early on fears of inflationary pressure can also be very costly as it can either reduce the potential growth of the economy or hinder positive developments in the labor market. In this new framework, policy makers should understand the likely large supply costs of not being as close as possible to potential output by running a “high-pressure” economy.

In practical terms, here is what hysteresis, or the persistence of economic shock, means in real life. A recent Goldman Sachs survey of small business participants by Babson College and David Binder Research reveals small firms have already suffered considerable damage from COVID-19. 9% are permanently closed, and only about half are fully open. Looking out over the next six months, respondents believe that 71% of customers will return, at a rate of only 63% of revenues.

What was not asked was how many and how long can small businesses survive at 63% of previous revenue levels.

The burden of reopening

Some clues to that question came from a survey done in late April by the Chicago Fed in association with the local chambers of commerce. Even though the survey was restricted only to the Chicago Fed’s Seventh District states, the survey does provide a window into the outlook for small business in the US. Survey respondents were predominantly small businesses: “About 60% of the respondents were from firms with fewer than ten employees and another 25% were from firms with ten to 49 workers.”

One of the biggest concern expressed in the survey was the extra costs involved in reopening after the lockdowns are lifted. As we move into Q2 and Q3, watch the narrative from companies start to change to “we are burdened with an extra layer of costs in reopening, along with reluctant customers”. The Chicago Fed survey found companies that would experience financial distress under “moderate” social distance measures and gatherings of 50 people or less if the operate at 75% capacity range from 38% for manufacturing to 88% for restaurants.

The survey also asked whether companies were concerned about different metrics of financial health over the next three months. Cutting to the chase, about 30% to 40% of most companies were concerned about their own financial solvency over this period. Companies in finance were in the best shape, while restaurants were in the worst.

In short, expect at least one-third of small businesses to fail in the next three months, even with massive fiscal and monetary support, and assuming that there is no second wave of infection. This is a level of business failure that does not appear to have been fully discounted by the financial markets.

Lastly, the recent wave of protests springing up around the US will hamper the prospect for a V-shaped rebound. Depending on how long the protests last, can anyone really believe that business will return to normal with rioters in the streets? Here are some reactions from analysts of the effects of the riots, as reported by Bloomberg.

“I think people are coming to the realization that their jobs may not be coming back or coming back quickly. This is all conflating with the racial tensions and completely boiling over,” said Mark Zandi, chief economist at Moody’s Analytics. “This highlights the depth of despair in America,” he added, citing 20% unemployment and 50 million workers who’ve lost their jobs or had pay cuts…

“The impact of the riots may be greater on the daily and weekly measures of consumer confidence, which were trending slightly upward since mid-April, but which may now post a pull-back into early June,” said Mike Englund, chief economist at Action Economics, which provides financial-market commentary.

In conclusion, even though market analysts have discussed “second waves”, I do not believe they fully appreciate the multi-factor nature of the second waves that threaten the growth outlook. While all of these risks may not fully materialize, the current consensus market narrative does not seem to have fully discounted many of these risks.

My son (age 25) has four friends who have started day trading who never mentioned the stock market before this. My trainer (age 23) and his father have started day trading. His father does it for an hour in the mornings before going to work.

This feels like we are witnessing a stock market bubble. The fundamentals are so out of sync with the stock market. The market is filled with gamblers that trade on price alone. Will likely end badly.

Are they bulls or bears?

I have had similar experiences lately. My dad, who historically has been very conservative and a low-turnover type investor told me last week he’d executed 250 trades so far this year. He sounded like he was bragging, but he wasn’t (I don’t think), he was more surprised at himself and admitted that $0 commissions had a lot to do with it.

It’s not wild bullishness in the traditional way, it’s more bullishness of activity. I have some ideas, but I’m not entirely sure how to process this.

As they said in The Big Short – “they’re not confessing – they’re bragging”.

In this past week’s Barron’s: “His survey found gyms expect new-member growth rates to be flat to up 5% for the year, and no respondents planned on closing locations. In fact, 86% said they planned to open more”. I’m absolutely blown away by this.

But, let’s not forget the 4/21/20 Barron’s Big Money Poll where only 4% of respondents were bearish on 2021, only 8% considered gold the most attractive asset, and only 1% considered Tbonds the most attractive asset.

Chew on that for a bit.

Very informative post Cam, thanks.

I’ve got “covid fatigue” if I’m honest, but this is interesting from a guy in the UK (seems to be just an ordinary average Joe who is good with data), so “your mileage may vary” as the saying goes.

_____________________

On 29 April, the UN’s International Labour Organisation stated that, due to the lockdowns, nearly half the global workforce is at risk of losing livelihoods.

Those who decide that the lockdown is the right thing to do, need to be very sure that its immense price is worth paying.

______________________

In the 1968/69 Asian flu epidemic, around 80,000 people died in the UK, nearly double the death toll of 43,479 that is forecast for Covid-19 by IHME

Lockdowns that have put around half the UK’s working population out of work were not considered necessary then, why are they now?

______________________

source: http://inproportion2.talkigy.com/

Additionally:

“…Camilla Stoltenberg, director of Norway’s public health agency, has given an interview where she is candid about the implications of this discovery.

‘Our assessment now, and I find that there is a broad consensus in relation to the reopening, was that one could probably achieve the same effect – and avoid part of the unfortunate repercussions – by not closing. But, instead, staying open with precautions to stop the spread.’

This is important to admit, she says, because if the infection levels rise again – or a second wave hits in the winter – you need to be brutally honest about whether lockdown proved effective…”

https://www.spectator.co.uk/article/norway-health-chief-lockdown-was-not-needed-to-tame-covid

Source: http://www.covidplanb.co.nz/

(Dr Simon Thornley – Senior lecturer of Epidemiology and Biostatistics, The University of Auckland

Dr Grant Schofield – Professor of Public Health, AUT, Auckland)

The 1968-1969 pandemic number was over two seasons, the second pandemic season was two to five times more severe than the first. You can imagine a COVID-19 number of 2 to 5 times 40,000 at the end of next season.

The extreme difference in policy this time, in my opinion, is Social Media. The news of the virus went viral (pun unintended) and caused fear to spread, Fear causes more eyeballs to look at our smartphones and the media companies send more gruesome images. This causes a panic to which politicians react. When a leader in one country sees another country shut down to save people, they are forced politically to follow suit. If they don’t they are ostracized (Brazil for example).

This is a Social Media event. Being of a certain age, I appreciate this care for my well-being but I see it comes at a huge societal cost.

Absolutely right on the money Ken. We are seeing a real life “tutorial” of Kuran and Sunstein’s work:

“…The idea of the availability cascade was first developed by Timur Kuran and Cass Sunstein as a variation of information cascades mediated by the availability heuristic, with the addition of reputational cascades. The availability cascade concept has been highly influential in finance theory and regulatory research, particular with respect to assessing and regulating risk…”

source: https://en.wikipedia.org/wiki/Availability_cascade

Thanks Donald. Availability cascades seem similar to Shiller’s Narratives. I can see how this simple stories or heuristics can drive markets irrationally like now.

Thanks for the reality check– very helpful. Question for Cam and others– does this seem like a “blow off top,” and if so, can this go on until the election in your view? I get that Fed was a game changer but it seems we are priced for perfection and it would be painful to buy at these valuations, but perhaps the Fed + election year might allow it go on far longer than is rational…

Anything can happen in the markets – and thinking back over several millenia ‘anything goes’ has happened many times. Tulip mania. Silver in 1980. Pet rocks and Beanie Babies. Adding a ‘dot com’ to your company name in the late Nineties, or the word ‘blockchain’ to your company strategy 2-3 years ago.

The disconnect between economic realitly and the stock market today reminds of a story published by Todd Harrison many years titled simply ‘Simon.’ I can’t find a link to the original story, so the link below will have to do:

http://mindandmarket.blogspot.com/2014/06/the-simon-trade.html

So today I’m wondering whether it’s possible to buy out-of-the-money puts at fire sale prices ahead of the next -50% leg down.

Thank you rx. Great analogies.

As an aside, the Hulbert Sentiment Index closed today @ +53.6% – the first reading in the fifties since mid-February. Versus +3.81% just twelve trading days ago and -26.45% on April 1. I can’t read his mind, but it seems like a good setup for a forthcoming column.

Hulbert usually doesn’t show much concern until HSNSI reaches at least 70 or 80.

Why so obsessed with your own prediction? Instead, react and follow the market. Tons of very smart people armed with supercomputers and relevant data and theorems have crunched the data and done any analysis imaginable. The net results are in the price charts and they are free for you to use. Is there any better deal in the world? Do you want to outsmart the collective talents? There is currently a good relevant example. Pretty much everyone thinks Biden will win in Nov (many prediction sites have it). But if you bet in Vegas the bookies give odds in Trump’s favor as of today. What would you do? Emotion has no place in investing or betting. I’ll go with Vegas bookies. They are rarely wrong. Why? The same thing. Behind the bookies there are tons of very smart people with best computers and algos. When it comes to money, you can hire any smartest person. This is serious business. Jim Simmons hired one of the smartest math guy from MIT not long ago. Again, predicting is utterly futile, and trying to outsmart the Market is financially suicidal.

Just a thought about what might finally cause the “inflection”. There seems to be so much bad news that has been overlooked by the market already that there are 2 possible scenarios;

a) It will take something really bad to turn things around such as a “Lehman” moment

OR b) The constant barrage of bad news will eventually grind the market down slowly. I suspect that this latter option is more likely.

I haven’t done the research on “Bear Market” rallies but I think I read that this has been the case in the past.

Maybe Cam could analyse previous Bear market rallies to determine the typical pattern here.

Cam, I don’t know what to tell you because I am afraid what I want to say will have the opposite effect. I used to love and mostly follow your anticipations of the market’s behavior. But since you have been on the wrong side of the Market for almost 35%, I stopped using your advice and said it doesn’t make sense but I am making money following the trend. Sure it will end; I anticipate it every 4 hours, but until …. I anticipate your every missive with the thought that he will still be doubling (quadrupling) down on his wrong thesis and barely read them now just a skim. Please start being right. Swallow it.

California has more than doubled the amount of testing in the last month, by rough estimate:

https://ycharts.com/indicators/california_coronavirus_tests_administered_per_day

And guess what, more infections/day get recorded as a result.

The actual percent positive level is at its lowest level so far.

More CA test increase still in store. This supposedly will facilitate the ‘test, trace and isolate’ strategy.

One week its Georgia, the next, Florida, now CA. Tiresome.

I don’t doubt there’ll be increases in infections, to what extent, and the impact, remains to be seen. The only thing we know for sure now is that even the smarties are guessing.

Until people can spend long periods of time indoors together the virus is going to remain a big problem. Schools, colleges and many workplaces requiring indoor time are constrained by the virus. Schools remain closed. Outdoors activities with masks on not a big risk which is why there is the illusion of normalcy over summer. Whether that adversely affects the market is not something I can predict.

Alternatively, maybe we should have been bracing for an Elliot third wave. As has been noted, the rally has broadened out to small caps and other countries. Once over, perhaps then the stockpocalypse will commence.

Just some random thoughts:

-when will layoffs start to accelerate: is it only when PPP start to expire in July, but there’s significant probability of PPP being extended and expanded, so from now till July go Bullish or at least don’t be bearish?

-some nowcasts that could be important: tsa air traffic data, restaurant booking data, any other consumption data, weekly employment, new covid infections, revised covid fatality rate as new data emerge like rate of actual asymptomatic cases, discovery of new effective drugs (not vaccine), etc.

-also very important I think is Sweden’s economic and covid statistics: how did their economy fare under the no lockdown rule in Q2 and how is their covid landscape looking like, and most importantly can we replicate or improve their method so that no lockdown is necessary?

-consumers will only spend if they have confidence in the job market (or believe free money will continue for some time), but businesses will only hire if there are consumers (or if they are paid by government to rehire recently dismissed employees or as a requirement to get more loans).. which comes first? Can a massive infrastructure bill break this impasse and act as a bridge between now till a vaccine is ready?

-internationally speaking how much money can other countries print? are there reasons to believe that the forex market will turn a blind eye on any country (either weak or strong in terms of deficits) if they’re printing money now since everyone is printing money anyway? If weak countries or other countries besides the US are penalized for printing money can the US stock market stand strong alone?

A few random counterpoints:

(a) The negative stories have all led to rallies. Markets are climbing one of the steepest walls of worry that I can recall. Every negative scenario generates the same market response-> ‘Bring it on.’

(b) I think there’s a ton of money flowing into this market. Where’s it all coming from? Underinvested longs and persistently stubborn bears?

(c) Might scientists, against all odds, come up with a safe and effective vaccine within the next 1-2 months? Might pharmaceutical companies manage to produce a billion doses by September?

My guess the money flows are from the bond market. We live in a ZIRP world for the foreseeable future.

N(egative)IRP might even be possible.

Point (a) is baffling indeed. Some of the smart people that I’ve followed had been bullish quite early in this latest rally but I didn’t believe them at first. Sad that I didn’t take them as seriously as I should. But I also think Cam is making great valid points. I am confused.

What I’m trying to absorb now is how the chicken & egg problem could be resolved (i.e. will consumers spend more first or will employers hire more first). And what are the bullish point of views to negate pessimism on the layoffs and bankruptcies front.

For the chicken and egg problem a job creating stimulus like infrastructure stimulus could be the key. Not sure how to be bullish about the incoming bankruptcies though. Maybe mail more cheques? lol So much assumptions have to be made to be bullish.

From what I read the markets have already priced in significant part of the stimulus part. Now is the time for fundamentals to take front stage.

I think the layoffs have accelerated already and will continue to increase as revenues fail to improve with each passing month.

My own corporate overlords have announced more layoffs in the coming months along with significant salary reductions across the board (10-25%).

Layoffs and bankruptcies aside, the market isn’t focused on a second covid wave as it will not shut down the economy again for the following reasons:

1) better understanding of who it is lethal for (please don’t bombard me with exceptions to the rule. Average age of death is 78 for covid fatalities).

2) Treatments (plenty of biologics such is IL-6 inhibitors, etc. targeting cytokine storm will prove effective) in development.

3) Vaccines that will be available to front line workers by the fall (continued progress on this front)

4) Governments/people realizing that the far reaching effects of shutting everything down is not pragmatic.

5) People realizing they are fine despite the increasing numbers reported daily

Your assertions about the health policy in the event of a second infection wave is highly speculative. We don’t really know how the authorities will react. As an example, the man behind Sweden’s more relaxed policy has admitted that he erred, and neighboring countries are contemplating restricting travel to and from Sweden.

For investors, what matters more are the economic effects, such as layoffs, salary cuts, and their effects on household behavior and business confidence.

Hi Cam, your comment about the man behind Sweden’s more relaxed policy doesn’t match what the man you are referring to is actually saying:

Its chief state epidemiologist Anders Tegnell, representing the country’s Public Health Authority, is still optimistic. A few days ago, he said that we have to wait until Autumn to know if the strategy worked. In an interview today (3 June) in Swedish daily Dagens Nyheter he admitted that “there are things that we could have done better, but generally I think Sweden has chosen the right track.”

source: https://www.brusselstimes.com/all-news/world-all-news/115019/swedish-state-epidemiologist-unrepentant-about-choice-of-strategy/

I think it’s only fair that we stick to facts, and not repeat half quotes.

What do we think of the ADP Non-Farm Employment Change report:

actual -2760 vs forecast -9000K

Does’t this suggest that employment is much better than anticipated?

Here is my initial reaction to the ADP print:

1) The number is so far above expectations that it calls into question their methodology. Even WH advisor Kevin Hassett is doubtbul: “the number is so good, it’s such good news that I really have to dig deep into it and see if there’s not something funny going on”.

2) Even -2.8 million jobs lost is still problematical, given that the economy is reopening and people are supposedly getting back to work. It speaks to the momentum of the job losses.

On Bloomberg this morning, they explained it as a quirk of how ADP counts furloughed employees. They are not getting paid but technically still on the “payroll”. Hence the numbers are overly positive.

A blow-your-hair back rally?

Sounds insane, but I’m going with that thesis for today. Opened positions in SPY/ EEM/ XLE/ XLI/ XLF + flyers in QCOM and UAL.

I know the ‘right’ thing to do is to wait for a pullback -ie, avoid chasing. I also know that occasionally it’s OK to make an exception to the rule.

I see upside breakouts left and right. Not saying I’m right, just taking my chances and jumping onto the ladder of a departing train. As always, I may be completely wrong.

You do not seem to have been so “off the mark” as yet. Kudos to you for taking the risk. You should enjoy all the rewards as they come.

I’m as averse to opening positions on gaps up as anyone else – almost always a pullback guy. My rationale here is pretty simple. Sure, it’s uncomfortable to open let’s say UAL up +6% (I think ~31.79). But what if it’s on its way to 50 or 79 or 90? Does it matter whether you opened at 30 or 32?

Any opinion on KRE (Regional banks)? You can play small- and mid-cap as well as financials angle with that.

I’ve always looked at XLF versus KRE as analogous to GDX versus GDXJ – ie, if you want more action, go with the ‘juniors.’ The differences in beta are comparable.

Thank you!

I think the Fed will own all securities soon. We’ll have to pay a pretty penny if we want to own any of them.

‘Stimulus is at roughly 30% of GDP’

~ Yahoo Financial Expert

I didn’t realize it was that high.

“The public is right during the trends but wrong at both ends.” – Humphrey Neill

https://twitter.com/mark_ungewitter/status/1267871788614246405

Given the Fed liquidity and the government stimulus, I don’t think we are close to ends yet. I won’t be surprised to see more coming in weeks ahead.

We’ll eventually though.

Given the Fed liquidity and the government stimulus, I don’t think we are close to ends yet. I won’t be surprised to see more liquidity and stimulus coming in weeks ahead.

We’ll get close to the ends – eventually.

“If we get 1160 net advances today the market will generate Breakaway Momentum. Currently 1750 net advances. ”

https://twitter.com/WalterDeemer/status/1268202100967825408

One way to gauge the strength of this rally is to watch whether the gap between last night’s close and this morning’s low is filled.

A runaway train won’t back up for late boarders.

So are you suggesting jumping in with both feet head first?

I’m not able to make suggestions, only statements re my own trading decisions and/or assessments of the odds and/or what I think is driving the markets. After all, I don’t know anything about anyone else’s risk profile or investing goals.

(a) IMO, this market acts like it wants to move higher.

(b) Also IMO, it acts like a bull surge that may not look back long enough for underinvested longs to board.

(c) At some point, probably when least expected, it will turn back down.

I track the markets on a daily basis and do the best I can. My early morning plan A was to buy any pullback in the first sixty minutes – that worked for only position on my buy list->QCOM. Since I’m only able to really watch the markets until ~730 am, Plan B was jump on board at that time if it looked like a bullish impulse move higher was imminent.

I don’t jump in with both feet, as position sizing is one way that I manage risk. I have, however, been sizing up significantly over the past few weeks simply because my trades have been working.

‘worked for only one position on my buy list.

I usually come up with a buy list the night before. There were a few other positions that gapped up way too much for me to act on-> EWZ and JPM for instance.

Thanks, RX. Use of “suggesting” was bad phrasing. Apologies. I did not mean to solicit advice on trading here, just a sentiment check up.

No worries – that was kind of my understanding to begin with.

Not sure what to make of this… Trinh Nguyen’s calls on COVID have been largely accurate, though she is obviously not a scientist. https://twitter.com/Trinhnomics/status/1267998090876735488?s=20

PMI is measured month/month so a reading of over 50 is not a measure of the level of activity, just shows acceleration and deceleration.

If the S&P500 is to be believed, “investors” now belive that the economic prospects are as good now as they were December 10th last year.

Hands up everybody who thinks that is the case (with reasons). Please limit answers to less than 10,000 words.

Another hard concept to embrace is the disconnect between the markets and the economy. I try to weight price action over ‘economic prospects’ ~80/20. Sure, the economy fits into the picture – but in general for ST swing trades all that really matters is price.

Keep in mind that I’m wrong half the time. When I’m wrong-> I bail immediately and will often simultaneously make a U-turn.

I also categorically avoid shorting – so a U-turn generally takes the form of let’s say dumping gold miners or the long bond and buying the SPY…or vice versa.

Speaking of which->the SPX is losing altitude in the final minutes so I’m paring back on my position in SPY by a third in hopes I can buy back lower after hours or tomorrow.

Thanks for your insight, RX. So “the trend is your friend” until it isn’t?

Something like that 😉

Waiting for the FOMO phase now. Today’s breakouts, sounds like we are entering a FOMO phase (see rxchen’s post). Still long, but with one foot out the door (!). My gut feeling is we are very very close to a double top here.

Right – the hard part is what Livermore referred to as ‘sitting tight.’ These moves almost always extend further than we think. Obviously, I’ve been prone to doubt the staying power of this rally throughout.

DV, we are very close to a double-top on Nasdaq Composite and a bit far away on S&P500. Which index did you mean?

I think you meant S&P500. So, why a double top of that index is more important than on Nasdaq Composite?

Sanjay

Yes, I meant the S&P 500. That said, right now, the NAZ is leading and a failed double top of the NAZ would be equally important. I usually use S&P 500 as a reference, but pay attention to other indices also as you suggested.

As an aside, Dan Niles, is out of Apple. AAPL is a big part of the larger indices. AAPL just dropped prices in China to support sales (not good).

Financials are up here, so are the airlines and ride sharing companies. These were the laggards. I am sure Cam will show us the index rotation pretty soon. For now, since the laggards are turning up, this rally may have short term legs.

To Rxchen’s point: Deep pull backs like to 2400 in December 2018 and to 2200 in March 2020 are anomalies IMHO. I call them “side lobes’ in a graph, are usually short lived and revert back to some resistance level quickly (in this case, the level would be 2650 and 2400 respectively; see the graphs for why these lines/levels in the sand are important). Such side lobes on a graph indicate increasing shorting pressure on the downside (that is how I interpret them).

Inverse the above idea, and what you would see are break out side lobes, that get amplified, as longs pile on (and there is a short squeeze at the same time). Current break out started at 3020, also the same level in October 2019.

It is hard to say when this current rally will peter out (from 3120-3400). The 3400 level is just a line in the sand, nothing magical about it (Ken would call it anchoring bias).

If we are close to a double top, I would like to see a countertrend rally that does not recapture the previous peak (that is a classic).

That said, there is nothing classic about what happened in March 2020, May 2020 nor December 2018 and January 2019. There are simply no historic precedents to such market actions. The sentiment at -30% in March 2020 had gotten so bearish, that we had no where to go but up. That said, I shall wait for Cam to reflect on the current sentiment. I am sure, we are seeing a series of good overbought conditions, as I write this. Furthermore, there is a lot of money on the sidelines, waiting to get in on pullbacks (Cam has indicated this also). Short term sentiment I am sure is somewhat frothy, as we know from Robinhoods of this world, but long term sentiment I am sure is not very bullish (contrarian buy). Cam, Ken and many others have warned about earnings number in the pipelines that would be very bad.

The extreme froth at market top seems missing here, which is why market may keep going higher. Market should rally into earnings which are next month, so we may have a while to go. So all up, we could have the next leg up till early July, right before earnings (memory fails me here, but someone chime in; this is what I think what happened in July 2016).

DV, this was awesome. Thank you very much for taking the time to share your thoughts.

SentimenTrader.com observes that two weeks ago, underlying breadth in the market was weak; the ten-day average of the NYSE Up Issues Ratio flirted with falling below the 40% threshold that suggests oversold conditions.

The rally since then has been dramatic, especially under the surface. An average day over the past two weeks has seen 65% of securities advance on the NYSE. That’s a swift cycle from one extreme to the other, the ST analysts point out.

The analysts note that this type of breadth thrust has a very strong tendency to lead to much higher prices, particularly over a 6-12 month time frame. Looking at the forward performance of the S&P 500 after 10-Day Up Issues cycles from less than 40% too more than 65% within three weeks since 1960, ST found six prior instances. The average 1-month forward gain was 6.8%; 3 months, 12.1%; 6 months, +17.5%; and 12 months, +23.7% with a very positive risk-reward ratio. The most recent was Jan 8 2019 and the forward 12-month gain was 26.4%.

Bottom line say the ST analysts: When buying pressure was so great that it pushed an overwhelming number of stocks to rise over a multi-week period, it was a sign of a healthy long-term market. There were few losses over a 6-12 month time frame, and the risk/reward was skewed heavily to the upside. … These kind of thrusts have been the most compelling bullish argument for two months and show no sign of slowing down.

Walter Deemer: the market generated a breakaway momentum today.

Supposed to get it near the beginning of a powerful move, not after a 42% advance (altho did have late signals Jul 12 2016 and Nov 20 1950). Definitely not its finest moment…

https://twitter.com/WalterDeemer/status/1268278703395659784