Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

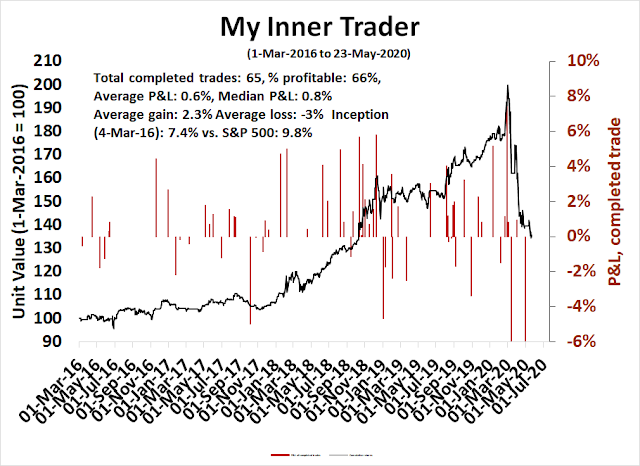

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Don’t count on the Fed

There is a belief among the bullish contingent that Fed intervention can solve everything that’s wrong with the stock market. While liquidity injection can boost equity prices, they do not represent a permanent solution. Otherwise, the Japanese and European markets would have been the clear leaders in the past decade.

Instead, the recent surge in stock prices has created a mini-bubble which is at risk of bursting.

Warnings of froth

I have written about the sudden surge in small investor trading that has been supporting this advance. Linette Lopez at Business Insider called a “perfect storm of stupid”.

- Close to 800,000 people have created new brokerage accounts on three of America’s top brokerage platforms since the coronavirus pandemic hit the US.

- That means tons of new people are playing the markets at a time when things are so uncertain that hundreds of companies canceled their 2020 earnings guidance. There is no model that can predict what’s about to happen to the economy or the market.

- That means tons of new people desperate for a coronavirus vaccine are now betting on potential treatments and cures. Just this week the market handed billions to two companies that made headlines without showing any real data.

- This is very stupid, and people are going to get played.

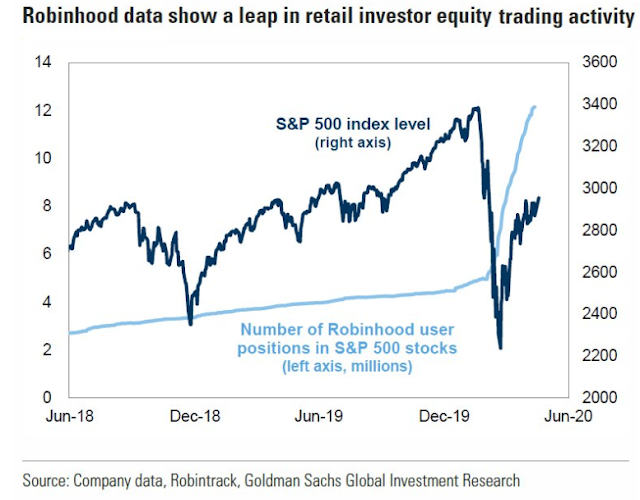

A much shared chart shows that the trading activity at discount broker Robinhood has rocketed upwards.

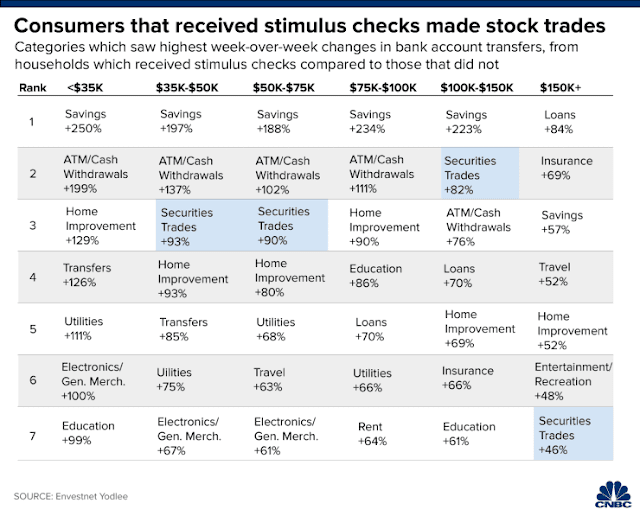

CNBC reported that consumers used much of their stimulus payments to trade the stock market.

Securities trading was among the most common uses for the government stimulus checks in nearly every income bracket, according to software and data aggregation company Envestnet Yodlee. For many consumers, trading was the second or third most common use for the funds, behind only increasing savings and cash withdrawals, the data showed.

Yodlee tracked spending habits of Americans starting in early March and found that behaviors diverged around mid-April — when the checks were sent — between those that received the stimulus and those that didn’t. Individuals that received a check increased spending by 81% from the week prior, and data show some of the spending went to buying stocks.

People earning between $35,000 and $75,000 annually increased stock trading by 90% more than the prior week after receiving their stimulus check, data show. Americans earning $100,000 to $150,000 annually increased trading 82% and those earnings more than $150,000 traded about 50% more often. “Securities trading” encompasses the buying and sells of stocks, ETFs or moving a 401k.

SentimenTrader extremes

Jason Goepfert at SentimenTrader recently issued his own warnings of sentiment extremes. First, the stampede into growth and technology is as overbought as 1980, 1999, and 2015. All of these episodes ended badly soon afterwards.

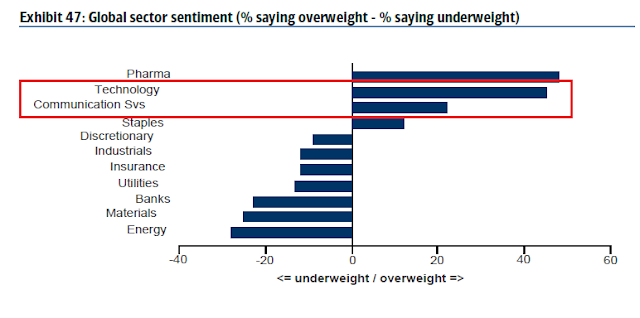

That warning was addressed not only at the small investors dabbling in the FANG+ names, but institutional investors too. The latest BAML Global Fund Manager Survey revealed that global institutions were underweight stocks, but they compensated by overweight high beta sectors like technology and communication services (GOOGL, NFLX).

From a tactical perspective, Goepfert also observed that the stock market is likely to staging a volatility breakout. Past breakouts have tended to resolve themselves in a bearish manner.

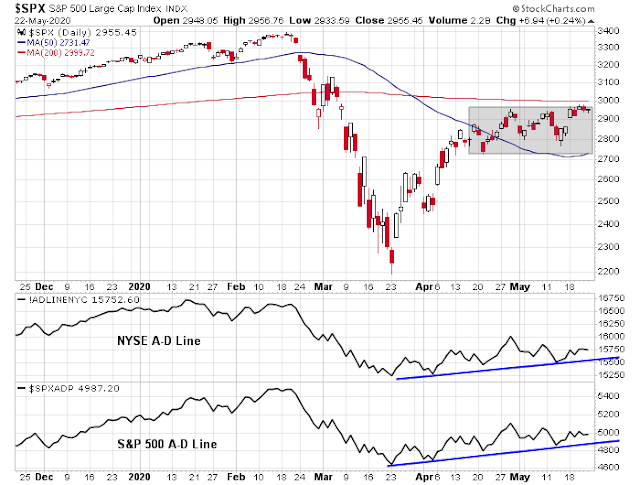

The S&P 500 has been stuck in a range for a month, above its medium-term 50-day moving average but below its long-term 200-day average. Based on other long streaks of being stuck between time frames, there has been a higher likelihood it will break the streak by falling below its 50-day average. But future returns were weak, no matter which way it broke.

He also issued a warning based on volume behavior.

How much gas is there left in the tank?

How much gas is there left in the bulls’ tank? Traditional sentiment models are unhelpful. AAII weekly sentiment has is retreated to neutral from a crowded short condition.

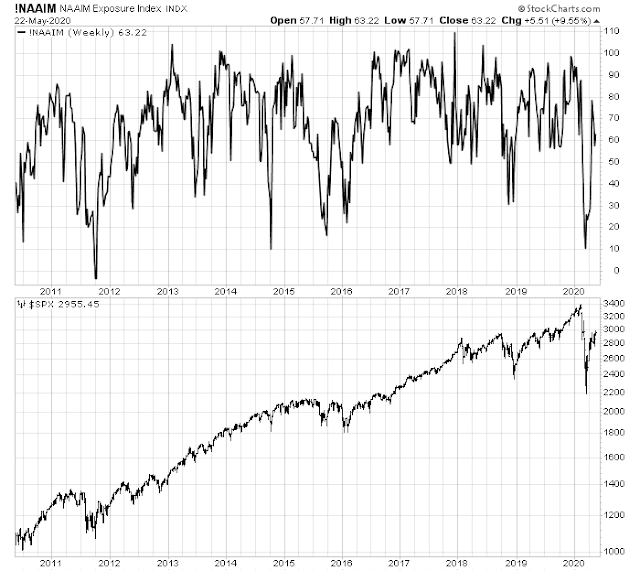

Same with the NAAIM Exposure Index, which measures the sentiment of RIAs.

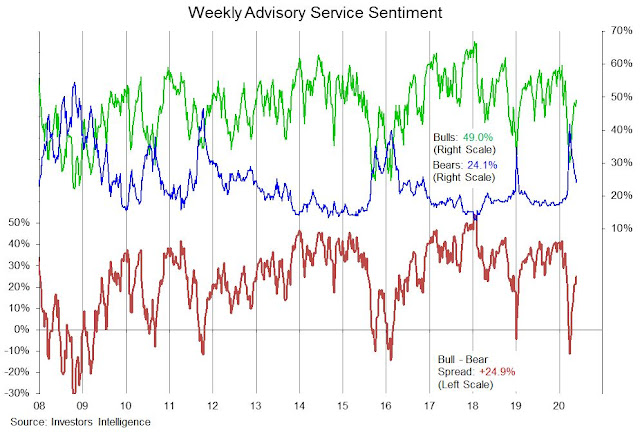

Investors Intelligence sentiment has also returned to neutral territory.

However, two major investment firms’ sentiment indicators are unusually giving off wildly contradictory readings. The BAML Bull-Bear Indicator is flashing an off-the-charts buy signal.

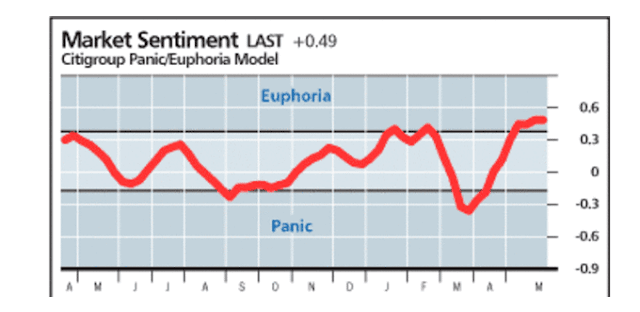

On the other hand, the Citi Panic-Euphoria Model pushed further into euphoric territory this week.

Someone is going to be wildly incorrect and have egg on his face.

The week ahead

Looking to the week ahead, the market still appears to be range-bound. The possibility exists that the S&P 500 could strengthen further to test its 200 dma at about 3000, but that only represents an upside potential of 1.5%. Different versions of the advance-decline lines remain in uptrends. Until those trend lines are broken, the bears cannot be said to have seized control of the tape.

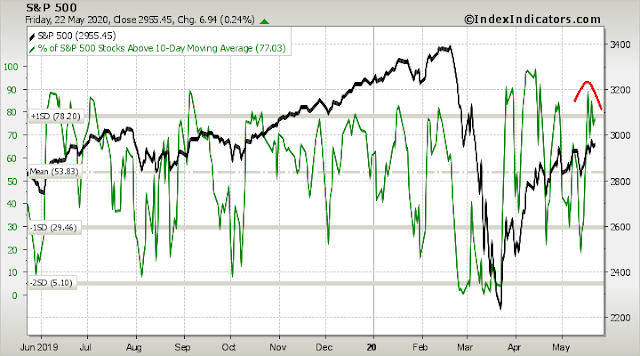

The week starts with a slight bearish bias. Short-term breadth is falling, and momentum is negative, but readings are neutral and the market could turn up from here.

Longer term breadth is recycling off an overbought condition.

My inner trader remains short the market. For the purposes of risk control, his line in the sand is 2970 on a closing basis.

Disclosure: Long SPXU, TZA

Sell at the top of the bull market. Buy at the bottom of the bear market and hold the best stocks in the bull market. Impossible? My new research into using Factors (Growth, Value, Small Cap, Low Volatility) to reveal market turning points and industry health does those things.

On this blog, you have been hearing about my momentum factor research. These studies have led to me making some important new discoveries of how the four basic factors (Value, Growth, Small Cap, Low Volatility) can signal precise important market and industry turning points.

My clients shifted almost entirely out of equities two business days after the February 18 peak and into bonds for example. We watched in safety as markets plunged. An important bottom turning point was signaled two business days before the March 23 low. How good is that!

This new factor research also shows the ongoing strengths and weaknesses of industry sectors by revealing the trends of their individual internal factor dynamics.

I’d love to show anyone interested in this with a one-on-one web meeting. Just email me at ken.macneal@tacticalfactorresearch.com and we can set a convenient time.

As I always say, “We are in this together”

What is your model saying right now? Any prediction for next few months?

You should email Ken and set up a direct discussion with him. This comment board is not the proper venue.

Amen to that.

Ken, I am sure you are a gifted analyst and have much to offer, but advertising on someone elses web site is pretty cheesy, don’t you think?

And twice, too!! Go away.

Joyce

To be clear, Ken asked permission first. I agreed.

I would also add that I derive no monetary benefit from any of Ken’s activities.

A little intro would have helped. One of the reasons that I like this website and am willing to pay is to not get advertising for “I have a sure thing in the stock markets” and similar. It can stilt the apprent lack of bias in the information supplied by the main contributor.

Apologies for any offense caused, none meant.

Well, I have a system guaranteed to lose money..lol…any smiles? Beuler?

I have been watching the AUD/USD as an indicator of the global economy, seeing how China influences the Aussie so much. The AUD/USD has followed the ES mini remarkably well, but it weakened earlier and is barely at it’s march peak and now seems to be making a rising wedge. I am looking at it as a non confirmation of the bear rally and if it heads south then maybe the ES mini does also. I don’t know if FOREX is less manipulable than the ES mini.

Forgot to add that the Aussie has been in decline since 2018 after the tax break market high, and each of the big drops in the SPY had a second leg down, will we get a repeat? I dunno, but geez the economy has taken a hit and going out even to Walmart is not what it used to be. Don’t fight the Fed, but maybe don’t trust it to save you either.

yodoc- If you have a system guaranteed to lose money, then by definition trading against it should guarantee a gain. There is no perfect system. And in fact that is exactly why trading can be and often is profitable – it involves a high degree of risk. If trading wasn’t a challenge why would there be a payoff, and why would any of us be engaged in playing the game?

Perhaps Ken has a system that works – for now. Or for someone with his risk profile and time horizon. Or worked well in timing an exit and reentry in February/ March. No one (including him) knows whether it will continue to work. That’s just the nature of the game.

Cam isn’t 100% accurate either – but he’s better at it than the vast majority of people that I follow.

If I was perfect (or nearly perfect), I’d be running a hedge fund and charging 2 and 50.

🙂

When I signed up with Cam he didn’t have a track record but his methodology was exactly what I was looking for. And it proved robust.

Ken has only two data points in his track record that we know of, albeit, excellent calls. I looked at his website and didn’t see any further explanation. Unless there is a long term track record of actual calls that are promising or a methodology that I wholeheartedly believe in, my personal preference is that I will pass on further inspection.

Joyce – I understand the sentiment. But if you regularly follow / read, Ken has continually provided insightful commentary and prompted great discussions through the years.

If I understand it correctly, the model you are selling is the best that there is. I don’t get why you need to sell something that can mint money for you and why use this forum for doing it?

I would never deal with a person or service with these tactics.

Just had the honour of being Ken’s number one on his web-meeting (it was late at night in Alberta!)

Very informative. He set up a nice timing tool which he will make available some time in the future. Learned quite a lot about leadership of stock groups in different cycles of the market

So go for it! Have a chat with him! Highly recommended

I just had my webmeeting with Ken. He shared part of his really interesting research on factors, his approach to the business cycle with clear examples and where he believes we stand now. Very revealing. Thank you very much Ken.

And thank you Cam too for allowing other great PMs to share their insight and contact information. Always faithful to the motto HUMBLE Student of the Markets.

I just had a great virtual meeting with Ken today and learned about his Factors approach. I think his work is amazing and I have great respect on his research!

I encourage people here who may be interested in Ken’s work to set up meeting to talk to him. He is great!

@Ken, look forward to learning your work and opinion more in the future!

Ken, thanks again for the call! I wanted to post some comment here, but for some reasons , it got to below.

I think you’ve described retail sentiment. During the panic, a few of my co-workers were going long on margin after the Fed announced their emergency stimulus. There’s an assumption that the Fed won’t allow equities to go into free-fall, even though that’s not true at all.

Last discussion at my company have broached the upcoming decline in sales – either effected by supply chain or customer budgets being frozen or eliminated. Forecast right now is grim, estimates average around ~50% reduced demand for retail and commercial real estate this year.

Be careful with Sentimentrader’s morning tweet on low -64% volume study “U.S. stocks ALWAYS pulled back over the next 2 months, sometimes *very sharply*”. This is not really true, especially around holiday trading and could represent a trap: Under similar conditions:

11/25/11 + 9.0% in the next 12 days then a 5% pull back followed by

12/27/11 + 12.9% in the next 96 days

I recognize that SentimenTrader’s analysis is statistical in nature, and intermediate term. But when it comes with other warnings, it’s time to recognize that this is a high risk environment.

Thanks, Alex.

Unless I’m missing something, the statement ‘US stocks ALWAYS pulled back over the next two months’ sounds a pretty good bet to make on any random day. Prices never move in a straight line. He probably intended to say ‘ALWAYS pulled back below current levels-‘ but even then, it might be an even bet.

“However, two major investment firms’ sentiment indicators are unusually giving off wildly contradictory readings. The BAML Bull-Bear Indicator is flashing an off-the-charts buy signal.”

Cam, aren’t both of these indicators in extreme bullish territory making them both contrary extremely BEARISH?

The Merrill Bull-Bear Indicator is extremely bullish, but the Citi Panic-Euphoria Model is euphoric, which is contrarian bearish.

OK. Thanks, Cam.

I suppose the models reflect underlying methodology which is unknown.

Cam- What do you make of Callum Thomas’ reply to the question ‘1. “But earnings revisions are catastrophic… shouldn’t the market be collapsing too?”

‘Maybe… but maybe actually when it comes to cycle data good is bad and bad is good. #SubtletiesOfStrategy’

Based on the chart below:

https://twitter.com/Callum_Thomas/status/1264295542248615936/photo/1

From Liz Ann Sonders at Schwab: ” correlation betweeen S&P 500 & forward earnings estimates has been +.90 over past 20 years, but a mirror image -.90 since 3/23/20″

https://twitter.com/lizannsonders/status/1263545888519184396

We are indeed in uncharted waters.

Wow, I didn’t realize it was that pronounced.

But check out a second tweet Sonders put out a day later in the thread below her original post – apparently not completely uncharted waters?

‘For the many who replied to this tweet & asked whether correlation might have also been negative around GFC era, answer is yes—at start of bull market (3/9/2009-5/8/2009), correlation was, like recently, -0.9.’

(Someone called her out on this – ‘So why leave this little fact out of the first text? Completely changes the message!’)

Food for thought.

The GFC was a crisis that occurred on Wall Street and the financial markets. The fix was financial. Congress and the Fed acted, eventually.

This crisis is a crisis that occurred on Main Street that seeped into Wall Street. While Congress and the Fed have acted to stabilize markets, the underlying problem hasn’t been solved. The Fed can’t print sales for distressed businesses, nor can it print jobs.

if you think that the underlying problem has been solved, this is a buying opportunity. Otherwise you are seeing the authorities address the symptoms, not the cause.

OK, both good points.

The best I can come up with is a combination of (a) an implicit promise by central banks to provide unlimited liquidity for the duration of the pandemic + (b) confidence (unfounded or not) in the global effort to either produce a vaccine or find an effective logistical solution to identifying/ tracking/ containing infected individuals.

While I agree that the Fed can neither print sales nor print jobs – it’s certainly not forcing investors/ traders to buy equities.

The question is why the unrelenting bid on stocks, much of it apparently funded by stimulus payments.

It’s to the Fed’s advantage if markets lift – higher stock prices will ultimately lift consumer confidence and/or spending. Is the Fed able to indirectly encourage demand for stocks? I think so. If Greenspan was able to talk markets down via ‘irrational exuberance,’ then perhaps Powell found the right phrases to use on 60 Minutes to achieve the opposite effect.

The latest moves by China regarding Hong Kong are causing the Hong Kong stock market to plunge.

Civil unrest could erupt in the U.S. It may even be likely with the negative effects of Covid heavily tilted towards African-Americans and generally lower income folks. The social divide which was uncomfortably wide before Covid has become a huge gulf. We are seeing much higher mortality rates in those communities and extreme income and job impairment. Pressure must be building. When lock-down is over, protests may starts. I pray they will be peaceful.

Hong Kongers are rioting on freedom theories. The U.S. will likely have riots based on more day to day graphic realities and grievances. Stock markets won’t do well if it happens.

From the dark pools, the DIX on Fri was > 50. still trying to figure out what this means right now right below the 200 dma; historically DIX> 50 short term very bullish. Of course it is hard to imagine going much higher than 3000 right now, but it is possible SPX overshoots due to euphoria/ FOMO. There is discussion as to whether retail traders are affecting the DIX signal. https://squeezemetrics.com/monitor/dix

Don’t know how you define dark pools. It is supposed to be off exchanges. Then how you track them? If you mean transactions with prices between bid and ask, then most of retail investors would not able to do it using those popular discount brokers. IB offers this and other algo-driven criteria (you write your own algos) to get the order filled, but the order is still thru the various changes. You can see the exchanges in the record when order is filled. I use this often trading options during the last 90 minutes and over night using gamma hedging trend as a guide. The win rate is quite high.

Thanks Ingjiunn, much appreciated. I’ve been referencing this paper:/ site: https://squeezemetrics.com/monitor/download/pdf/short_is_long.pdf?

It is an interesting paper. But it does not look very predictive. The dark pool money is not big enough to be a dominant factor in the market. There are other factors having more predictive power at certain situations. I think DIX can be used as a reinforcing indicator, after the major ones are examined. There is one scatter plot inside the paper. This looks like an example of pseudo-math, frequently found in articles related to finance and investing. Are both return and dix independent variables? Or dix is independent variable and return dependent variable? From the article, dix is obviously not an independent variable. There are other ways to make money more reliably if you employ math of probability and simple set theory, and the most reliable of all: time decay of option prices.

Thanks for reading! I will look into time decay of option prices.

Ellen- Why the obsession with dark pool transactions?

Fact or fiction on the Moderna vaccine?

https://www.independentsentinel.com/moderna-vaccine-causes-serious-injury-in-20-insiders-cash-out/

The next phase of the pandemic?

https://www.sfgate.com/news/article/A-deadly-checkerboard-Covid-19-s-new-surge-15292024.php

https://www.marketwatch.com/story/hulbert-my-stock-market-forecast-for-june-is-likely-wrong-but-watch-out-for-august-2020-05-25?mod=mw_latestnews

Now that Hulbert has gone public re a wrong call – what if he’s actually right? Or at least half right?

With the caveat that this year is hugely atypical, a swoon in June sets up a strong July, then weakness precedes the month before the November is usual pattern.

https://twitter.com/ukarlewitz/status/1264319209489625088

I am seeing more and more articles about the tech, trade and cold (and even hot) war with China in the future. I also hear about the roles global elites played in offshoring the US industry to low-wage locations, China in particular.

Clearly, it is not in the interest of global elites including in the US and China to engage in any kind of war. Can they prevent it or at least avoid the temperate to rise too far?

Any thoughts?

Thank you.

Both sides have already confirmed that they are willing to respect the “phase 1” trade deal. The Huawei export restrictions have been telegraphed multiple times before. So both sides are taking more targeted company or location specific action, but are shying away from more significant measures that would lead to broader risk-off moves. The “tech cold war” in the semiconductor space is still in the “warning shots” phase and what we have seen war is simply part of Trump’s reelection campaign as he doesn’t want to look “soft on China” after signing the “phase 1” trade deal.

The British Columbia Supreme Court is due to rule Wednesday on Huawei executive Meng Wangzhou

https://globalnews.ca/news/6970105/meng-wanzhou-huawei-extradition-ruling/

Xi just declared war against China’s collective Red 2nd Gen by chocking off their money flow facilitated by orgs in HK. Usually we don’t need to pay too much attention to all kinds of political movements and posturing. But when huge money is at stake, it is time to sit up and observe. Xi either gets expelled or consolidates more power. Watch the movements unfolding.

As for offshoring, it is like “You can’t fool all people all the time.” Right after Tianman, Bush Sr. sent secret delegates to CCP to assure them things will be business as usual. On the front, engage in all kinds of campaign condemning China. Do you know Bush Sr. was the chairman of Carlyle Group? A group whose investors are a collection of world’s most brutal and repressive dictators and most corrupt politicians. When he died the world becomes a better place. From Bush Sr. on to Obama, business is as usual. Do you know two senators from my home state of California, Feinstein and Boxer, profited big time from ties with China? Don’t even mention Biden. Feinstein is still in this game today. She got rich from illicit deals in RE during S$L crisis in late eighties and early nineties when she was Mayor of SF. Her husband still today is profiteering in the California’s high speed rail project together with Pelosi and Newsom.

Trump got into so much trouble because he does not want to play by the rules set by the cabal of global elites. Simple as that. Everything else is just noise.

The awakening of the masses has been a long time coming. There is nothing the globalists can do to suppress it. Info is free flowing today. 70% of Americans have an unfavorable view of China. Politicians will seize the opportunities and steer in even more extreme directions.

This health crisis just laid bare everything. The game has changed. We need to watch and prepare for any scenarios.

Appreciate the responses.

Thank you, All.

I just had a great virtual meeting with Ken today and learned about his Factors approach. I think his work is amazing and I have great respect on his research!

I encourage people here who may be interested in Ken’s work to set up meeting to talk to him. He is great!

@Ken, look forward to learning your work and opinion more in the future!

I noticed that none of the people who had a virtual meeting with Ken failed to pass-on what Ken thinks the stock market will do next! Were they sworn to secrecy or doesn’t Ken have a clue?

I’ve seen Ken’s presentation. Without giving away all the details, he is quite cautious.

SPY breaking out of a bull flag/pennant. A strong bid continues to drive this rally, IMO.

Measured move to 305 – who knows.

Probably anathema to say it, but it’s possible we’re in the midst of a new bull market and have yet to appreciate the move. Can’t say I believe it, but neither do I disbelieve it. Staying agnostic for now, with the intention of playing the bull trend until it ends.

Not anathema, just hard to swallow. Can’t be a “new” bull market, just a major correction in the “old” bull market and we aren’t in a recession and never were!!

Interested in my Brooklyn bridge?

It may be hard to swallow, but that’s exactly how the market often operates. A -35% move in one month? That wasn’t easy to embrace either.

Anyone sitting out the Nasdaq 100 move back near 2020 highs because ‘it’s just a retracement rally’ can’t be feeling too pleased right now.

Our job isn’t to ‘outsmart’ the market – if we’re playing for P/L, then the market is always ‘right.’

Yeah, I know – it’s just the fear / greed equation. My fear is probably too great, so I miss a lot of opportunity.

First breach of SPX 3000/ 200-day unlikely to hold. You might wait for a pullback to SPY 285 +/- a few points for an entry – assuming you turn bullish, of course.

You might also overweight the sectors left for dead – tanks, banks, airlines, energy. Not saying they’re necessarily bargains – but likely to outperform technology and healthcare in the ST.

Thanks, rx. I did miss the down draught in March, so not too bad. The banks are of great interest as they are probably a reasonably safe place at this point.

So you think we will hit SP500 2850? Do you not think the EPS will weigh? I noted the following:

“As of May 21, earnings for 2020 are now expected to fall by 30% to $110.62”

Unless we get a V return, economically speaking, are the 2021 EPS estimates not too high at $160 +/-, – and does it matter?

I don’t think we can predict EPS estimates with any accuracy.

Do earnings matter? Yes, of course. But they matter less than price movements – and apparently markets aren’t too concerned right now. They may suddenly become more concerned tomorrow/ next week/ next month – but that’s not helpful to me today.

I’m ‘pretty sure’ SPY will pull back to at least 285 – simply because that’s how the market (ie human nature) tends to behave.

Nothing wrong with staying in cash while waiting for an attractive entry.

Don’t you just hate being the last one to a party? Just when you get there everyone else starts heading out the door.

Sometimes they’re headed to another location where the party gets even better.

Not being a “party gal”, not too bothered about that.

Was doing quite well from years 2000 to 2020 – survived dotcom, GFC and have missed the pandemic meltdown. But the speed ar which things are going at the moment, I am not staying up in these choppy waters – just sitting on the sidelines waiting the chopiness to settle down.

That is mostly what I have been doing. Cam got me to cash just before the crash but I would hate to see the market go back to new highs with me still on the sidelines. But, I’ll wait for Cam to signal the “all clear” before taking any sizeable positions.

Novavax picking up the vaccine banner while Moderna falters.

Phase 1 trials. A long way to go.

Human trials have not started yet and usually last a few years. Although for some reason, I’m seeing news about a vaccine by end of year.

Covering all shorts as the S&P 500 tests its 200 dma. No doubt my action will induce the market gods to weaken the market.

Or simply reopen at even better levels. SPX likely to stall at 3030 to 3050 – my time horizon isn’t likely to extend beyond today or tomorrow.

Even the junk bond market started staging a recovery last week.

Maybe the big boys are fading your calls, Cam. Better change brokers.

Cam, I have doubts about your analysis of retail investors as drivers of the latest surge. While the number of accounts at brokerages increased, the total capital from retail cannot possibly compete with institutional investors. It must be the institutions driving the rise. I don’t care how many millions of new accounts there are on Robinhood, the amount traded is a pittance compared to what pension and hedge funds can wield.

SPX pulling back below 3000. I have weak conviction re the first breach of SPY above 300, and have started trimming or closing positions (SPY, XLE/, XLI/ XLF, FXI, EWH, JPM, BABA).

Photos of Memorial Day packed-in crowds around the U.S. leads me to believe we will see a surge in Covid cases in two weeks, three at the most. Given the severity, this could be a big set-back to the bull crowd.

I quote Ken

“Photos of Memorial Day packed-in crowds around the U.S. leads me to believe we will see a surge in Covid cases in two weeks, three at the most. Given the severity, this could be a big set-back to the bull crowd”.

The photos of parties in the US do not matter unless there is reimposition of “lock down” in states that opened. If state after state imposed a lock down in the next 1-2 weeks, I would like to think the market pulls back.

Texas opened on 1 May. So far, we do not have any indication that Texas leadership is going to re impose a lock down. Florida is another. Two big states.

So, there is a binary outcome. No Lock down indicates FOMO (??).

A new lock down, indicates a pull back. Let us wait, and watch. Our master Cam, will hold our hands when it comes to technicals.

Let us pencil in 2650 on the downside as support (see my previous posts why this level is important; 2800 is the upper end of this band; we had three occasions of 2650-2800 side ways trading last year).

Below 2650 is 2400 and then 2200.

Full disclosure: My target allocations remain long and in place. I will cut target exposure to bare minimal if there is re imposition of lock downs (this is a hard line in the sand IMHO). All said, no vaccine as of today and no anti viral either. Let us not forget these two “factors”.

I keep reading that the Fed cannot replace sales. My daughter and son in law borrowed $700,000 in a forgivable loan for their business. The money, which is fungible, will go directly to their bottom line.

Without an accounting entry pointing it out, that money is pure profit and will more than offset (in the short run at least) their lost sales from the shutdown.

That’s providing free money to the net worth of the business the way I see it. And there’s about a half trillion been doled out that way.

Fund managers with full-time research staff probably figured this out a few weeks ago and began funneling money into small-caps.

Tough trading environment.

I trimmed the vast majority of positions yesterday in hopes of reopening against downside follow-through this morning. Instead, the market is poised to gap up above yesterday’s highs.

Then again, you could say the market is doing exactly what I expect it to do – ie, the unexpected.

Banks and airlines gapping up for a second day.

Today’s gap-up feels ‘off.’ Closing all remaining positions. Not a guy who rides a trend to the bitter end – but this morning’s action kind of feels like the bitter end. JMO.

Look at the Nas. It’s giving a clue.

You know, Wally – I think the flush to 2969 may have been enough to shake out the weak hands.

Now cleared for takeoff? One of many scenarios under consideration…

I don’t know, RX?. I see all this talk on TV even from Obama people about the great economic explosion coming – but can you really believe that? What would be the reasoning behind it? Are we to think businesses will come back lean and mean having shed all the excesses they have accumulated since the GFC? I think the economy is still in trouble. But who am I to say?

It’s the missile launch, stupid!! We’re back!!

We should have jumped in when the SPX recovered above yesterday’s close (~299).

US: HK no longer autonomous from China

https://www.bloomberg.com/news/articles/2020-05-27/pompeo-finds-hong-kong-is-no-longer-autonomous-from-china-kapiu0a2?sref=a31LTMEA

A good thread on the market:

In summary, bulls aren’t in fact bullish on the economy, but buy stocks because everything else is rubbish. And bears aren’t in fact bearish, but are looking for an entry point, because they’re long-term bullish.

https://twitter.com/EdVanDerWalt/status/1265606831365328896