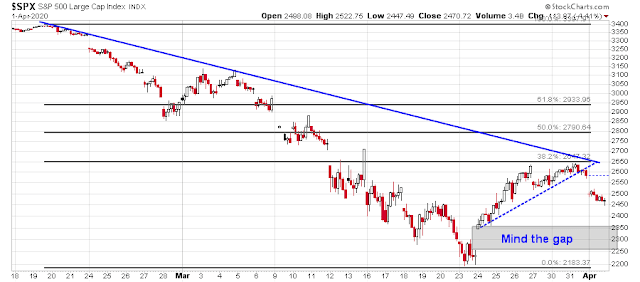

Mid-week market update: The bear market rally appears to have stalled at the first Fibonacci resistance level of 2650. The bulls also failed to stage an upside breakout through the falling trend line. Instead, it broke down through the (dotted) rising trend line, indicating the bears had taken control of the tape.

Deteriorating internals

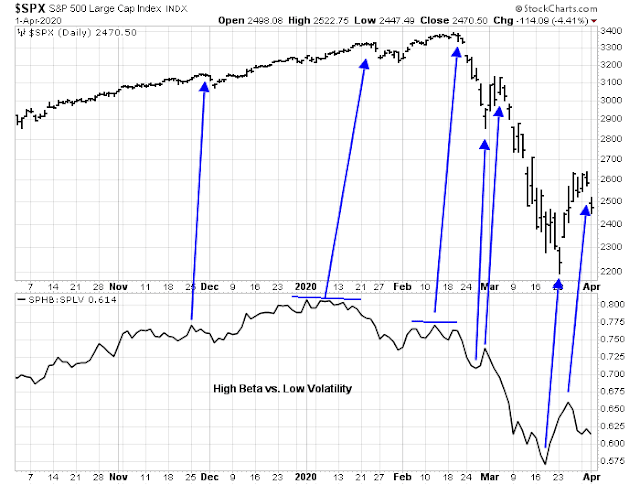

I should have known better. One of the most reliable indicators has been the ratio of high beta stocks to low volatility stocks. This ratio has signaled most of the turning points in the last few months, and it turned down again late last week. (Warning: No model works forever, and relying on any single indicator is hazardous to your bottom line).

As well, I had expressed concerns about how USD strength was pressuring EM economies. The relative performance of EM bonds and EM currencies have not been reassuring during the recent bear market rally.

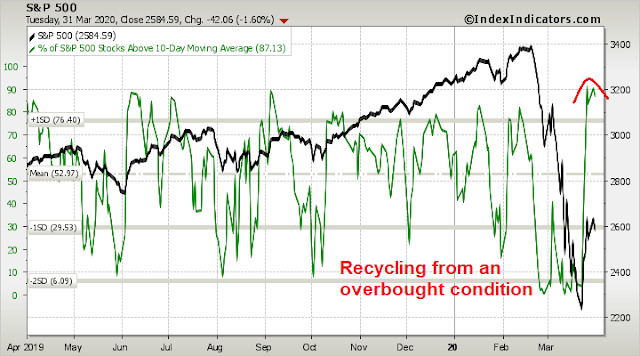

Short-term breadth is recycling from an overbought condition, based on last night’s close. Undoubtedly readings will have deteriorated by today’s close, but not enough to move to an oversold reading.

My inner investor is at a position of maximum defensiveness. Subscribers received an email alert this morning that my inner trader had sold his long position and reversed short. A logical downside objective is see the gap at 2260-2350 to be filled.

One key test of market psychology will be tomorrow (Thursday) morning’s release of initial jobless claims. While initial claims are likely to spike even further, watch for revisions to last week’s release, which may surprise with further upward revisions. Watch how the market reacts.

Disclosure: Long SPXU

Hi

Your disclosure says Long SPU.

I got the email today. But I wasn’t sure whether you entered short right there and then and what the level was? Can you shed some light as to where your entry was?

Thank you

This is the most pessimistic prediction I have seen so far.

https://twitter.com/albertedwards99/status/1245669227996033029

Albert Edwards is a permabear for the institutional set and his views would put Zero Hedge to shame. Unlike ZH, however, Edwards’ analysis is well grounded so PMs listen to him to understand downside risk.

Thanks, Cam. I had not heard the name before. However, Lance Roberts who runs an RIA advisory service, retweeted his tweet giving some credence to the guy.

The economy looks really bad but we have “whatever it takes” Fed and Congress. That should somewhat limit the damage even if the CV is not erased for another year.

“Even as the spread of COVID-19 accelerates in many regions of the U.S., institutional investors are becoming ever more bullish about the prospects for the stock market, according to a survey released Thursday by RBC Capital Markets. ”

https://www.marketwatch.com/story/smart-money-investors-havent-been-this-bullish-on-stocks-since-2018-says-rbc-survey-2020-04-02?

Cam, saw your tweet this morning regarding initial claims, were you being sarcastic/ironic?

The numbers were worse than expected this week and last week but market moved up, whereas on March 12th the market tanked.

ES futures was up over 1% before the initial claims print, and then dipped into the red afterwards. Yes, it was reacting to macro news.

Looks like the aid will be slow in coming…

“My accountant has spoken to 4 banks and none of them have an idea of how this Payroll Protection Program is going to be administered. It looks like banks may end up providing their own application form and standards rather than using the Federal.”

https://twitter.com/dwyerstrategy/status/1245801299272175618

Sanjay, here is an SBA page that lists the coronavirus aid programs.

https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

Wally, well, there are plenty of aid programs but you need to put the right processes and procedures to effect those programs. How does one apply? Are those applications templates ready and available? Do bankers have access to them? Do they know how to verify the application data? All this cool stuff. Based on the tweet above, they may not yet be ready.

Well, it is the GOVERNMENT. Fast or accurate is not in the average government worker’s vocabulary.

To be fair, some of the policies were announced this week, but they haven’t even passed the legislation yet. It took the bureaucrats about 3-4 days to finalize the rules. That’s not bad for any large organization.

I have various small business friends here in Canada. Speaking to them, it’s taking everyone time to get their act together up here too.

Note according to the article, BofA began accepting applications since this morning and Chase at 1pm EST. Citi is reviewing the guidelines.

A note on Citizens’ website said: “The SBA has not yet issued guidelines describing specific requirements for the programme, and it has not yet finalised borrower documentation requirements. Therefore, unlike we had hoped, we are not accepting applications at this time.”

https://www.ft.com/content/d16d8020-64d5-4342-8818-61f4caa5bcbb

Just had to post this.

https://twitter.com/eminiplayer/status/1245806099216748545

At last count there were at least 40 trials going on. I am sure there will be a breakthrough, but the testing process takes time.

Google thaliadomide. No one wants a repeat of that disaster.

The safety of the vaccine is especially important as that will be given to 330M Americans and 7B-plus people allover. Even if the vaccine is not safe among 1% of the population, that means 3.3M Americans and 70M people are at risk.

Wow! Thaliadomide was quite a disaster. Hard to imagine that today.

https://www.marketwatch.com/story/this-recession-will-finally-end-the-private-sector-debt-supercycle-says-firm-that-invented-the-term-2020-04-03?mod=home-page

The US consumer is re liquified after GFC. However, US corporations are now addicted to that debt. It remains to be seen how all this ends, as the US adds even more debt to pre existing debt! Globalization is slated to reduce (even before the pandemic), which is likely to be inflationary!! We may have a rebound in global growth in the next few quarters, but whether supply chains return to the West from far East is yet to be seen. If this were to happen, we may be peeping into growth sapping inflation (eventually). Future is hard to predict, but for now the de globalization move may not have the best outcomes, all said.

https://www.usdebtclock.org

Gold is supposed to be a hedge, but is hitting a brick wall of resistance around 1650-1700. That said, if US inflation takes off, gold may be something to buy, going forward.

We keep getting really bad news on jobs and out of NYC on deaths and new cases but the market doesn’t seem to want to drop much. I’m tempted to move a little long term money back into the market today.

What’s it looking like to you, Cam?

Here is my problem with raising the risk profile of a long-term portfolio by buying US equities. The question is, what’s going to make prices go up (in the long run)?

At last report, the S&P 500 is trading at a forward P/E of 15.5, which is ok value but not great value. But the E in the P/E is falling fast, just like the NFP number. Adjusted for trough E, the market is probably trading at a multiple of 17-20.

In order for the market to rise, you either need an earnings recovery (do you think earnings are really going come back that quickly?) or multiple expansion (how much upside do you think there is in an adjusted forward P/E of 17-19)?

The PE ratio tends to be on the high side at market bottoms. as “E” drops significantly. Market, being a forward discounting mechanism, the challenge is to ‘estimate’ next quarters PE. Your line in the sand is a PE of 10-13.5, with EPS of 160 $ per share.

Yardeni is expecting the 2020 earnings to decline by 26.4%. Also, share buybacks will be down a lot in 2020 which won’t help the earnings (EPS) either.

Yardeni is forecasting EPS of $120 in 2020 and $150 in 20201.

Agree, the multiple should be higher at the trough.

These are very very bearish numbers. That said, a lot depends on how this pandemic pans out (or not). There is a whole lot we do not know nor understand about this pandemic. Critical question is what are the environmental factors that came together to cause this thing to spread. Why did it not happen in years bygone? Would such factors come together again?

Why did MERS/SARS did not rear their ugly heads again?

It is tough to make such predictions, FWIW. We are at maximum point of bearishness as I write this, and watching Anderson Cooper at 9-45 PM EST. The only more bearish forecast would be demise of the entire human race! It is time to put some probabilities to such bearish numbers.

That makes sense, Cam, so long as the market isn’t looking across the gulf of bad earnings. 1st Quarter earnings should start being reported soon so, I guess I’ll wait and see how the market responds to the first round of partially bad earnings.

Thanks, Cam.

To drive Cam’s point home, this was just released by IBD.

“Yardeni Research projects plunges of 23.4% in Q1, 51.6% in Q2, 28.8% in Q3 and 4.8% in Q4. For all of 2020, the firm expects S&P 500 earnings to decrease by 26.4%, before turning positive next year.”

https://www.investors.com/news/coronavirus-recession-ravage-corporate-earnings-longer-than-you-think/?src=A00220&yptr=yahoo

Just looking at charts, the first minor support level is at 2450 and then 2400. Seems logical it will head for at least 2450.

Massive support @ 2450-60. We are seeing this today.

https://covid19.healthdata.org/projections

State-by-state projections.