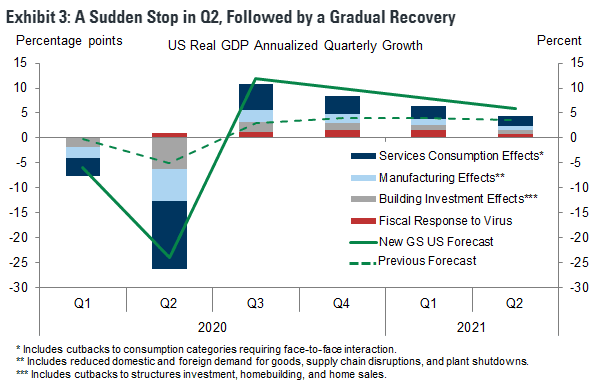

There is little doubt that we are in a recession induced bear market. Goldman Sachs published their GDP forecast late last week of a V-shaped slowdown and recovery.

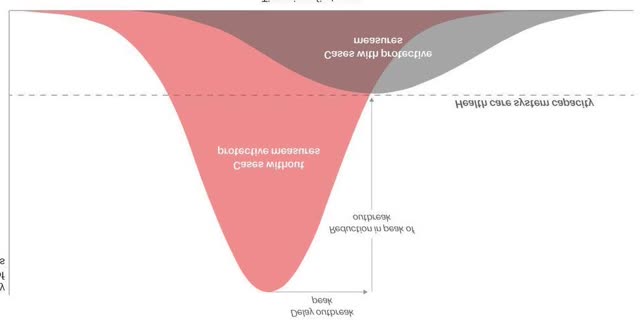

For some context, New Deal democrat raised an important point about a framework for thinking about the recession by flipping the well-known “flatten the curve” chart upside down:

The problem with this from a strictly *economic* point of view is that, so long as we don’t know who is infectious, everybody needs to stay in self-quarantine. This will be catastrophic economically if it must continue for 12 to 18 months.

The inverted curve shows the stylized effects of economic growth based on a government’s choice of public health policy. Do nothing and allow the virus to run wild, and you get a short, sharp slowdown at great human and electoral cost (pink curve). Flatten the curve, and you get a lower death count but longer recession (grey curve), with the hope that a vaccine can be found in the future to cut off the right tail. For an idea of how the Trump White House is grappling with this dilemma, see the WSJ‘s “As Economic Toll Mounts, Nation Ponders the Trade-offs”, and Bloomberg‘s “Trump Weighs Easing Stay-at-Home Advice to Curb Economic Rout”.

Even the experts are only guessing. FiveThirtyEight conducted a survey of infectious diseases experts, and the poll showed wildly varying opinions. Since we know neither the depth nor the length of the slowdown, it’s very difficult to estimate the nature of the recession, and the equity bear market. In that case, where can investors hide?

Time for gold to shine?

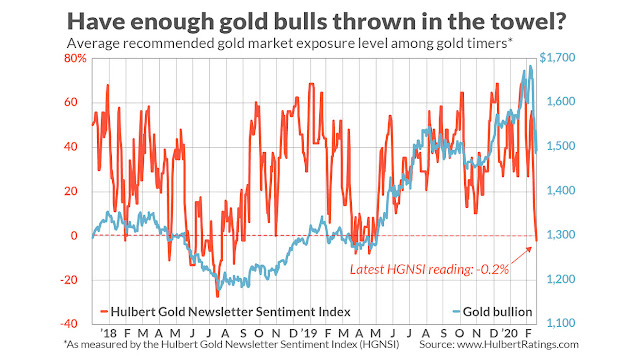

The classic hedge against an equity decline is gold, and this may be the time for bullion to shine. Mark Hulbert recently highlighted signs of growing despondency among gold market timers, which is a contrarian bullish indicator for the gold price.

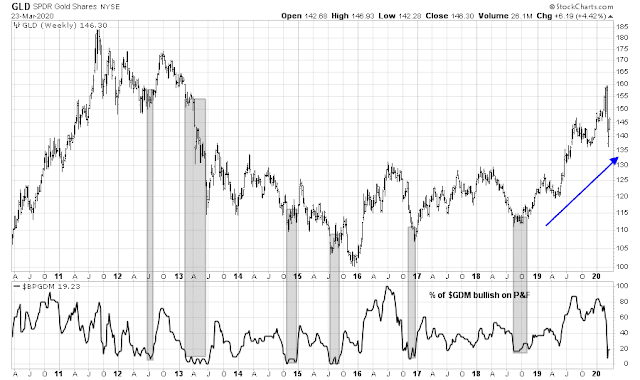

The technical picture confirms Hulbert’s conclusions. The % bullish of stocks in GDM (the index underlying the gold stock ETF GDX), has fallen to a level that has signaled low risk entry points in the past. This signal has worked well in gold bulls, but it’s less effective in bear markets.

I would warn, however, that any allocation to gold should be only tactical in nature. Gold does not perform well in a deflationary recessionary environment. While the tsunami of monetary and (hoped for) fiscal stimulus is theoretically inflationary, the authorities would undoubtedly welcome such a problem. Bond market inflationary expectations are falling on a daily basis, so don’t count on inflation bailing out a long-term commitment to gold. Any commitment should be regarded as a trading position, not an investing position.

US investors

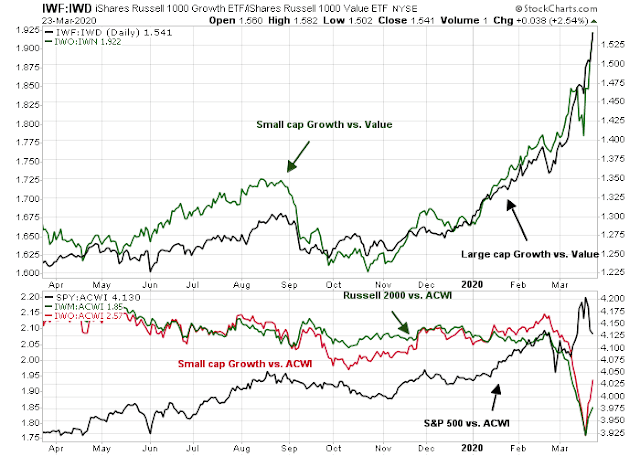

For investors who must hold some US equities by mandate, here is where you can find some outperformers. The analysis of relative strength by market cap groupings tells a clear story of megacap and NASDAQ leadership.

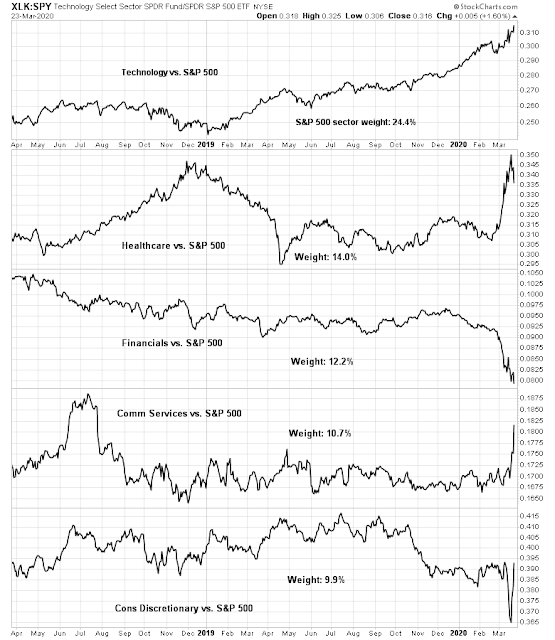

An analysis of the top five sectors reveal two clear winners. Technology stocks have been in a steady relative uptrend, as investors believe that they are the least affected by the COVID-19 pandemic. Healthcare is another winner, which is an obvious choice under the circumstances. The other sectors are either too volatile, or exhibiting overly bearish patterns to be considered.

Putting it another way, it has been large cap growth that has been driving equity performance. While both large and small cap growth has been beating their value counterparts, small caps, and even small cap growth have dramatically lagged global stocks, as measured by the MSCI All-Country World Index (ACWI).

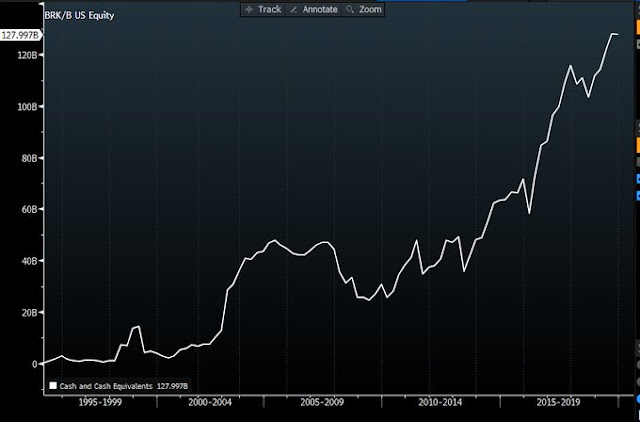

Contrarian investors can consider Berkshire Hathaway. Regular readers know that my main focus is on top-down analysis, and I hesitate to analyze single companies. However, I can’t help but wonder about Berkshire Hathaway, which has been accumulating a big pile of cash. Warren Buffett has shown a historical tendency to be ready to use his cash for the right investment at distressed prices when the right opportunity presents itself.

The stock has fallen, but it beat the market during the latest rout.

Non-US markets

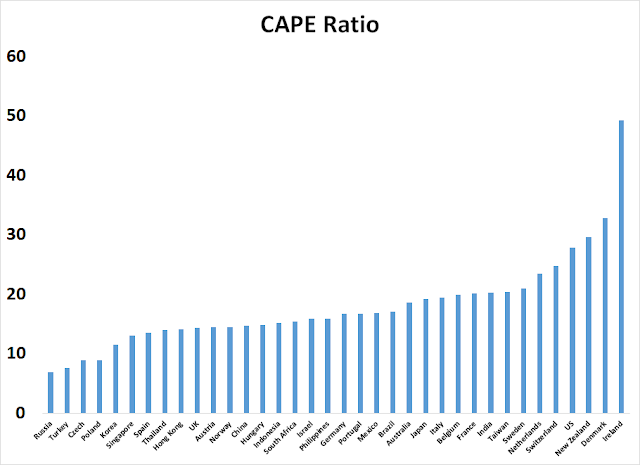

For non-US markets, I turn to Star Capital‘s analysis of Shiller CAPE. Despite its faults, CAPE has shown to be an effective tool to spot cheap national markets (see Meb Faber’s research).

Here are the results by country. Note that the US is the fourth most expensive market.

Some of the countries in the cheap zone, such as Czechia and Poland, do not have US-listed country ETFs. Shown below are the relative returns of selected countries compared to then ACWI in the cheap region.

Here are my main takeaways from this analysis:

- Russia and Turkey are the “hold your nose and buy” contrarian value plays. They could be interesting for a patient value investor, as these markets are nearing long-term relative support, indicating low relative strength risk.

- Spain is statistically cheap, but it should probably be avoided as value trap as it struggles with the COVID-19 pandemic.

- The Asian markets offer some potential. The Asian countries shown in the chart have emerged after their successful battles with COVID-19. While Singapore remains in a relative downtrend, the Hong Kong and Korean markets offer some potential. Hong Kong is already exhibiting some relative strength. The Korean market is testing relative support. Combined with its impressive efforts at controlling its COVID-19 epidemic and its proximity to a recovering China, South Korea offers potential for outperformance.

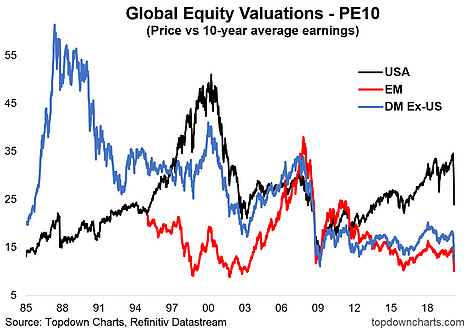

- The US market is still expensive, as shown by this chart from Callum Thomas of Topdown Charts.

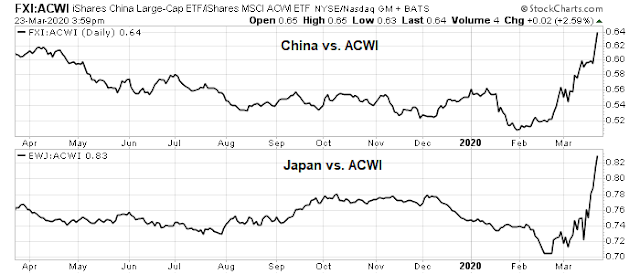

I would be remiss if I did not mention the pure price momentum plays internationally. China and Japan have been surging as their COVID-19 epidemics have come under control. From a technical perspective, however, they appear to be highly extended and ripe for setbacks. Momentum traders can consider buying them on pullbacks.

As well, I am worried about possible cracks in the Chinese financial system despite their massive stimulus and signs of economic normalization. The highly leveraged property market is a source of concern. Bellwether China Evergrande skidded -17% overnight and violated multi-year support, indicating a rising stress levels among developers.

The charts of other property developers appear serious, but less dire. China Vanke fell -7% overnight, breached short-term support, and it is now testing long-term support.

Country Garden Holdings fell -8% overnight, and it is testing a key support level. These price breakdowns are part of a disturbing pattern and represents a key risk for China that investors need to keep an eye on.

In summary, there are few places to hide for equity investors focused on absolute returns. Stocks fall in a bear market. Gold can provide a temporary hedge against falling equities. However, there are pockets of opportunity for investors who want to be exposed to equity risk. US-focused equity investors can focus on large cap growth, and Technology and Healthcare in particular. Value investors may want to consider Buffett’s Berkshire Hathaway, which has a huge cash horde ready for opportunistic investment. For investors who can roam globally, Russia and Turkey are the contrarian value plays, while Hong Kong and Korea are the cheap markets exhibiting potential upside momentum.

Disclosure: Long EWH, EWY

1. Great remarks and the comparison made for the different markets. Asian markets will probably lead the way, not sure if any particular sector is more attractive than others once the recovery starts…?

2. Damodaran made an interesting analysis on sector specific and corporate bond investments for the US market. In addition, he talks about fundamental change in our economic structure.

https://www.youtube.com/watch?v=Q_ZFRyeN_iU

Regarding indefinite lock-down –

If you’re on twitter, follow Yaneer Bar-Yam.

He describes the post-lock-down process here:

https://twitter.com/yaneerbaryam/status/1242135820242477065

Thanks Len

https://www.marketwatch.com/story/the-fed-is-going-to-buy-etfs-what-does-it-ying value mean-2020-03-23?mod=home-page

I had asked the question in previous post if Fed would be buying bonds and if so what duration would it focus on. I did not have to wait for too long. With the above news, the price and underlying asset value of LQD seems to have narrowed (see Ken’s comments in previous post), and I seem to have my answer.

As US Congress bickers about the stimulus, last few days futures markets have been in the green, but cash markets have been selling off. Of course gold had a huge snap back rally today, but one wonders how much more downside is left in this emotion driven market.

It would be easy to see a 20-25% rally here (to 2650-2700), and gold hitting resistance at 1600 (incomplete retracement of 1700), based on purely a massive stimulus package. That said, the agreement in US Congress may take longer than thought. On the ground floor in the US, there is talk of schools closing for the rest of the year, lay offs starting to mount etc. which is likely to sap the confidence of Joe Six pack.

Let us see is 2100 holds here (38.2% Fibonacci retracement).

Here is a link to moving average charts on U.S. Corporate Bond ETF LQD and General Bond ETF BND (65% government rest in quality corps). Keep it. It updates nightly.

https://tmsnrt.rs/2y5rJtV

EPOL for Poland.

Thanks for alerting me, but EPOL is in a relative downtrend and the chart looks similar to Spain.

As I survey my Twitter feed, almost everyone is expecting a rebound and retest of lows and/or even lower lows.

How does that play out when the expectations converge?

I think the market sold off after industry bailout requests amounting to $2.3 Trillion were reported.

https://www.marketwatch.com/story/coronavirus-stimulus-package-lobbyists-have-asked-us-government-for-more-than-23-trillion-in-aid-2020-03-24?siteid=yhoof2&yptr=yahoo#main-content

After a Ed piece yesterday, the WSJ posted an Op piece today.

Is the Coronavirus as Deadly as They Say? https://www.wsj.com/articles/is-the-coronavirus-as-deadly-as-they-say-11585088464?mod=hp_opin_pos_2

The authors are professors are Stanford.

Their premise is that the denominator, the actual number of infected people, is an order of magnitude higher.

I guess even if the mortality is much lower, we still need to flatten the curve to prevent our hospitals from being overwhelmed.

Thanks for posting this, which could well be true.

Bill Ackman was on CNBC a week ago to scare the living daylights out of market. Now he has covered and gone long. I guess the market still has some ways to go up. I will wait for his next appearance.