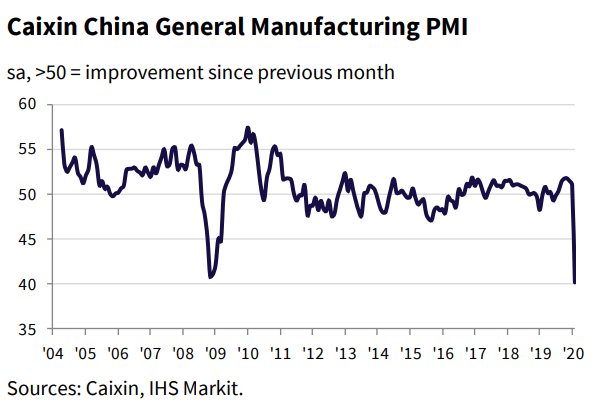

The data points closely watched this past weekend were the releases of China’s Purchasing Manager Index (PMI) readings. On Saturday, China reported that its February manufacturing PMI had missed expectations and skidded to 35.7, and services PMI also missed and printed at 29.6. Both readings were all-time lows.

The Caixin private sector PMI also fell to an all-time low on Monday.

Was these misses surprises? Yes and no. They were surprises inasmuch as the market partly expected the authorities to manipulate the numbers and report a less severe downturn. They were no surprise as the Chinese economy was obviously very weak in the wake of the COVID-19 coronavirus epidemic gripping the country.

Returning to work?

On the other hand, there was emerging evidence that China is returning to work. The Credit Suisse estimates of China’s labor utilization rate has been rising.

A Marketwatch interview with Leland Miller, the CEO of China Beige Book (CBB), indicated that CBB’s bottom-up surveys found that China’s weakness is worse than reported, but the situation is improving.

MarketWatch: What does China’s economic situation mean for the rest of the world – markets, economic growth, supply chains, and so on?

Miller: I would expect the data to get better if only because in March you’ll see firms back to work and the outbreak will hopefully be less terrible. Conditions — and data — should improve. But the implications of data anywhere near this bad is: China is an important cog in the supply and demand chains of the world. Globalization runs through China. Car factories around the world can’t build their cars because they can’t get their inputs from China. China buys a lot of commodities — oil and so on. Even if the outbreak can be contained, which doesn’t look like it, the economic impact can’t be.

As well, the fine print buried in the Saturday PMI report was a survey question for firms which asked when they expect to be back in business. 90.8% by end of March. But then, the Street expected China to be fully back to work by the end of March.

Is the glass half full, or half empty?

You can tell a lot about market psychology by observing how it responds to news. This news could be interpreted in both bullish or bearish ways. Notwithstanding how equity markets have behaved overnight and before the New York open, the more important barometer of sentiment on China is how its currency behaved. The offshore yuan (USDCNH) strengthened after the market opened at the Asian open, and it has remained strong.

The market thinks the glass is half full. Risk on (at least for now)!

Thanks for the timely post, Cam.

It seems everyone is expecting the Fed to act this week by Friday.

Yeaa, CME Fed watch tool shows 100% percent chance of 50 basis point cut by March meeting, followed by more cuts going forward lol.

Best finish for the DJIA that I’m able to recall.

~2% away from a 50% retracement, which is what many traders were targeting. Given the strength of today’s rally, they may be revised to a +62.5% retracement.

‘THAT may be revised…’

You mean 61.8%?

.

I’m thinking 78.6%, which coincides with 50 dma.

Right! Either way – prices will be taken over/under to shake out traders who play the exact numbers. Just easier for me to think in terms of fractions that make calculations easy on the fly.

I wasn’t expecting that strong of a rally into the close after the mid-day action. I lightened up my remaining longs into it. Here are the two news event (on top off the normal market shaking news that will probably come):

1. The market is expecting the Fed to make a move by the end of the week before they enter the quiet period coming into the month end decision the the market expects to be 1/2 basis point. And

2. The CDC has had a problem getting out valid test kits. This has resulted in a lower than actual infected reporting. The kits should be out to the states later this week. When that happens there will probably be a huge increase in the reported infected in the U.S. This could roil the markets.

Within five points of Hulbert’s sentiment index target as of today’s close. A ten-point decline on a day that US indexes rally +4% – that’s notable.

For those of you still tracking Hulbert’s Feb 24 column, his sentiment index closed the day a full forty points below where it ended that day. It’s not a perfect timing tool (no such thing), but I plan on adding to positions on Wednesday.

What happens if the 30 year goes below 1%?