Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

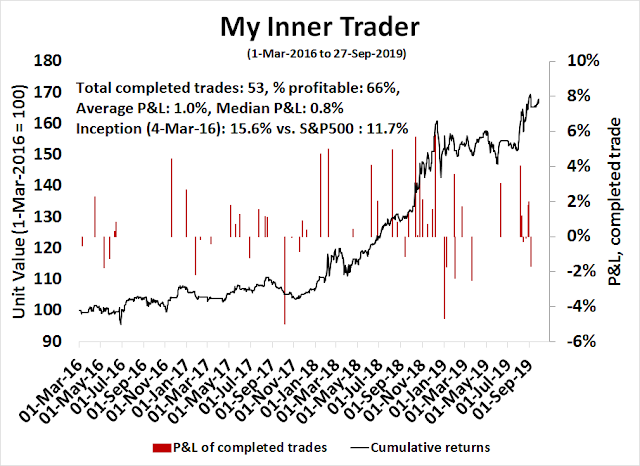

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bearish

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Discounting a Warren Presidency

It began with two respected polls of Iowa and New Hampshire voters which showed Elizabeth Warren leading Joe Biden and the rest of the field for the Democrats` race for president, Last week, a national poll reported that Warren caught the previous front runner Biden by 27% to 25%, Wall Street has started to become unsettled at the prospect of a Warren nomination. A Washington Post article indicates that there is only concern, but no panic:

Wall Street is sounding the alarm over Sen. Elizabeth Warren’s rise in the Democratic presidential race, as investors start to grapple with the possibility the industry scourge secures her party’s nomination.

One investor joked that the stock market wouldn’t even open if the Massachusetts senator became president; a segment on CNBC featured the idea that married couples could get divorced rather than be subjected to Warren’s “wealth tax.”

For now, the rising nerves are mostly evident in chatter. There’s an emerging consensus that a Warren presidency would hurt the stock market — yet there’s little evidence that investors are pricing in the risk.

“From a pure markets perspective, a Warren nomination hardly seemed ‘priced in,'” Chris Krueger of Cowen Washington Research Group writes. He offers a few theories why that’s the case: The election remains far away; Warren could be seen as a weaker Trump foe; or that Warren will moderate her pitch if she secures the nomination. “In any event, buckle up.”

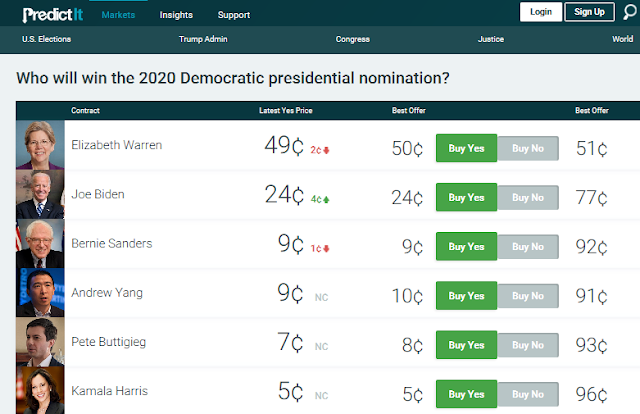

Warren`s odds of securing the nomination at PredictIt has soared in the last few days. This presents the picture of two main contenders. Warren and Biden have left the rest of the field behind. (For the uninitiated, the PredictIt market allows participants to buy and sell contracts based on events. If that event occurs, the contract pays out at $1.)

Expect the markets to begin to price in the prospect of a Warren win in the days and weeks ahead. For investors, it is time to consider the implications of a Warren White House.

I conclude that many of the often raised tax related concerns expressed by Wall Street are relatively minor in nature. Assuming no multiple contraction, I estimate them to come a 5-10% haircut on stock prices, which is well within the normal bounds of equity risk.

The much bigger risk is the Warren trade policy’s focus on “economic patriotism”. Her approach to trade has the potential to spark a prolonged cold war with China. With it, we could also see a bear market or widespread global slowdown by 2021. Moreover, it could seriously damage the existing global supply chains and usher in an era of global instability in trade relations.

Understanding the Warren surge

An LA Times article captures the zeitgeist of Elizabeth Warren`s electoral surge in Iowa. She has adopted a strategy of re-focusing the angst that elected Trump by reframing the issue as a problem of inequality.

In her rallies, Warren taps into much of the same voter anger toward government and the political system that President Trump feeds on, while offering a dramatically different solution.

Where Trump plays off his supporters’ resentment of “the elites,” Warren denounces the corrupting power of money. She has honed her case into a succinct argument that she laid out this way at an event Thursday evening in Iowa City:

“Whatever issue brought you here tonight, whether it’s gun violence, healthcare, education — whatever brought you here — there’s a decision to be made in Washington: I guarantee, it’s been influenced by money.

“When government works for the wealthy and the well connected, when government works for those who have money, when government works for those who hire armies of lobbyists and lawyers and is not working well for everyone else, that is corruption pure and simple, and we need to call it out for what it is.”

She studiously avoids mentioning her rivals by name but offers an unmistakable contrast with Biden when she declares that “we’re not at a moment where you can say, ‘I know, I’ve got two statutes over here and one regulatory change over there, and we’ll change the head of a department over there.’ No, we need big, structural change in this country.

“How do we get there? I’ve got a plan.”

Democrats go to Warren rallies and become energized. By contrast, they go to Biden rallies to be reassured.

Although Warren, who turned 70 in June, is only 6 ½ years younger than Biden, who will turn 77 in November, voters don’t seem to view the two as similar in age. Her rallies, from the jogging onstage that invariably opens them through the lengthy selfie line that ends them, convey a message of vigor.

The crowd at her Thursday evening event was about 10 times larger than Biden’s, and about 900 stayed for as long as an hour and a half afterward to get selfies with the candidate.

Susan Futrell and Flora Cassiliano, neighbors in Iowa City, were near the end of the line. Both said they were still weighing several candidates but praised Warren’s energy and stamina.

Even CNBC host Jim Cramer expressed grudging admiration for Elizabeth Warren, despite the widespread Wall Street opposition over her policies.

CNBC’s Jim Cramer said Thursday that he has a soft spot for Democratic presidential candidate Elizabeth Warren because she has really spent her career thinking about how to help people.

“You have a soft spot for her, it seems,” “Squawk on the Street” host Carl Quintanilla said to Cramer.

“Yes,” Cramer replied, saying it’s “because I think she has thought about the people who are not doing well in the country, and that is great.”

Those remarks add another layer to this week’s back-and-forth between the Massachusetts senator and the “Mad Money” host, who on Tuesday said Wall Street executives were telling him that her 2020 bid has “got to be stopped.”

Expect more taxes and regulation

What does that mean for the markets? Warren’s signature initiatives are higher taxes and more regulation. She has proposed a wealth tax on fortunes over $50 million, with a higher rate on billionaires. While Wall Street will undoubtedly focus attention on the wealth tax, the marginal effect on the markets and the economy is likely to be minor compared to some of the other measures.

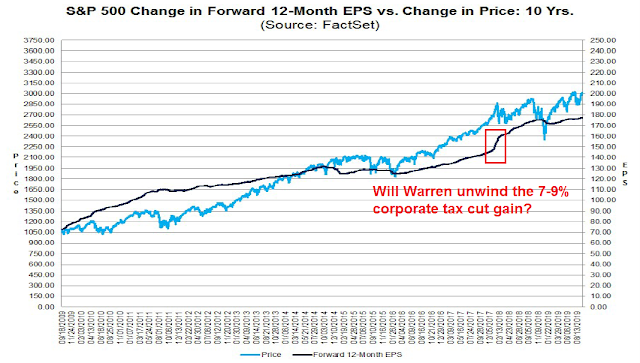

At a minimum, expect her to unwind the Trump corporate tax cuts, which resulted in a one-time gain of 7-9% in after tax EPS.

Warren`s work on the banking regulation will also put the banks in the crosshairs of more government regulation. In effect, she knows where all the bodies are buried, and which bank buried which body. One indicator to keep an eye on is the relative performance of banking stocks. In the past, technical breakdowns of relative performance have been warnings of major bearish episodes, The last break, which occurred in September 2019, led to a -20% downdraft in the S&P 500. In particular, technical relative breakdowns of the large cap banks have either been led by or coincidental with the behavior of the regional banks (bottom panel). As the relative performance of the regional banks weakens and approaches all-time lows, pay particular attention to this indicator as a barometer of the health of the sector, and the market.

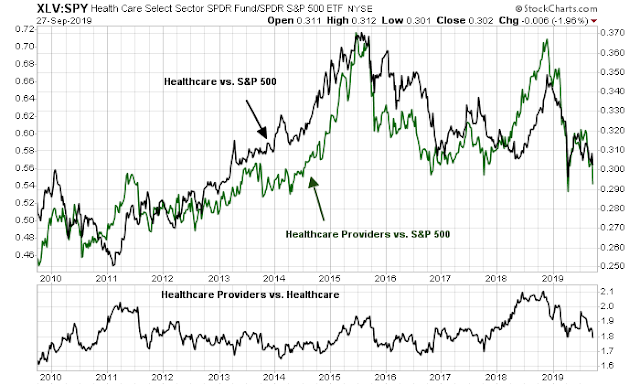

In addition, Warren has shown strong support for Medicare For All. I have doubts as to whether such a proposal would ever be passed. Obama had control of both chambers of Congress, and it was a struggle to even pass the Affordable Care Act. It is difficult to see how Warren could pass Medicare For All. Nevertheless, the healthcare sector would be hurt under these measures, and the healthcare providers would be especially hard hit.

The silver lining

It is easy to enumerate all the market and economic headwinds of Warren`s policies. Not all is doom and gloom. There are a number of silver linings in the dark cloud that investors should be aware of.

First, Warren`s policies are highly redistributive in nature. Proposals, such as student debt forgiveness, are designed to lessen inequality and put more money in the pockets of middle and lower income earners. Instead of the Republican formula of providing greater incentives for the owners of capital to invest and boost the economy based on a “trickle down” effect, her initiatives are aimed at Main Street, which will eventually benefit Wall Street based on a “trickle up” effect. While it is difficult to quantify the overall effects of a broader based stimulus, there will be a positive effect on economic growth. The gains, however, will be shared differently under a Warren administration compared to past Republican presidents.

In addition, Medicare For All could prove to be a source of long-term competitive advantage for America, which Warren Buffett explained in a PBS interview.

First, healthcare costs are a far greater drag on American competitiveness than corporate taxes. Healthcare costs have grown from 5% of GDP in 1960 to about 17% today. Other major industrialized countries spend far less per capita, and achieve better results. That is a source of competitive advantage for America’s trading partners. While Buffett is known to have supported Hillary Clinton in the last election, his partner Charlie Munger, a Republican, agrees with Buffett’s assessment of healthcare as an impediment to American business.

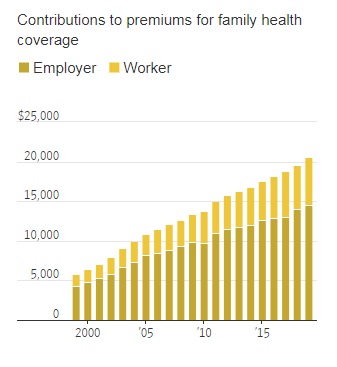

Healthcare costs are skyrocketing out of control. Buffett believes that a single payer system, otherwise known as Medicare For All, is the best way to control escalating costs. Indeed, the WSJ reported that the cost of employer coverage for a family plan has risen steadily and topped $20,000 a year.

Undoubtedly, Wall Street will express a lot of anxiety over Warren’s tax proposals. While I believe that their net effect will be negative for both the economy and suppliers of capital, these concerns are really a red herring. The wealth tax may be worrisome for the ultra-rich, but the net effect on Main Street is likely minimal. Notwithstanding the effects of the wealth tax, let us guesstimate the effect of these measures on the stock market.

- Subtract the one-time earnings boost of the Trump tax cuts of 7-9%. Assuming no changes in P/E multiples, stock prices fall by 7-9%.

- Subtract the effects of increased regulatory scrutiny on banks. Assume that this group craters by an additional 10-15% net of the market. Since financial stocks account for 13% of the index, stock prices fall by an additional 2%.

- Add back the income broadening effect on middle and low income earners, which will stimulate the economy. Effect is unknown, as it will be difficult to quantify.

- Add back the long-term boost in competitiveness to American business if Medicare for All is implemented (as per Buffett and Munger). Effect difficult to quantify.

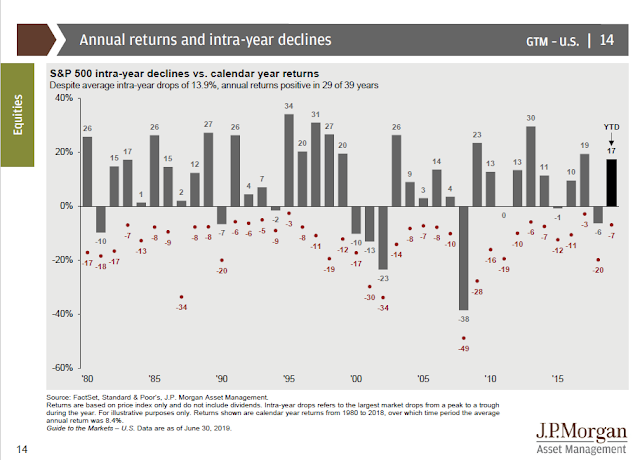

Overall, this amounts to a 5-10% haircut on stock prices, which is well within the normal bounds of equity risk. While the effects are unpleasant, they are by no means catastrophic.

However, there is one elephant in the room in the discussion of Warren’s policies, and it is trade.

The (trade) elephant in the room

Elizabeth Warren recently released a plan to completely overhaul trade policy based on the principles of “economic patriotism”. The plan is going to unsettle global markets because of her broad principles on trade:

- Recognize and enforce the core labor rights of the International Labour Organization, like collective bargaining and the elimination of child labor.

- Uphold internationally recognized human rights, as reported in the Department of State’s Country Reports on Human Rights, including the rights of indigenous people, migrant workers, and other vulnerable groups.

- Recognize and enforce religious freedom as reported in the State Department’s Country Reports.

- Comply with minimum standards of the Trafficking Victims Protection Act.

- Be a party to the Paris Climate agreement and have a national plan that has been independently verified to put the country on track to reduce its emissions consistent with the long-term emissions goals in that agreement.

- Eliminate all domestic fossil fuel subsidies.

- Ratify the Convention on Combating Bribery of Foreign Public Officials in International Business Transactions.

- Comply with any tax treaty they have with the United States and participate in the OECD’s Base Erosion and Profit Shifting project to combat tax evasion and avoidance.

- Not appear on the Department of Treasury monitoring list of countries that merit attention for their currency practices.

This plan is aimed directly at China. This initiative is likely to create a long-term rupture in the trade relationship between the two countries and foster the decoupling of the two economies.

Warren’s approach to trade is ultimately protectionist, but in a manner that is different from Trump. Trump has focused on the dual objectives of the trade deficit and China’s practice of restricting foreign competition to favor domestic industries, but the objectives are inherently contradictory. The US cannot at the same time want to reduce the trade deficit, and want China to open its economy to foreign companies, which would increase the trade deficit.

By contrast, Warren’s focus is on principled trade, which hardens back to the days of Jimmy Carter, whose administration was focused on human rights. The same focus on human and labor rights will be major impediments to reaching a trade agreement with the Chinese. As a reminder, Warren sponsored the Uyghur Human Rights Policy Act of 2019, which underlines her commitment to human rights but will prove to be a source of friction in negotiations with Beijing. In addition, the imposition of environmental standards, along with human and labor rights demands, will make a trade agreement with China all but impossible.

In addition, there are a number of other obstacles to a comprehensive trade agreement with China. As the Chinese economy has grown and matured, Bloomberg reported that Australia has joined the US in calling for China to drop its developing nation status. This means that China will lose many exemptions accorded developing countries, and it will be treated the same way as advanced economies.

If the election were to pit Trump against Warren in 2020, expect a deep freeze in Sino-American trade relations, and a new cold war to begin. T. Greer recently revealed in a Twitter thread China’s unusually frank view of its relationship with the US from a member of the politburo [edited for brevity].

Huang Qifan gave a speech on the trade war a few days ago . It is eye opening. The ideas in it aren’t really new, but they are expressed with such frankness (+with so little Communist cant) that I triple checked this guy is who I thought he was.

Huang is a central committee member. Currently works as Financial and Economic Affairs Committee of the NPC. Not a small fry.

He divides his speech into four sections. The first section discusses why the 2013-now is actually a “new era” in China’s economic development…

Huang starts off by explicitly addressing the argument for ceding to American demands (what he rather colorfully compares to ‘letting them punch our face… in hopes they will feel pity for us and decide to stop”). His rebuttal to this argument is very simple: look at Japan.

Japan, he says, is a vassal state (属国)of the Americans. Since 1945 the Japanese have done everything the Americans have ever wanted them to. And what has been the result of Japanese benevolence/cravenness? Nothing! Despite Japan toeing the American line time and again, the United States “bullies” Tokyo. The 1980s trade show off is the central example of his case, but he spends a whole paragraph talking about how humiliating it must be to be Shinzo Abe. Abe spends all of this time “fawning over Trump, playing golf for him” but has it resulted in Abe obtaining anything? To the contrary, there was this one time when a big ol red carpet was laid out for the two guys at a state dinner, and Trump walked right down the center of it. To stay by his side, Abe had to walk off of the red carpet all together. And that, Huang reminds us, “was in Japan!” Abe plays all that golf and Trump still hogs the red carpets of Japan. How embarrassing to be Abe–and how foolish, Huang says, to think that personal relationships or chemistry between leaders matter. What matters is national interest.

And it is in America’s interest to keep down China.

Huang uses numbers to justify the point. We went from 4% of America’s GDP to 60% in just 40 years. Give it another 15 and we will be ahead of them. The Americans will not allow it.

They have been the global top dog(世界的老大)for several decades. As big boss, they have broken rules whenever they feel the need, conflating their domestic rules with international ones. Huang specifically ties the Meng extradition case to the Iraq war as examples of American rule-breaking and “bullying.” Having acted this way as the big boss for so long, the Americans fear that China will do the exact same thing to them once China becomes #1 (他想着如果有一天你也是老大了,你也这么来对我那怎么办) so the Americans will try to hold you down.

Interestingly, Huang doesn’t really condemn the Americans for this. He calls it “inevitable.” And that is one of the themes of this speech–with or without Trump, America trying to hold China down is inevitable. That is just what powerful countries to do challengers.

Now this is where things get interesting. He says, in effect, that the Americans are right to fear being surpassed by China. Why? ‘cuz Socialism with Chinese Characteristics is simply a far better way to reach the top and stay there than the American system will ever be.

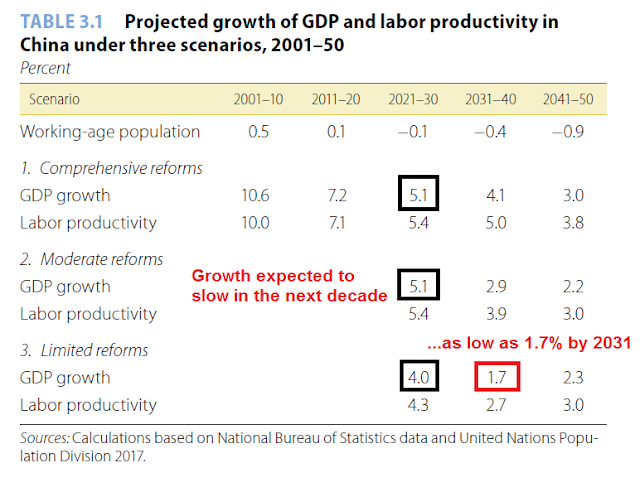

This speech is an unequivocal signal that Chinese leadership is digging for the long fight. While there are some in the US and in particular in the Trump administration who believe that since China will cave because their economy is hurting, nothing could be further from the truth. A recent World Bank report on China, which is signed and endorsed by the Chinese government, is already projecting slower growth rates over the coming decade. Moreover, growth could slow to as low as 1.7% by 2031 in an adverse scenario. In short, slower growth is already part of their base case scenario, and Bejing is bracing for pain.

In addition, an Ipso poll comparing which country are on the right and wrong track shows China at the top, indicating broad support for government policies.

By my estimation, growth will be at the low end of the range. Productivity growth will lag as Xi Jinping has pivoted to a command-and-control model to suppress dissent and division, the use of party cadres instead of technocrats as sources of policy and their implementation, and the reliance of SOEs as ways to control the path of economic growth. These measures will, in the end, stifle growth by suppressing the faster growing SMEs, and reduce growth potential through lower productivity.

These circumstances are setting up some dire conditions for world growth. If the electoral contest is between Trump and Warren, it’s going to be a long cold war. For investors, a reversal in global trade will have chilling effects on global growth. The following IMF analysis models the effects of rising Sino-American tariffs, but the message is unmistakable. A slowdown in Chinese growth will sideswipe most of Asia. As well, it will have negative effects on commodity exporting economies like Australia, New Zealand, Canada, and Brazil. This could all begin in 2021 should Elizabeth Warren win the race for the White House.

In summary, I believe many of the often raised tax related concerns expressed by Wall Street are relatively minor in nature. Assuming no multiple contraction, I estimate them to come a 5-10% haircut on stock prices, which is well within the normal bounds of equity risk.

The much bigger risk is the Warren trade policy’s focus on “economic patriotism”. Her approach to trade has the potential to spark a prolonged cold war with China. With it, we could also see a bear market or widespread global slowdown by 2021. Moreover, it could seriously damage the existing global supply chains and usher in an era of global instability in trade relations.

The week ahead

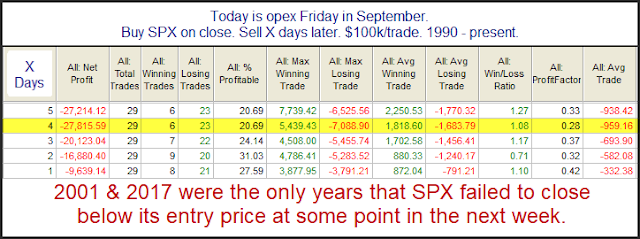

The weakest week strikes again! Last week, I highlighted analysis from Rob Hanna of Quantifiable Edges who found that last week was reliably the weakest week of the year from a seasonal viewpoint. Right on cue, the SPX fell -1.0% last week.

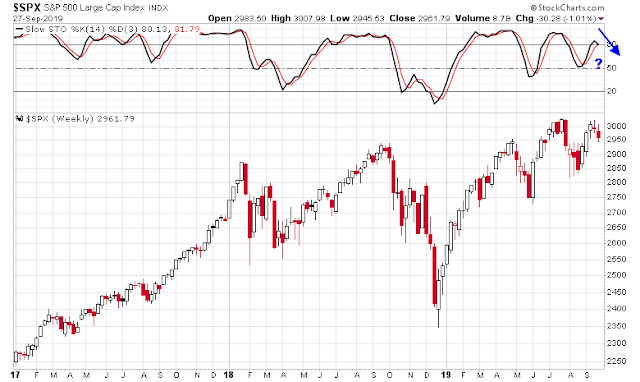

On balance, I judge the tactical outlook to be tilted to the bearish side. The stochastics indicator recycled from an overbought readings last week, which is a sell signal, but conditions are not oversold yet. The market decline was arrested at support at its 50 dma and at about 2960, with a partial fill of the gap at 2940-2960. However, the index may be constructively tracing out a bull flag formation, which is a bullish continuation pattern. Keep an eye on the VIX Index (bottom panel), as closes above its upper Bollinger Band signal an oversold condition and a short-term bottom.

However, the bulls should not get overly excited just yet. The weekly chart shows the stochastic rolling over from an overbought condition and it is about to flash a sell signal on a weekly time frame.

Risk appetite indicators are not supportive of gains and they are not showing any signs of bullish divergence. The relative duration-adjusted price performance of high yield bonds have been signaling a bearish divergence for several months, and it is a signal of negative credit market risk appetite. In addition, the poor market reception of the Peloton IPO exposed another gaping wound in equity risk appetite. The PTON IPO was not an isolated incident, IPOs had been lagging the market since early August (bottom panel).

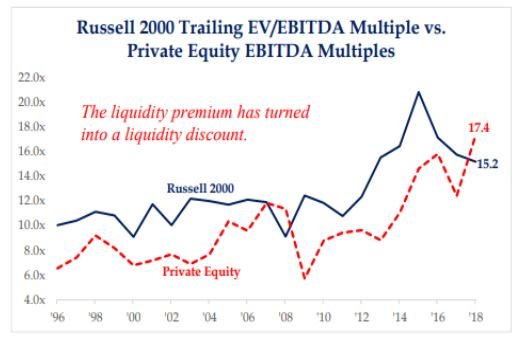

Analysis from Strategas revealed that private market multiples now exceed public market multiples. Is it any wonder why IPOs are struggling?

Bloomberg also reported that risk aversion is rising in the credit market:

At a quick glance, everything seems wonderful in the world of risky credit. In September alone, companies have raked in more than $52 billion by tapping the U.S. leveraged-loan and high-yield bond markets.

But look a little closer and cracks start to emerge. Lots of cracks.

In recent weeks, a slew of companies — typically those considered the riskiest of the risky — have been forced to either ratchet up interest rates or dangle sweeteners to drum up investor demand and complete deals. A few more — including at least four this month — have been yanked from the market entirely.

One common refrain coming from investors is that they don’t want to touch companies with excessive debt, especially those from struggling sectors or with businesses that could suffer more in a downturn. Particularly problematic: companies rated B3 by Moody’s Investors Service or B- by S&P Global Ratings, one step away from the junk market’s riskiest tier.

“If you’re looking to finance an LBO in the wrong sector or a business vulnerable to a slowdown, that’s tougher,” said John Cokinos, co-head of leveraged finance at RBC Capital Markets. “The loan market has limited appetite for new B3 rated deals, and the high-yield market is pushing back on highly levered deals.”

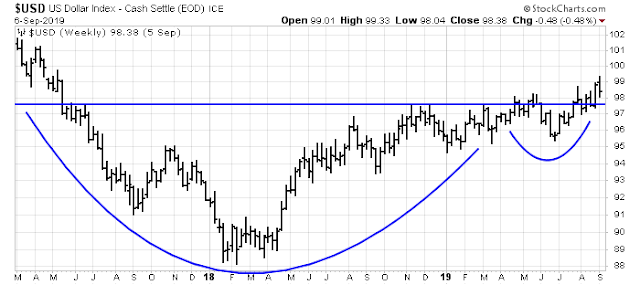

Global risk appetite has not been helped by recent USD strength, which continued to rally after a brief pullback and consolidation after an upside breakout out of a multi-year base.

Historically, USD strength (inverted in the chart below) has not been helpful to the relative strength of EM stocks, which are high beta and cyclical stocks in the global market.

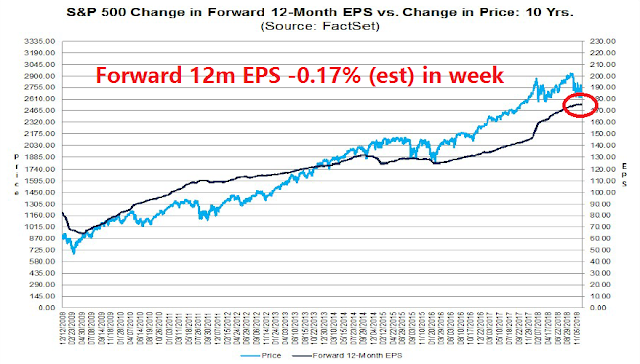

There is also bad news on the fundamental front. FactSet reported that forward 12-month estimate revisions, which had turned positive for several weeks, stalled and turned negative last week. While the latest reading may be a data blip, it could also be an indication of weakening fundamental momentum. This leaves little room for error when the market trades at a forward P/E ratio of 16.8, which is ahead of its 5-year average of 16.6 and 10-year average of 14.8.

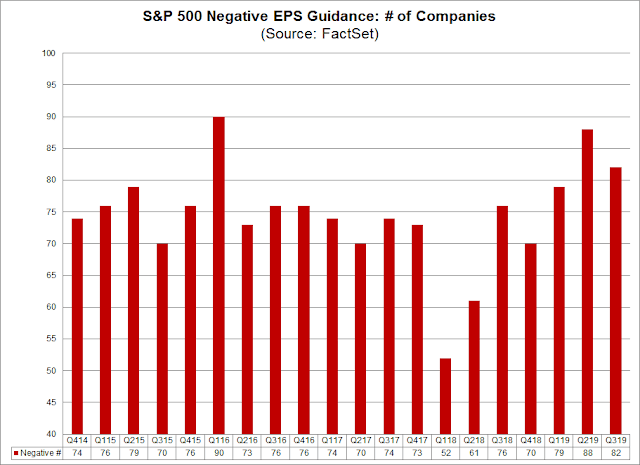

FactSet also reported that the rate of Q3 negative guidance is higher than average, and most of the warnings are clustered in the high flying and high beta technology sector.

Is the bottom near? Probably net yet. The market is not yet oversold, even on a short-term basis.

If history is any guide, the stock/bond ratio should bottom once the 5-day RSI becomes oversold, and the 14-day RSI reaches a near oversold reading. We are not there yet.

My inner investor remains cautiously positioned. My inner investor is maintaining his short position.

Disclosure: Long SPXU

1) I do think Warren will be the Democrat nominee. Biden is sinking for a number of reasons. But, I wouldn’t count out Hillary just yet. She is back under her email investigation and that may push her over the edge to run again and see that the FBI continues to overlook her crimes.

2) There is a slim chance the House can get a yes vote to impeach Trump. Regardless, he will be President and the GOP nominee next November. Between the impeachment thing and the fact that Warren is so anti-business (Remember “You Didn’t Build That?) and taxing fool hearty I think Trump will win in a landslide. She is also very unlikable as can be seen in her past that will be run on TV over and over. And she is a proven liar about important matters. Isn’t that right Pocahontas?

At this point it’s impossible to know what will happen. Will Trump get impeached? Will Warren get the nomination? If so, would she win?

I am not here to make a judgment as to political outcome. The important thing for investors is to be aware of how the market is likely to react should she get the nomination. If she does, it will start to price in the probability of a Warren win, which will likely be bearish for equities.

Wallace – you don’t seem to approach this with much objectivity. Referring to her as Pocahontas is borderline gross.

Cam & Group: I apologize if this has been asked before. I’m unfamiliar with recent Fed repo operations and the underlying causes/effects. Is this activity an unusual indicator? Should investors be concerned? Thanks!

Here is a thread that explains the repo situation. Bottom line, not much to worry about.

https://twitter.com/thestalwart/status/1177231608375644161

If any of you are interested, pls watch the interview of Kyle Bass by the Epoch times. It is pretty succinct in describing the current Sino-American relationship.

https://www.youtube.com/watch?v=DOFwxcb0Bjc

It just feels that decoupling is inevitable. Brace for a new world order.

While a Warren presidency would be unfriendly to the market, the republicans would have to also lose the Senate for Warren to have a free hand. Even Obama with the backing of both the House and the Senate had difficulty getting the Affordable Care Act through congress.