Mid-week market update: I have been writing in these pages about the remarkable muted equity market volatility. Indeed, Luke Kawa observed on Monday that realized volatility had fallen to historical lows.

Recent developments indicate that volatility may be about to return to the markets. This reminds me of the lyrics of a song that I vaguely remember from my youth:

Where have you gone, Vol-a-tility?

A nation turns its lonely eyes to you…

Woo woo woo…

Event-driven volatility

Stock prices opened Tuesday on a slight upbeat note, until Trump made a highly assertive speech at the United Nations on trade that was directed mainly at China. Even China’s latest conciliatory gesture to allow limited tariff exemptions for the purchase of American soybeans failed to move the markets.

Later in the day, House Speaker Nancy Pelosi announced that the House would begin impeachment proceedings against Trump. Indeed, the PredictIt betting odds of an impeachment has skyrocketed in the last few days, even before the Pelosi announcement.

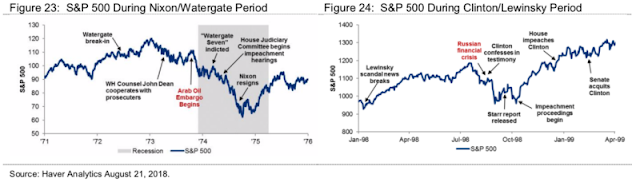

Almost immediately, analysts searched market history of how stock prices behaved during the last two impeachment proceedings. The results were very different. The market weakened considerably during the Nixon impeachment hearings, but that era was marked by a recession. Stock prices were generally firm during the Clinton impeachment proceedings, but the NASDAQ Bubble was just taking off.

I will let readers make their own political judgments about the current episode, but it is clear that investors cannot come to any definitive conclusions about what might happen next based on political history (n=2). However, Trump has shown a pattern of deflecting criticism by re-focusing the news cycle when he is threatened to two familiar topics that are under his control, border security and trade. Moreover, the impeachment inquiry could prove sufficiently distracting that substantive trade discussions becomes all but impossible for the Trump administration. This environment can only mean one thing for the markets.

Volatility.

A bearish bias

While the market could certainly be volatile with prices going upwards, my inclination is to expect a bearish bias in the days and weeks ahead.

The following chart of the stock/bond ratio, which is an indicator of risk appetite, tells the story. The SPY/TLT ratio has shown an up-and-down pattern which were marked by overbought and oversold readings. While the fit isn’t perfect, the market was already undergoing a risk-off phase even before the latest news hit the tape. If history is any guide, this will not bottom out until the 14-day RSI becomes oversold.

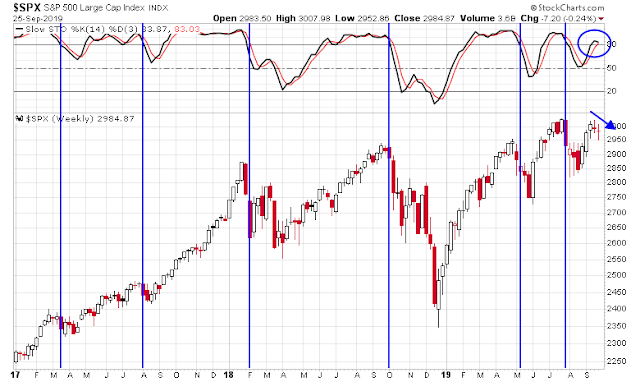

The weekly stochastic is overbought and it is poised to recycle to neutral. Past episodes have been effective sell signals.

As well, my monitor of the top 5 sectors that comprise nearly 70% of index weight is also telling a bearish tale. Virtually all sectors are exhibiting negative relative strength. It would difficult for the market to rally without a substantial participation of most of these sectors.

The market is also facing seasonal headwinds. Ryan Detrick observed that the market is entering a period of negative seasonality until Thanksgiving.

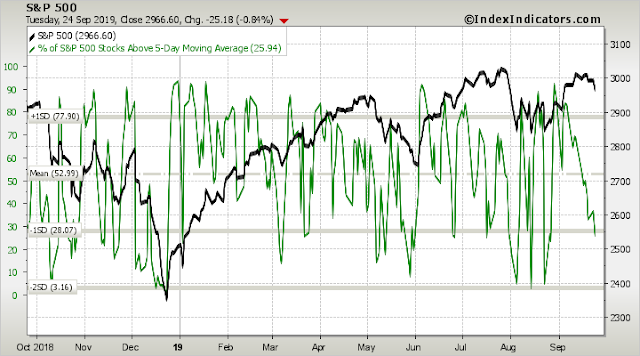

From a tactical perspective, short-term momentum was approaching a near oversold condition as of Tuesday night’s close, which showed a recovery today.

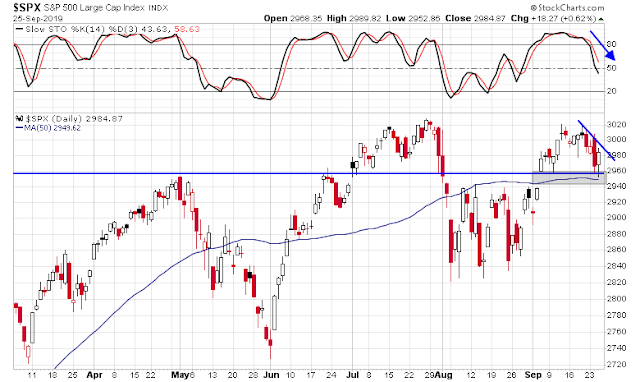

The market successfully tested its 50 day moving average, and support at about 2960. However, the daily stochastic has turned south, which is a bearish signal. We may see a short-term rally back to the declining trend line in the next couple of days.

My inner investor remains defensively positioned. My inner trader is short, but a 1-3 day bounce could happen at any time. He is prepared to add to his short positions should the market stage what would be expected to be a brief relief rally.

Disclosure: Long SPXU

Good write-up, Cam.

I was around for Nixon’s impeachment proceedings, but wasn’t following the market. I recall the dips and rises during the Clinton scandal (Bob Brinker used the phrase ‘twisting in the wind’ several times when attempting to envision the market effect) – the market was able to stop positions out on both sides before finally grinding higher.

Volatility does seem muted given the many dramas unfolding in Asia, the Middle East, Europe, and the US – I guess that covers most of the globe! Volatility may be waiting for the perfect pitch – then Joltin’ Joe hits one out of the park.

Oh, boy, you have seen a lot of market cycles. Interestingly, old timer, Bob Brinker remains fully invested and does not expect more than a single digit pull back in this market cycle (same as Ken). Cheers.

We’re closing in on the 2-month setup outlined by SentimenTrader in early August. (Following ten consecutive down days, emerging markets have historically continued to decline for another two months. The sector then begins a year-long recovery marked by gains in the 20% to 30% range). MSCI Emerging Markets has actually performed quite well since August 8, but today’s selloff increases the odds of a retest of last month’s lows.

Brinker made a few great calls in the Nineties, including the call to cash out in early 2000.

I remember his response to a woman who couldn’t decide what to do – the SPX had recovered to retest the highs around May of 2000 and Brinker’s response was ‘Look, how many times do you expect the market will allow you to return to the trough?’ For some reason, that comment resonated with me, and my wife and I liquidated our accounts! Pure luck that I was driving with the radio on that day.

I don’t think any President in my lifetime was more universally disliked than Richard Nixon. This despite the fact that he effectively ended the Vietnam War (right before I would have been subject to the draft lottery), and reestablished ties diplomatic relations with China. Partly because I had no idea whether I’d be drafted, I dropped out of school my freshman year and spent a year hitchhiking/ working odd jobs along the West Coast. I remember jumping into the bed of a pickup in downtown LA with one of the more creative bumper stickers of the time-> Impeach The Cox Sacker (the White House had just fired Watergate Special Prosecutor Archibald Cox).

I think that whatever move the market makes, there will be some kind of rationale.

This is a bit after the 25th, but the hourly SPY sure looks like it made a H&S over the last 3 weeks. This would target approx 287 which if you look at all the gaps since June and is pretty well in the center of all the consolidation that occurred in august.

Curious to see what happens next week in that respect