Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

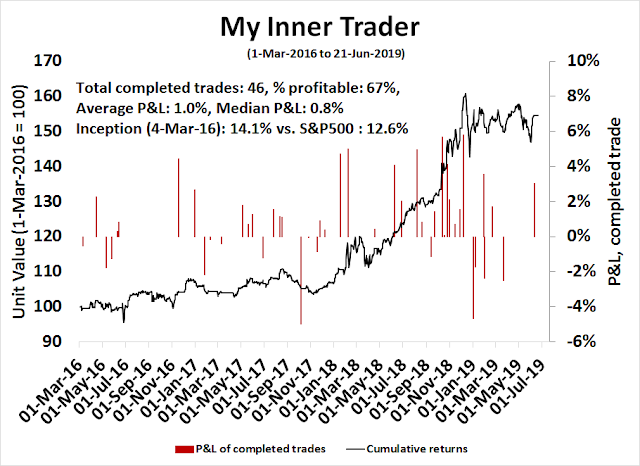

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Signs of complacency

I have been writing in these pages that the market faced two key sources of near-term volatility. The first was the uncertainty of the FOMC decision. Approaching the meeting, the market was expecting three quarter-point rate cuts by year-end, with the first occurring in July. The Powell Fed delivered a dovish hold. The bond market reacted with a bull steepening, and stock prices soared.

The next key event is the Trump-Xi meeting on the sidelines of the G-20 meeting in Osaka. In the wake of the Fed decision, the ensuing equity market euphoria is seemingly discounting a successful conclusion to the trade talks. Our trade war factor, which is measured by the relative performance of an ETF of Russell 1000 stocks with pure domestic revenues, is indicating a dramatic decline in trade tensions.

While I have no idea how the trade talks will be resolved, some caution is warranted as the market appears to be mis-pricing trade talks risk.

The market is about to the roll the dice, and the odds favors the bears in the short-run. What would you do?

China’s red lines

The success of the Trump-Xi meeting will depend on each side’s underlying demands. When the latest round of talks broke down, Chinese negotiators outlined three key red lines, which Trump will have to give serious consideration to in order to conclude a deal.

The removal of past tariffs. The US proposal of a staged removal of tariffs based on performance and adherence to the provisions of any agreement is unacceptable to China.

An agreement of reasonable levels of purchase of American goods by China. Chinese negotiators felt constrained because Trump and Xi had agreed upon China buying a certain amount of American exports at their last G-20 meeting in Buenos Ares. This is a point that can be re-negotiated between the two presidents at Osaka.

An agreement made in the spirit of mutual respect and equality. That phrase means many things, which I will try to translate:

- Don’t make China change itss way of doing things, such as its political system, and development strategy.

- Don’t start a Cold War and challenge China in the geopolitical realm. This is a trade agreement.

It is this last issue of “mutual respect” that will be the greatest sticking point for trade hawks like Robert Lightizer and Peter Navarro. China’s development strategy has been to create SOEs and endow them with dominant market power, through both subsidization with cheap credit and favorable regulatory regimes that result in monopolistic or monopolistic market regimes. Moreover, China’s development strategy is focused on key industries as a way of migrating up the value-added ladder. US restrictions on companies like Huawei, which has a global lead on 5G infrastructure, is seen by Beijing as an American attempt to suppress China’s development.

In addition, China is unsure of how to interpret recent geopolitical flare-ups. The recent US decision to sell arms to Taiwan is viewed as unwarranted interference in China’s internal affairs. There is also a suspicion that the massive protests in Hong Kong had the backing of the CIA. Global Times recent published an editorial which warned against US interference in Hong Kong affairs:

If Washington believes it can take the recent incident in Hong Kong Special Administrative Region (HKSAR) as a bargaining chip in the game between China and the US; if it thinks playing the Hong Kong card can force China to make compromises in trade negotiations with the US, it had better think twice. The riots in Hong Kong will only consolidate Beijing’s tough stance against Washington.

The editorial highlighted contact between the Hong Kong opposition and American lawmakers:

In March and May this year, the city’s opposition politicians visited the US to seek support. Figures from the US Senate and House of Representatives lent their supportive voices by piling pressure on China. US House Speaker Nancy Pelosi vowed to review Hong Kong’s special trading privileges if the city’s lawmakers pass the extradition bill.

In an article titled “How Trump Could Suddenly Amplify the Hong Kong Protests,” Bloomberg also noted that US President Donald Trump “has the unilateral power to rescind Hong Kong’s status as a preferential trading partner.” The author believes the move would be an almost unthinkable escalation of the US-China trade war.

At the height of the Hong Kong protests, a series of photos of a white woman who seemed to be handing out money on social media had gone viral. This was seen as evidence of CIA support for the protesters.

While I am agnostic about how to interpret these pictures, they are nevertheless an illustration of rising geopolitical tensions.

Trade truce less likely?

Bloomberg’s Asian economist Tom Orlik summarized the risks when he penned an editorial which suggested that a trade truce is likely, not more:

It’s possible a meeting between U.S. President Donald Trump and his Chinese counterpart Xi Jinping at next week’s G-20 summit will result in an “agreement to agree” on trade. But the chances of a more comprehensive deal appear remote. A key concept in negotiation textbooks is something called the “best alternative to negotiated agreement” — in other words, the best outcome each party can hope for if talks fail. Trump’s “best alternative” is looking better than it was. That means the prospects for an agreement are looking worse.

The alternative, namely “best alternative to negotiated agreement” (BATNA), appears to be increasingly attractive to both sides. Here is the American viewpoint:

Changing circumstances may be encouraging administration hardliners to hold out for more Chinese concessions. The one factor that seems to play on Trump’s mood is any sign that U.S. markets are faltering. The Federal Reserve’s gradual evolution from a focus on tightening monetary policy, to a patient pause, to hints at further easing has greatly reduced the risk of slumping growth or a market plunge. Pressure to reach a quick agreement has correspondingly declined.

At the same time, the incentives for Trump, who officially launched his reelection bid this week, to stand tough on China are rising. The lesson of past presidential elections is that bashing Beijing is a vote-winning strategy with few downsides, politically speaking. By contrast, the concessions required to get a deal done would open up Trump to criticism that he’d gone soft at the last minute.

China has prepared for a full-blown trade war, and it appears confident about holding out:

China’s “best alternative” to a deal may also be looking more attractive. Increased stimulus promises to put a floor under growth. Its leaders have at least some incentive to hold out and hope to confront a less-adversarial U.S. leader after November 2020. Also, after lower-level officials apparently reached agreement in earlier rounds of talks only for top leaders to retreat from commitments, trust between the U.S. and China is in limited supply. Trump’s threat to impose tariffs on Mexico, even after successfully concluding talks on a free-trade deal, give Chinese leaders further reason to act cautiously.

Orlik concluded that it depends on Trump’s bottom line. Does he want just a trade deal, or to suppress the rise of China?

When Trump and Xi met at Mar-a-Lago in 2017, they enjoyed what Trump called “the most beautiful piece of chocolate cake.” This time around, friendly dinners won’t make any difference until both sides determine what they really want out of trade talks. If Trump is hoping for wins on market access, intellectual property and the trade balance, a deal should be easy to do. If the real U.S. concern is China’s economic and political model, markets should be bracing for a much longer struggle.

Signs of conciliation

Investors should be encouraged by the emergence of more conciliatory tones from both sides of the Pacific. After negotiations broke off, Trump announced that he would be speaking with Xi one the sidelines of the Osaka G-20 meeting, but the Chinese refused to confirm the meeting. For some time, it was uncertain whether the two leaders would even meet face-to-face in Osaka. The logjam was finally broken when Trump call Xi asking to meet.

The tone of the rhetoric has cooled down on both sides. At the height of the trade tensions, Chinese television was broadcasting an anti-American movie about the Korean War. Now, they are broadcasting “Lover’s Grief over the Yellow River”, which is a story about an American pilot who falls in love with a Chinese woman during the Second World War.

There have been conciliatory changes on the US side as well. Bloomberg reported that Vice-President Mike Pence was scheduled to make a speech on June 4, the anniversary of the Tiananmen massacre, criticizing China’s human rights policy, but Trump cancelled the speech in order to avoid offending jeopardizing the atmosphere ahead of the G-20. The speech had been re-scheduled for June 24, but it was later cancelled.

Robert Lightizer and Steve Mnuchin are expected to speak with Chinese officials as preparation for the Trump-Xi G-20 meeting.

The signs are hopeful, but a favorable outcome is no slam dunk. The best the market could hope for is a “kick the can” agreement to keep talking, with a US suspension of the 25% tariffs on an additional $300 billion in Chinese imports.

Equity market risk appetite ahead of itself

In light of these developments, investors should be reminded of the George Soros quote: “Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting the unexpected.”

Even as the S&P 500 broke out to new all-time highs, market internals are signaling caution. Equity risk appetite appears to have run ahead of itself. Risk appetite indicators are not confirming the bull trend. Higher beta mid and small cap stocks broke down through relative support, but they have not regained relative support turned resistance levels.

The relative price performance of high yield (junk) bonds to duration-equivalent Treasuries is flashing a negative divergence.

The relative performance of the top 5 sectors are not showing signs of strong leadership. These sectors comprise just under 70% of index weight, and a majority of them need to become relative strength leaders before the index can rise in a sustainable fashion.

Even the option complex is showing relatively low levels of fear. The ratio of 9-day to 1-month VIX spiked last week into backwardation indicating rising anxiety, but mean reverted back into contango by the end of the week. In the meantime, the 1-month to 3-month VIX ratio steepened its contango, indicting rising complacency. The 9-day VIX window includes the G-20 meeting, which should be pricing increased volatility due to the uncertainty of its outcome.

Recall I wrote last week that the latest BAML Global Fund Manager Survey revealed another piece of the puzzle (see Monetary policy Catch-22). Even though the headlines indicated that global institutions were de-risking their portfolios, a more subtle analysis indicated that they were really shifting their risk exposure away from Asia and towards the US. To be sure, equity weights were falling, but managers were not de-risking across the board, and falling equity positions were not actionable contrarian buy signals.

That’s because they were buying into the US.

And selling EM and Japan (not shown).

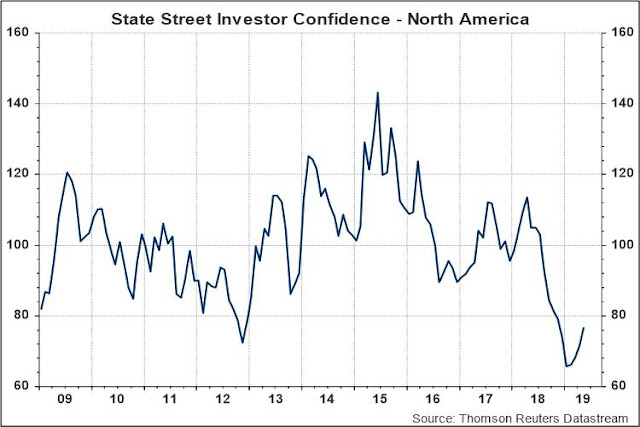

That condition is consistent with the readings from the State Street Confidence Index, which measures the aggregate equity weights of managers custodied with State Street. North American weights have been rising from a very low level.

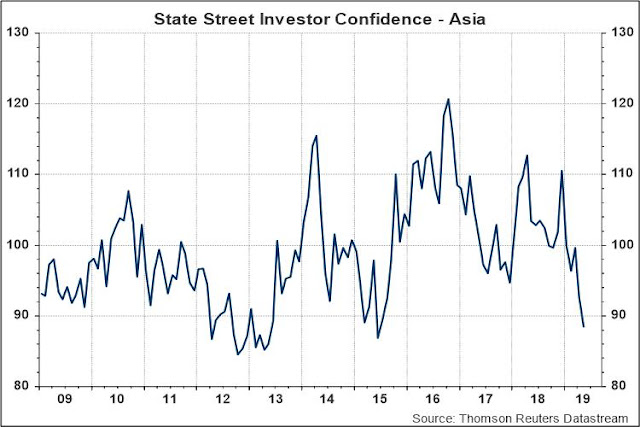

While Asian weights have been falling.

This institutional reactions ahead of a make-or-break trade discussions appears to be curious. The market is expressing its anxiety by shifting its equity allocation from Asia and EM to the US, which would be also vulnerable should trade talks break down.

Intermediate term bullish

Despite these near-term risks, I am intermediate-term bullish on stocks, especially in the absence of trade tensions.

Both the NYSE and S&P 500 Advance-Decline Lines made new all-time highs last week. These are signs of positive breadth support, and while that does not preclude the market from pulling back in the short run, market tops simply do not look like this from a technical perspective.

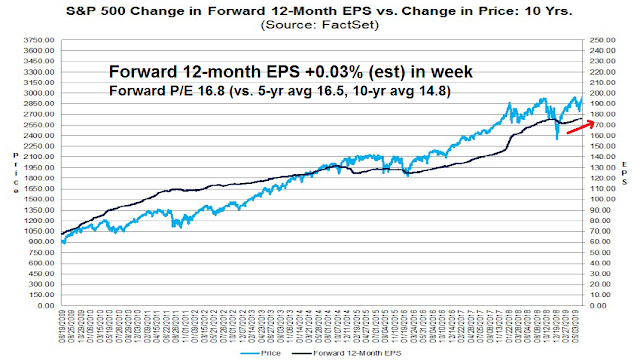

FactSet reported that bottom-up Street estimates are continuing to rise, indicating positive fundamental momentum. While valuations, as measured by forward P/E, are now a little elevated, they are not excessive and have further room to rise.

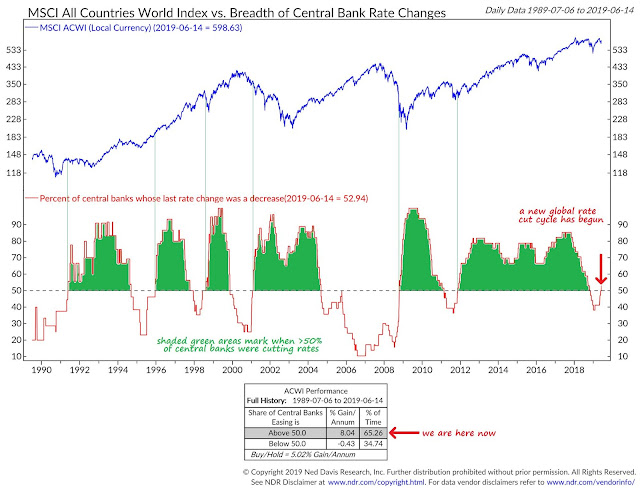

In addition, stock prices have the tailwind of global central bank support. Global central bank policy is now perceived to be leaning dovish.

In the past, equities have performed when a majority of the major central banks around the world have entered easing mode.

In conclusion, the market appears to be discounting a bullish outcome from the Trump-Xi G-20 meeting. While I have no special insights as to how each side will act, a successful meeting is no slam dunk. The combination of poor market internals and excessive bullishness leads me to suggest that the near-term risk/reward favors the downside. Looking out over the trade tension valley, I remain constructive on the equity outlook.

The market is about to the roll the dice, and the odds favors the bears. What would you do?

My inner investor`s reaction is maintain a neutral exposure roughly equal to the benchmark weights as specified by his investment policy. He has also selectively sold some covered call options against existing positions to capture heightened premiums.

My inner trader is standing aside and staying in cash until after the G-20.

China has a lot to say about ‘face’.

Some might say it urinated on Obama’s face for eight years. Time for USA to stand firm.

Respect is a two way process

Is it enough for Trump to win, or does China have to lose? Does he truly want “win, win” or does he require “win, lose”?

I think that there is a chance that this will be a reelection issue. In 2016 he made a promise about a wall with Mexico. I would not be surprised to see “Make America Great Again” 2.0 in the upcoming election. So the trade talks would drag on because he is fighting hard. You can criticize all you want, but if the answer is that it is being done for the good of America, it sounds good.

One thing I am pretty sure about is that the market misprices, otherwise there would be no such thing as tops and bottoms. Correct me if I’m wrong but my understanding is that tops can be choppy. We have just had this hold your breath for the FOMC which when you think of it doesn’t really change much…do you know anyone who was waiting for the release to go buy a house, car or boat?..and we have the trade talks hanging over us…expect choppy…but I don’t think the top is in yet.

While we watch the trade talks, there is a huge event happening: gold is soaring. The Gold Miners ETF (GDX) has outperformed the S&P 500 over my 9 month momentum look-back period.

Is this just the Iran/Middle East flare up or is it a bigger deal about the US weaponizing its central role in global financial/banking and internet/technology? Europe, Russia and China are looking to somehow find alternatives.

America built these global systems for globalization. They were meant to be fair and overseen by global institutions like the World Bank , WTO and IMF that America help found and champion. Now Trump is weaponizing their lead role in these financial systems to promote economic warfare in a win/lose nationalistic way.

The world is being forced into regional (America, Europe, Far East) anti-global framework. Gold is a canary in the coal mine.

There are technical signs just recently that the U.S. dollar is entering a longer term downtrend. THAT is as much or more important than next week’s trade meeting.

Europe cannot abide by their Nuclear Agreement with Iran because America can punish their banking system since America oversees the global payments. That is just one example. You can see why nations will look for a different way where the US dollar is not king.

The outcomes of all this are a big unknown with long term implications. If anybody figures this out, call me collect.

I should have said that the Gold Miners ETF outperformed by 36% . That is huge. It went up when stocks fell recently in May and then went up even faster in the last two week’s rally.

Here is a chart.

https://product.datastream.com/dscharting/gateway.aspx?guid=572acfb3-698a-4800-b1a1-17fc86e60e2e&action=REFRESH

Something is brewing.

Ken,

Is it fair to conclude that the actionable insight is to accumulate gold or gold stock etf on pull-back/temp weakness?

what’s your assessment on the alternate ‘safe’ asset class such as Bitcoin. Its recent action is suggesting something similar along the line of Gold?

At the end of the day, the US is just 5% of the world’s population. Technology is a winner-take-all game. If you cut yourself off from a significant part of the world’s demand, then you will ultimately lose in the long run. Years ago, when I was working on super computers, we’d joke that there was more power under the Christmas tree in the form of game consoles than in most advanced government labs. Cutting off huge swathes of the world from our leading tech companies is simply cutting ones nose to spite the face.

Amen

No one wants to negotiate under duress, and the expectation of new cycles of demands later. If China could make the difference between 18 months or 18 months + 4 years of Trump, would they not be tempted?

It is common cause that they have the resilience.

What will be the impact of the recent news about human trafficking in the Pacific Rim countries on negotiations?

F

Not likely to be a major issue. Both sides have bigger fish to fry.

Key sentences from Trump G20

“This doesn’t mean that there is going to be a deal,’’ Trump told reporters of the agreement to resume discussions. “But they would like to make a deal, I can tell you that.’’

And this:

“The quality of the transaction is far more important to me than speed. I am in no hurry, but things look very good! “

Odds of a deal before the 2020 election have receded now. Eurasia puts the odds at 45%. We are where we were last year in Buenos Aires.

Both sides seem happy with the status quo for now, won’t rush to a deal and won’t try to escalate the trade war any more until the 2020 elections. Trump won’t impose additional tariffs to minimize further impact on the US economy and US consumers before the election. Trump base will also be happy as China purchases a lot of soybeans and hogs.

Xi is content now having reversed the ban on the purchase of US technology by the homegrown hero, Huawei, and is praying for favorable election results in 2020.