Mid-week market update: It is always a challenge to make a technical market comment on an FOMC announcement day. Market signals are unreliable. The initial market reaction can be deceptive, and any move reversed the next day after some somber second thought. In addition, today is May Day, and a number of foreign markets are closed, which deprive traders of additional signals from overseas.

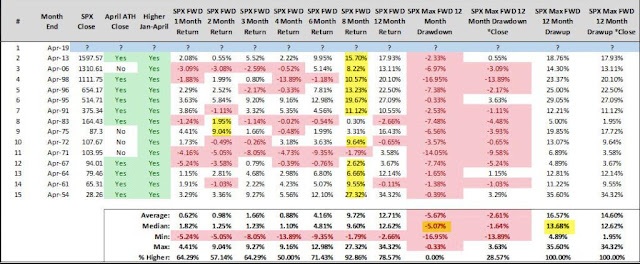

With those caveats, I can make a general observation that the advance off the Christmas Eve low has been remarkable and resilient. A historical analysis from Steve Deppe shows that years that have begun with four consecutive monthly advances since 1950 have resolved bullishly, with only one single exception (N=14).

Oddstats also pointed out that 2019 was the fifth best start to the year.

If these small samples of history are any guide, the stock market should be considerably higher by year-end, unless you believe this is a repeat of 1971, based on Steve Deppe’s analysis, or 1987, based on Oddstats’ data.

Intermediate term bullish

I continue to believe that the outlook is intermediate term bullish. The analysis of the market relative performance of the top five sectors, which comprise just over two-thirds of index weight, shows a healthy rotation in leadership. Technology stocks are still strong, and Healthcare has made a relative bottom. The steepening yield curve, which is closely correlated with the relative strength of Financial stocks, has pulled that sector out of the doldrums. Consumer Discretionary and Communication Services staged a brief relative breakout, but pulled back.

The important takeaway is these top sectors are strong. Even in cases when they have faltered, another heavyweight sector has stepped up to take up the baton.

Here is another case in point. Cyclical sectors faced a brief setback on a brief growth scare. In particular, the high flying semiconductor stocks were hit hard, but everything except the Transportation sector has recovered and regained their mojo.

I recently highlighted the NASDAQ leadership as a source of market strength. The equal-weighted relative performance ratio (bottom panel) is especially important indicator of NASDAQ price momentum.

The NDX took a hit on Tuesday when heavyweight Alphabet disappointed, but the relative uptrend remained intact, and the index recovered the next day after Apple reported. As this table from BAML shows, the market has been rewarding earnings and sales beats while punishing misses during earnings season. Q1 Earnings Season has featured an above average level of beats. That’s market resilience, which is intermediate term bullish.

Brief pullback ahead?

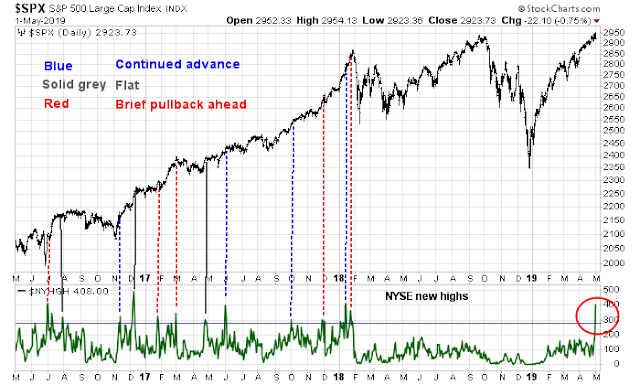

Still, this advance appears extended and a brief and shallow pullback can happen at any time. NYSE 52-week highs began to spiked on Tuesday and continued today. While a surge in new highs is considered intermediate term bullish, such market action could be a short-term sign of bullish exhaustion. In only four of the last 12 instances (33%) in the last three years saw the market continue to rise. In the other two-thirds of the occasions, stock prices have either stalled and consolidated, or pulled back, usually in a shallow fashion.

My inner investor is bullishly positioned. My inner trader remains cautiously bullish, and he is waiting for market weakness so that he can buy the dip.

Disclosure: Long SPXL

Cam, I’m increasingly seeing many leading figures in finance call for a melt-up in the equity market. This includes BofA, Blackrock and several others. I wonder if that is becoming mainstream prognostication. Does that affect your call for a continued run-up in prices?

https://www.cnbc.com/2019/05/01/major-wall-street-banks-are-telling-clients-to-be-ready-for-a-sudden-rip-higher-in-the-market.html

I suppose that Wall Street is waking up to the melt up thesis that I wrote about back in late March. 🙂

https://humblestudentofthemarkets.com/2019/03/24/how-the-market-could-melt-up/

Seriously…if there is to be a FOMO melt up, then reports like these are signs that the bandwagon is just starting to roll.

Yesterday Democratic leaders had a friendly meeting with Trump about large infrastructure projects. This reminds me what I said last year when things were crashing, that the Presidential Cycle would have stocks higher at year end 2019.

This cycle ALWAYS works from October 1 two years before the election to January first of the election year. Every time people don’t believe just like last year. Mark October first 2022 on your calendar with a note to turn bullish whatever the crap that’s happening at the time.

Both parties are always economically friendly in the year leading up to the election year.

On December 24, the day of the low I bought SPY January 2020 295 call options. I chose 295 because the September high was 293. SPY was at 235.

I only did this because of the Presidential Cycle said the market would be over 293. Little did I expect it would get there in April.

Can you please elaborate on the timing decision on 24th Dec?

how do you distinguish between a counter rally in (potential) start of bear market vs correction in a general uptrend?

So, the bull cycle in your opinion continues from October 2018 to January 2020? Following this, cycle turns up in October 2022?

You have to recognize the kind of policy support that will keep the market from falling. The Chinese are going to do everything in their power to hold their economy up until their October anniversary. Powell has said that he is concerned about financial stability. It was financial instability that sparked the last two recessions (2000 and 2007-09). At a minimum, that means we will have policy support until Q4 (from China). After that, who knows.

Combine that with institutions and HFs underweight beta faced with signs of stabilization and possibly renewed growth. The bull should be ok for another 3-6 months.

I can`t really forecast much more beyond that time horizon.

Thanks Cam, for putting a time frame of October 2019, as Chinese anniversary, or q4 2019. That helps a lot put things into perspective.

Ken, I don’t get it. Why should the party in opposition co-operate to have a robust economy? If the economy is doing well, it can only be good for the governing party and improve the odds of a victory in the next election.

Democrats will co-operate only on their signature issues that speak to their constituents (infrastructure, healthcare for all, minimum wage legislation) so they can take credit in the next election, but on nothing else.

Sanjay,

No political party is going to court a recession going into an election or immediately after the election. As hard winning elections are, this is the least of things they want to address.

As you have noted, the two parties differ in ways they see as best in how to address economic growth. In either case, the idea is neither party wants a recession, both parties will throw austerity measures out of the window and spend as though money was going out of style. This has been going on for the last several decades. Modern monetary theory (MMT) that has been referred to by Cam, has promoted the idea that endless money borrowing and spending can give rise to endless prosperity, ever rising asset prices, and no recessions. Only time will tell how far MMT is sound, but IMHO, it seems to not meet the smell test.

Cam–of the 4 years in the charts of years with very strong Jan through April returns, one made significant further gains, one (1987) was dome significvantly from the late April high and two showed very modest gains for the rest of that year. How is this meaningfully bullish for 2019? bob Millman

Cam, I have a suggestion (not a comment). You indepth analysis emails take me some time to go through and weigh what you are saying. Often I don’t have the time right away to do that. I would like to suggest putting a summary at the top of each email, much like you do at the bottom, noting what your analysis is concluding such as a probable pullback expected or an explosive breakout on the longer term, etc.

Wally

Cam, really like the trading updates. I find them valuable. I know you are reluctant to comment on your trades but I find it helpful. Thanks for your great service.

It’s not so much reluctance. I just don’t trade that often.