Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The ”

Ultimate Market Timing Model

” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a

trading model

, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Unicorn cull ahead?

As we bid adieu to the Q1 2019, there has been increasing angst about the possibility of a recession, though I have expressed my view that a number of internals cast doubt about the usefulness of the inverted yield curve signal (see How the market could melt up and Why the yield curve panic is a buying opportunity). Notwithstanding my skepticism, I would like to explore what happens in a recession.

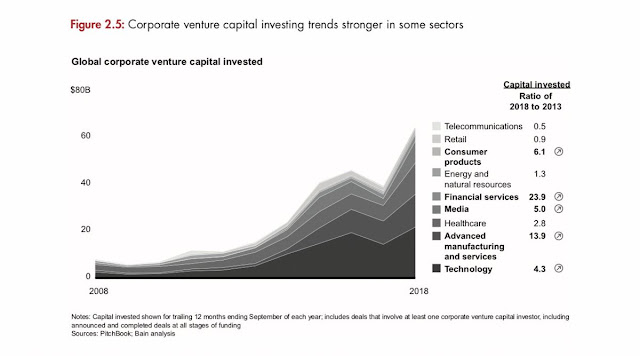

Recessions are cathartic processes that unwind the excesses of the past expansion cycle. The most obvious excess in this cycle has been the rise of Silicon Valley unicorns, private companies with valuations in excess of $1 billion.

The enthusiasm that greeted the Lyft IPO has raised angst among some investors about the herd of unicorns stampeding towards the IPO door, Bloomberg sounded a warning about a possible unicorn IPO mania:

Should these and others make it to the stock exchange, 2019 could prove to be one of the biggest years on record for the amount of money raised in U.S.-listed IPOs. The total will reach $80 billion this year, double the yearly average since 1999, Goldman Sachs Group Inc. predicted in November—an estimate that may prove low. And there’s no arguing that peaks in IPOs have occurred near major tops in the stock market and close to the onset of recessions. Both 1999 and 2007 were unusually strong years for IPOs that were swiftly followed by nasty bear markets in stocks and downturns in the economy.

Could a stampede of unicorns mark a market top, and their subsequent cull sink the American economy?

Private value excesses

Jawad Mian, the founder of Stray Reflections, recently warned about how private market valuations have gotten ahead of public market valuations, and how these excesses are about to unwind in a Twitter thread.

1) In 2015, venture capitalist Bill Gurley predicted “dead unicorns” and that all these private valuations are “fake.” Now he has reconsidered his view, “You have to adjust to the reality and play the game on the field.” There are no more disbelievers, except @chamath.

2) The value of the Nasdaq grew from around 1,000 points in 1995 to more than 5,000 in 2000 at the bubble peak, which mirrors the extreme jump in US unicorn valuations from $100 billion to about $500 billion in the past five years.

3) China is now home to 168 unicorns, worth a total $628 billion. It now takes just four years, on average, in China for a new company to achieve unicorn status compared to seven years in the US. In fact, nearly half of the Chinese unicorns became so just two years after launch.

4) The median global VC deal size for late-stage companies was around $11 million in 2017, but now mega-rounds of $100 million-plus are more common. So much so that CB Insights is considering lifting its threshold of a mega-round to $200 million or more.

5) VCs raising ever-larger funds at an increasing pace, despite a lack of viable opportunities. Sequoia raised $8bn, largest ever by US venture firm. “It’s easier to raise money than anytime I’ve been in the business,” said David Rubenstein. Does not bode well for future returns.

6) Gulf money is notoriously late to the party, purchasing Carlye Group in 2007 at the peak of the credit bubble, and anchor investors in Glencore IPO in 2011 at the peak of the commodity bubble. Now they are “all in” on Uber and opened offices in Silicon Valley to do more.

7) Discipline is loosening considerably. @bfeld noted, “A number of companies, often times with nothing more than a team and a Powerpoint presentation, have had great success raising capital north of that $10 million level… I view this as a significant negative indicator.”

8) Bird is fastest company to unicorn valuation, raising four rounds in less than 12 months. In less than six months, DoorDash’s valuation nearly tripled to $4 billion. Robinhood went to $5.6 billion from $1.3 billion. Coinbase to $8 billion from $1.6 billon.

9) There has been a 10-fold increase in VC-stage investment by mutual funds in just three years, with more than 250 funds now holding positions in private tech companies.

10) After the new SEC chairman, Jay Clayton, “pledged” to look after ordinary investors upon taking the job, he said he wants to make it easier for small mom-and-pop investors to invest in private companies.

11) Stanford professor Strebulaev examined 135 unicorns and found nearly half would lose unicorn status after taking into account the complicated structure of multiple funding rounds and generous promises to their preferred shareholders.

12) Because of QE, capital was abundant, but had nowhere to go and be productive because the world was still in a downturn. The scarce asset was “growth” and so have created a bubble in the riskiest long-duration asset—venture backed companies.

13) As @lessin puts it, technology was a “bubble of last resort”… soaring tech valuations are really more a commentary on the plummeting value of capital than the value of tech companies themselves. This is now changing, money is becoming scarcer and cost of capital is rising.

14) Uber’s new CEO said, “We suffer from having too much opportunity right now as a company.” Uber addresses this ailment by burning money some $20 billion since it’s founding a decade ago and now accessing public markets as private capital is tapped out.

Mian followed up with tales of past excesses and their subsequent collapses, which may or may not be relevant in the current circumstances:

15) A century ago, railroad entrepreneurs found a ready market to fund their massive expansion plans based on an extreme overestimation of the market opportunity. This ended badly, of course, and holds more parallels to today’s ride-sharing companies than we might like.

16) On seeing the announcement of a new issue of stock by the Northern Pacific and Great Northern roads, Jesse Livermore said, “The time to sell is right now… If money already was that scarce and the railroads needed it desperately. What was the answer? Sell ’em! Of course!”

17) Saudi Arabia is the single largest funding source for US startups, funneling at least $15 billion since mid-2016. As @karaswisher said, “If you remove the Saudis from the worldwide network, everything collapses.” By comparison, China has invested $11 billion since 2000.

18) Masa announced a second $100 billion Vision Fund last year. Saudis committed another $45 billion. But after the Khashoggi murder, Softbank raised doubts over its plans. Without a second Vision Fund and with tighter scrutiny on China investing in US, party coming to an end.

19) Just as churches once raised the highest towers of the city, wealthy individuals use skyscrapers as egotistical personal and corporate symbols at the peak of every cycle. Salesforce Tower, the new tallest structure in San Francisco, is the church of our time.

20) At the opening last May, the building was christened as a symbol of “transformational optimism” that “courageously reaches up to the clouds” and creates a “seamless connection between heaven and earth.”

21) Transamerica Building became the city’s tallest in 1972. What followed was a collapse in the high-flying Nifty Fifty growth stocks and the vicious 1973-74 bear market, the worst ever since the Great Depression. Same story with Woolworth in 1913 and Chrysler in 1929.

22) When the leading company in the hottest sector goes public, it reflects a peak in social mood and usually presents an important inflection point in financial markets. As a rule, insiders sell at the top.

23) The AOL Time Warner merger in 2000 culminated in the tech crash, the Blackstone IPO in 2007 presaged the 2008 meltdown, and the Glencore listing in 2011 marked the peak in the commodity super-cycle. Uber, we believe, will mark the peak in Silicon Valley and tech valuations.

24) Let us not forget the consequences of humans’ compulsive greed and hubris. Uber—and many other Silicon Valley unicorns—could be worth multiples of their current value over the long run but not without first facing a reality check from public markets. The time to worry is now.

He closed with a contrarian warning about the IPO of Lyft, to be followed by Uber’s IPO:

25) We believe Lyft’s IPO will be successful, allowing Uber to easily cross the $100 billion valuation mark. This inevitably makes the public markets test more difficult after the initial euphoria and lock up period is over.

In short, the recent surge of unicorns has been fueled by a FOMO stampede of too much VC money chasing too few deals.

A New Era?

The mania is creating a wave of “new era” accounting and valuation metrics reminiscent of the giddiness of the NASDAQ Bubble. Even Harvard Business Review chimed in with an article entitled “Why We Need to Update Financial Reporting for the Digital Era”. Finance theory is now turned upside down. Instead of demanding payment for risk, it is now to be embraced because of the lottery-like value of its payoffs:

Risk is now considered a feature, not a bug.

Traditional valuation models consider risk to be an undesirable feature. Digital companies, in contrast, chase risky projects that have lottery-like payoffs. An idea with uncertain prospects but with at least some conceivable chance of reaching a billion dollars in revenue is considered far more valuable than a project with net present value of few hundred million dollars but no chance of massive upside. In light of this, an employee is evaluated not based on what she contributed to the company’s bottom line, but whether she identified a new, breakthrough idea.

This notion, that risk is a desirable feature, can seem like sacrilege to anyone who’s taken an introductory finance course. It’s unlikely that investors’ risk aversion has fundamentally changed. However, many investors seem to have concluded that the most successful companies with tens of billions of dollars of valuation today could never have justified their valuation at the start of their operation based on discounted cash flow. So, investors, and therefore managers, might be adjusting their approach to risk accordingly.

Earnings and cash flow matter less than the option value of the enterprise:

Investors are paying more attention to ideas and options than to earnings.

Business students are taught to value a company based on the discounted amounts of future cash flows or earnings. That concept is becoming almost impossible to apply to emerging companies that are run as a portfolio of ideas and projects, each with uncertain lottery-like payoffs. CFOs of these companies themselves admit that they cannot justify their market capitalizations based on traditional metrics. They conjecture that their market values might be the sum of the option values of the projects undertaken, a sum of best-case scenario payoffs. One CFO said that her valuation should be considered on a per idea basis instead of a per earnings multiple.

In theory, options valuation should be able to handle this problem of valuing firms with lottery-like payoffs. In practice, we have yet to see a model that can justify, for instance, Amazon’s market capitalization. It’s possible that companies like those are overvalued. It’s also possible that we simply don’t know how to estimate the right parameters to make an options-based valuation work.

As digital technology becomes more pervasive, more and more companies will present this sort of valuation challenge. Given that even sophisticated investors cannot estimate the value of these companies, CFOs question the ability of a day trader to value a digital company. Therefore, companies see little value in disclosing the details of their current and planned projects in their financial disclosures, even if those disclosures can reduce the information asymmetry between investors and managers. Given the bull market in digital stocks, CFOs believe that they have no incentives to provide any additional information beyond mandatory SEC disclosures, which they consider excessive, tedious, and uninformative and might invite unnecessary scrutiny and litigation.

FT Alphaville made a similar point. In this era of a “winner take all” competitive environment, the goal of market dominance is now the holy grail of many start-ups [emphasis added]:

To recap, a few weeks ago we made the argument that the rise of mystic job titles like “chief vision officer” — especially in the trendy start-up sphere — was indicative of corporates having lost their purpose. By that we meant that it used to be the purpose of corporates to make or provide stuff people wanted so much they were prepared to pay for it. This therefore loosely translated into a profit-generating operation.

In the modern corporate sphere the desire to make profits, however, has been replaced with the desire to achieve growth at any cost. Often this means the adoption of loss-leading strategies where products or services are given away for free or subsidised — because people are unlikely to want to pay for them — for the purpose of capturing customers.

This is justified by two notions. First, these products and services are so visionary and forward thinking that we the customers can’t yet understand, or imagine, what they will mean to us. Hence, while we may not be prepared to pay for them today, one day in the future — perhaps once we have fully lost the skills to make our own food, drive, write lists or interact with people face-to-face — we will eventually be prepared to pay top dollar for them.

The second justification is that if you hook enough customers to your brand you will eventually be able to sell them something they will be prepared to pay for. What that thing is doesn’t necessarily have to be determined yet, and may or may not be determined in countless corporate pivots that follow onwards.

This is why the mystic vision officer is so important. Establishing a vision of what tomorrow’s needs may be, rather than what today’s needs actually are, is essential to keeping the investment case alive. It has little to do with the practical realities of operating a profitable and successful business on the ground in the here and now.

And it’s all very believable because this is exactly how a selection of today’s most profitable technology stocks have made it.

The problem is, it’s a strategy closely linked to monopoly and not one that every single corporate can make work.

The Lyft IPO was oversubscribed, and its reception suggests that there is a voracious appetite for unicorn IPOs. But private market values, as determined by VC funding, now exceed public market values, which is determined by the stock market. What happens when these valuations adjust?

Who gets hurt? Assessing the possible damage

If one of the economic roles of recessions is to unwind the excesses of the previous expansion cycle, there are two questions that need to be answered. Who gets hurt, and how widespread is the damage?

While there are similarities between today’s surge of unicorns and the NASDAQ Bubble of the late 1990’s, there are a number of key differences that serve to cushion the economic effects of a unicorn cull, should it occur. First, the NASDAQ Bubble was a mania with widespread public participation. Today’s rise of unicorns was fueled by VCs, which represents well capitalized institutional money.

The recession of 2000 was caused by the collapse of NASDAQ Bubble, which had widespread public participation. The roots of the recession of 2007 were subprime mortgages, which drive housing prices to bubbly levels and exacerbated by excessive financial leverage. Neither of those elements are in place today. We have neither widespread public participation nor levered investments in venture capital. Therefore a demise of unicorns will only inflicted limited economic damage.

To be sure, Jawad Mian pointed out that Gulf money has historically been late to the party, and may represent a major group of players holding the bag. Oil prices are still relatively low and below the budget break-even levels of GCC oil producers, and GCC states are continuing to see capital outflows. The demise of their VC investments could put strains on their budgets and raise political uncertainty in that region, but that is at worse a second or third order effect.

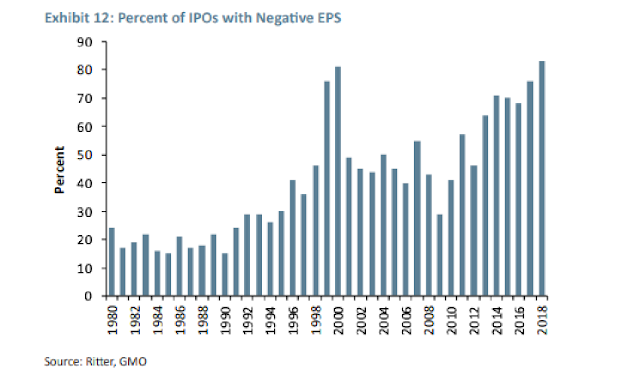

What about the effects of a rush by unicorns out the IPO door? Could that tank the stock market? There is little evidence of an IPO bubble. To be sure, the quality of IPOs is deteriorating.

The bigger question is the market reception for such issues. The relative performance of IPO stocks cratered in line with the late 2018 market swoon but they have recovered, but their level is not out of line with their longer term experience. If the likes of Lyft, Uber, and other unicorns create a stampede for unicorn IPOs, the potential for a unicorn driven market top exists. But the market has to go up first before it can fall.

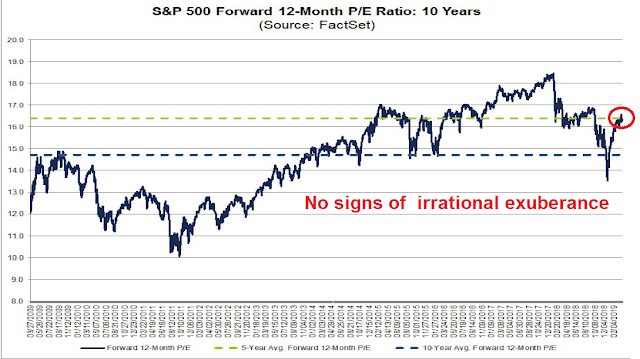

From a valuation perspective, stock prices are elevated, but not a bubbly levels. FactSet reported that the market is currently trading at a forward P/E of 16.3, which is just below its 5 average of 16.4 but above its 10 year average of 14.7.

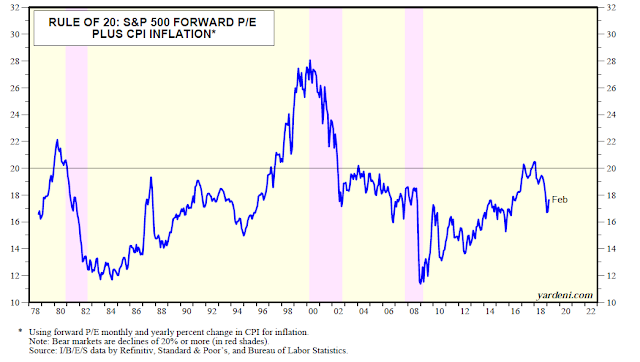

Ed Yardeni’s Rule of 20 confirms my view of stock market valuations. His Rule of 20 adds the market’s forward P/E to the inflation rate. A sum of 20 or more is a valuation warning for the stock market. The market is not there yet, but here are some back of the envelope projections. Let us assume that forward 12-month S&P 500 EPS estimates rise by between 2% and 4% real, with an inflation rate of 1.5%. Apply a forward P/E of 19x to those earnings, add in 1.5% inflation, which would exceed the Rule of 20 tripwire. That translates to an S&P 500 level of 3400-3450, or a return of 20-22% to year-end. I would emphasize that this is not a forecast, but scenario analysis of what might happen should the market become bubbly.

In short, if we were to assume that VC investments have become excessively bubbly, and a unicorn cull is in the near future, such an event is unlikely to have much economic or market effect.

While a unicorn cull could hurt some investors, these investors are well capitalized and losses are unlikely to be catastrophic for their portfolio. Unicorn investments are funded by VC money, which is not subject to little financial leverage, and the lack of leverage should be a mitigating factor in cushioning the economy from the worst of these effects.

In addition, stock market valuations are elevated, but not at danger levels and there is no sign of a valuation bubble. The risk of a unicorn IPO crash dragging down stock prices is low. However, scenario of a IPO FOMO stampede that causes stock price surge, followed by a crash, is remains on the table, but the market has to go up before it goes down. Risk on!

Where are the excesses?

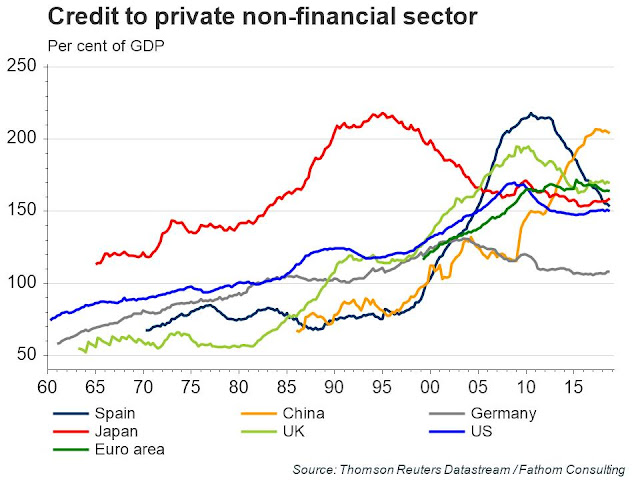

If a unicorn cull will not sink the American economy, then what could? I have long argued that the excesses in this expansion cycle can be found outside US borders. The most obvious is China. This China bears’ favorite chart of excess financial leverage tells the story.

China has long been a “this will not end well” story with no obvious bearish catalyst. In the short run, Beijing is pulling out all stops with another stimulus program to ensure their economy remains robust ahead of the October celebration of Mao Zedong’s victory and founding of the People’s Republic of China.

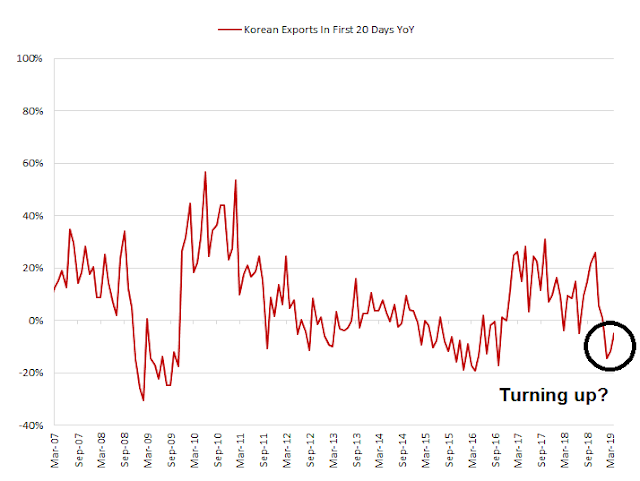

Already, there are some preliminary signs of a growth turnaround in China’s economy. Korean exports for March 1-20 are starting to turn up, which is a positive sign.

Chinese real estate is one of the most sensitive barometers of economic stress. Yuan Talks reported the property market is starting to warm up again, with notable price increases in Tier 1 and Tier 2 cities:

Chinese property developers are having a warmer-than-usual spring season this year as more and more signs are indicating a recovery in the housing market and many expect a bottom-out in top-tier cities this year.

According to a report released by China Academy of Social Sciences (CASS) on Thursday, the country’s top state think tank, the average home prices in the 142 sample cities tracked by the academy rose 0.36 per cent in February from the previous month, 0.494 percentage point faster than the previous month.

My real-time canaries in the Chinese coalmine are also behaving well. The AUDCAD exchange rate is healthy. This is an important indicator as both Australia and Canada are resource producing economies of similar size, but Australian exports are more sensitive to China while Canadian exports are more sensitive to the US.

The relative performance of Chinese Materials stocks to Global Materials is turning up, indicating a more constructive outlook for this cyclically sensitive sector in China.

In addition, the stock price of Chinese property developers like China Evergrande (3333.HK) are behaving well and well above key support levels.

In short, the near-term risk of a global recession is relatively low. Moreover, the latest update from New Deal democrat’s monitor of high frequency economic indicators shows that US recession risk is receding.

The long-term forecast improved from neutral to positive based on a major decline in long-term interest rates, despite Q4 corporate profits being reported down. The short-term forecast also changed from negative to neutral. The nowcast remains slightly positive. Generally speaking, while the outlook for the rest of 2019 is a continued slowdown and possibly worse, 2020 is initially beginning to shape up as a recovery.

Investors should be able to sleep well, and stay with a risk-on profile in their portfolios.

The week ahead: Rational caution

If you are looking for a “tell” on the tone of the stock market, the performance of the unicorn IPO of Lyft on its first day of trading is a demonstration of rational caution, not irrational exuberance. The issue was universally panned on my social media feed. The IPO was priced at the top of its range at 72 per share, and the stock ended the day up 8.8% in an atmosphere of universal caution (mildly NSFW example here). Major market tops simply don’t look like this.

Similarly, the Citi Panic/Euphoria Model shows that sentiment remains in neutral territory despite the Q1 stock market rally. No signs of any excess extremes yet.

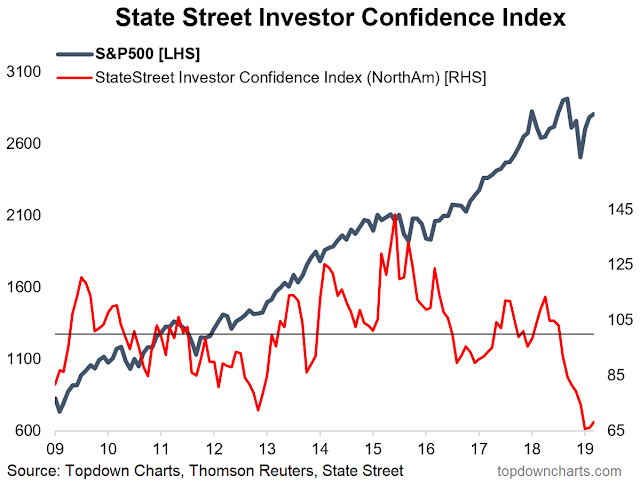

Callum Thomas‘ update of the State Street Confidence Index of North American institutional investors confirms the lack of bullishness.

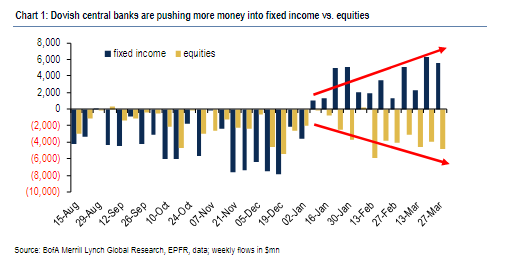

As well, BAML’s funds flow monitor shows that money has been pouring into fixed income and out of equities. This is hardly the picture of out of control market enthusiasm.

In the past year, the S&P 500 has experienced a series of “good overbought” conditions on RSI-5 even as the index advanced, and past declines have been halted when RSI-14 reached neutral. We may be seeing the start of another series of “good overbought” advances again, as the index is about to achieve a golden cross, which is intermediate term bullish.

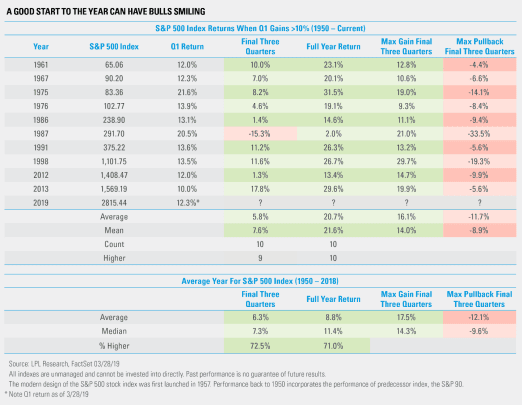

The market ended the first quarter on a positive note. Ryan Detrick of LPL Financial found the historical experience shows that strong first quarters has led to strong stock markets for the rest of the year. The only outlier was the market crash of 1987.

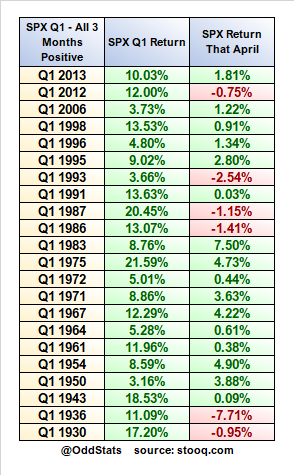

If you are too impatient to wait until year-end, OddStats compiled the historical record of what stocks did in April after strong first quarters. He added, “The pattern is obvious – if you can’t spot it immediately, you should close your trading account.”

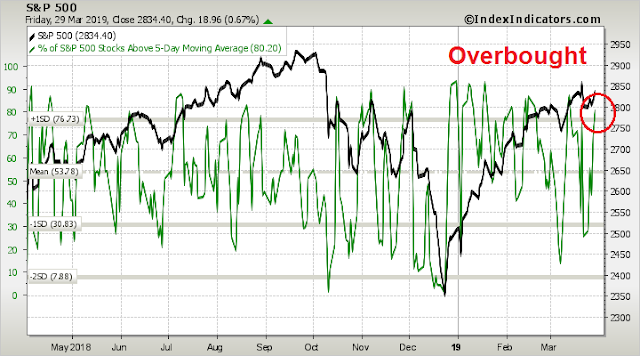

However, the market is overbought on a 1-2 day time horizon, and some consolidation or pullback is to be expected early next week.

The bulls will face a test of whether they can continue to maintain the positive momentum. Past “good overbought” conditions indicating strong momentum has carried prices higher in the last year.

The market is not without its headwinds. President Trump threatened to close the border with Mexico in the coming week in a series of tweets if Mexico does not control the flow of illegal immigrants headed north.

The DEMOCRATS have given us the weakest immigration laws anywhere in the World. Mexico has the strongest, & they make more than $100 Billion a year on the U.S. Therefore, CONGRESS MUST CHANGE OUR WEAK IMMIGRATION LAWS NOW, & Mexico must stop illegals from entering the U.S….

….through their country and our Southern Border. Mexico has for many years made a fortune off of the U.S., far greater than Border Costs. If Mexico doesn’t immediately stop ALL illegal immigration coming into the United States through our Southern Border, I will be CLOSING…..

….the Border, or large sections of the Border, next week. This would be so easy for Mexico to do, but they just take our money and “talk.” Besides, we lose so much money with them, especially when you add in drug trafficking etc.), that the Border closing would be a good thing!

The market has so far shrugged of these threats, as an unexpected border shutdown would crater stock prices. As a reminder, US-Mexico trade amounts to roughly $1 million per minute, 365 days out of the year. Closing the border would have a catastrophic effect on the economy.

Trump is known to closely watch the stock market as a barometer of his own performance. In his very next tweet, he berated the Federal Reserve for its interest rate policy, and blamed it for low stock prices.

That tweet does not represent just some off-the-cuff remark, but a coordinated White House effort to support the economy and boost stock prices. National Economic Council Director Larry Kudlow was on CNBC last Friday and urged the Fed to cut rates by 50bp.

Top White House economic advisor Larry Kudlow wants the Federal Reserve to “immediately” cut interest rates by 50 basis points.

“I am echoing the president’s view — he’s not been bashful about that view — he would also like the Fed to cease shrinking its balance sheet. And I concur with that view,” Kudlow told CNBC on Friday.

“Looking at some of the indicators — I mean the economy looks fundamentally quite healthy, we just don’t want that threat,” he added. “There’s no inflation out there, so I think the Fed’s actions were probably overdone.”

In that context, a threat to close the Mexican border is simply not credible.

I will be watching several important economic releases next week that could be major market movers. ISM Manufacturing will be reported on Monday, and Non-Manufacturing on Wednesday. Friday’s Jobs Report will also serve as an important test of the economy’s health. While most market observers will be focused on whether Non-Farm Payroll can beat the consensus estimate of 170K, my focus will be on temporary jobs as leading NFP indicator. Temp job growth has been topping out in the last two months, but the weakness was not confirmed by the quits to layoffs ratio from the JOLTS report. Which indicator is right? Was the weakness in temp jobs just a blip?

My inner investor was neutrally positioned at his asset allocation targets, but he is allowing his equity weight to drift upwards as stock prices rally. My inner trader is also bullish, and he may add to his long positions should the market pull back early next week.

Disclosure: Long SPXL

Is David Rosenberg still bearish?

Incredibly

Thanks.